IRS eases up on foreign retirement, benefit trusts, allows retroactive penalty waivers.

Taxpayers facing big foot-fault penalties for failing to report interests in foreign retirement plans and employee benefit trusts got good news from the IRS yesterday. Rev. Proc. 2020-17 announces that the IRS intends to exempt such trusts from annual reporting requirements, providing they meet some conditions. More importantly, the ruling provides for abatement and refund of penalties already assessed.

The tax law has strict rules for reporting interests in foreign trusts. Failure to File Form 3520 triggers penalties that start at $10,000.

These reporting requirements are designed to police the use of offshore trusts to avoid taxes. Jared Johnson, Director of Global Mobility Services at Eide Bailly, explains how the IRS has read these rules to apply to more innocent arrangements:

For many years the IRS has determined that US persons (US Citizens, Green Card Holders, and US Tax Residents) who own tax favored foreign (non-US) retirement accounts and some tax favored non-retirement savings accounts could be considered foreign grantor trusts and subject these investments to US tax reporting on US international informational reporting on form 3520 and form 3520-A

This can easily trip up a U.S. Person working for a foreign employer, imposing a reporting requirement for retirement and benefit plan participation that has no counterpart for someone working in the U.S.

Rev. Proc. 2020-17 wisely concludes that these trusts aren't really suitable for evading taxes:

...applicable tax-favored foreign trusts generally are subject to written restrictions, such as contribution limitations, conditions for withdrawal, and information reporting, which are imposed under the laws of the country in which the trust is established, and because U.S. individuals with an interest in these trusts may be required under section 6038D (Form 8938) to separately report information about their interests in accounts held by, or through, these trusts, it would be appropriate to exempt U.S. individuals from the requirement to provide information about these trusts under section 6048.

That doesn't mean U.S. persons with interests in such plans are entirely off the hook for U.S. reporting. As the above passage notes, Form 8938 may apply to interests in such plans if the value of the interest exceeds $50,000 for U.S. residents, or $200,000 for Americans living overseas. Also, these plans may cause U.S. income tax. But the waiver of the Form 3520 requirement and the promise of penalty abatement or refund will be great news for many overseas Americans.

Eide Bailly’s Beatrice Skyberg, who specializes in offshore reporting, cautions “This Rev. Proc. would not impact the ‘US-sitused foreign trust’ in popular trust jurisdictions such as South Dakota and Nevada. They still need to file 3520/3520A and many other relevant forms based on existing rules - no break for them.”

IRS Urged to Make Full Use of Arsenal Against Improper Payments - William Hoffman, Tax Notes. "By its own estimate, the agency made $18.4 billion in improper earned income tax credit payments (25 percent of the total) in fiscal 2018, and billions more in recent years for improper American opportunity tax credit and additional child tax credit payments, the Treasury Inspector General for Tax Administration found in an audit released March 2."

What is a “Trade or Business” For Purposes of I.R.C. §199A? - Roger McEowen, Agricultural Law and Taxation Blog. "One thing that the Final Regulations did not do, however, was provide a precise definition of what constitutes a “trade or business” for QBID purposes."

IRS Clarifies Guidance for Business Meals and Entertainment - Kristine Tidgren, The Ag Docket. "The proposed regulations include a number of examples explaining the deductibility of food and beverages under different circumstances, including the TCJA’s 50 percent limit to the deduction for food and beverages provided as a de minimis fringe benefit."

Check, Please: IRS Issues Proposed Regulations On Business Meals & Entertainment - Kelly Phillips Erb, Forbes. "Under prior law, the rule was that you could deduct 50% of entertainment, amusement, or recreation expenses directly related to your trade or business. Under the TCJA, the meals deduction remained but there is no deduction for any item generally considered to constitute entertainment, amusement, or recreation."

Applications open for Renewable Chemicals Production Tax Credit - Des Moines Business Record. "The program offers incentives for the production of 30 high-value chemicals derived from biomass feedstocks. Applications and information on the program are available online."

HSAs For Wealthy Clients? Yes! - Eric L. Reiner, Financial Advisor Magazine. "'HSAs can be beneficial to the high-income individual for a lot of reasons,' says Amie Kuntz, tax senior manager at Eide Bailly LLP in Des Moines, Iowa."

6 tax moves to make this March - Kay Bell, Don't Mess With Taxes. "1. Contribute to your 2019 IRA."

While you are at it, fund your 2020 IRA too!

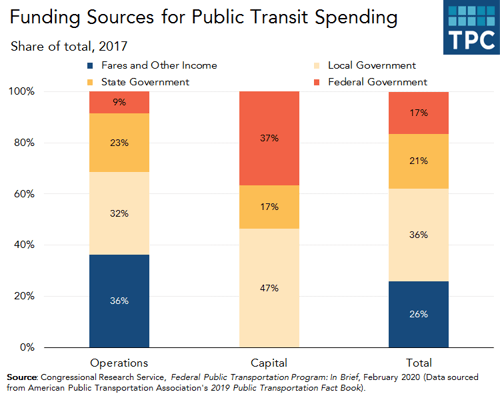

What Do Federal Taxes Have To Do With Your Public Transit? - Aravind Boddupalli and Erin Huffer, TaxVox. "More ridership means more money from fares, but user fares only cover about a quarter of all transit costs."

AI Comes to the Tax Code - Richard Rubin, Wall Street Journal. IRS resources may be tight, but you don't have to pay bots overtime. That makes skipping taxes a tougher proposition. Richard Rubin quotes the IRS Commissioner discussing the new IRS initiative to visit the homes of high-income nonfilers:

“How do you think we found these people?” said IRS Commissioner Charles Rettig at a conference on artificial intelligence and taxes this week at the University of California, Irvine law school. “It wasn’t on filed returns. These are non-filers. There is a heat map that says where there are concentrations of these people. We have sufficient data on these people.”

The article notes that states are using similar technology, making it riskier to ignore state income and sales tax filing requirements. Be careful!

Make a habit of sustained success.