House to Vote on Bill Expanding Benefits of PPP - Jad Chamseddine, Tax Notes ($). "The House is scheduled to vote the week of May 25 on legislation to extend the loan forgiveness period of the Paycheck Protection Program (PPP) and allow businesses that take loans under the program to defer payroll taxes."

This is a different bill from the 1,800 page "Phase 4" bill that the House recently sent to die in the Senate. Coming in at only about five pages, H.R. 6886 would extend the PPP forgiveness period to 24 weeks and eliminate the 25% cap on non-payroll expenses. It does not address the deductiblility of expenses triggering PPP loan forgiveness. The IRS taxes the position that such expenses are not deductible because the loan forgiveness is tax-exempt.

The Tax Notes article says the future of this bill is also uncertain. The Senate isn't expected to take up the bill until next month.

IRS Announces 2021 Health Savings Account Contribution Limits, Still Time To Make 2019 And 2020 HSA Contributions - Ashlea Ebeling, Forbes. "You’ll be allowed to contribute $3,600 for individual coverage for 2021, up from $3,550 for 2020, or $7,200 for family coverage, up from $7,100 for 2020."

New DOL & IRS COVID-19 Relief Stops Time for COBRA and ERISA Benefit Plan Deadlines - Nicole M. Krueger, Davis Brown Tax Law Blog. "Plan fiduciaries and participants should review and follow the deadline extensions to help alleviate the effects of COVID-19. These extensions will continue for at least 60 days following the end of the declared state of National Emergency."

Two clients asked me about their tax refunds this week. Both had filed several weeks ago, and each had received their state refunds. Neither had received their federal refunds. With the IRS phone lines for practitioners now working (albeit with a reduced staff), I called the IRS for both clients.

The first client’s return was filed at the end of March. The helpful IRS phone agent told me there was a ‘processing error’ with her return, and the problem is normally resolved within one to four days by the “Error Resolution Department.” Unfortunately, that departments isn’t working right now, so her return (and likely hundreds or thousands of others) is waiting for the IRS Service Centers that process returns to reopen.

Your friendly tax preparer can call the IRS, but she can't make IRS people show up for work.

Bankruptcy and Farm Debt - Keith Fogg, Procedurally Taxing. "The provision for farmers in the bankruptcy code is unusual, in part, because Congress placed it in an even numbered chapter while leaving the rest of the bankruptcy in odd numbered chapters and, in part, because of the amazingly different way Congress treats debts owed by farmers. The case of In re Richards provides a glimpse of some of the unusual provisions in chapter 12 of the bankruptcy code. At issue is whether the IRS can offset a tax refund against debts owed by the farming couple."

Tax Changes in California Governor’s Budget Could Stand in the Way of Economic Recovery - Jared Walczak, Tax Policy Blog:

Consider, for instance, a business that loses $10 million in year 1 and then posts profits of $10 million a year in years 2 and 3. It’s clear that this company has netted $10 million over three years, but without the ability to carry forward the losses, it would actually pay taxes on twice that amount: no tax in year one, and taxes on $10 million per year in years two and three. Net operating loss provisions allow losses to be carried forward (and in some cases back) to smooth income, ensuring that the tax code is targeting average profitability over time and thus allowing corporate net income taxes to do what they’re supposed to do: tax net income.

Under California’s proposed budget, however, net operating losses would be suspended for three years for any business or individual with more than $1 million in taxable income. The governor also proposes capping the amount of credits a company can use in a given year at $5 million.

Some tax policy discussion implies that operating loss deductions are some sort of gimmick or giveaway to the "rich," or are just "paper losses." As Jared explains here, loss deductions are the only way to measure business income accurately over time. Without carryforwards - or better yet, carrybacks - businesses can be taxed at oppressive rates over a period of years -- or even be subject to income tax when they have no income.

Related: A Defense Of The Break Republicans Snuck Into The CARES Act (Peter Reilly, Forbes, citing me).

Shelter In Place In California, Pay California Tax? - Robert W. Wood, Forbes. "How will California and other high tax states treat you if you working from home and just trying to stay safe in this strange new era? It is a surprisingly open question, raising state tax and even city tax issues in California and beyond. As the New York Times NYT recently warned, sheltering in place can put your tax strategy at risk."

Nebraska DOR Issues Guidance on Telework Nexus During Pandemic - Carolina Vargas, Tax Notes ($). "Nebraska employers do not have to change how they report or remit income tax withholding for employees working remotely during the COVID-19 pandemic, according to guidance from the state Department of Revenue."

Link: Nebraska FAQ listing.

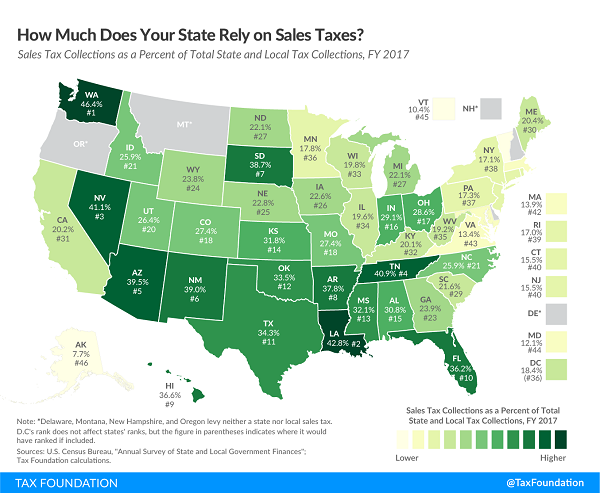

To What Extent Does Your State Rely on Sales Taxes? - Janelle Cammenga, Tax Policy Blog. "Sales taxes are the second largest source of state and local tax revenue, accounting for 23.6 percent of total U.S. state and local tax collections in fiscal year 2017 (the latest data available; see Facts & Figures Table 8). Only property taxes make up a greater share of state and local tax revenue."

Some states take specific steps to exempt COVID-19 payments from taxation - Kay Bell, Don't Mess With Taxes. "The accounting and business advisory firm Eide Bailly LLP notes in today's edition of its tax blog round up (curated by Hawkeye resident and CPA Joe Kristan that Iowa says it won't tax federal individual COVID-19 relief payments."

Today in history: Amelia Earhart becomes the first woman to make solo, nonstop transatlantic flight - History.com:

Five years to the day that American aviator Charles Lindbergh became the first pilot to accomplish a solo, nonstop flight across the Atlantic Ocean, female aviator Amelia Earhart becomes the first pilot to repeat the feat, landing her plane in Ireland after flying across the North Atlantic. Earhart traveled over 2,000 miles from Newfoundland in just under 15 hours.

Amelia Earhart spent some of her childhood in Des Moines, where her father worked for the Rock Island railroad.

Make a habit of sustained success.