Key Takeaways

-

July 29 deadline for IRS online business account renewal.

-

House appropriators zero out DOJ tax division.

-

IRS watchdog TIGTA takes 15% staffing hit.

-

Tip deduction fights loom.

-

Organ procurement orgs under House scrutiny.

-

15% tariffs: the new standard?

-

National Drive-Thru Day.

Programming Note: Eide Bailly is hosting a webinar on New Tax Legislation: Impacts on Opportunity Zones next Monday, July 28. The webinar is free, and 2 hours of CPE are offered. Register here.

Designated Officials must revalidate their Business Tax Account by July 29 or risk losing access - IRS:

Designated Officials who do not revalidate their accounts by July 29, 2025, will need to request access to the account again, either as a Designated Official or other user type.

Revalidation requires a W-2 for the most recent tax filing year or proof that they can legally bind an entity for tax purposes.

To revalidate, Designated Officials must log in to their BTA account.

House Bill Would Formalize Abolition of DOJ Tax Division - Cady Stanton, Tax Notes ($):

...

The bill breaks from the Senate version of the legislation, which appeared to maintain the division’s funding, according to an appropriations committee report released July 17. Senate appropriators slightly reduced legal activities from the previous year to about $1.03 billion for fiscal 2026, but a committee aide told Tax Notes that reduction isn’t attributable to plans to eliminate the division.

The Justice Department’s budget request outlined a plan to fold the Tax Division and send its lawyers to the department’s criminal and civil divisions, zeroing out its funding, which was set at $106 million for fiscal 2025.

Government Watchdog Confirms Mass Exodus of IRS Employees - More Cuts Are Expected - Kelly Phillips Erb, Forbes:

According to IRS records, more than 25,000 employees either separated, accepted a deferred resignation program offer, or took some other incentive to leave. These departures represent 25% of the IRS’s workforce—and some job positions were impacted more than others. For example, approximately 27% of tax examiners (they review and process tax returns) and 26% of revenue agents (they conduct audits) left the agency.

IRS Watchdog Office Loses 15% of Workers Amid Wider Job Cuts - Cole Reynolds, Bloomberg ($):

The Treasury Inspector General for Tax Administration had 800 employees at the start of the 2025 fiscal year. But after “natural attrition” and two rounds of a deferred resignation offer—an effort from the Trump administration to reduce government-wide staffing—about 680 employees remain, TIGTA said. The watchdog didn’t specify how many employees accepted the resignation offers.

President Donald Trump fired at least a dozen inspectors general in January, but TIGTA acting chief Heather M. Hill wasn’t among them.

Unpacking the Big Bill

Lawyers Predict Reconciliation Bill Tax Controversies - Nathan Richman and Trevor Sikes, Tax Notes ($):

...

In one scenario, Amin suggested that a barber could give a customer a haircut and then reduce the price for the service and ask the customer to make up the difference in the tip. He said this aim to reclassify what would be normal wages into tips gives more space for fraud and abuse.

The IRS might also scrutinize taxpayers claiming the deduction when they own their businesses, Amin said, giving the example of coffee shops. Also, those sorts of owners could use the deduction as an excuse to lower wages — maybe so the employees end up with the same after-tax income — which would also lower their employment tax liabilities, he said.

Related: Eide Bailly IRS Dispute Resolution and Collections Services.

One US Tax Policy OECD Countries Should Copy - Cristina Enache, Tax Policy Blog. "Capital investment is critical for driving innovation and sustainable economic growth. Unfortunately, some countries’ important investment incentives are scheduled to decrease in the coming years—including in three countries that account for nearly a fifth of global private investment"

The Three Best - and Worst - Things in Trump's Big Tax Law - Scott Lincicome, The Dispatch ($):

...

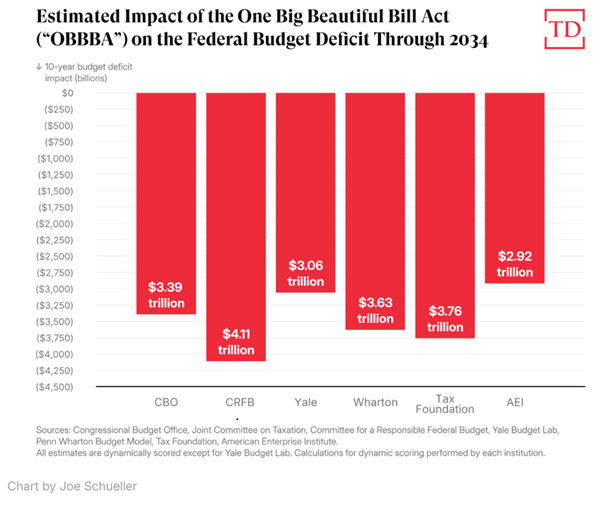

The law’s biggest problem, by far, is that it didn’t come anywhere close to matching tax cuts—good and bad—with spending cuts. Thus, as following chart shows, budget experts from across the political spectrum have calculated that the OBBBA will add trillions to the federal debt over the next 10 years:

Organ Procurement Organizations Under Scrutiny

Tax-Exempt Organ Procurement Orgs Face House Probe Into Spending - Tyrah Burris, Tax Notes ($):

“Congress must continue to ensure that all tax-exempt health care entities, including Organ Procurement Organizations, are aligning their incentives with their core mission of delivering quality care,” Schweikert said in a statement regarding the investigation of the Indiana Donor Network, Lifeshare Network Inc., and the New Jersey Organ and Tissue Sharing Network.

Under section 501(c)(3), OPOs receive reimbursement from Medicare for all costs classified as allowable under program regulations. An organization must operate exclusively for exempt purposes, and none of its earnings may inure to any private shareholder or individual.

OPOs are responsible for obtaining and distributing transplant organs.

Disclosure: I formerly served on the board of the Iowa Donor Network, the OPO serving Iowa.

Related: Eide Bailly Exempt Organization Tax Services.

Tariff Thursday

Trump’s New Trade Standard Takes Shape With 15% Tariff Deal - Chao Deng, Kim Mackrael and Gavin Bade, Wall Street Journal:

Taken together, the two developments represent a turning point in months of global trade negotiations that have stoked uncertainty among investors and America’s biggest trading partners.

US and EU close in on 15% tariff deal - Andy Bounds, Financial Times:

“The Japan agreement made clear the terms of the shakedown,” said one EU diplomat. “Most member states are holding their noses and could take this deal.”

Both sides would waive tariffs on some products, including aircraft, spirits and medical devices, the people said.

Blogs and Bits

Gamblers lose part of their tax break in OBBB - Kay Bell, Don't Mess With Taxes. "Some lawmakers, however, are not letting the new gambling tax loss limit ride. They’ve upped the ante by introducing legislation to restore the offset using 100 percent of losses."

Crypto Tax Implications After The GENIUS Act - Robert Green, Forbes. "The GENIUS Act introduces robust reserve, audit, and disclosure requirements for U.S. stablecoin issuers, including 1:1 asset backing and monthly financial attestations. However, it does not reclassify stablecoins for tax purposes."

IRS sending CP59SN notices despite valid extensions - National Association of Tax Professionals. "There are reports on social media of multiple instances where taxpayers received these notices despite filing a timely extension with the IRS earlier this year."

The Danger Of Relying On AI For U.S. Tax Advice - Virginia La Torre Jeker, Forbes. "While AI has laudable capabilities and provides great speed in its responses, the reality is that currently in the U.S. international tax area (indeed, in the tax area generally), AI often delivers inaccurate or incomplete information."

Unused Estate Tax Exclusion Lost Due to Failure to Make a Valid Portability Election - Parker Tax Pro Library. "The Tax Court held that a taxpayer's estate was not allowed to reduce the value of the estate by the amount by the taxpayer's deceased wife's unused exclusion amount (i.e., the deceased spousal unused exclusion) because the estate tax return for the taxpayer's deceased wife was not timely filed."

Related: Execution is a Lot - Estate Tax Portability Edition

We'll never be royalties

Indiana CPA Gets 3 Years In Royalty Payment Tax Scheme - Kat Lucero, Law360 Tax Authority ($). "An Indiana accountant received a three-year prison sentence for willfully preparing tax returns for clients who inappropriately claimed millions of dollars worth of business deductions based on false royalty payments made for using intellectual property, according to federal prosecutors."

From the Department of Justice press release (defendant names omitted, emphasis added):

In total, Defendant’s preparation of false tax returns claiming fraudulent “royalty” deductions caused a loss to the IRS of more than $2.5 million.

In addition to his prison sentence, the court sentenced Defendant to serve one year of supervised release and to pay restitution of $2,532,936.

It's likely that the clients claiming fraudulent deductions thought it was great, and even told their friends. Be assured the IRS is going after the clients too, who should have known better. There is no collections statute of limitations on a fraudulent return.

What day is it?

It's National Drive-Thru Day. "The first drive-thru is believed to have been at Red’s Giant Hamburg on Route 66 in Springfield, Missouri in 1947. In 1948 the original In-N Out Burger opened a drive-thru, which is now the longest surviving drive-thru in the U.S."

Always worth celebrating when you need dinner and it's in the high 90s outside.

Make a habit of sustained success.