Key Takeaways

- TIGTA warns of possible IRS tax season struggles.

- IRS boss promises "lowest backlog in 20 years" at end of tax season.

- Watchdog says current backlog more than double pre-pandemic level.

- Phone service goal lowered to provide more processing personnel.

- Paper refunds will still be issued if 1040 lacks bank info - after a 6-week wait.

- IRS still will take paper checks, but would rather you pay electronically.

- Elder fraud season.

- National Daisy Day, meet Rattlesnake Roundup Day.

Watchdog Warns IRS May Struggle During The 2026 Tax Filing Season - Kelly Phillips Erb, Forbes:

...

IRS staffing shortages have compounded inventory challenges. As of October 2025, overall IRS staffing levels had declined by roughly 19%, or about 19,000 employees, thanks to Department of Government Efficiency (DOGE) cuts and Congressional clawbacks of billions of dollars in Inflation Reduction Act (IRA) funding. (The Trump administration has since proposed even more dramatic cuts but Congress has so far resisted, offering instead a more modest trim.)

TIGTA Warns About IRS Hiring Levels Ahead Of Senate Vote - Asha Glover, Law360 Tax Authority ($):

As of October 2025, the Internal Revenue Service had lost 19,000 — or 19% — of its employees, and key filing season programs had had their workforce cut by 8,300 — or 17% — according to a memorandum from TIGTA Deputy Inspector General for Audit Diana M. Tengesdal to IRS acting Commissioner Scott Bessent.

While most of the IRS' functions were staffed at similar levels in October 2025 as they were in October 2021, the agency's Submission Processing and Return Integrity and Compliance Services functions were operating with less staff than they had in October 2021, according to the memo.

IRS Lowered Phone Service Goal for Filing Season, Watchdog Says - Benjamin Valdez, Tax Notes ($):

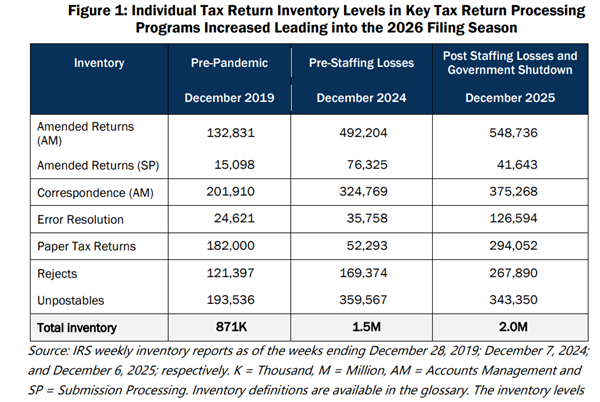

In a January 26 memo to IRS management, the Treasury Inspector General for Tax Administration said deep IRS staff cuts and the 43-day government shutdown have slowed the agency’s progress on clearing a backlog of individual tax returns that has grown to 2 million as of December 2025.

To ensure staff can work on the backlog, the IRS set a target of answering 70 percent of calls into its accounts management phone lines — down from the 85 percent target of the past three filing seasons, according to the report.

The Wall Street Journal quotes the IRS "CEO," Frank Bisignano:

According to the TIGTA memo, the backlog is 129% higher than at the start of the pandemic. If backlogs are more than twice what they were pre-pandemic before the start of filing season, reducing them to "the smallest in 20 years" during the season may be a stretch.

Paper Refunds Still Available, But You'll Have to Wait

What to Know if You Still Want Your Tax Refund as a Paper Check - Ashlea Ebeling, Wall Street Journal:

The order applies to tax refunds and to tax payments, including balances due on 1040 individual tax returns.

...

If you don’t provide direct deposit information, the IRS will mail you a notice asking you to provide your banking information or to explain why you can’t provide it. If you don’t respond within 30 days, the refund will be released as a paper check after six weeks.

The information comes from an IRS Fact Sheet. A few other key items:

- Until further notice, the IRS will continue to issue paper refunds to decedent accounts.

- The IRS continues to accept paper checks and money orders for individual returns.

- Individuals will lose the use of the Electronic Federal Tax Payment System (EFTPS) sometime this year. The IRS encourages taxpayers to obtain an IRS Individual Online Account instead.

Using electronic payments and having refunds direct deposited avoids a lot of problems. New postal regulations make getting a timely postmark a crapshoot, increasing the possibility that mailed payments will be penalized as late. Electronic refunds can't be stolen in the mail.

Link: IRS Make A Payment page, with electronic payment options.

Another Backlog: Syndicated Conservation Easement Cases

IRS Conservation Easement Offer Success Hinges on Key Details - Erin Schilling, Bloomberg ($):

The article says that prior settlement offers had practical issues that made it hard for investors and partnerships to take the deals:

The IRS could loosen its timelines for taxpayers to accept the deal, Levin said. It’s difficult to get all the investors on board with the offer in the timeline allotted by the agency.

It also would help if the IRS allowed individual investors in a partnership to take a settlement offer rather than requiring the partnership itself to agree to a deal, Harvey said.

Related: Eide Bailly IRS Dispute Resolution and Collections Services.

Tariffs: A South Korea Surprise; An India-EU Deal

Vowing Higher Tariffs, Trump Rattles South Korea Months After Trade Deal - Choe Sang-Hun, New York Times:

Only recently it seemed that South Korea had resolved its worst trade dispute with the United States, its only treaty ally. After months of talks, Mr. Trump in October agreed to lower tariffs on South Korean products to 15 percent after winning a pledge that Seoul would invest $350 billion in the United States.

At the time, the South Korean leader, Lee Jae Myung, flattered Mr. Trump with gifts like a replica of an ancient golden crown.

Facing U.S. turmoil, Europe and India announce blockbuster trade deal - Ellen Francis and Karishma Mehrotra, Washington Post:

Blogs and Bits

Do you have to file a 2025 tax year return? Probably - Kay Bell, Don't Mess With Taxes. "Getting older also has a benefit when it comes to whether you have to file. As the table indicates, older individuals get to earn more money before the IRS requires a return."

Paying the Piper: Qualified Opportunity Zones - Russ Fox, Taxable Talk. "When Qualified Opportunity Zones (QOZs) began (with the Tax Cuts and Jobs Act (TCJA) in 2018), they were a way of deferring capital gains received. This year–the 2026 tax year–is when taxpayers who invested in QOZs will be paying the piper."

Related: Eide Bailly Qualified Opportunity Zone Fund Consulting.

Addressing a Few Common Arguments for the Work Opportunity Tax Credit - Jack Salmon, The Unseen and the Unsaid. "Focused specifically on veterans with disabilities, a 2012 study implies that only about 13% of WOTC benefits actually lead to new employment, meaning about 87% of benefits accrue to hires that would have occurred in the absence of the credit."

A Darker Side to the Golden Years

Fraudster sentenced to eighteen years in prison after taking and laundering millions from elderly victims - IRS (Defendant name omitted, emphasis added):

...

After an elderly victim suspected he was being defrauded, he notified law enforcement who coordinated an undercover operation. The defendant was arrested upon his arrival at the elderly victim’s residence to pick up more gold. A subsequent search of the defendant’s cellular phone confirmed his involvement in the extensive elder fraud scheme. Over a 4-month period, the defendant made at least 33 trips to retrieve gold and cash from the elderly victims. Forensic analysis of the defendant’s phone revealed that he primarily operated in Florida, but he also traveled to Pennsylvania, Virginia, New Jersey, and New York to retrieve cash and gold from elderly victims of this fraud scheme and deliver those proceeds to other co-conspirators. As a result of the fraud scheme, numerous elderly American citizens lost their entire life savings or experienced substantial financial hardship.

Watch out for vulnerable friends and family:

Tax season is also busy season for fraudsters. Tax agencies will never call, text, or email you about your taxes.

Increased elder fraud is an unintended but likely result of continued IRS enforcement cuts.

What day is it?

It's National Daisy Day! It's also Rattlesnake Roundup Day for those who observe.

Make a habit of sustained success.