Today is it. The extensions expire today for calendar 2019 individual and C corporation returns. Unless you live in an area affected by a recent natural disaster, any 2019 1120 or 1040 is late.

Why should you care? If you owe, the penalty for late filing is 5% of the amount due per month, instead of 1/2% per month if you just file and pay late. If you don't file, the statute of limitations never starts to run, giving the taxing authorities that much more time to examine your returns. While I can't prove it, I believe strongly that late filing increases your chances of an audit, based on how often cases that end up in Tax Court involve returns that weren't filed on time.

If you owe and can't pay, file anyway. If you owe up to $100,000, you can qualify online for a payment plan with the IRS.

To file today, electronic filing is the safest bet. If you don't use a preparer, the IRS has free e-filing options.

If you must file on paper, spring for certified mail, return receipt requested, to prove that you mailed it today. If you are really late and get to the post office after it closes, you might try UPS, Fed-Ex, or another authorized private delivery service. Be sure to use the right IRS street address and one of the specified shipping methods. For example, UPS Ground doesn't work, but Next Day Air does.

Oh, and congratulations on the expiration of the three-year statute of limitations for extended 2016 filings!

White House Concedes on More Tax Credits, PPP Money - Jad Chamseddine, Tax Notes. "The Trump administration has offered to further extend the Paycheck Protection Program and tax credits to encourage hiring during negotiations with House Democrats, but that doesn't make the relief legislation any more likely to pass Congress ahead of the election."

Related: The Latest PPP Update

Taxpayer Could Not Claim Accrued Expenses to Maintain Manufacturing Line Until Following Year - Ed Zollars, Current Federal Tax Developments. "The Court found the taxpayers could not claim a tax deduction for certain accrued expenses, finding that not all events had taken place to establish the fact of the liabilities in question."

I wonder whether the IRS will say that expenses related to PPP loans don't meet the "all events" test if forgiveness is pending.

IRS Sets Deadline for Temporary Fax Procedures for Refunds - Eric Yauch, Tax Notes:

The IRS clarified in informal guidance that taxpayers looking to fax quick refund claims that stem from provisions in pandemic-related legislation can do so until the end of the calendar year.

The IRS on October 14 updated its FAQ on procedures taxpayers can use to temporarily fax quick refund claims stemming from the alternative minimum tax and net operating loss deduction changes in the Coronavirus Aid, Relief, and Economic Security Act (P.L. 116-136).

Remember, quick refund carrryback claims on Forms 1045 and 1139 for calendar 2019 are due December 31.

Vista Equity’s Robert Smith Reaches Settlement With DOJ in Tax Probe - Miriam Gottfried and Dave Michaels, Wall Street Journal ($). "The settlement is a result of a four-year criminal inquiry by officials in the Justice Department’s Tax Division and the U.S. attorney’s office for the Northern District of California. At issue was whether Mr. Smith failed to pay U.S. taxes on more than $200 million in assets from Caribbean entities set up by the sole investor in Vista’s first private-equity fund."

International tax reporting gets very expensive if it's done wrong, or not done at all. The Eide Bailly International Tax Help Desk can help get your reporting on track.

IRS adding QR codes to tax-due notices - Kay Bell, Don't Mess With Taxes. "With the addition of the QR code to the correspondence, the taxpayer can use their smartphones to scan it and go directly to IRS website. From there, they can access their taxpayer account, set up a payment plan or contact the Taxpayer Advocate Service."

Gaps and Confusion in Cryptocurrency Taxation - Nana Ama Sarfo, Tax Notes."Amid this backdrop, taxing authorities are gradually collecting more information about cryptocurrency accounts from crypto exchanges. The IRS was the first to seek information, sending a John Doe summons to Coinbase in 2016 seeking information on over 13,000 users."

Related: New Tax Guidance Issued on Cryptocurrency Transactions.

Tech Companies Pay Lower Taxes Abroad, WalletHub Reports - Frederic Lee, Tax Notes ($):

Most tech companies in the S&P 100 paid taxes abroad that were more than 5 percent lower than those paid in the United States in 2019, continuing a trend that’s been ongoing since 2013, according to a new report from WalletHub.

In contrast, the October 14 report shows that S&P 100 companies as a group paid tax at rates that were roughly 6 percent lower in the United States than internationally.

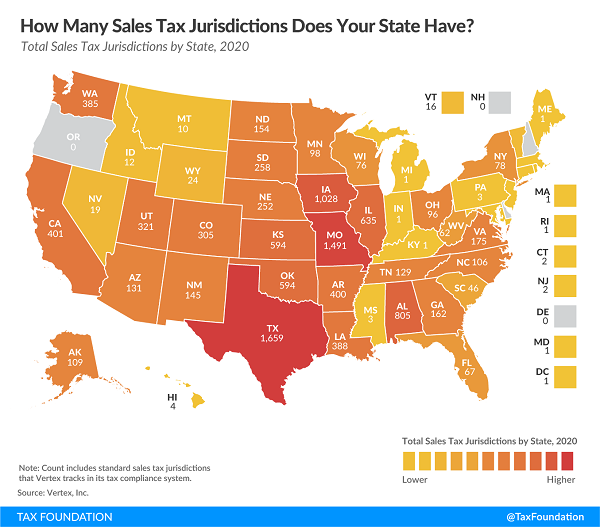

How Many Sales Tax Jurisdictions Does Your State Have? - Janelle Cammenga, Tax Policy Blog. "There are over 11,000 standard sales tax jurisdictions in the United States in 2020, according to software company Vertex Inc. Each jurisdiction has a distinct aggregate sales tax rate based on a unique combination of factors, including sales taxes levied by taxing authorities at the state, county, city, and district levels."

Iowa reportedly has 1,028 sales tax jurisdictions, or roughly one for every 3,000 Iowans.

Applications for $335 COVID‐19 Relief Due By Thursday, October 15 - North Carolina Department of Revenue. "Grant provides $335 Coronavirus relief for most North Carolinians with children."

Tax Fairness: President Trump, A Case Study - Steven M. Rosenthal, TaxVox. "This picture calls into question the president’s returns in three respects: (1) the fairness of the amount of income taxes he reportedly paid, (2) the fairness of his reported business losses, and (3) the fairness of the IRS audit of his income taxes."

That Extra Penny in Retirement Income Can Really Cost You - Neal Templin, Wall Street Journal ($). "Here’s something most people nearing the age of 65 don’t know: Extra income in retirement—even as little as one penny—can mean much higher Medicare premiums."

Related: A Retirement Fact Sheet

On this day in 1956, the FORTRAN computing language was first shared with the coding community. Designed for punch cards, it is still used in government, but not, apparently, by IRS.

Make a habit of sustained success.