Key Takeaways

- Late-night session advances budget bill.

- A deal to cancel energy credits earlier?

- The week ahead for the bill.

- IRS reportedly asks fired staff back.

- Commissioner nominee Billy Long hearings this week.

- Scammers and the vulnerable.

- Frog jumping jubilee.

Trump’s tax and immigration bill clears hurdle after late-night vote - Marianna Sotomayor and Mariana Alfaro, Washington Post:

Four fiscal conservatives — all deficit hawks aligned with the ultraconservative House Freedom Caucus — changed their vote to “present,” allowing the legislative package to be recommended “favorably” to the House, 17-16. But their hesitance to vote the One Big Beautiful Bill Act out of committee is a reminder that the far-right flank of the Republican conference remains skeptical.

This week: Reconciliation bill back on track, at least for now - Niels Lesniewski, Roll Call:

The Rules Committee is scheduled to convene at 1 a.m. Wednesday to set the ground rules for floor debate on the measure after releasing an updated committee print version of the legislative text overnight.

Among the newest changes is the removal of a provision opposed by Rep. Michael R. Turner, R-Ohio, that would force federal agency employees, lawmakers and congressional staff to contribute more of their salaries to their pension plans. The effective dates of two other pension-related provisions would be delayed to 2028.

1 a.m.? Yes, 1 a.m.

Capitol Hill Recap: The House Budget Bump in the Road - Alex Parker, Eide Bailly. "But just because there’s a script, doesn’t mean that everyone will follow it. That’s what the party leaders found out Friday morning, with four conservative Republican members announcing their opposition to the bill, mostly due to its potential cost."

Bond Market Fallout

US borrowing costs top 5% after Moody’s downgrade - Ian Smith, William Sandlund, Kate Duguid, and Claire Jones, Financial Times:

Yields on 30-year US Treasuries rose as much as 0.13 percentage points to 5.03 per cent on Monday, narrowly exceeding a peak reached during the tariff sell-off last month and putting the country’s long-term borrowing costs at their highest point since November 2023. Yields move inversely to prices.

Budgetary Effects of the May 2025 Tax Bill (Preliminary)- The Budget Lab. "If the provisions become permanent, the debt-to-GDP ratio would hit 200 percent in 2055. The only countries that currently have a higher debt-to- GDP ratio are Sudan and Japan."

Big Beautiful Bill Prospects, Potential Changes

Budget clears the reconciliation bill. GOP has a rough week ahead - Jake Sherman, John Bresnahan, Laura Weiss and Brendan Pedersen, Punchbowl News:

...

Let’s be clear here: A deal isn’t very close. The changes conservatives are seeking are drastic. Some of these tweaks are clearly unacceptable to moderates and the middle of the conference.

GOP to End Energy Tax Credits Earlier in Deal With House Leaders - Ari Natter and Jarrell Dillard, Bloomberg ($). "US House Republican hardliners said on Sunday they’d won a commitment from the House leadership to end energy tax credits sooner than originally planned, as part of a deal to allow President Donald Trump’s giant tax and spending package to advance out of a key committee"

The article provides no details on the reported agreement; other reports suggest a plan to cut off credits for existing projects by 2028.

EBay, PayPal Sellers’ Relief at Risk as Senators Chase Revenue - Zach Cohen and Erin Slowey, Bloomberg ($):

House Republicans and their allies in the Senate have proposed returning to the $20,000 threshold for such requirements. It’s been a major priority for panel chair Rep. Jason Smith (R-Mo.), who has cast it as an attack on gig workers and an invasion of taxpayers’ privacy.

...

But other Republicans are pushing a partial rollback to bring in more revenue. A reversal would cost the Treasury $8.9 billion over the next decade, according to the Joint Committee on Taxation.

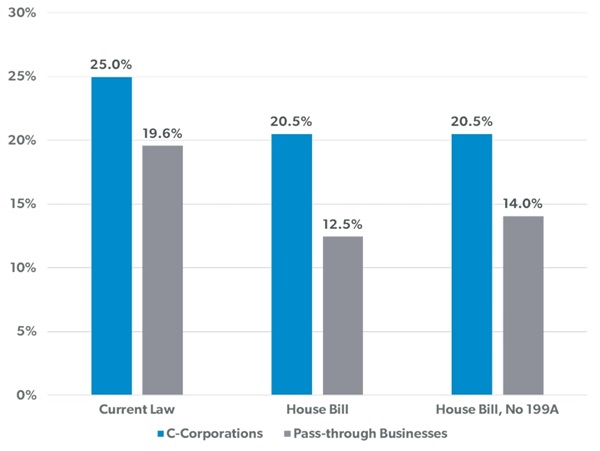

House Tax Bill Would Worsen Business Tax Parity - Kyle Pomerleau, AEIdeas:

In fact, pass-through business investment would have an advantage under the House proposal even if 199A were allowed to expire. This is because most of the tax advantage for pass-through businesses in the House bill is due to expensing. Expensing eliminates the entire tax pass-through businesses pay on qualifying investments, but only eliminates the entity-level tax for C corporations. C corporate investment still faces the individual income tax. Expensing is also why 199A only marginally reduces the tax burden on pass-through business investments in the House bill.

IRS - Return of fired IRS staff; Billy Long hearings this week.

IRS Probationary Employees Asked to Return to Work by May 23 - Erin Slowey, Bloomberg ($):

About 7,000 probationary workers were fired in February as part of the broader effort by the Trump administration to shrink the federal government. Following court rulings, these workers were put on administrative leave and some were asked to come back full-time as the IRS considered them critical.

Astonishing.

Senate Panel to Grill IRS Pick on Dubious Tax Credits, Donors - Erin Schilling and Chris Cioffi, Bloomberg ($):

Long’s ethics disclosures show that he earned money from White River Energy Corp., the credits’ sponsor, and another company that has promotional materials for the credits on its website. He also received recent campaign contributions, years after his failed Senate run, from people associated with White River and other promoters that were large enough to pay off his campaign debts.

Wyden and Cortez Masto have demanded to know whether Long has a deal with White River to legitimize the tax credits.

Tariffs

Trump Says Walmart Shouldn’t Blame Tariffs for Higher Prices - Skylar Woodhouse, Bloomberg ($):

“Walmart should STOP trying to blame Tariffs as the reason for raising prices throughout the chain. Walmart made BILLIONS OF DOLLARS last year, far more than expected,” Trump said in a post on Truth Social Saturday. “Between Walmart and China they should, as is said, “EAT THE TARIFFS,” and not charge valued customers ANYTHING. I’ll be watching, and so will your customers!!!”

Blogs and Bits

As an American, Pope Leo XIV also must answer to IRS - Kay Bell, Don't Mess With Taxes. "As a U.S. citizen living and working abroad, Pope Leo XIV still must abide by the Internal Revenue Code. So, since U.S. tax law requires all citizens to pay taxes on their worldwide income, he’ll have to file a return and pay tax on his earnings like all the rest of us Internal Revenue Service subjects."

Related: Eide Bailly Expatriate Tax Services.

Three Hobby Loss Developments And The Romanowski Judgement - Peter Reilly, Forbes. "If there is a Schedule C running large losses every year, you need to think about and document the Section 183 issue every year not rely on a judgement made far in the past."

House “One Big Beautiful Bill” Riddled with Temporary Tax Policy - Erica York, Tax Policy Blog:

The new deductions make tax policy worse.

18th Anniversary of the 21st Century Taxation Blog - Annette Nellen, 21st Century Taxation. "My goal in creating this website and blog was to highlight how tax systems can be improved to reflect how we live and do business today and to reflect principles of good tax policy."

Congratulations, Annette! A lot more blogs last less than a month than hold on for 18 years.

I see scammers

Long-time fugitive extradited to the United States to face charges for orchestrating mail fraud scheme defrauding elderly and vulnerable victims of over $10 million - IRS (Defendant name removed, emphasis added):

According to the Indictment and statements made in court:

From at least 2011 through 2016, Defendant created numerous direct mail solicitations supposedly from world-renowned psychics, falsely and fraudulently claiming that the recipients were being contacted because they had been the subject of specific visions by the psychics, including visions that the recipients were going to receive large sums of money and good fortune. Many of the letters falsely promised that the psychic services being offered were free of charge. In fact, the letters were mass-produced using software and information provided by Defendant to a direct mail marketing services company, Company-1, located in Piscataway, New Jersey, which Defendant retained to print and mail the solicitations.

Defendant directed a second company, Company-2, to send fraudulent billing notices to the same victims that stated that the victims owed money for psychic services, which in many cases had been offered free of charge. The fraudulent billing notices were labeled “collection notices” and “invoices,” falsely representing that the victims owed late payment fees, and falsely stating that a psychic or astrology organization would refer the victim to a “collection agency” and take legal action if the victim did not send a check, usually for $20 to $50. Through his fraudulent psychic mailing campaign, Defendant obtained more than $10 million dollars from victims.

This is a reminder of how many ways scammers try to fleece the elderly and vulnerable.

As outlandish as the mass-mailed personalized psychic claims are, it's hard to say they are worse than the perfectly legal work of political fund raisers. We get intelligence-insulting text messages saying some politican is personally disappointed that we haven't sent him money lately because some people actually believe it. Keep an eye out for relatives and friends who might be at risk.

What day is it?

It's Frog Jumping Jubilee Day! Keep hop alive.

Make a habit of sustained success.