Key Takeaways

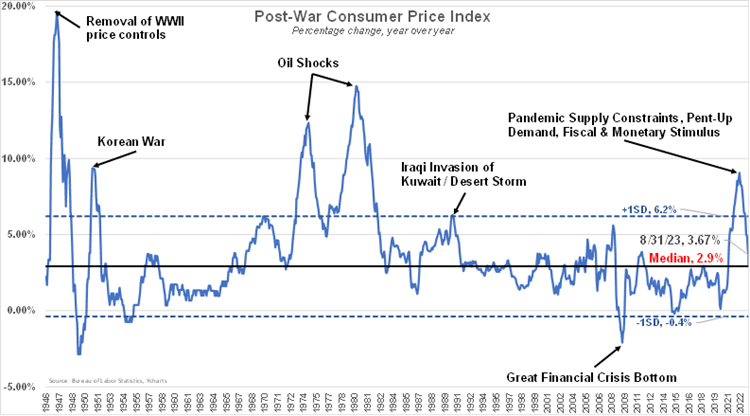

- The post-WWII median CPI inflation rate stands at 2.9%, even accounting for a few periods of high inflation. We spent most of the past decade and a half below this median.

- While it appears that longer-term interest rates may be approaching their peak, if the new normal is indeed over, they will likely remain closer to the historical average of around 4.5% (for a 10-year Treasury) rather than the recent levels investors have grown accustomed to.

- We believe that a prudent, well-researched strategy that does not waver in the face of market fluctuations should ultimately yield optimal results for investors over time.

Hindsight has made it clear that the U.S. Federal Reserve (the Fed) waited too long before raising short-term interest rates. The question now is: Will the battle against inflation mark the end of the era of cheap debt (e.g., 2.5% 30-year fixed mortgages) and easy access to money we’ve grown accustomed to? We believe the answer is likely yes in the long run, leading to a transition back to the “old normal” of average interest rates and inflation.

What is the New Normal?

The term “new normal” has been used several times throughout history, possibly dating back to WWI. Most recently, it was used during the 2008 financial crisis to describe a prolonged period of sub-par growth and low interest rates — and it can certainly be argued that the term lived up to its name for close to fifteen years. That is, until the disruption caused by the global pandemic coincided with increased demand, leading to the highest inflation rates since the early 1980s.

Initially, the consensus — including the Fed — believed that this spike in inflation was a temporary occurrence as the economy fully reopened. Despite their goal of maintaining price stability, aiming for a 2% long-term inflation rate, the Fed allowed it to reach approximately 6% before taking action.

The New Normal vs. Historical Norms

Prior to nearly 15 years ago, average inflation rates were significantly higher than the new normal. The post-WWII median CPI inflation rate stands at 2.9%, even accounting for a few periods of high inflation. We spent most of the past decade and a half below this median.

This holds true for 10-year Treasury yields, the typical benchmark for bond interest rates. According to Ned Davis Research, the median 10-year yield from 2009 to 2023 was 2.33%. However, the long-term average yield, dating back to 1953, is 4.25%. This aligns closely with the current yield, which closed at 4.59% on September 29, 2023, according to the U.S. Treasury.

Mortgage rates are quickly approaching 7.5% for 30-year fixed-rate mortgages. The median rate — going back to 1971 — is 7.41%, according to the St. Louis Fed. Even excluding the exceptionally high mortgage rates of the early 1980s, which topped 18%, the median mortgage rate from 1987 onwards is 6.27%, still much closer to today’s rate than the low 3% range of recent memory.

Consequently, the current environment aligns more with historical norms than the recent new normal. For some investors, this recent past may be the only experience they have to draw from, an unfortunate perspective when navigating financial markets.

What We Expect Moving Forward

What might be on the horizon for interest rates, inflation, the economy, and financial markets? Consider a proactive approach to assessing potential future trends from a broader historical context.

Inflation & Interest Rates

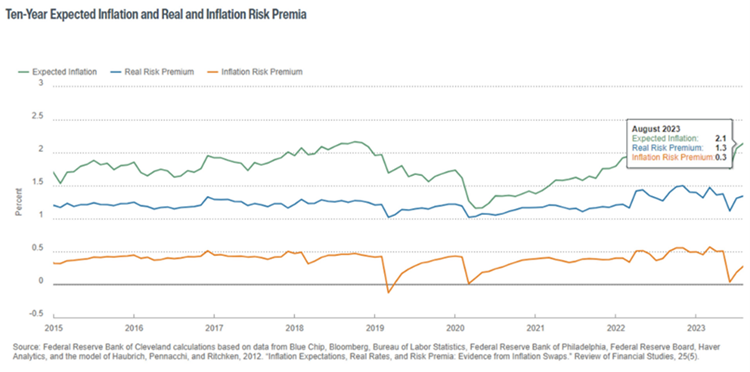

Market expectations imply inflation is under control.

Considering that interest rates remain high despite the anticipation of inflation gradually decreasing just above the Fed's 2% target, the implication is that longer-term rates near these current levels are required to keep inflation in check. Additionally, with the Fed signaling another short-term rate increase before year-end, rates across different maturities may continue to adjust. While it appears that rates may be approaching their peak, if the new normal is indeed over, they will likely remain closer to the historical average rather than the recent levels investors have grown accustomed to.

U.S. Economy

The U.S. economy’s resilience amid increased borrowing costs and rising inflation is primarily attributed to excess savings from lack of spending during lockdowns and pandemic-related stimulus, alongside ongoing employment stability.

Credit-worthy consumers and businesses took advantage of the new normal by securing low long-term rates. Higher rates have little effect on their borrowing costs and will only impact their balance sheets when the debt needs to be refinanced.

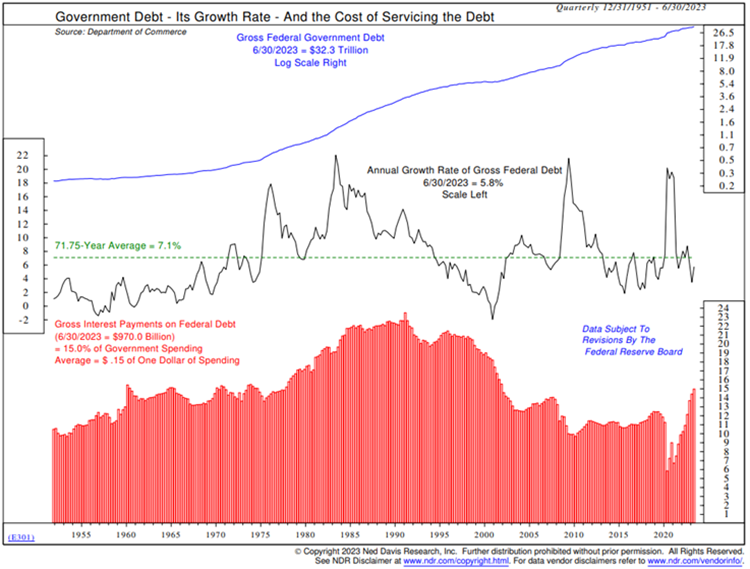

While these factors have kept many consumers and businesses in good financial shape, their ability to sustain the economy will diminish over time. Moreover, while private individuals and entities generally have strong balance sheets for now, U.S. government debt and its servicing costs have been rapidly increasing.

As of the second quarter’s end, the cost to cover the interest on government debt was 15% of GDP. This surpasses levels from the financial crisis over a decade ago but is not yet at historically high levels.

However, this will become a lingering problem as debt continues to be refinanced at higher rates. Higher debt and interest costs have traditionally correlated with lower long-term economic growth. Could this trigger the next economic downturn? The odds are likely, but the weight of the evidence suggests it’s not imminent.

Financial Markets

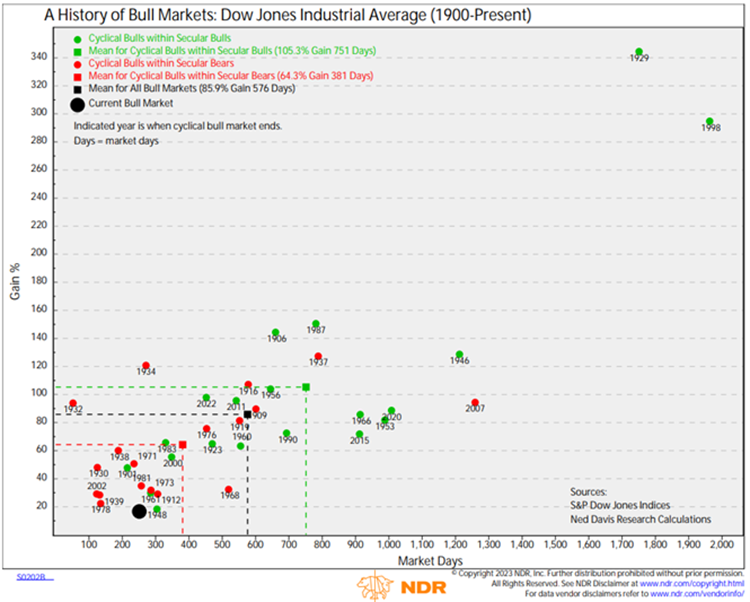

U.S. stocks, as measured by the Dow Jones Industrial Average and S&P 500, have been in a bull market since September 30, 2022. Historically, this bull market is shorter than average in terms of both magnitude and time.

While this data might suggest that stocks could continue to rise, several key takeaways connect the economy, interest rates, inflation, and investments in stocks, bonds, and cash:

- Cash has become a viable alternative to stocks and bonds, offering a return of over 5% on short-term Treasury Bills and money market funds1. This partly explains the relatively modest rally in stocks during this bull market compared to historical patterns.

- The shift away from the new normal toward higher rates means that while bonds have provided poor returns during the transition, they should offer more competitive interest in the future.

- Higher interest rates will pose challenges for large, high-growth companies that have thrived recently. When rates are low or falling, investors are willing to pay more for a company’s earnings to tap into expected long-term growth. However, rising rates reduce the incentive to pay premium prices for riskier companies. Therefore, investors will likely become more valuation conscious if current trends persist.

- Despite the significant shift in interest rates and inflation, the stock market is following historical trends given continued economic strength. Stock market peaks usually, though not always, occur as a process rather than an event. If the current bull market were to end soon, it would likely take time for the process to unfold.

How Should Investors React?

Regardless of short-term market direction, our belief in the long-term potential of diversified portfolios remains strong. Although each cycle of events may have unique aspects, we advocate relying on discipline and objectivity as a guide, rather than attempting to forecast short-term market movements. This is why we continue to believe that a prudent, well-researched strategy that does not waver in the face of market fluctuations should ultimately yield optimal results for investors over time.

1For example, money market funds from Schwab (SWVXX), Fidelity (SPRXX), and Federated (MMPXX) are paying 5.24%, 5.08%, and 5.46% respectively, as of October 26, 2023, as measured by their 7-day SEC yields.

Material discussed is meant to provide general information and it is not to be construed as specific investment, tax or legal advice. Keep in mind that current and historical facts may not be indicative of future results. This is meant for educational purposes only. Information presented should not be considered investment advice or a recommendation to take a particular course of action. Always consult with a financial professional regarding your personal situation before making any financial decisions.

Lessons Learned in Investing — 5 Strategies for an Effective Portfolio