Key Takeaways

- File those 990 Forms!

- "On track" for Memorial Day in House."

- Senate has its own plans.

- SALT cap debate gets... salty.

- SALT cap workarounds targeted.

- Payroll service goes bad.

- National Chocolate Chip Day.

It's a deadline day! May 15 is the deadline for calendar year exempt organizations and private foundations to file their annual Form 990 reports with the IRS.

"Ah, but we're tax exempt!" you say. Why should we have to file with the IRS?"

Because if you don't do so, you stop being tax-exempt, for starters. And the cash penalties for late filing pile up in a hurry.

Any organization that fails to file its 990-series returns for three years will lose its tax exemption automatically. Late filing penalties start at $20 per day, or $120 per day for larger organizations.

If your organization is not ready to file its return on time, automatic extensions are available using Form 8868. If you can file electronically, that's the way to go. If you don't have the software or a paid preparer, send Form 8868 via Certified Mail, return receipt requested, to the address provided in the form instructions.

Related: Eide Bailly Exempt Organization Tax Services.

Whither the Big Beautiful Bill?

House on Track to Pass Tax Bill by Memorial Day After W&M Markup - Katie Lobosco and Cady Stanton, Tax Notes ($):

Johnson originally said he hoped the bill would get to the president’s desk by the May 26 holiday but has since accepted a July 4 deadline set by the White House. All 11 committees tasked with passing parts of the reconciliation package finished their work by the end of May 14.

The House Budget Committee will combine the pieces and is scheduled to mark up the full package on May 16. The larger bill will then face the Rules Committee, followed by a vote on the House floor.

Senators Give Advance Notice to House on Plans to Edit Tax Bill - Cady Stanton, Tax Notes ($):

When asked if there was anything in the House tax bill he’d like to change, Sen. John Kennedy, R-La., responded: “A lot.”

GOP Tax Debate Gets Testy as Conservatives Fume Over SALT - Richard Rubin, Wall Street Journal:

The current plan, approved Wednesday by the House Ways and Means Committee, includes a $30,000 cap for individuals and married couples that starts phasing down when income reaches $400,000. That is a boost from today’s $10,000, but it isn’t high enough for lawmakers like Reps. Mike Lawler (R., N.Y.) and Nick LaLota (R., N.Y.), whose negotiations with House leaders on what is known as the SALT cap are expected to drag into the weekend.

...

“If you go north of [$30,000], you’re talking about people that make between like $200,000 and $2 million,” said Rep. Greg Steube (R., Fla.). “And it’s really hard for a Floridian, who has no income tax, to go back to his district and say we’re subsidizing bad decisions in New York, California and New Jersey.”

Moderate Republicans call for fixes to energy tax credit cuts in House GOP megabill - Josh Siegel, Politico. "Rep. Jen Kiggans (R-Va.) and 12 other moderate Republicans, warned in a statement that abruptly cutting off Inflation Reduction Act tax credits, imposing onerous restrictions and changing provisions that help fund projects more quickly could stifle investments in new energy technologies."

What happens when you put warring GOP factions in one room? - Jake Sherman, Laura Weiss, Mica Soellner and Samantha Handler, Punchbowl News:

...

Johnson is running out of time to find a consensus on the reconciliation bill. The House Budget Committee is scheduled to assemble the component parts of this wide-ranging legislation – 11 committees are involved in the process – into one mega-package on Friday.

Republicans wrestle with possible failure of ‘big, beautiful bill’ - Eleanor Mueller, Burgess Everett, and Kadia Goba, Semafor:

Some Republicans are starting to worry that their own BBB — President Donald Trump’s “big, beautiful bill” — could face the same fate.

One week away from a possible House floor vote, the GOP’s massive tax and spending bill is facing opposition from enough lawmakers to defeat it and criticism from senators eager to rewrite it.

About That Tax Bill

House Releases New Proposed Tax Legislation - Eide Bailly. "The legislation allows for full expensing of qualified business property and R&D expenditures and relaxes the limitation on business interest deductions."

Rich vs. Poor: Who Gets What in the GOP Tax Bill - Richard Rubin, Wall Street Journal:

Middle-income households would get permanent tax-cut extensions, too. They would also gain temporary tax cuts, including a larger standard deduction and child tax credit and targeted benefits for senior citizens and people receiving tips and overtime pay.

There is relatively little for low-income people who aren’t paying income taxes now, and they will encounter some new complexity when claiming refundable tax credits.

Trump’s New Tax Cuts Could Shower Americans With Cash, for Now - Andrew Duehren, New York Times. "Almost all of the new tax cuts that Republicans have included in the bill, which could evolve over the coming weeks, will last only until the end of 2028, just days before President Trump is set to leave office. That includes a $500 increase to the child tax credit and a $1,000 bonus to the standard deduction, as well as Mr. Trump’s pledges to not tax tips or overtime pay."

SALT Workaround Used by Doctors, Lawyers Axed in GOP Tax Bill - Michael Bologna, Bloomberg ($). "House Republicans’ bill to extend and expand Trump’s 2017 tax law would also raise revenue by cutting many professional service providers out of using state workarounds for the cap on state and local tax deductions."

“Big Beautiful Bill” House GOP Tax Plan: Preliminary Details and Analysis - Tax Foundation. "Overall, the bill would prevent tax increases on 62 percent of taxpayers that would occur if the TCJA expired as scheduled. However, by introducing narrowly targeted new provisions and sunsetting the most pro-growth provisions, like bonus depreciation and research and development (R&D) expensing, it leaves economic growth on the table and complicates the structure of the tax code."

Republicans’ One, Big, Beautiful Tax Bill Needs a Makeover - Adam Michel, Cato at Liberty. "As written, the tax bill is not significantly pro-growth. The Tax Foundation estimates it would boost gross domestic product by just 0.6 percent in the long run. But most of that modest gain is driven by increased labor supply, not better productivity, higher wages, or more investment. In fact, the plan is expected to reduce investment, lower pre-tax wages, and have little impact on total national income."

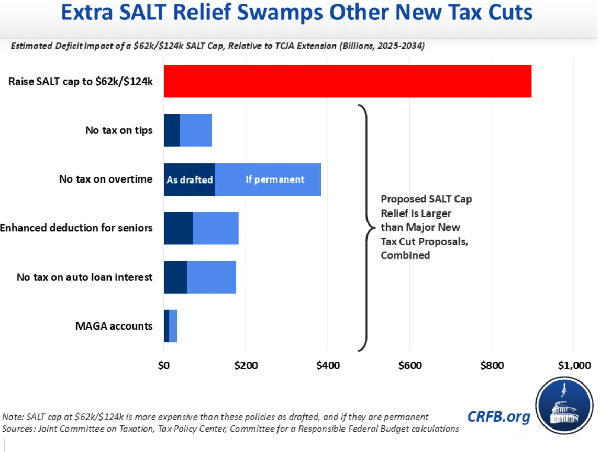

Further SALT Relief Would Be a Mistake - Committee for a Responsible Federal Budget. "The House reconciliation bill extends the state and local tax (SALT) deduction, raising it to $30,000 for taxpayers making less than $400,000 per year and phasing it down to $10,000 above that. Despite this increase, members of the so-called “SALT caucus” have demanded that the cap be raised to $62,000 for single filers and $124,000 for married filers. Doing so would total just as much as all the major new tax cuts in the House bill combined, and 60 percent of benefits would accrue to high-income Americans."

IRS News

IRS Can Only Give Tax Data to ICE in Deportation, Criminal Cases - Alicia Caldwell and Jason Leopold, Bloomberg:

By agreeing to share taxpayer data at all, the IRS is taking an unprecedented step that breaks with longstanding assurances that such information wouldn’t be used to aid in immigration enforcement. Melanie Krause resigned as the acting IRS commissioner last month as the data-sharing arrangement was finalized.

Tariff Talk

White House eased China tariffs after warnings of harm to ‘Trump’s people’ - Jeff Stein, Natalie Allison and David Lynch, Washington Post. "Trump’s pullback reflected the core tension that has bedeviled the White House as he has tried using tariffs to remake the global economy in record time: What he seeks is virtually impossible without substantial political and economic blowback, even to constituencies the administration aims to protect."

Walmart warns US-China tariff deal will not avert price rises - Gregory Meyer, Financial Times:

“We will do our best to keep our prices as low as possible but given the magnitude of the tariffs, even at the reduced levels announced this week, we aren’t able to absorb all the pressure given the reality of narrow retail margins,” he said in prepared remarks.

Blogs and Bits

Students should study up on these 2 education tax credits - Kay Bell, Don't Mess With Taxes. "Here’s a quick primer on the tax credits, starting with a key component they share. As tax credits, they are among the best types of tax savings, since credits offset dollar-for-dollar any tax you owe."

House Tax Plan Would Kill Direct File And Rescue Controversial Contingency Fees - Kelly Phillips Erb, Forbes. "The American Institute for Certified Public Accountants (AICPA) Code of Professional Conduct prohibits CPAs from charging contingent fees for preparing original returns, amended returns, and ordinary refund claims because of the risk that these arrangements would allow a CPA to improperly benefit from the transaction. Many state accountancy board rules also ban contingent fee arrangements for preparing an original or amended return or claim for refund or credit."

An Overview of the Collection Statute of Limitations - Thomas Gorczynski, Tom Talks Taxes. "The IRS does not have unlimited time to collect an unpaid balance."

Related: Eide Bailly IRS Dispute Resolution & Collections Services.

Analyzing ERISA Fiduciary Duties: Insights from Watson v. EMC Corp. - Ed Zollars, Current Federal Tax Developments. "A recent decision from the United States District Court for the District of Colorado in Marie Watson v. EMC Corp., Civil Action No. 1:19-cv-02667-RMR-STV, decided May 7, 2025, provides valuable insights into a plan administrator’s obligation to provide complete and accurate information to beneficiaries."

Related: Eide Bailly Compensation & Benefits Services

Tax News & Views International Weekly: Coexisting with the World - Alex Parker, Eide Bailly. "The UTPR in particular has been a concern for Republican Pillar Two critics, who claim it will target U.S. companies, since the U.S. hasn’t enacted Pillar Two and has a minimum tax—the tax on global intangible low-taxed income—that is only applied at 10.5%."

Payroll Service Goes to the Dark Side

Payroll Co. Owner Cops To Fraud, Tax Charges - Elliot Weld, Law360 Tax Authority ($). "A former payroll company owner pled guilty to embezzling from her clients and failing to pay employee withholdings to the IRS on their behalf."

From a Department of Justice press release on the indictment that led to the guilty plea (Defendant name omitted, emphasis added:

Defendant allegedly embezzled money from the payroll account held in trust for Moresource’s clients. She took her clients’ money for her personal benefit, the indictment says, as well as to fund her company’s operations. Defendant allegedly embezzled approximately $1,545,427 of payroll deposits from 24 Moresource clients.

...

Defendant attempted to conceal her embezzlement of client funds by causing Moresource to stop making timely and accurate IRS filings, the indictment says, and to stop making regular payments to the IRS for the employment taxes owed by her clients. Defendant caused documents to be transmitted to her clients that falsely stated all payroll tax obligations had been satisfied. Defendant falsely told her clients that the IRS sent them tax deficiency notices because the IRS was behind in processing tax payments, because the IRS misapplied the tax payments, and because of issues with Moresource’s payroll software.

Most third party payroll tax providers do honest work, but a bad one is catastrophic. The IRS still wants its money, and the unfortunate businesses who are victimized can end up paying twice - once to the embezzler, and again to the tax agency.

It's good fiscal hygiene for employers to regularly log into their account in the Electronic Federal Tax Payment System - whether they do their own payroll or outsource it - to make sure their payroll tax remittances are properly credited.

What day is it?

It's National Chocolate Chip Day! A worthy holiday.

Make a habit of sustained success.