Tax Court Affirms Disallowance of Pot Dispensary Deductions - Emily Foster, Tax Notes ($):

Judge Emin Toro, writing for the court, considered San Jose Wellness’s arguments on the merits — rather than “simply resting on our holdings in [prior] cases” that no deductions under any section are allowed under section 280E — because of the company’s “more nuanced textual arguments.”

The tax law disallows expenses other than direct inventory costs of marijuana (and other Schedule 1 drugs). This makes tax life difficult for state-legal cannabis sellers. It's up to Congress if this is to be changed.

Link to opinion: 156 T.C. No. 4

Minnesota: Forms W-2 May Show Incorrect Wage Allocation - Minnesota Dept. of Revenue via Tax Notes. "The Minnesota Department of Revenue reminded tax preparers to be mindful that clients may present incorrect Forms W-2, as individuals who normally work in one state but live in another and are now working from home because of COVID-19 may have received a Form W-2 that fails to account for where their work was physically performed..."

8 reasons to wait to file your 2020 taxes - Kay Bell, Don't Mess With Taxes:

1. To get a bigger COVID-19 economic impact payment (EIP). "While lots of folks saw their income drop in 2020 due to COVID-19 complications, some actually earned more than they did in 2019. If you're one of those who made more money in 2020, you might want to wait to file your current return so that the IRS will determine your third EIP using 2019's lower earnings."

Beware of "ghost" preparers who don’t sign tax returns - IRS. "By law, anyone who is paid to prepare or assists in preparing federal tax returns must have a valid Preparer Tax Identification Number, or PTIN. Paid preparers must sign and include their PTIN on the return. Not signing a return is a red flag that the paid preparer may be looking to make a fast buck by promising a big refund or charging fees based on the size of the refund."

6 Keys to Unlocking the Power of 529 Plans - Ashley Hampton, Keisha Price, and Febby Sugianto, Tax Warrior Chronicles. "Although 529 plans require the beneficiary to have a valid Social Security Number (SSN), expectant parents can get a head start by opening a 529 plan where another qualified family member (parents and siblings, among others) is listed as the initial beneficiary."

What You Need to Know about Sales Tax When Selling Your Company - Jennifer Dunn, TaxJar. "When a buyer purchases your business, they are also buying your sales tax liability. This means a savvy buyer will make sure all of their sales tax i’s are dotted and t’s are crossed before they sign on the dotted line."

Interview: Practitioners Anticipate Tax Filing Season Wins and Woes - William Hoffman, Phyllis Jo Kubey, and Ryan Losi, Tax Notes Opinions. "I would not be surprised if we had another extension of the April 15 deadline. Last March they announced the extension of April 15 for the 2020 season. I think it was right before the March 15 business filing deadline and everybody was kind of laying odds on whether that business deadline would be extended or not"

I think the April 15 deadline should be permanently moved back, to take into account increased tax complexity and the need for many taxpayers to wait on K-1s. I'm not counting on any later deadline this year, though.

IRS mission-critical functions continue during COVID-19 - National Association of Tax Professionals Blog. "The IRS is open and processing mail, tax returns, payments, refunds and correspondence. However, COVID-19 continues to cause delay in some services..."

How Do States Tax Retirement and Social Security Income? Wolters Kluwer Tax & Accounting Blog. "How big of a bite will state taxes take out of your retirement and Social Security income? It depends on where you decide to retire."

Daugerdas Fails in Post-Conviction Hail Mary Motion - Jack Townsend, Federal Tax Crimes. "Daugerdas’ failed effort included the common use of the ineffective assistance of counsel allegation and other 'blunderbuss' claims."

Mr. Daugerdas was an important figure in the turn-of-the-century mass tax shelter craze.

Pandemic-Era Unemployment Compensations Could Generate $78 Billion in Income Tax Collections - Jared Walczak, Tax Policy Blog. "There are valid reasons for the taxability of UC, which is intended as a replacement for wages which were themselves taxable, and is funded—ordinarily—through taxes on the (income taxable) wages of the employed. With so many more people collecting benefits, however, there is the potential for many recipients to be surprised come Tax Day."

Should IRS or Social Security Administer A Monthly Child Benefit? - Elaine Maag, TaxVox:

President Biden, the House Ways & Means Committee, and Senator Mitt Romney (R-UT) agree: They want to increase child benefits to parents who work and those who do not, and they want to deliver benefits regularly throughout the year rather than waiting until families file their tax returns each spring.

But what federal agency should administer such a program—the IRS or the Social Security Administration (SSA)?

Neither SSA nor IRS is the obvious best choice. In the short-term, the IRS holds a slight edge: It has political support and expanding a program is easier than starting a new one. In the long-term, SSA may be better because it has experience delivering monthly payments and shifting benefits when families change. But transitioning from a tax credit delivered by the IRS to a child allowance delivered by SSA might prove difficult and should be done cautiously.

Biden Uses Sketchy Math on Free Community College Pay-For - Jonathan Curry, Tax Notes ($). "President Biden’s assertion that the cost of making community college tuition-free is roughly equivalent to the cost of a tax incentive for racehorse owners doesn’t make it out of the starting gate for tax policy observers."

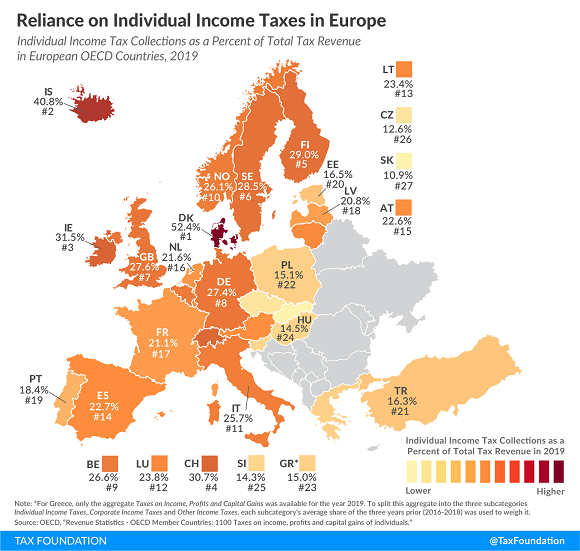

Reliance on Individual Income Tax Revenue in Europe - Elke Asen, Tax Policy Blog. "Denmark relied the most on revenue from individual income taxes, at 52.4 percent of total tax revenue. This is partially because Denmark uses a share of its individual income tax revenue for its social programs instead of levying a social insurance tax dedicated to fund these programs."

The U.S. percentage of reliance on income taxes is 41.5%.

Post-Brexit companies face new UK tariff regime and trade compliance challenges - Suzanne Offerman, Thomson Reuters Tax & Accounting. "Given the ongoing uncertainty and fluidity of the UK’s global trade situation post-Brexit, corporate leaders are understandably concerned about their ability to manage their supply chains."

Related: February Brexit deadline looms for US tech companies and telecoms operating in Europe.

It is reliably reported that today is National Drink Wine Day, if you are so inclined.

Make a habit of sustained success.