COVID bill with PPP expense deductions, extenders pass. Congress last night sent the COVID omnibus compromise to the President, who is expected to sign the bill. Key tax-related features of the bill include:

- Allowance of deductions for expenses giving rise to forgiveness of Paycheck Protection Program loans. The forgiveness itself is tax-exempt. The Treasury had ruled that the tax-free forgiveness made the expenses non-deductible.

- $600 cash payments to individuals, $1,200 to couples. The payments will phase out for individuals with incomes over $75,000 and couples earning over $150,000.

- Changes and improvements to the Employee Retention Credit.

- A provision allowing taxpayers to claimed 2020 Earned Income and Child Tax Credits based on 2019 earned income.

- Temporary restoration of 100% deductibility for meals and entertainment expenses for 2021 and 2022.

- An increase in the above-the-line charitable deduction for non-itemizers to $600 for joint filers. It had been $300 for both joint and single filers. The deduction is extended through 2021.

- It made some temporary tax breaks permanent while extending the lives of others. Tax breaks made permanent include the Sec. 45G railroad track maintenance credit, the Sec. 179D deduction for energy efficiency improvements to commercial buildings, and a reduction in excise taxes for craft breweries and distilleries. Extended credits include the Work Opportunity Credit and New Markets Tax Credit.

The bill also includes an extension and modification of the PPP loan program

Watch Tax News & Views and the Eide Bailly insights page for additional analysis of the COVID bill provisions.

Six key tax provisions in the very long bill that Congress is about to pass - Scott Greenberg, No Withholding. "By my quick count, roughly 200 out of the 5593 pages of the bill deal with tax changes."

Congress Passes Year-End Bill With Full PPP Deductibility - Jad Chamseddine, Tax Notes. "There were initial concerns that despite its overwhelming bipartisan support, PPP deductibility wouldn’t be included in the bill because of objections raised by Treasury Secretary Steven Mnuchin. The IRS released guidance (Notice 2020-32, 2020-21 IRB 837) in April declaring that expenses funded with forgiven PPP loans weren’t deductible."

Tax Extenders Hitch a Ride on Omnibus and COVID-19 Relief Deal - Erica York, Tax Policy Blog. "The only extender allowed to lapse of the 33 scheduled to expire at year end is the special rule for sales or dispositions by a qualified electric utility to implement Federal Energy Regulatory Commission (“FERC”) or state electric restructuring policy (sec. 451(k)(3)). Lawmakers chose to make a handful of extenders permanent, offer five-year extensions for some, and one-year extensions for the rest."

Relief Bill Modestly Expands Universal Charitable Deduction - Fred Stokeld, Tax Notes. " It would set the deduction at $300 for individuals and $600 for joint filers. Under the CARES Act, the deduction is $300 for both individuals and joint filers."

Special COVID pandemic tax benefits for charitable help - Kay Bell, Don't Mess With Taxes. "Most taxpayers — the IRS says it's close to 90 percent of us — choose to take the standard deduction. For years, that's meant these filers couldn't claim any tax deduction for their charitable contributions. The CARES Act changed that."

Stimulus Payments, Paycheck Protection Program Expense Deductibility Headline Tax Changes In Latest COVID Relief Package - Tony Nitti, Forbes. "The bill reopens the original Paycheck Protection Program by earmarking $35 billion for those who have not yet borrowed."

Congress Takes Lead On PPP In New Stimulus Bill, Defying Treasury - Kelly Philips Erb, Forbes. "The bill would expand the PPP program to allow some businesses to receive an additional loan. The second loan, called a 'PPP second draw' loan, is targeted to smaller and harder-hit businesses."

Congress Reaches a Deal on $900 Billion in Pandemic Relief - Garrett Watson and Erica York, Tax Policy Blog. "Flexible Savings Account (FSA) balances can be rolled from the 2020 tax year into 2021, and 2021 balances can be rolled into 2022. This will help taxpayers with unused balances such as for childcare expenses who would normally lose the value of the FSA balance at the end of the tax year."

The Pandemic Relief Bill’s Good, Bad, and Ugly Tax Provisions - Howard Gleckman, TaxVox. "The pandemic relief bill Congress is about to pass is loaded with tax provisions. Some deliver important assistance to households and businesses damaged by COVID-19 and the economic downturn, some represent sensible long-term tax policy that has little to do with pandemic relief, and some are awful special interest-giveaways."

Help for the Holidays, at Last - Renu Zaretsky, Daily Deduction. "The bill includes a few unexpected provisions. There are no limits on the ability of firms to deduct expenses already funded with Paycheck Protection Program grants. Lawmakers had considered 'guardrails.'"

COVID-19 relief bill addresses key PPP issues - Jeff Drew, Journal of Accountancy. "The U.S. Senate and House of Representatives overwhelmingly passed a $900 billion COVID-19 relief bill Monday night that provides $600 stimulus payments to individuals, adds $300 to extended weekly unemployment benefits, and provides more than $300 billion in aid for small businesses."

Brewers, Restaurants, Federal Workers Set for Tax Wins in Congressional Deal - Richard Rubin, WSJ ($). "The beer industry, struggling restaurants and federal workers forced into President Trump’s payroll-tax deferral all stand to gain from the year-end congressional agreement reached Sunday."

Expenses Associated with PPP Loans to be Fully Deductible - Russ Fox, Taxable Talk.

Expenses With PPP Money Are Tax Deductible, Congress Reverses IRS - Robert W. Wood, Forbes.

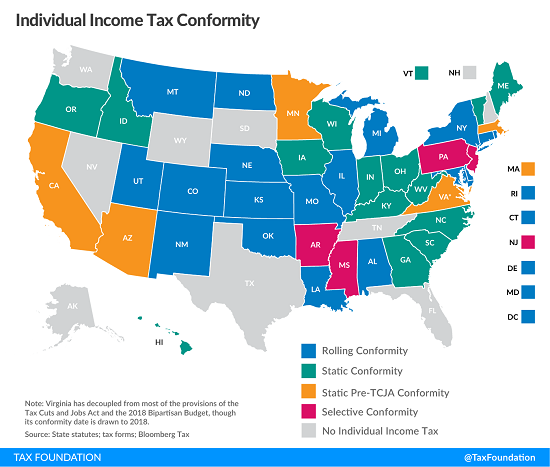

What will states do? Some states, including Iowa, automatically couple with federal tax law changes absent action by their own legislatures. Other states will only conform to federal changes if their own legislatures pass bills conforming to the new law. More here.

Note: Iowa switched to rolling confimity effective in 2020.

IRS Believes It Was Unaffected by SolarWinds Hack, Wyden Says - Wesley Elmore, Tax Notes ($). "There’s no evidence that the IRS was compromised or that taxpayer information was stolen as part of the recent SolarWinds network software breach, Senate Finance Committee staff have been informed."

COVID-19 Sparks Activity on Traditional Mobile Workforce Issues - Amy Hamilton, Tax Notes. "The COVID-19 pandemic is bringing to the surface a renewed focus on mobile workforce issues regarding when income tax return filing and withholding requirements are triggered by workers traveling to a state for a conference, for example."

Atlanta Tax Professionals Plead Guilty to Promoting Syndicated Conservation Easement Tax Scheme Involving More Than $1.2 Billion in Fraudulent Charitable Deductions - Department of Justice. "According to court documents, [the Defendants] additionally solicited investors after the end of the tax year and advised them to backdate payments and documents to make it appear that the “investments” were timely made before the end of the tax year. [the Defendants] also prepared and assisted in the preparation of false tax returns for clients who agreed to invest in the SCE shelters. In exchange for their promotion of the abusive SCE tax shelters, between 2013 and 2019, [the Defendants] each received more than $1.7 million in commissions."

Roots Of The 250% Solution To Charitable Easement Tax Abuse - Peter Reilly, Forbes. "Back in the day there were legitimate tax shelters for people with high incomes and not much else."

‘Tis the Season for Giving, But When Is A Transfer A Gift? - Roger McEowen, Agricultural Law and Taxation Blog. "When is a transfer of property a completed gift for federal gift tax purposes?"

How the CARES Act Affects Net Operating Losses - Deborah Petro, Thomson Reuters Tax & Accounting Blog. "Under the CARES Act, taxpayers that carryback their NOLs must use the entire five-year carry back period."

Theft Loss Deduction – the “Discovery Year” - Ryan Dean, Freeman Law. "In Giambrone v. Commissioner, the Tax Court held that the taxpayers were not entitled to a theft loss deduction because they did not claim the deduction in the year they discovered the illegal scheme giving rise to the deduction."

Celebrate! Today is National Cookie Exchange Day! I will gladly give you a cookie tomorrow if you will give me a cookie today.

Time off. I will be participating in the Eide Bailly sabbatical program for partners for the next six weeks or so. During that time I will be cut off from the firm's phone system, network and emails. It's the firm's way of ensuring that even workaholic partners take a break occasionally.

While I am enjoying radio silence, Dan McNeil will continue to provide Roundups on Monday's and Fridays. Adam Sweet, leader of our firm's partnership specialty group, will cover Wednesdays and chip in on other days as the spirit moves him. The various specialty groups of our National Tax Office will cover the remaining weekdays while I am gone.

My next post is scheduled for February 9. Behave while I'm away, everyone!

Make a habit of sustained success.