GOP Pauses Relief Bill Quest, Wants Traveling Worker Tax Equity - Jad Chamseddine, Tax Notes:

Senate Majority Leader Mitch McConnell, R-Ky., stayed on course with his message to see how the economy plays out before cobbling together another relief package. With the Senate in recess the week of May 25, additional legislation to help taxpayers and the economy rebound from the COVID-19 crisis will be put on hold until June.

Despite rejecting the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act (H.R. 6800), Republicans say a bill at some point is necessary, and insist that a provision to limit liability for businesses be included.

The prospect of states taxing health professionals who traveled to help hard-hit areas during the pandemic may help move a long-stalled initiative to limit the ability of states to tax individuals temporarily in-state - a bill promoted by South Dakota Senator John Thune:

Thune, who also sits on the Finance Committee, said he is promoting his Mobile Workforce State Income Tax Simplification Act of 2019 (S. 604) to help workers who cross state lines for brief periods of time. The bill would exempt workers from filing returns in another state if they work there for 30 or fewer days a year.

But opposition from New Yorkers in Congress, including Senate Minority Leader Schumer, reportedly is a big obstacle to inclusion of mobile workforce relief in any additional COVID-19 legislation.

The deductibility of expenses triggering Paycheck Protection Program loan forgiveness may be part of any new pandemic relief legislation. The IRS position is such expenses may not be deducted.

Mnuchin Satisfied With Latest PPP Guidance Despite Criticism - Alexis Gravely, Tax Notes ($). "Among the questions practitioners still have are whether an employee receiving severance pay counts in the calculation for full-time equivalency and how retirement plan expenses are determined."

USDA Releases Final Rule for Coronavirus Food Assistance Program - Kristine Tidgren, Ag Docket:

To be eligible for a payment, a producer generally must have suffered a five percent or greater price loss over a specified time resulting from the COVID-19 outbreak or face additional significant marketing costs for inventories. A “producer” is a person or legal entity who shares in the risk of producing a crop or livestock and who is entitled to a share in the crop or livestock available for marketing.

Specialty crops eligible for payments include almonds, beans, broccoli, sweet corn, lemons, iceberg lettuce, spinach, squash, strawberries, and tomatoes. CFAP payments will also be made for dairy, cattle, lambs and yearlings, wool, and hogs and pigs. Non-specialty crops eligible for CFAP payments include malting barley, canola, corn, upland cotton, millet, oats, sorghum, soybeans, sunflowers, durum wheat, and hard red spring wheat. The Rule states that eligible commodities, such as aquaculture and nursery crops (including cut flowers) will be announced in the future.

Iowa confirms that PPP forgiveness will be treated as tax-exempt on state returns -- but not for fiscal year filers. From the recently-updated Iowa COVID-19 FAQ:

A taxpayer's PPP loan that is forgiven and properly excluded from federal gross income under section 1106 of the federal CARES Act in a tax year beginning on or after January 1, 2020, will also qualify for exclusion from income for Iowa tax purposes. However, Iowa is not conformed with section 1106 of the federal CARES Act for tax years beginning prior to January 1, 2020. If a taxpayer receives PPP loan forgiveness for a tax year beginning prior to January 1, 2020, that discharge of indebtedness may be considered income for Iowa tax purposes, unless the income qualifies for exclusion under another applicable provision of federal or Iowa law.

This treatment for fiscal-filers may be reconsidered when the legislature resumes its suspended session next month.

Also, Iowa announced that it won't treat the presence of taxpayers working at home as a result of the pandemic as "nexus" for taxing their employers in Iowa.

Iowa says it won't tax federal individual COVID-19 relief payments. Iowa is one of a handful of states that allows a deduction for federal taxes; that means it usually taxes refunds. That led to uncertainty on whether Iowa would tax COVID-19 rebates. The Department of Revenue says no. From the updated Iowa Department of Revenue COVID-19 FAQ:

The COVID-19 economic impact payments authorized in section 2201 of the federal CARES Act, whether in the form of a rebate or a refundable tax credit, will not be included in Iowa taxable income or added back as part of an individual’s reportable federal income tax refund for Iowa individual income tax purposes.

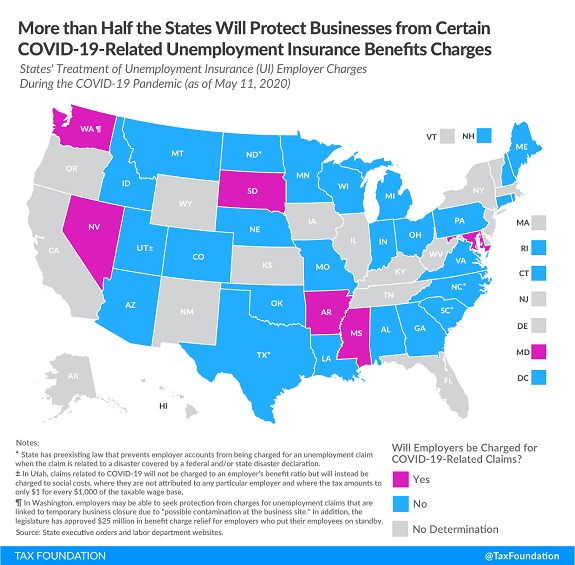

More Than Half the States Will Protect Businesses from Certain COVID-19-Related Unemployment Insurance Tax Hikes - Katherine Loughead, Tax Policy Blog. "This is a reasonable way to help protect businesses and industries that have been disproportionately impacted by mandated business closures and stay-at-home orders. It will also help ensure more businesses will be able to survive this crisis and rehire their employees once they can safely resume operations."

July 15 is still Tax Day (for now), but Form 4868 Oct. 15 extension still available - Kay Bell, Don't Mess With Taxes. "Submitting Form 4868 give you until Oct. 15 to complete and file your tax return. That can be done up until the annual tax deadline, which this year is July 15. That way you'll have more time to fill in the revised Form 1040 and its now just three schedules."

The CARES Act Charitable Deduction For Non-Itemizers Was A Lost Opportunity To Help Beneficiaries Of Non-Profits - C. Eugene Steuerle, TaxVox. "The CARES Act version has several flaws: First, it provides deductions for what people do anyway. Second, the law creates no way for the IRS to track newly deductible gifts, and cheaters will be among the biggest winners. Finally, it caps at a very low level the amount of giving eligible for the new subsidy."

FSA and Health Insurance Mid-Year Changes Allowed - Susan Freed, Davis Brown Tax Law Blog. "Importantly, employers are not required to allow these mid-year election changes and if they do decide to allow some or all of these changes, they may place parameters on them-such as a onetime opportunity to take advantage of the event."

Article on Renewed Focus on Criminal Tax Enforcement - Jack Townsend, Federal Tax Crimes. The post quotes from a Bloomberg Tax article:

Before the onset of the Covid-19 pandemic, the IRS took a number of steps to swing the pendulum back toward more fraud enforcement. Once the IRS and the rest of us are beyond the extraordinary adjustments underway now to our tax administration system and our lives, these actions will begin to take hold. This article will consider these increasingly clear signals from the IRS that when that happens, investigating and punishing fraud will again be a growing focus for the IRS, with important implications for tax practitioners advising clients in audit and collection matters.

With reduced enforcement resources, the IRS may resort more to the threat of prosecution to keep taxpayers on the straight and narrow.

Related: Increased IRS Compliance & How it Will Affect You

Still, he persisted. And it went badly.

A La Crosse, Wisconsin dentist has been sentenced to 72 months in federal prison on federal tax charges. Six years is an unusually harsh tax sentence. The government's sentencing request gives some background. According to the document, this is the dentist's third tax conviction, following a 1993 Wisconsin conviction that resulted in prison time and a federal conviction with a three year sentence in 2007.

Still, he persisted. From the government's sentencing memorandum:

In June 2011, when his supervised release expired, the defendant reopened his dental practice and reverted to a familiar pattern of tax evasion. As detailed at trial, this included evading both his outstanding tax obligations (as determined in the prior trial and by IRS audit), as well as the assessment of taxes on the income from his reopened dental practice. Similar to his prior scheme, he ran his finances in a way to avoid creating a paper trail or records that would potentially result in the IRS receiving notice of his income or assets. He did not file income tax returns. He had his patients pay in cash, checks with the payee line left blank, and silver. He rejected direct payments from insurance companies, with statements such as: “I do not have a tax ID #. I do not use a social security #. I do not accept assignment of benefits, and therefore you do not need to produce a[n IRS Form] 1099 for me.” Ex. 8 (Insurer Letters). He did not have a bank account. He paid his expenses in a way to conceal his assets and income from the IRS. This included paying office rent using money orders and paying his employee and his home rent with checks received from patients with the payee line left blank.

The defendant’s efforts to conceal assets and income from IRS collection worked. The IRS was unable to locate any assets or income to lien or levy.

"Worked" may not be exactly how I would put it. The dentist is 71 years old. He faces six years behind bars, and under federal rules, he will have to serve almost all of it. But the IRS can't find his assets, so it...worked?

Make a habit of sustained success.