Interesting Court Cases: Failure to File an FBAR and Interpretation of “Reasonable Cause” – Manasa Sogal Nadig, The Buzz About Taxes

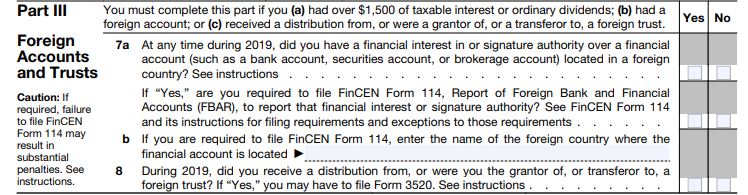

Small checkboxes on a tax return may not seem like much but oh can they cause trouble if not answered correctly and honestly. The foreign bank account reporting, or FBAR, is one such return line. Found on Schedule B of Form 1040, the question asks if during the year taxpayer had a financial interest in or signature authority over a financial account located in a foreign country. If yes, was the value of such account greater than $10,000 at any time during the year requiring FBAR filing?

The penalty for nonfiling if required is steep, ranging from $10,000 to $100,000. However, the IRS may waive the penalty if nonreporting was due to reasonable cause, determined on a case by case basis.

Recently, an immigrant from India found himself on the wrong end of the Court’s decision regarding his FBAR nonfiling and reasonable cause when he failed to appropriately file arguing English was his second language and he had an inexpert understanding of requirements. Ms. Nadig explains:

“The court held that no reasonable juror could find that [taxpayer] acted with ordinary business care and prudence, or that he made a reasonable effort to understand his FBAR reporting responsibilities, when he failed to file his FBARs for the years 2006-2009.”

Ego likely didn’t help the taxpayer when he admitted enough smarts to work as a geophysicist in the U.S. and to represent himself in this case…but not enough to properly file his tax return. Taxes aren’t rocket science but clearly they warrant proper diligence.

Related: Our International team can help determine what foreign filing requirements you might have - given the penalty potential, it's not something to overlook!

Taxpayer Gets Hit With Willful Failure to File FBAR Penalties After Voluntarily Withdrawing from OVDI Program – Ed Zollars, Current Federal Tax Developments. “The IRS position was that [taxpayer] was constructively aware of his FBAR reporting obligations by signing the return with the Schedule B questions referring to FBAR as part of the form. As well, his use of his sister’s address represented evidence of an attempt to conceal the accounts.”

What is a “Trade or Business” For Purposes of I.R.C. §199A - Roger A. McEowen, Agricultural Law and Taxation Blog. “The rub for many farm landlords is to create QBI from rental income without triggering self-employment tax.”

Where’s My Refund?

Many tax pros will tell you having a big refund is just bad tax planning. But if you must have one each year, the IRS and your CPA want you to know you can check its status on your own!

Visit “Where’s My Refund?” page on the IRS website or use the IRS2GO Mobile App to see how close your refund is to that new pair of shoes. You’ll need your social security number or ITIN, filing status, and exact refund amount.

Amazon Sellers Hit by Huge Back-Tax Bills Across the Country – Tripp Baltz, BloombergTax. “Under the law in most sales tax states, having inventory in an Amazon warehouse qualifies as having a physical presence in that state—giving rise to the responsibility of collecting and remitting sales tax. But for years, many third-party sellers didn’t collect and remit.”

Related: Sales Tax Reform: Amazon Fulfillment Centers Creating Confusion

Bill Gates and the Tax Benefits of Private Foundations – Edward A. Zelinsky, TaxNotes ($). “The IRC could (and should) impose higher taxes on taxpayers who contribute to private foundations”

Lesson From The Tax Court: Taxpayer Cannot Cure Reporting Error During Audit – Bryan Camp, TaxProf Blog. “Courts have long recognized why the IRS must have the power to regulate reporting. Without such power ‘the business of tax collecting would result in insurmountable confusion.’”

Monday Motivation:

"The moment you want to quit is the moment you need to keep pushing." - Unknown

Make a habit of sustained success.