Key Takeaways

- Determining if you’re an Applicable Large Employer is critical to current year compliance filings. An Applicable Large Employer is defined as an employer with 50 full-time equivalent employees or more.

- There are many forms individuals and businesses need to consider with the ACA. Completing the appropriate form is key to compliance.

- Self-funded insurance plans have a filing requirement regardless of size.

The Affordable Care Act changed the way small and large employers provide health coverage to their employees. Despite taking effect years ago, many businesses are still asking the same question: what do I need to do to comply with the Affordable Care Act?

Here are some key considerations as you work to avoid costly ACA penalties:

Are you an Applicable Large Employer?

All businesses should review their prior calendar year employee count to determine if they are considered an Applicable Large Employer (ALE), which is defined as an employer with 50 full-time equivalent employees or more. This number is important as your current year compliance filings are dependent on your prior year count. Remember to consider related entities.

Do you know which form to use?

There are many forms individuals and businesses need to consider as they work to comply with the Affordable Care Act. Receiving and completing the appropriate form at the right time is key.

-

1095-A

Individuals who have an Exchange plan will receive Form 1095-A from the Exchange. This form is used to report the premiums that they paid as well as note any advanced premium tax credit, or APTC, that they may have received. Individuals need to obtain this form prior to preparing their 1040.

-

1095-B

Individuals who have fully insured plans will receive Form 1095-B from the insurance company. This form exists to notify individuals of the months in which they had health insurance coverage.

-

1094-B and 1095-B

Small employers with self-insured plans need to file these forms with the IRS. The 1094-B is the transmittal form. The 1095-B, as mentioned above, reports the months in which the individual had health insurance. A copy needs to go to the individual that has coverage as well as to the IRS along with the transmittal for 1094-B.

Note: One day of coverage within a month is sufficient to indicate that the individual had coverage for that month.

-

1094-C and 1095-C

Large employers need to file both of these forms with the IRS. Employers must also provide a copy of the 1095-C to their employees. There is a misconception that insurance companies file this form on a business’s behalf, but instead all large employers must file these forms. The insurance companies are required to file Form 1094/1095-B, not Form 1094/1095-C.

If the large employer has a fully insured plan, they will need to fill out parts one and two of the 1095-C, as the insurance company will give employees/recipients a 1095-C to report the months in which the individuals had coverage. If the large employer has a self–funded plan, they will also need to fill out part three of the 1095-C, as the employee will not receive a 1095-B from the insurance company.

Note: Fully-insured large employers do not provide forms to part-time or non-employees such as retirees.

Employers need to gather their information and reconcile employee hours to the insurance offering made to each employee. While the forms can seem basic, there are specific rules that tend to be forgotten, such as:

- The requirement for Applicable Large Employers (ALEs) to offer at least 95% of full-time employees’ health insurance in order to use any of the three safe harbors for any employees that waive coverage. This is a rule that is too often overlooked, resulting in inaccurate forms.

- The rule that allows employers to use the lookback measurement method as a way to reclassify a full-time employee who is in his/her stability period as a part-time employee is often overlooked. Typically, when an employee has worked full-time hours in the lookback period, they are classified as full-time employees in the following stability period. However, if an employee takes a part-time position during the stability period, they may be classified as a part-time employee on the first day of the fourth month if they average less than 30 hours a month for three prior consecutive full months and were offered health insurance when they were first hired that met minimum value.

A group of related restaurants that each had less than 50 full-time employees but together had more than 50 became subject to the ACA compliance requirements due to the controlled group. Eide Bailly helped the client recognize their compliance obligation and filed the 1095-C forms, saving costly penalties.

Are you using the right measurement method for Form 1095-C?

If you’re an ALE, you need to use a monthly or lookback measurement method. Be sure to document your measurement method and file your 1095-C forms using that method.

In addition, review insurance premiums and 1095-C coding to verify which codes to use on the forms.

The non-deductible penalties for not filing these forms range from $260 to $580 per form.

A large trust providing insurance to school districts asked Eide Bailly if they have an ACA filing requirement. After a conversation with the client and their attorney, it was determined that the organization had 70 full-time employees and needed to complete 70 1095-C forms for their employees in addition to the 19,000 1095-B forms for the school district employees that were provided insurance through the trust. The insurance company did not realize their filing requirement. Knowing their compliance requirement saved the client $250 per form.

Do you have a self-funded insurance plan?

If so, you have a filing requirement regardless of your size.

Are you providing the right documentation?

In the case of an ACA audit, it’s vital to have the correct documentation. Therefore, we encourage you to collect and file insurance waivers.

Further, gather employee hours according to the measurement period you are using to verify each employee’s status.

Are you filling out the forms correctly?

After years of helping clients complete or review ACA filings, including responding to IRS “Pay or Play” penalty letters, we have found a few common errors that cause problems in form completion:

- Using conflicting codes on lines 14 and 16.

- Not filling out all of the appropriate lines on the forms, especially line 16, which is often missed.

- Completing forms for non-full-time employees in the case of a fully-insured plan.

- Completing forms for non-full-time employees of self-insured plans who are not enrolled.

Do you understand how many full-time employees you have?

ALEs face penalties for not offering affordable and adequate coverage to substantially all of their full-time employees. If substantially all employees aren’t offered adequate insurance, it’s as if no employees were offered insurance and the employer will be subject to the “no offer” penalty.

Many ALEs believe 95% of their full-time employees are offered coverage based on extending coverage to everyone who works 30 hours a week for an entire year. However, ALEs may be surprised to find out – after analyzing employee hours – the requirement isn't met. The reason for not meeting the requirement is because coverage is not offered to employees working full-time part of the year, or full-time employees employed part of the year. In addition, ALEs may find themselves on the wrong side of these requirements for employees who are rehired. As these situations suggest, the definition of full-time status is critical.

Under the ACA, an employee's full-time status determination is based on a lookback measurement method or the default monthly measurement method. Under the monthly method, an employee is full-time if they work 30 hours a week multiplied by the number of weeks in the month or an employer can use the 130 hours a month rule. To meet the requirement, at least 95% of full-time employees for each month must be offered coverage. The lookback method measures hours over a three- to 12-month measurement period to determine full-time status. This status is locked in over a corresponding stability period. ALEs using the lookback method will know with greater certainty who is full-time and should be offered coverage, thereby minimizing the risk of being assessed a "no offer" penalty on top of providing coverage. For those not offering coverage, the lookback method provides greater clarity on potential penalties, if any.

Benefit of the Look-Back Method

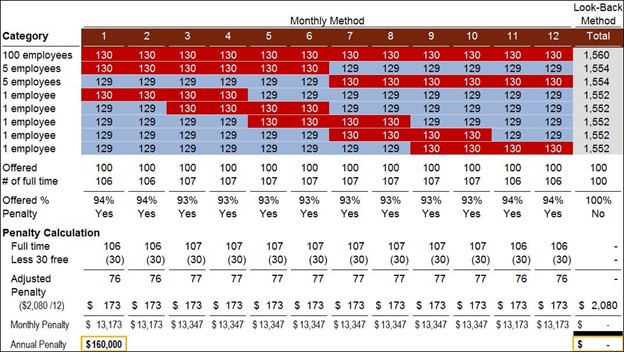

The following example illustrates the benefit of the look-back method for ongoing employees outside of their initial measurement period.

ABC Company has 115 employees on staff:

- 100 employees working 130 hours a month for 12 months (130 hours a month is considered full time)

- Five employees working full time for months one through six

- Five employees working full time for months seven through 12

- Five employees full time at a four-month increment throughout the year

ABC Company offered coverage to the first 100 employees working 130 hours a month throughout the year:

The example below shows that under the monthly method, ABC Company is offering coverage to less than 95 percent of their full-time employees for all 12 months and may be assessed the "no offer" penalty each month. The penalty is $173.33 per month ($2,080 annually) multiplied by the number of full-time employees, less the 30 (this number is 80 for 2015 only) full-time employees.

ABC Company could have a $160,000 non-deductible penalty for not offering coverage to 95 percent of its employees, even though ABC Company offered coverage to 100 full-time employees.

If ABC Company used the look-back method, it would know which employees are full time, offer coverage to those employees, and would incur no penalty. By using a 12-month look-back period, ABC Company would meet the 95 percent test without extending coverage to any other employees because they would be classified as part time. As a result, ABC Company would not extend coverage to any more employees and would save $160,000 in non-deductible penalties by using the look-back method.

We helped a hotel that operates a ski resort determine if they qualified as an applicable large employer. Due to the seasonality of the snow ski industry, the business had a large number of seasonal employees from November to May each year but had only about 10 year-round full-time employees. Through comprehensive analyses, we determined that the client only had about 40 full-time-equivalent employees, and so the employer was not subject to the filing requirement, nor were they required to offer insurance to these employees.

Have you considered your furloughed employees?

When an employee is placed on furlough, the continuation of benefits is up to the employer. Key to this consideration is the Affordable Care Act (ACA). Under the ACA, there can be costly ramifications if the offer of health insurance isn’t extended for a furloughed employee who is deemed full-time under the employer’s stability period.

Employees that are full-time due to the stability period will remain full-time even when furloughed unless they subsequently become terminated. It’s important to remember that while an offer of COBRA coverage is deemed an offer of coverage under the ACA, typically it is not affordable and could therefore cause unaffordability penalties under §4980H(b).

ACA Penalties

The §4980H(b) penalty for 2023 is $4,320 per year for each employee that goes to the Exchange and qualifies for a Premium Tax Credit (PTC). This penalty cannot exceed the potential §4980H(a) penalty.

The §4980H(a) penalty for 2023 is $2,880 per year per employee, less the first 30 employees This penalty is triggered if an ALE does not offer minimal essential coverage (MEC) meeting minimum value to at least 95% of their full-time employees and at least one full-time employee goes to the Exchange and qualifies for a PTC.

Each employer, or group of related employers, receives the first 30 full-time employees free from the calculation of the §4980H(a) penalty. Therefore, an employer with 100 full-time employees that doesn’t offer MEC to 95% of their full-time employees would be subject to a $201,600 ($2,880 x (100-30 employees)) annual penalty if one full-time employee qualified for a PTC from the Exchange.

Other Considerations:

-

The 13-week Rule

Under the ACA, when an employee does not have one hour of service for a period of 13 weeks, they are considered a new employee upon resumption of services. Educational institutions must use 26 weeks for purposes of this rule instead of 13 weeks.

-

Rule of Parity

In addition to the 13-week rule, there is a rule of parity that employers may choose to use. Under the rule of parity, if an employee has no hours of service for a period of at least four weeks and their period of absence, measured in weeks, was greater than their period of work, they will be deemed a new employee when they return to work.

-

Health Insurance Documentation

It’s also important for employers to review their health insurance plan document and their insurance policies and make any changes as needed so that ACA penalties are not an issue.

Rules surrounding the ACA continue to change.

Our ACA team is here to help.

Our ACA team is here to help.