Key Takeaways

-

$2.8B additional IRS funding cut clears House subcommittee.

-

Appeals chief to leave September 1.

-

IRS sends "pay up" letter to tax-delinquent federal employees.

-

The hidden tax bracket behind the big SALT deduction cap.

-

CBO: tax bill boosts deficits by $3.4 trillion.

-

Bad news, good news for energy credits.

-

National Hammock Day

Programming Note: Eide Bailly is hosting a webinar on New Tax Legislation: Impacts on Opportunity Zones next Monday, July 28. The webinar is free, and 2 hours of CPE are offered. Register here.

GOP Bill to Slash IRS Funding Approved by House Panel - Chris Cioffi, Bloomberg ($):

The 9-6 party-line vote is the latest hit to the beleaguered tax agency, which has seen major leadership churn and a mass exodus of staff this year as the White House slashes the federal workforce.

The bill advanced by the Financial Services and General Government subcommittee to the full Appropriations panel would fund the IRS at $9.5 billion for fiscal year 2026, compared with the current $12.3 billion in annual funding for this fiscal year

COMING AFTER THEM - Bernie Becker, Politico:

...

Bessent and other senior administration officials have sketched out a vision in which the IRS sheds further employees, after already losing about a quarter of its staff just over the last six months, and then leans in further on automation for core functions.

Still, cutting IRS funding by almost $3 billion could be a step too far for the Senate, which usually takes a more bipartisan approach to spending matters. (Though not always!)

IRS Chief of Appeals to Exit Agency - Benjamin Valdez, Tax Notes ($):

...

The reason for Askey’s pending departure wasn’t made clear. The office has lost 500 employees under the workforce reduction efforts of the Trump administration, mostly through voluntary resignations, according to a report from the national taxpayer advocate.

Askey recently anticipated that those cuts would cause disruptions to the office’s workflow, which focuses on resolving tax controversies without litigation.

IRS Tells 525,000 Federal Employees to Pay Tax Bills, Or Else - Tim Shaw, Checkpoint News ($):

Speaking with Checkpoint in an interview July 18, Frost Law Director Jessica Marine said her practice saw a small handful of the new notices reach clients the third week of June. Another 20 came in the week after... Given "what has been happening with this current administration and the federal workforce and the push to downsize, it did concern me that this was going to be a bigger push, a stronger push to enforce … this action against federal employees, up to and including termination."

Paying the Big Bill

Taxpayers Should Beware the Costly SALT Cap Phaseout Zone - Philip DeMuth, Wall Street Journal:

Trouble is coming, however, and it lies in the SALT Cap Phaseout Zone. The problem arises when the effective marginal tax rate on their next dollar of income increases from 32% to 41.6%, which they will discover next April.

...

The new $40,000 cap is available to people in the lower tax brackets when they don’t need it, while remaining unobtainable to those in the highest brackets when they could really use it. The people with income in between have been selected for special punishment: a 9.6% surtax on income from $500,000 to $600,000.

New GOP Tax Law Will Add $3.4 Trillion to the Deficit, CBO Says - Katie Lobosco, Tax Notes ($):

A significant portion of the cost comes from making most of the expiring provisions of the Tax Cuts and Jobs Act permanent, including individual rate cuts, a near doubling of the standard deduction, and a bigger child tax credit. The law also made some business tax breaks, like full research and development expensing, permanent.

Some of Trump’s tax priorities in the package are less costly because they sunset after 2028. The tax deduction on tipped wages will cost $32 billion, the deduction for overtime pay will cost $90 billion, and the deduction for car loan interest will cost $31 billion. Those provisions are also capped and phase out for higher-income earners.

Big Bill Energy

Strict Construction Rules Could Gut Solar, Wind Credits - Kat Lucero, Law360 Tax Authority ($):

On top of that shortened timeline, the credits could become far less accessible if Treasury strictly enforces a July 7 executive order by Trump requiring it to release stringent construction timeline rules for the incentives, according to practitioners.

The Good News for Energy in the One Big Beautiful Bill Act - Marie Sapirie, Tax Notes ($):

Mark your calendar for an Eide Bailly Webinar "New Tax Legislation: Impacts on Energy Incentives" scheduled for August 5.

Interest and Research Costs

Manufacturers, Telecoms Will Save From Tax Law’s Interest Move - Michael Rapoport, Bloomberg ($):

EBITDA is larger than EBIT, so the change allows companies to shield more of their interest from taxes—hundreds of millions of dollars worth of interest in some cases, leading to millions in tax savings.

The OBBBA - Research and Development Expenses - Roger McEowen, Agricultural Law and Taxation:

The retroactive relief is generally available to "small businesses" that meet a specific test. This test is defined as having average annual gross receipts of $31 million or less for the three taxable years preceding the year in question. The calculation for this threshold is based on the rules in Internal Revenue Code Section 448(c).

Related: Eide Bailly Accounting Methods Services.

Blogs and Bits

New tax law changes present challenges to IRS and taxpayers - Kay Bell, Don't Mess With Taxes. "Cuts to IRS staff and operations by Department of Government Efficiency (DOGE) earlier this year are going to be felt for a long time. And now, thanks to the recently-enacted One Big Beautiful Bill (OBBB) Act, the reduced IRS staff will be dealing with a coming filing season full of change."

Oklahoma Supreme Court Denies Income Tax Exclusion To Native American - Peter Reilly, Forbes. "The Oklahoma Society of CPAs issued a case study of the opinion. Included in the practical advice is to 'Consider maintaining all pending claims until all potential appeals of the Stroble decision have been exhausted.' It is mentioned in the decision that there were more than 11,500 claims like Stroble's."

Sixth Circuit Holds Dentist's Life Insurance Plan Was a Split-Dollar Arrangement - Parker Tax Pro Library. "The Sixth Circuit affirmed a district court and held that the value of the economic benefits of a taxpayer's life insurance policy had to be included in the taxpayer's income under the split-dollar life insurance rules in Reg. Sec 1.61-22. The court further held that the taxpayer's dental practice was not allowed to claim deductions for the annual premium payments it made because they were not ordinary and necessary business expenses."

Substantiating Noncash Charitable Contributions: A Review of Besaw v. Commissioner - Ed Zollars, Current Federal Tax Developments. "A critical failure for the petitioner was the receipts provided from donee organizations during the audit. While these receipts were dated and signed, the sections for identifying the goods donated and their values were blank. The petitioner's attempt to remedy this by providing "reconstructed" documents in 2022 (after filing his 2019 return) was ultimately insufficient because these were noncontemporaneous."

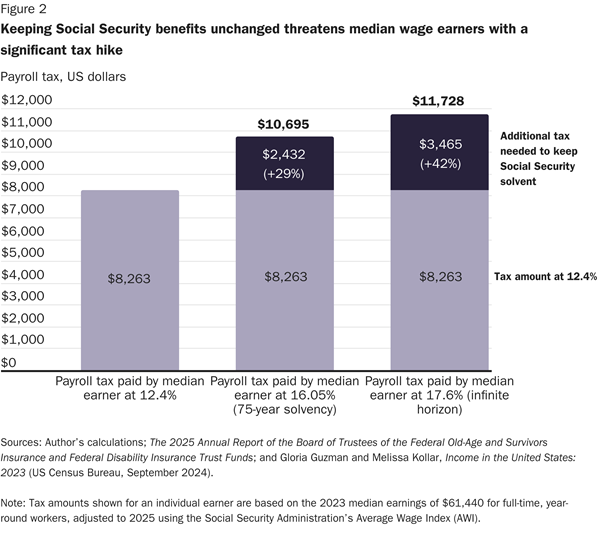

Young Workers Could Lose $110,000 in Lifetime Earnings to Keep Social Security Solvent - Romina Boccia and Ivane Nachkebia, The Debt Dispatch. "The bottom line is that promises to keep Social Security benefits exactly as currently legislated are immensely expensive for younger workers, whether Congress tries to levy additional taxes on all workers or only on those with earnings above the payroll tax cap."

Trust Fund Bogey; 21-Month Penalty

Independence attorney sentenced for tax evasion - IRS (Defendant name omitted, emphasis added):

Defendant pleaded guilty to tax evasion on Nov. 25, 2024, and was sentenced to 21 months in federal prison today by U.S. District Judge Howard F. Sachs. Defendant was also ordered to pay restitution in the amount of $794,540.

According to court documents, Defendant admitted that he willfully attempted to evade paying his personal income taxes for tax years 2012 through 2018. Defendant kept his income in his attorney trust accounts, then withdrew cash from his attorney trust accounts to pay for personal and business expenses. An attorney trust account is a bank account in which a lawyer has a fiduciary duty to hold property of clients or third persons, including prospective clients. It is for funds that are in a lawyer’s possession in connection with representation, separate from the lawyer’s own property.

Attorney tax fraud involving trust accounts keeps coming up in tax crime reports. That surprises me, given that these accounts are subject to oversight by state courts.

Not the best way to invest trust assets, perhaps.

The moral? Business payments to attorneys have to be reported on 1099 forms. Stashing the payments in trust accounts doesn't make the 1099s go away.

What day is it?

It's National Hammock Day! Get out there and get busy being not busy.

Make a habit of sustained success.