Expanded Relief for Healthcare Providers and Nonprofits under the CARES ACT – Kim Hunwardsen, Eide Bailly.

The relief efforts are centered on three key areas:

- Nonprofit service providers participating in state Medicaid and children’s health insurance programs may now be eligible for federal assistance as part of a new $15 billion Provider Relief Fund.

- The Protecting Nonprofits from Catastrophic Cash Flow Strain Act will provide relief to certain reimbursing employers who reimburse states, dollar-for-dollar, when former or furloughed employees collect unemployment benefits.

- The CARES Act established and funded $75 billion in equity relief via the Main Street Lending Program to provide loans to mid-size employers with 50 to 10,000 employees. Guidance initially released on the implementation of these loans indicated the funds were not available to nonprofit organizations. However, the Federal Reserve Board recently modified the program to provide loan options suited to the needs of nonprofit organizations.

Contact Eide Bailly’s Nonprofit team for more guidance.

GOP senators propose stimulus checks of $1,000 for both adults and children – Naomi Jagoda, The Hill. “Four Republican senators on Thursday introduced a bill that would create a second round of coronavirus relief payments, providing more money to children and less to adults compared to the first round.”

Adult dependents, who are not eligible for payments under the CARES Act, would also be eligible for payments of $1,000 under the Republican senators' proposal. The senators said their bill is aimed at focusing coronavirus assistance on families. They noted that under their bill, a family of two parents and two children would receive $600 more than they did under the CARES Act.

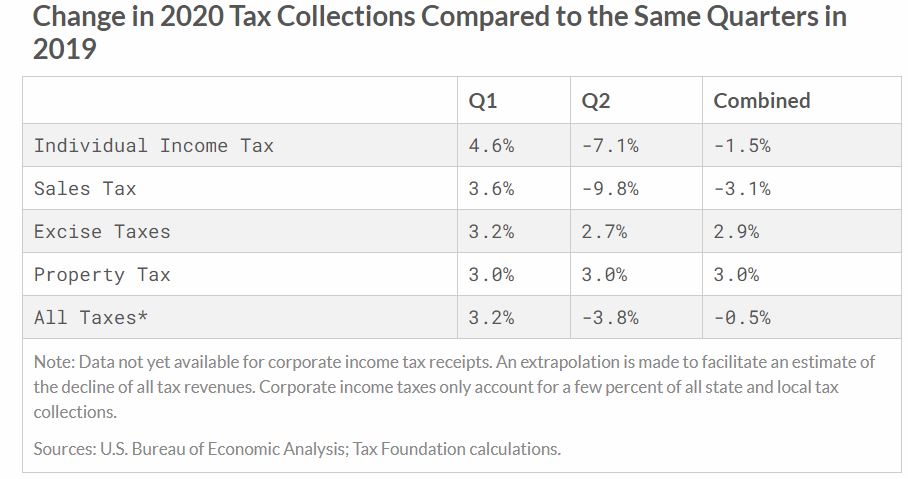

State Income and Sales Tax Revenues Slide in Second Quarter – Jared Walczak, Tax Foundation. “Today marked the release of both second-quarter GDP and national accounts data and provides a new glimpse into early changes in state and local revenues and spending.”

How you can tap your retirement plan to cover COVID costs – Kay Bell, Don’t Mess With Taxes. “The Coronavirus Aid, Relief, and Economic Security (CARES) Act enacted on March 27 provides more favorable tax treatment for withdrawals from retirement plans and IRAs, as well as allows certain retirement plans to offer expanded loan options.”

Per the article, Coronavirus-related retirement account withdrawals or loans can only be made to an individual if any of the following situations apply:

- You are diagnosed with the virus SARS-CoV-2 or with coronavirus disease 2019, referred to as COVID-19, by a test approved by the Centers for Disease Control and Prevention. This includes a test authorized under the Federal Food, Drug, and Cosmetics Act. The same positive COVID-19 test result also applies to your spouse or a dependent.

- You experience adverse financial consequences as a result of being quarantined, furloughed or laid off, having work hours reduced, being unable to work due to lack of childcare, having a reduction in pay (or self-employment income) or having a job offer rescinded or start date for a job delayed, due to COVID-19. Again, if those same circumstances apply to your spouse or a member of your household — specifically, someone who shares your primary residence — that also is a qualifier.

- You or, again, your spouse or a member of your household owns or operates a business and must close it or reduce its hours of a business due to COVID-19.

Simplified accounting rules issued for small businesses – Sally P. Schreiber, J.D., Journal of Accountancy. “Proposed regulations (REG-132766-18) issued Thursday update various tax accounting regulations to adopt the simplified tax accounting rules for small businesses enacted by the law known as the Tax Cuts and Jobs Act (TCJA), P.L. 115-97.”

Small Businesses Still Face Some Tax Accounting Uncertainties – Nathan J. Richman, Tax Notes ($).

The Surprise Provision to Help Traveling Workers With Their Taxes – Jad Chamseddine, Tax Notes($). “A provision in Senate Republicans’ coronavirus relief package that would standardize the taxation of mobile workers came as a surprise to its biggest Democratic proponent.”

“The proposal in the HEALS Act goes further than prior mobile tax simplification bills by clarifying how remote workers should be taxed during the pandemic. The bill dictates that the taxing jurisdiction of an employee is that of the employer regardless of where the employee is while working remotely during the pandemic.”

Where Do Digital Nomads Pay Their Taxes? - Tim Lai, Forbes. “Whether rightly or wrongly, digital nomads have appeared to gain reputation as tax dodgers.”

IRS Provides Extension for Rehab Credit Deadlines – Eric Yauch, Tax Notes($). “The IRS has extended deadlines related to rehabilitation tax credits because of delays caused by the coronavirus, but some are questioning whether the relief goes far enough.”

IRS to allow faxing of automatic method change requests - Sally P. Schreiber, J.D., Journal of Accountancy. “In response to the coronavirus pandemic, beginning July 31, the IRS is allowing taxpayers that file Form 3115, Application for Change in Accounting Method, to fax the duplicate copy of the request, instead of mailing a paper copy.”

Make a habit of sustained success.