Syndicated Easement Sponsor Warns Investors of IRS Audits - Kristen Parillo, Tax Notes ($). "A prominent Georgia-based company that previously sponsored syndicated conservation easement deals is warning its investors that IRS audits are coming and that it doesn’t expect resolutions at the exam level."

These deals attempted to use favorable IRS treatment of appreciated property contributions and conservation easements to create a marketable tax shelter. The IRS has challenged these deals on a number of grounds with notable success. The IRS has even launched an enforcement "campaign" dedicated to these transactions.

Trump Calls for Cutting Capital Gains Taxes - All of Them - Jonathan Curry, Tax Notes ($). "During a May 8 news conference at the White House with Republican members of Congress, Trump said he favors getting rid of the capital gains tax altogether."

I'm no Nostradamus, but this seems unlikely.

Capital Gains Cuts Won’t Cure the Covid-19 Economy - Leonard Burman, TaxVox. "There is nothing wrong with a good debate over the appropriate treatment of capital gains income in the context of a very imperfect federal income tax. But lowering the taxes imposed on capital gains income is not a cure-all policy. And this proposed policy change makes no sense as a response to the COVID-19 pandemic."

Reducing the Bias Against Long-term Investments - Daniel Bunn and Elke Asen, Tax Policy Blog. "Just as depreciation schedules are a common feature of tax systems around the world and create a bias against long-term investments, a tax bias in favor of debt-financed investment also exists. This is primarily due to the deductibility of interest costs when there is usually no comparable deduction for equity financing costs."

Stimulus-Response. Former Taxpayer Advocate Nina Olson posted The Uncertainty of Death and Taxes: Economic Stimulus Payments to Deceased Individuals at Procedurally Taxing blog:

First of all, it sounds admonishing. This to survivors of loved ones who died in 2020, 2019, or 2018 and did nothing to receive this payment other than open the mail or check their bank accounts.

Bryan Camp responds on the same platform with Of Mountains and Molehills: A Further Analysis of EIP To Dead People, saying:

Folks who died before January 1, 2020, are not entitled to the refundable credit authorized by subsection (a). Perhaps obviously, neither will such folks be able to file a return for 2020 on which to have errors forgiven by the subsection (f) true up provisions.

Perhaps.

6 reasons why your COVID stimulus amount was less than you expected - Kay Bell, Don't Mess With Taxes. "The available amounts are based on where your income falls within the coronavirus relief payment earning parameters... If you made more than those top income amounts for your status, you won't get any COVID-19 payment at all this year."

IRS Explains Why Your Stimulus Check Might Be Different Than You Expected - Kelly Phillips Erb, Forbes. "If your payment is smaller-than-expected, and it's a mistake, you may be able to "fix" it early next year when you file your 2020 federal income tax return."

Answers - Robert D. Flach, The Wandering Tax Pro. "Perhaps most important – there is absolutely nothing your tax preparer can do to expedite the processing of your 2019 tax return or 2020 stimulus payment or the issuance of your 2019 refund or 2020 stimulus payment check."

How PPP Loans Impact Public Hospitals - Eide Bailly. "In other words, the SBA is providing some leeway when it comes to public hospitals by allowing them to be eligible recipients for these loans even without having 501(c)(3) status but instead relying on their exemption under Section 115. They do, however, need to meet the requirements of a 501(c)(3)."

New DOL & IRS COVID-19 Relief Stops Time for COBRA and ERISA Benefit Plan Deadlines - Nicole Krueger, Davis Brown Tax Law Blog. "The DOL recognizes that plan administrators may have difficulty complying with notice and disclosure deadlines at this time. As a result, the deadlines for furnishing notices, disclosures, and other documents (notices) required under Title I of ERISA, such as SPDs and notices of blackout periods, have been extended."

3 Virus-Related Tax Credits IRS Pays In Cash Long Before Tax Time - Robert W. Wood, Forbes. "Here are three credits employers can claim."

Lesson From The Tax Court: Late Is Late! The Impact Of COVID-19 On Filing Petitions - Bryan Camp, TaxProf Blog. "A recurring issue in Tax Court litigation is the timeliness of petitions. Currently the rules are strict. While the Tax Court has used some very creative legal reasoning over the years to find some small stretch in the statutes, it steadfastly holds to the view that it is powerless to apply basic and well-settled equitable principles to stretch the statutes any further. Thus Tax Court judges routinely, and reluctantly, kick taxpayers out of court."

Non-COVID Topic - Form 1040-SR and Data - Annette Nellen, 21st Century Taxation. "There is no difference between the 1040 and 1040-SR besides the 'SR' and font size."

Indiana Announces additional COVID-19 filing and payment extensions - Indiana Department of Revenue Release:

- Individual estimated payments originally due on June 15, 2020, are now due on or before July 15, 2020.

- The deadline for filing a claim for refund of income tax set to expire between April 1 and July 14, 2020, is now extended to July 15, 2020 (including refunds of withholding or estimated tax paid in 2016).

- Corporate estimated payments due on April 20, May 20 or June 22, 2020, are now due on or before July 15, 2020.

- The corporate tax returns listed below due on May 15, June 15 or July 15, 2020, are now due on August 17, 2020. This includes forms IT-20, IT-41, IT-65, IT-20S, FIT-20, IT-6WTH and URT-1.

Could Donald Trump’s Dock Battle With Mar-A-Lago Neighbors Cost Him Millions In New York Taxes? - Peter Reilly, Forbes. "A story in the Washington Post by Manuel Roig-Franzia maintains that the President’s claim of Mar-a-Lago as his permanent residence violates agreements that he made when he converted Mar-a-Lago from a private residence to a club."

Chancery Court Finds Delaware Property Tax System Unconstitutional - Aaron Davis, Tax Notes ($). "The court's ruling in Delawareans for Educational Opportunity v. Carney, written by Vice Chancellor J. Travis Laster, found that Delaware’s three counties used property tax assessment methods that violated the state’s uniformity clause by treating owners of the same class of property differently, and violated the state’s true value statute by not assessing properties at their fair market value."

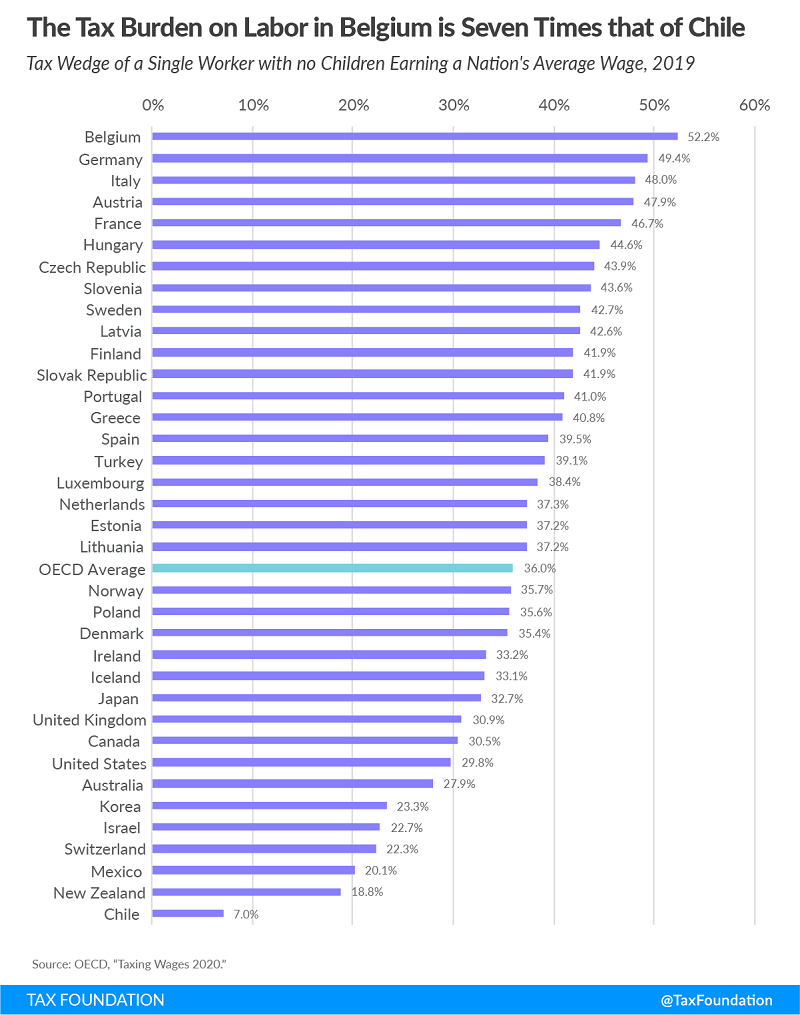

A Comparison of the Tax Burden on Labor in the OECD - Cristina Enache, Tax Policy Blog. "Average wage earners in the OECD have their take-home pay lowered by three major taxes: individual income, payroll (both employee and employer side), and value-added (VAT) and sales taxes"

Interesting throughout.

Man who asked Iowa court to let him engage in sword fight with ex-wife is found not insane - AP via Omaha World Herald. No sword fight, though.

Make a habit of sustained success.