PPP Deductibility May Find Its Way Into Final Relief Bill - Jad Chamseddine, Tax Notes:

Democratic lawmakers want a bipartisan framework that includes Paycheck Protection Program deductibility as the starting point in a new round of coronavirus relief negotiations.

In a joint statement December 2, House Speaker Nancy Pelosi, D-Calif., and Senate Minority Leader Charles E. Schumer, D-N.Y., said that “in the spirit of compromise,” a framework released the previous day should be used as common ground to negotiate a comprehensive relief bill.

Also:

Senate Finance Committee member John Cornyn, R-Texas, who introduced a PPP deductibility bill (S. 3612), was confident that his provision would make it into a relief package. “I don’t know of any real opposition among lawmakers, so I would think it is a noncontroversial issue,” he told Tax Notes.

With fourth-quarter corporation income tax estimates due December 15, it would sure help to know how taxable income for 2020 will be computed.

Coronavirus-Stimulus Efforts Pick Up Speed - Kristina Peterson, Wall Street Journal ($). "Lawmakers hope to attach any coronavirus relief to a full-year spending bill they are trying to pass before the government’s current funding expires on Dec. 11. Senate Appropriations Committee Chairman Richard Shelby (R., Ala.) said Wednesday he was concerned the bill might not be ready in time, forcing lawmakers to pass a short-term extension to give them time to wrap up their work."

AICPA Pushes Back on PPP Questionnaires for High-Dollar Borrowers - Eric Yauch, Tax Notes:

Borrowers of more than $2 million in Paycheck Protection Program loans are being asked to compare their gross revenue during the second quarter of 2020 with that same quarter in 2019, but that metric was irrelevant when businesses applied for the loans, the American Institute of CPAs said in a November 25 letter to the Small Business Administration.

At the time the businesses took PPP loans, they were required only to certify in good faith that they needed the loans, the group pointed out.

Related: Resources to Help You Maximize Your PPP Loan Forgiveness.

IRS expands Identity Protection PIN Opt-In Program to taxpayers nationwide - IRS.

As part of the Security Summit effort, the Internal Revenue Service announced today that starting in January the Identity Protection PIN Opt-In Program will be expanded to all taxpayers who can properly verify their identities...

The IP PIN is a six-digit number assigned to eligible taxpayers to help prevent the misuse of their Social Security number on fraudulent federal income tax returns. An IP PIN helps the IRS verify a taxpayer's identity and accept their electronic or paper tax return. The online Get An IP PIN tool at IRS.gov/ippin immediately displays the taxpayer's IP PIN.

"When you have this special code, it prevents someone else from filing a tax return with your Social Security number," said IRS Commissioner Chuck Rettig. "The fastest way to get an Identity Protection PIN is to use our online tool but remember you must pass a rigorous authentication process. We must know that the person asking for the IP PIN is the legitimate taxpayer."

IP PINS are a good tool to keep someone else from filing a false return in your name, but they are a last line of defense. They are re-issued annually, and taxpayers who lose their annual IP-PIN notice will be shut out of E-filing, and their paper return processing will be delayed.

You should protect yourself from ID theft by being careful online. Never send tax documents like W-2s or 1099s as unprotected e-mail attachments - let alone pdf copies of tax returns. Don't send your Social Security Number or IP PIN via E-mail or text. The IRS has more online safety tips.

Stop tax ID theft by applying for special IRS ID number - Kay Bell, Don't Mess With Taxes. "Come January 2021, this IP PIN opt-in program will be expanded to all taxpayers who can properly verify their identities. The IRS says the online application tool should be operational by the middle of next month."

How to Account for the Employee Retention Credit - Matthew Neir, Eide Bailly. "Unfortunately, with the unprecedented nature of the pandemic and the CARES Act relief programs, such as the Payroll Protection Program (PPP), ERC, and Economic Injury Disaster Loan (EIDL), generally accepted accounting principles (GAAP) does not provide a business entity with specific accounting treatment for government grants. Therefore, accountants must rely on other accounting guidance by analogy."

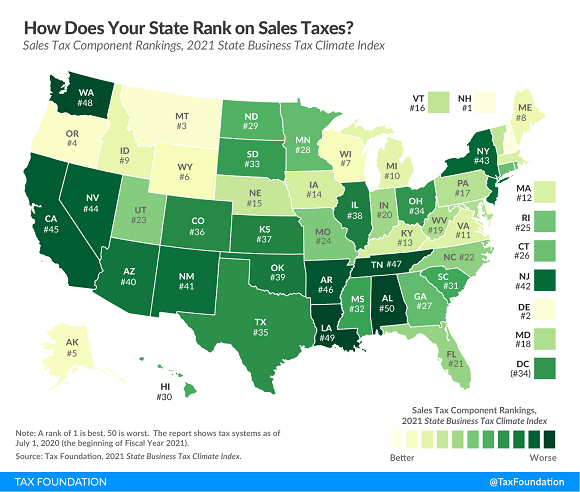

Ranking Sales Taxes on the 2021 State Business Tax Climate Index - Janelle Cammenga, Tax Policy Blog. "An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate. Broad-based, low-rate tax structures minimize tax-induced economic distortions that can occur when people change their purchasing behavior because of tax differences."

Is your Christmas Tree Taxable? - Jennifer Dunn, TaxJar. "Do you Have to Pay Sales Tax on Your Christmas Tree? The short answer is (almost always): yes."

As More Americans Move To No-Income-Tax States, More Lawmakers Move To Phase Out State Income Taxes - Patrick Gleason, Forbes. "According to IRS migration data, between 2011 and 2018 more than 3.1 million Americans on net moved into one of the nine no-income-tax states, taking more than $235 billion in annual income with them."

CFOs feel confident Biden won’t be able to raise the corporate tax rate to 28%: Survey - Eric Rosenbaum, CNBC:

Just-under 60% of CFOs (58%) think it is unlikely that President-elect Biden can pass a corporate tax hike to 28% within the first two years of his administration. No CFO indicated they think it is “very likely” that a corporate tax hike is coming, though a little under one-third of chief financial officers (32%) indicated they do think it is “somewhat likely” Biden achieves his corporate tax goal. Another 11% remain uncertain about the tax policy outlook, which has been made more difficult to ascertain given the two Senate races in Georgia remaining up for grabs, and with them, control of the Senate.

This Time, It’s the Corporation’s Owner and Accountant Who Try to Evade Tax Evasion Charges - Jim Maule, Mauled Again:

The indictment alleges that the business owner and the accountant worked together to falsify corporate records so that the business owner’s federal income tax liability would be less than what it should have been. One of the “techniques” used by the pair was the hiring of the business owner’s wife for a “no show job,” paying her $166,400 annually, and classifying it as a legitimate compensation business expense. In other words, taxable income of the corporation was reduced by creating fake salary deductions. Also classified as corporate business expenses were salaries paid to employees who renovated a condominium owned by the wife, and expenses paid for the wife’s use of a car.

I wonder whether the defendant told his friends that "my accountant lets me deduct that!" And how many of his friends groused that they wish they had a bold and aggressive accountant like the defendant had.

Light it up. 110 years ago today, Neon lights debut at Paris Motor Show.

Celebrate! Today is "Let's Hug Day" and "National Green Bean Casserole Day." Roughly equivalent, I'd say.

Make a habit of sustained success.