Rules Committee slates Friday to prepare COVID-19 rescue bill for House floor debate - Jay Heflin, Eide Bailly. "The House Rules Committee has announced that it will hold a hearing Friday on the COVID-19 “rescue” bill to prepare it for debate on the House floor. Full house may vote passage the same day."

NOL Relief Could Face Future Chopping Block - Jad Chamseddine, Tax Notes ($):

A net operating loss provision enacted in coronavirus relief legislation last year appears to be safe from the chopping block for now, but its future is far from certain.

With the House preparing to vote on the American Rescue Plan, the name given to the COVID-19 relief bill crafted by Democrats to comply with Senate reconciliation rules, some congressional Democrats are still hoping that repeal of the temporary NOL and loss limitation relief provisions might make its way into the bill.

California Governor Signs Stimulus Bills; PPP Loan Expensing Still Pending - Paul Jones, Tax Notes:

California Gov. Gavin Newsom (D) has approved a $7.6 billion stimulus package that includes checks for low-income residents, fee waivers for restaurants and bars, and grants for small businesses.

However, the bills signed by Newsom February 23 did not include a measure that would partially conform the state to federal law allowing deductions of expenses paid for with forgiven Paycheck Protection Program loans. That bill is still moving through the State Legislature.

Minnesota Justices Find Retailer Not Entitled to Sales Tax Offset - Jennifer McLoughlin, Tax Notes ($). "A home improvement retailer was not entitled to a sales tax offset based on unpaid debts related to customer purchases made on the retailer’s private-label credit card, according to the Minnesota Supreme Court."

Related: Sales Taxability Analysis.

Small Businesses Struggle to Assess Whether They Are Eligible for PPP Funds - Mark Maurer, Wall Street Journal ($):

Businesses only receive a second loan if they can demonstrate that their revenue fell by 25% during one quarter in 2020 compared with the prior-year period. The requirement didn’t exist during PPP’s original run, which ended in August.

Tax Court: You have to be 'away from home' to take lodging deduction - Roger Russell, Accounting Today. "The Tax Court added its voice to the dilemma facing many taxpayers working remotely due to the pandemic, denying an attorney his lodging expenses in Maryland because he was not 'away from home' while working in the Washington, D.C., area."

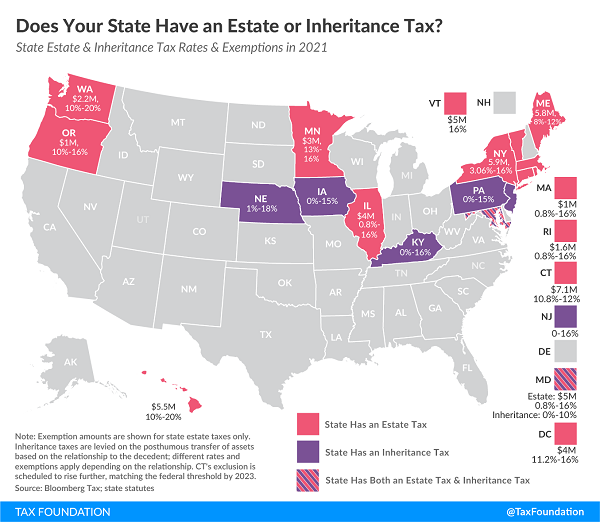

Does Your State Have an Estate or Inheritance Tax? - Janelle Cammenga, Tax Policy Blog. "In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax... Estate taxes are paid by the decedent’s estate before assets are distributed to heirs, and are thus imposed on the overall value of the estate. Inheritance taxes are remitted by the recipient of a bequest, and are thus based on the amount distributed to each beneficiary."

What Gig Workers Need To Know About A Key Tax Form - Megan Gorman, Forbes ($). "...you should report all income even when you don’t get a 1099-NEC."

Considerations in making a major disaster tax claim - Kay Bell, Don't Mess With Taxes. "A disaster loss claim, either now with an amended return (when you're ready) or next filing season, could provide some much-needed tax help in making it through a terrible time."

Taxpayer Warning: Beware of 'Ghost' Preparers Who Don't Sign Tax Returns - Spencer Wilson, TaxBuzz. "No matter who prepares the return, the IRS urges taxpayers to review it carefully and ask questions about anything not clear before signing."

IRS Guidance Clarifies COVID-19 Relief for Van Pools - Wolters Kluwer Tax & Accounting Blog.

Insights into the Tax Systems of Scandinavian Countries - Elke Asen, Tax Policy Blog:

Scandinavian countries tend to levy top personal income tax rates on (upper) middle-class earners, not just high-income taxpayers. For example, in Denmark the top statutory personal income tax rate of 55.9 percent applies to all income over 1.3 times the average income. From a U.S. perspective, this means that all income over $70,000 (1.3 times the average U.S. income of about $55,000) would be taxed at 55.9 percent.

The marginal rate for U.S. single filers at $70,000 is 22%; the 37% top rate for single filers starts at $523,601.

A City’s Mayor, Police Chief and Clerk Face Misconduct Charges - Allyson Waller, New York Times. Armstrong Iowa, Population 840: "Its mayor, clerk, police chief and a former clerk face charges related to misappropriation of funds, fraudulent public records, concealing embezzlement and the deployment of a Taser against a civilian in exchange for cash."

Related: How to Prevent Fraud in Your Government.

Chili and chowder. Today is both National Chili Day and National Clam Chowder Day. Mixing not advised.

Make a habit of sustained success.