IRS Extends Some Filing Deadlines for Victims of Texas Winter Storms - Russ Fox, Taxable Talk. "The IRS announced today that they have extended the deadline for victims of Texas winter storms until June 15th. This impacts the March 15th partnership and S-Corporation filing deadline and the April 15th individual, C-Corporation, and Trust/Estate deadline for those in a FEMA-declared disaster area."

More here.

House Budget Committee approves $1.9 trillion rescue plan - Jay Heflin, Eide Bailly. "The House chamber is expected to vote on the rescue bill later this week where passage is expected."

Democrats Race to Advance COVID-19 Relief Package - Jad Chanseddine, Tax Notes:

The relief bill would temporarily expand and extend some refundable credits like the child tax credit and earned income tax credit. The EITC would be expanded for 2021 and the age to claim the credit reduced from 25 to 19, while the child tax credit would be fully refundable for 2021.

The bill would also extend the employee retention credit that was implemented by the Coronavirus Aid, Relief, and Economic Security Act (P.L. 116-136). Democrats also settled on sending $1,400 checks to qualifying taxpayers who make less than $75,000 a year.

Democrats Propose Dramatic Expansion Of The Child Tax Credit - Tony Nitti, Forbes ($). "If you produce a newborn before the end of 2021, the government will pay you up to $3,600 for the effort..."

Justices will not block New York grand jury subpoena for Trump’s records - Amy Howe, SCOTUSblog. "Monday’s order means that Vance and the grand jury likely will finally acquire eight years of Trump’s tax returns and other related records, although grand jury secrecy laws may preclude them from becoming public."

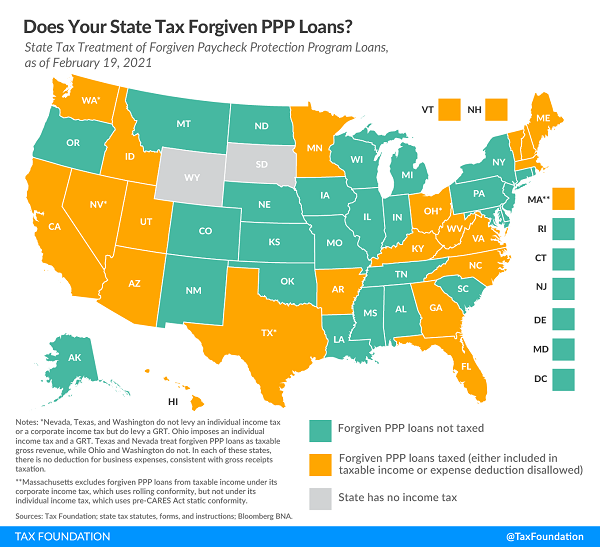

Which States Are Taxing Forgiven PPP Loans? - Katherine Loughead, Tax Policy Blog:

Many borrowers will have these loans forgiven; eligibility for forgiveness requires using the loan for qualifying purposes (like payroll costs, mortgage interest payments, rent, and utilities) within a specified amount of time. Ordinarily, a forgiven loan qualifies as income. However, Congress chose to exempt forgiven PPP loans from federal income taxation. Many states, however, remain on track to tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both. The map and table below show states’ tax treatment of forgiven PPP loans.

Washington Exempts Financial Assistance From Business, Occupation Tax - Tax Notes. "Washington H.B. 1095 as signed into law exempts qualifying financial assistance for small businesses from business and occupation tax, public utility tax, and retail sales tax during declared states of emergency, including COVID-19."

SCOTUS Rejects Idaho's Appeal in Business Income Case - Andrea Muse, Tax Notes ($). "In a February 22 order, the Court denied the state’s January 11 cert petition in Idaho State Tax Commission v. Noell Industries Inc., letting stand a 3–2 ruling by the state supreme court that Noell Industries Inc.’s $120 million gain from the sale of its interest in a limited liability company that manufactures combat and tactical gear was nonbusiness income and not subject to apportionment to Idaho."

Related: Eide Bailly State Apportionment Reviews.

IRS Faces Challenges in Detecting Exempt Org Noncompliance - Fred Stokeld, Tax Notes ($). "Tax abuse continues among exempt organizations because unscrupulous entities “may use elaborate or fraudulent schemes to conceal their illegal activities, making such abuse difficult to identify,” the Treasury Inspector General for Tax Administration said in a report released February 22."

Taking Another Look At The Hazards Of Filing Form 1099 - Peter Reilly, Forbes. "Failing to send a 1099 can have some really nasty implications, so a lot of us are careful to not miss sending one out when required. Unfortunately, you can also get in trouble for sending one that should not have been sent if the person receiving it objects."

Attorney Malpractice Settlement Related to Claimed Failures in Representing Taxpayer in a Physical Injury Case Not Excludable from Income - Ed Zollars, Current Federal Tax Developments. "Debra Jean Blum filed a lawsuit that clearly dealt with physical injuries she sustained, but which she claimed her attorneys had bungled—so she then filed suit against the law firm."

Medical Marijuana Dispensary Cannot Claim Depreciation or Charitable Contribution Deductions - Chaim Gordon. "The Tax Court continues to strictly enforce the section 280E prohibition on claiming business deduction on businesses that sell marijuana as a part of their trade or business. Although public attitudes toward marijuana have shifted dramatically in recent years, Federal law remains static and the courts have so far resisted the growing urge to narrow the scope of section 280E on statutory or constitutional grounds."

Lesson From The Tax Court: The Fearsome Scope Of Evil §280E - Bryan Camp, TaxProf Blog. "Section 280E creates a draconian qualification for businesses engaged in the trafficking of substances that are illegal under federal law. Because marijuana is still illegal under federal law, that has caused no end of tax headaches for businesses that are perfectly legal under state law."

Home Sweet Tax Home - Roxanne Bland, Tax Notes Opinions. "A taxpayer’s tax home is the general locality of his primary place of work; that is, the city or vicinity where the taxpayer is employed or carries on business, regardless of where his permanent residence is located. It is the place where the taxpayer spends most of his time while working and earns most of his income."

Spending in the tax law exceeds discretionary spending! - Annette Nellen, 21st Century Taxation. "Tax expenditures are spending that exists in the tax law. For example, the American Opportunity Tax Credit provides taxpayers with a $2,500 tax credit for each of the first four years of college. While this government spending could have instead been given by a direct grant payable to the university to cover the students tuition, it was put into the tax law as a tax reduction."

How alcohol taxes figure into your Margarita Day celebration - Kay Bell, Don't Mess With Taxes. "Washington state assessed the largest excise tax on booze, a whopping $14.27 per gallon. Alaska is close on the Evergreen State's heels. The Last Frontier's distilled spirit excise tax is $12.80 per gallon."

Big day for the doggies. Today is National Dog Biscuit Day.

Make a habit of sustained success.