Key Takeaways

- Corporate AMT guidance pushback.

- Supreme Court review of Trump tariffs.

- IRS crackdown on tax shelters halted.

- IRS data sharing.

- "Revenge Tax".

- Complexity of the OBBB.

- OBBB effects on Child Tax Credit.

- National Swap Ideas Day!

Tariffs

Trump tariffs face high-stakes Supreme Court review - Alex Simendinger and Kristina Karisch, The Hill:

...

The Supreme Court’s conservative majority has granted numerous of Trump’s emergency requests this year, but the tariffs case will be the first time in which justices will weigh the arguments and legal underpinnings of a key administration priority — one that affects hundreds of millions of people globally.

Justices Grant Fast-Track Review For Trump Tariff Suit - Dylan Moroses, Law 360 Tax Authority ($):

With the high court okaying Trump's request for a speedy review, the government now has until Sept. 19 to file its opening brief in the case, while the states, small businesses and Illinois toymakers that challenged the tariffs will have until Oct. 20 to file their responses.

Corporate AMT

Trump administration loosens corporate taxes after pulling out of global deal - Tobias Burns, The Hill:

...

Democrats blasted the new regulations in a letter to Treasury Secretary Scott Bessent on Monday. After the unexpected departure of new IRS Commissioner Billy Long, whom the Senate confirmed, Bessent is serving as acting head of the agency. They accused Trump’s IRS of either postponing or abandoning the corporate alternative minimum taxes (CAMT) that enable the international corporate tax arrangement to remain nominally in place.

Lawmakers Push Treasury to Rescind Corporate AMT Guidance - Cady Stanton, Tax Notes ($):

...

The lawmakers further requested that Treasury answer questions related to the corporate AMT, including the number of corporations affected by the new safe harbor threshold, how many corporations it projects will use the new calculation methods, what external input — including contact with corporate representatives — Treasury and the IRS received to support drafting the notices, and when Treasury and the IRS expect to release the new proposed and final corporate AMT rule.

Tax Shelters

Trump Administration Halts I.R.S. Crackdown on Major Tax Shelters - Jesse Drucker, New York Times:

In late July, 20 House Republicans asked the I.R.S. to withdraw yet another line of attack on the transactions, one providing guidance to auditors on how to analyze the tax shelter deals.

IRS Ordered To Notify Court Of ICE Info-Sharing Requests - Anna Scott Farrell, Law 360 Tax Authority ($):

She additionally ordered the IRS on Tuesday to produce the administrative record underlying its decisions to share information with immigration authorities, saying she needed the record to make a decision on whether to issue a preliminary injunction that would stop the agency from sharing taxpayer data across government departments.

IRS Must Provide Administrative Record on Data Sharing Decision - Wesley Elmore, Tax Notes ($):

...

The judge said the court will more fully explain its reasoning in a coming written ruling on the plaintiffs’ motion, but the plaintiffs showed a substantial likelihood that the Center for Taxpayer Rights has standing “based on the harms to its core activities” described in the declaration of the center’s executive director, Nina Olson, included in the motion.

Revenge Tax

Treasury Looks to Revive ‘Revenge Tax’ if OECD Deal Falls Short - Zach Cohen, Bloomberg Tax ($):

OBBB

One Big Beautiful Bill Act Makes the Individual Income Tax More Complex - Alex Muresianu, Same Cluggish, Rebecca Walker, Tax Foundation:

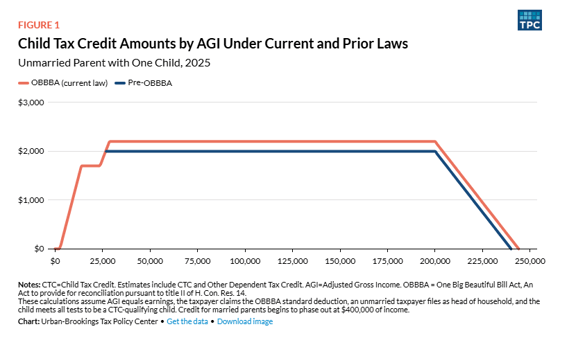

Child Tax Credit Changes Boost And Stabilize Benefits For Some; Still Exclude Lowest-Income Families - Elaine Maag, Tax Policy Center:

...

In all, the changes to the CTC were a mixed bag for families with children. A larger, permanent, inflation-indexed credit helps many families plan with greater certainty. But, despite research suggesting that investments in children with low incomes pay off more than many other social policies, millions of children in low-income families remain excluded, along with the economic returns that come from investing in them.

Blogs and Bits

‘You Earned It, You Keep It’ bill would end all income tax on Social Security benefits - Kay Bell, Don't Mess with Taxes:

Still, it’s Congress, where the saying “you never know” is the legislative branch’s unofficial motto.

Ready For Some Football? When It Comes To Gambling, Odds Are The IRS Is Watching, Too - Kelly Phillips Erb, Forbes:

...

The overall total tax impact of sports betting revenue is huge. In 2024, it was pegged at $52.7 billion. With those dollars at stake, it’s important to follow tax laws. IRS-CI also encourages taxpayers to report all gambling winnings as taxable income to prevent civil and criminal penalties from the IRS.

IRS assesses $162 million in penalties over false tax credit claims tied to social media - IRS:

Since 2022, the IRS has seen a surge in questionable refund claims fueled by misleading social media posts and bad actors posing as tax experts. Many of the posts falsely claim that all taxpayers are eligible for credits they do not actually qualify for, such as those meant for self-employed individuals or businesses. The IRS routinely publishes and updates a list of frivolous positions on IRS.gov that could lead to the imposition of penalties.

What day is it?

It's National Swap Ideas Day!

Make a habit of sustained success.