Tax Pros Skeptical of IRS Payment Deferral, but Welcome Relief - William Hoffman, Tax Notes ($). The limited relief offered by the Treasury for payments, but not filings, made after April 15 has not impressed:

Tax practitioners told Tax Notes that while they appreciate the tax payment relief for individuals and businesses in sudden financial distress from the pandemic’s fallout, there are too many unanswered questions about how the IRS will deal with taxpayers already on payment plans or without access to the internet or in-person tax help, and how state tax authorities will mesh — or not — with the new tax season regime.

“There’s a large gap between the guidance tax professionals would like to see and what we’re seeing,” said Robert Kerr, executive vice president of the National Association of Enrolled Agents.

Practitioners note the difficulty of continuing business as usual when many tax shops have gone to work-at-home schedules. Especially for older taxpayers and in hard-hit areas, taxpayers have problems getting their information to their tax pros. And there are other questions:

David Werlich of Ryan & Werlich wondered how the IRS will handle first- and second-quarter estimated tax payments due on June 15. “Safe harbor payment rules require the calculation of the 2019 tax,” he noted.

“We need an auto extension of time to file,” [Enrolled Agent Kathy] Hettick said. “Why not just extend the [tax return] due date? For me, in [coronavirus-stricken] King County, Washington state, this is causing added stress to taxpayers, particularly small businesses, who don’t have the time or energy to worry about getting tax information together and then deliver it to me.”

We need to remember that all we have to go on so far is the Mnuchin press conference and unofficial leaks to the press. The published guidance may differ. I think the Treasury position as it appears to be this morning - which allows late payments, but penalizes late filing - is untenable and will crumble under the pressure of events. But for now, everyone needs to be shooting for April 15 filing.

IRS Must Implement Measures in Support of Small Businesses Through Coronavirus Pandemic - Noah McGraw, Procedurally Taxing. A view that the IRS and Treasury are failing to use the tools available to provide relief to taxpayers:

Per IRM 25.16.1.1 3(a), “The objectives of the Disaster Program Office are to: a. ensure eligible taxpayers receive the appropriate level of federal tax relief when they are impacted by a federally declared disaster,” and “c. timely and effectively communicate IRS disaster relief decisions to external and internal customers.”

In consideration of the level of escalation experienced over the past week, now is the time for the Service to follow the guideline and provide taxpayers with relief on this latest disaster affecting the country.

The Service should invoke IRC Section 7508A (“Authority to postpone certain deadlines by reason of Presidentially declared disaster or terroristic or military actions”) for tax returns and liabilities at least until such time that the Coronavirus could be considered by relevant health experts to be “past the peak” of the outbreak. An additional 90 days beyond this peak would be even more helpful to those businesses who are facing extreme drops in demand for their services as individuals self-quarantine across the country.

This relief necessarily should include extending the filing date for individual and business income tax returns, the Quarterly filing date for businesses’ payroll returns, as well as the non-assessment of penalty and interest against taxpayers who are unable to meet the Federal Tax Deposit payment deadline, or the Estimated Tax payment deadlines.

There is some uncertainty whether the currently declared "emergency" qualifies as a "disaster" under 7508A. It seems close enough to one for government work.

In Response To Coronavirus, Mnuchin Confirms Tax Relief But Does Not Extend IRS Filing Season - Kelly Phillips Erb, Forbes. "To be clear, as of today, the deadline for filing your individual federal income tax returns remains April 15, 2020."

Tax Deadline NOT Being Extended; Payment Deadline Extended for Most by 90 Days - Russ Fox, Taxable Talk. "In any case, there is some relief though I think it would have been far better to have simply extended the deadline to July 15th."

IRS Adviser Calls for Relief Beyond Extensions and Penalties - Stephanie Cumings, Tax Notes ($). "The IRS Advisory Council (IRSAC) is asking for temporary relief from physical signatures on tax returns and other measures for coping with the coronavirus pandemic in addition to deadline extensions and waived penalties."

Senate Sets Sights on Rebate Checks, Tax Cuts to Aid Economy - Jad Chamseddine and Alexis Gravely, Tax Notes ($). "Republicans, however, appear to have coalesced around an idea to provide direct cash payments for a number of months to taxpayers... The proposed direct cash payment to taxpayers appears to have replaced talk of a payroll tax holiday."

How the Federal Government and the States Could Help Save Small Businesses Through Temporary UI Tax Adjustments - Jared Walczak, Tax Policy Blog. The bulk of unemployment insurance taxes are imposed by the states themselves, and these systems are incredibly complex."

LB&I Revamping How It Audits High-Risk Research Credit Claims - Kristen Parillo, Tax Notes ($). "The IRS Large Business and International Division has announced plans to centralize the process for examining research credit claims that pose the greatest compliance risks."

Free link to directive here.

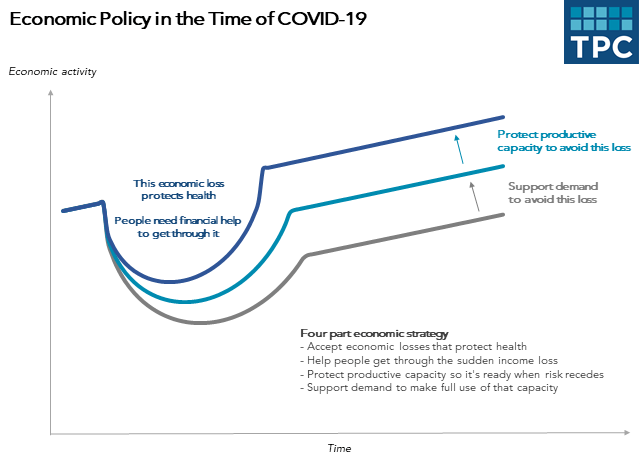

Macroeconomic Policy In The Time Of COVID-19 - Donald Marron, TaxVox.

"First, we should embrace those economic losses that protect health."

Tax Change Ideas to Address Coronavirus Costs - Annette Nellen, 21st Century Taxation.

Stop smoking to reduce health risks & possibly your taxes - Kay Bell, Don't Mess With Taxes. "Certain smoking cessation programs are tax deductible."

DOJ Tax Announces Convictions in Massive Biodiesel Tax Fraud - Jack Townsend, Federal Tax Crimes. "The press release is interesting for the pictures posted at the bottom, which presumably show the boys’ toys’ from their ill-gotten gains."

Interesting. Still, I'm not sure seeing these visuals will deter impressionable would-be fraudsters from a life of tax crime.

Make a habit of sustained success.