Key Takeaways

- Audits of exempt organizations crater.

- Senators, Trump still have tax differences.

- Musk, Trump have differences.

- 899 problems.

- Still playing the refs.

- Hot Air Balloon Day.

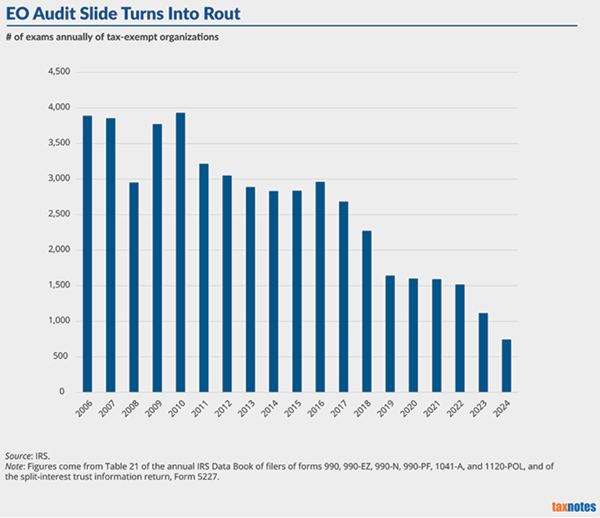

Audits of Exempt Organizations Plummet 34 Percent to Record Low - Doug Sword, Tax Notes ($):

That’s the lowest number since the IRS began publishing data on tax-exempt audits in the new format in 2006, and down from a high of 3,925, which the IRS reached in fiscal 2010. The previous low was the 1,110 audits the IRS reported conducting for fiscal 2023.

Related: Eide Bailly Exempt Organization Tax Services.

Congress: Is Momentum a Thing?

Trump’s ‘big, beautiful bill’ losing momentum in Senate - Alexander Bolton, The Hill:

“Crapo just said I think of us are two of us who are pretty definite ‘no’s’ which means we can’t lose anybody else,” the source said.

Crapo did not name names but colleagues assumed he was talking about conservative Sens. Rand Paul (R-Ky.) and Ron Johnson (R-Wis.).

The Senate and Trump have some big tax differences - Laura Weiss, Andrew Desiderio and Jake Sherman, Punchbowl News:

- The White House isn’t sold on Senate Finance Committee Republicans’ case for making permanent a slate of business tax breaks that would sunset after five years under the House bill.

- Senate Republicans want to put additional limits on several key Trump priorities, including “no tax on overtime” and new savings accounts for kids.

- There’s no resolution yet on SALT, which Senate Republicans want to change significantly. We’re told Trump didn’t object when GOP senators reiterated their desire to water down the House’s $40,000 deduction cap.

So far President Trump has often had one or two GOP "no" votes on things he wants from Congress, but nobody has yet been willing to cast a decisive vote to defeat him. While past performance doesn't guarantee future results, I think that's still the way to bet. Senators may change some things in the bill, but I expect them to pass something not terribly different from the House version.

Musk Aims to ‘Kill’ Tax Bill as He Fails to Save EV Credits - Erik Wasson, Bloomberg ($): "The Tesla Inc. chief executive officer personally appealed to House Speaker Mike Johnson to save the tax credit, the person said, requesting anonymity to discuss a private conversation. The House version of the tax measure calls for largely ending the popular $7,500 electric car subsidies by the end of 2025 that Tesla has benefited from for years."

Trump Is Losing Patience With Musk’s Outbursts Over Megabill - Brian Schwartz, Natalie Andrews and Olivia Beavers, Wall Street Journal. "President Trump is losing patience with Elon Musk after the billionaire attacked Republicans’ sprawling tax-and-spending bill. Musk is irked about Trump’s decision to withdraw the nomination of a key ally to lead the National Aeronautics and Space Administration."

899 Problems

We Should Be Worried About “Section 899” - Kyle Pomerleau and Stan Veuger, AEIdeas:

Section 899’s higher taxes would apply to investors resident in countries that levy what lawmakers consider “unfair” taxes on US companies.

Tax Bill’s ‘Revenge Tax’ May Run Afoul of Senate’s Byrd Rule - Jonathan Curry, Tax Notes ($):

According to some observers, Senate Parliamentarian Elizabeth MacDonough could conclude that the Foreign Relations Committee shares jurisdiction over tax treaties with the Finance Committee. Since the Foreign Relations Committee did not receive any budget reconciliation instructions in the initial budget reconciliation resolution adopted by the House and Senate, that conclusion would imperil the bill, making it necessary to remove the provision.

Tax News & Views International Weekly: Retaliatory Fears - Alex Parker, Eide Bailly:

But despite those worries, the Trump administration has made clear that the legislation matches their position regarding the 15% global minimum tax, digital services taxes, and others they view as problematic and unfair.

Republican senators face Wall Street worries over megabill’s retaliatory tax - Burgess Everett and Eleanor Mueller, Semafor:

“In terms of implementation, I’m going to have to get more comfortable with it. Going into it in its current form, I’m not comfortable,” Sen. Thom Tillis, R-N.C., a staunch ally of Wall Street who serves on the tax-writing Finance Committee, said in an interview.

Related: Eide Bailly International Business Structuring Services.

Negotiations and Scorekeeping

Trump, GOP Senators Discussed Cutting SALT Break in Tax Bill - Erik Wasson and Steven Dennis, Bloomberg via MSN:

“There really isn’t a single Republican senator who cares much about the SALT issue,” Thune told reporters as he departed the meeting with Trump on Wednesday.

Republicans Try to Discredit Experts Warning About the Cost of Tax Cuts - Tony Romm, New York Times:

The latest estimate arrived on Wednesday, projecting that the sprawling bill endorsed by Mr. Trump could add about $2.4 trillion to the federal debt over the next decade.

Tariff Update

CBO: Trump’s Tariffs Raise Big Revenue, Hurt Growth - Jonathan Curry, Tax Notes ($):

The tariffs would cause a drop in real GDP of 0.6 percent by 2035, the Congressional Budget Office concluded in an analysis released June 4. Estimates by the Joint Committee on Taxation released May 22 found that the tax portion of the budget reconciliation bill now working its way through the Senate would increase the level of real GDP by 0.4 percent.

Kennedy grills Lutnick over Trump’s tariff goals - Daniel Desrochers and Doug Palmer, Politico:

Lutnick soundly rejected the idea, saying Vietnam is being used as a pathway for China to send products to the U.S.: “Absolutely not. That would be the silliest thing we could do.”

...

“Why are you negotiating trade deals then?” Kennedy replied. “You just said that if a country came to you and offered the ultimate reciprocity, no tariffs, no trade barriers, you would reject that.”

Where Taxes Come From

Sources of US Tax Revenue by Tax Type, 2025 - Cristina Enache, Tax Foundation. "The United States relies much less on consumption taxes than other OECD countries. Taxes on goods and services accounted for only 16.8 percent of total US tax revenue, compared to 31.1 percent in the OECD."

Blogs and Bits

Better call a reputable tax professional for help - Kay Bell, Don't Mess With Taxes. "While most tax preparers are reputable professionals who provide reliable, correct service, the sad fact is that, as in all professions, some tax pros are in the business to make fast, and illegal, bucks."

Understanding Treasury’s Request for Information on Modernizing Federal Payments - Ed Zollars, Current Federal Tax Developments. "Effective September 30, 2025, the Federal Government is directed to cease issuing paper checks for all Federal disbursements, with limited exceptions as specified in the E.O."

Tax Court Upholds $7 Million Deduction Under Claim of Right Doctrine - Parker Tax Pro Library. "The Tax Court held that a mortgage loan originator that overreported more than $7 million in income on its tax returns for years 2007-2013 due to accounting errors was entitled to claim a deduction for 2014, the year the errors were discovered, because the income from 2007-13 was included in accordance with the claim of right doctrine. The court further held that, as an accrual basis taxpayer, the taxpayer was entitled to claim the deduction in 2014 because all events relating to the taxpayer's obligation to provide collateral as a substitute for the underreported mortgage receivables were met in that year."

Related: Eide Bailly Accounting Methods Services.

Why Pope Leo Can Skip FATCA, But Not FBAR - Virginia La Torre Jeker, US tax Talk. "This article explains why, notwithstanding his vow of poverty with the Order of St. Augustine, Pope Leo XIV might face a legal duty under the FBAR rules to disclose financial accounts at the Vatican Bank, but need not report them under the mandates of FATCA on Form 8938."

Related: Eide Bailly Expatriate Tax Services.

He'll Have Some Time to Mend His Tents

Outdoor retailer sentenced to prison for tax fraud and ordered to pay over $2M in fines and restitution - IRS (defendant name omitted, emphasis added):

The sentence, imposed by U.S. District Court Judge Ann Marie McIff Allen, comes after Defendant pleaded guilty to tax evasion on February 24, 2025. In addition to his term of imprisonment, the court ordered Defendant to pay a $95,000.00 fine and $1,947,906.79 in restitution, which the defendant paid in full at the time of his sentencing hearing.

According to court documents and statements made at Defendant’s change of plea and sentencing hearings, from 2017 to 2022, Defendant evaded taxes by underreporting his income to the Internal Revenue Service (IRS). Defendant is the sole owner of... an outdoor retailer in Springdale, Utah. He managed the company and handled the finances. When tax season came, he provided certified public accountants (CPAs) with information and records to prepare tax forms to submit to the IRS. The CPAs relied on the information they received from Defendant. By underreporting Zion Outfitter’s gross receipts, Defendant ultimately underreported his taxable personal income, which resulted in Defendant evading at least $1.9 million of income tax.

It's never a good idea to hide income from your preparer. The assessment for six years of taxes reminds us that the statute of limitations for assessing taxes is forever when fraud is involved.

What day is it?

It's Hot Air Balloon Day! Take the slow scenic way.

Make a habit of sustained success.