Key Takeaways

- Tax bill updates.

- Proposed IRC 899.

- Form 3520 penalties in the courts.

- IRS fiscal year data.

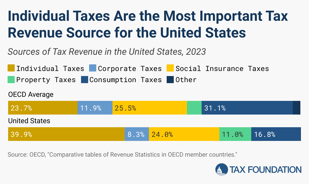

- Sources of US tax revenue by tax type.

- National Creativity Day!

Leader Look: Long, hot summer for one big, beautiful battle - Jake Sherman and John Bresnahan, Punchbowl News:

– The White House is expected to send up a package of DOGE-generated cuts to the Hill for a vote. Johnson is under no statutory obligation to bring this rescission proposal to the floor. But he’ll be under heavy internal pressure to do so.

Congress must act within 45 days once it receives the presidential message on the long-awaited rescissions package or the funding will be spent as directed. There’s no Senate filibuster, and it doesn’t have to go through any committees in either chamber.

The proposal is expected to total at least $9 billion (funding that’s already being withheld, which is questionable legally, but OK). The cuts will mainly focus on the already shuttered USAID, but there will also be proposed cuts to NPR and PBS.

House Bill Targets SALT And PTET Deductions For Traders, Professionals - Robert Green, Forbes:

Johnson defends reconciliation bill from Musk’s criticism: ‘It can be big and beautiful’ - Ali Bianco, Politico:

Musk said earlier this week he was disappointed in the massive reconciliation proposal in an interview with CBS News. In a rare criticism of President Donald Trump’s key policies, Musk said that the proposed bill “undermines the work” that DOGE had done.

Section 899

Section 899 Backs Up U.S. Negotiating Position, Burch Says - Stephanie Soong, Tax Notes ($):

Section 899, a key feature of the House-passed tax bill, reflects House Republicans’ dissatisfaction with the trajectory of the OECD’s pillar 2 global minimum tax framework, Rebecca Burch, Treasury deputy assistant secretary for international tax affairs, said May 29. The proposed provision also mirrors Republicans’ view that the agreements that have been made under pillar 2 “usurp the United States of its tax sovereignty,” she added. Burch spoke at a Federal Bar Association conference in Washington.

Global Investors Suddenly Have a New Concern: A U.S. 'Revenge Tax' - Chelsey Dulaney, Wall Street Journal:

The U.S. would impose the tax on investors from countries that it believes unfairly tax American businesses. That could include countries that impose digital-services taxes on U.S. tech companies, such as European Union members and the U.K.

In the Courts

District Court Addresses Form 3520 Penalties, Reasonable Cause, and IRS Authority in Huang v. United States: A TurboTax Defense Not Dismissed Out of Hand - Ed Zollars, Current Federal Tax Developments:

Blogs and Bits

IRS releases fiscal year 2024 Data Book describing agency’s activities - IRS:

Sources of US Tax Revenue by Tax Type, 2025 - Cristina Enache, Tax Foundation:

What day is it?

Make a habit of sustained success.