On Capitol Hill

Republicans Flesh Out Trump’s ‘No Tax on Overtime’ Idea—With Limits - Richard Rubin, Wall Street Journal:

Marshall’s bill, slated for introduction Tuesday, would limit the overtime-pay break to people who get at least 1.5 times their normal pay rate, either under the Fair Labor Standards Act or an agreement with their employer.

The break would be an above-the-line income tax deduction. That means workers can claim it whether they itemize deductions or take the standard deduction. They would still pay payroll taxes on the income. According to the Yale Budget Lab, about 8% of hourly workers and 4% of salaried workers regularly work overtime.

Key Republican: GOP ‘hard pressed’ to wrap megabill by Memorial Day - David Lim, Politico:

Republicans are still sorting through major divisions on how deeply to make cuts to Medicaid and issues related to state and local tax deductions. At stake is extending President Donald Trump’s tax cuts and enacting his broader agenda on tax, energy and border policy.

Johnson also suggested Monday the timeline could change as lawmakers work to resolve major policy differences, but that if it slips past Memorial Day it would be wrapped “shortly thereafter.”

Tariffs

Trump Tariffs: The Economic Impact of the Trump Trade War - Erica York and Alex Durante, Tax Foundation:

On April 29, 2025, the president signed an executive order to prevent certain tariffs from stacking; rather than add on, the executive order specifies a hierarchy for which tariffs apply. The top priority is auto tariffs, followed by IEEPA “fentanyl” tariffs on Canada and Mexico, followed by steel and aluminum tariffs.

Newsom Asks Trump to Work With Him on $7.5 Billion Tax Credit for Hollywood - Shawn Hubler, Matt Stevens, and Nicole Sperling, New York Times:

Mr. Newsom’s proposal came in response to the president’s social media post on Sunday that called for a 100 percent tariff on films produced outside the United States. Over the weekend, Mr. Trump met at his Mar-a-Lago club in Florida with the actor Jon Voight, whom he has named a “special ambassador” to Hollywood. After that meeting he published his post, declaring: “WE WANT MOVIES MADE IN AMERICA, AGAIN!”

...

A tax credit modeled after California’s incentive program is essentially what Mr. Newsom is proposing, though the exact mechanics of how it would work or be enacted remained uncertain. Earlier Monday, Senator Adam Schiff, Democrat of California, said his office was working on a federal film incentive proposal.

Hollywood Wanted Trump to Bring Movie-Making Back to the U.S.—but Not Like This - Ben Fritz, Brian Schwartz, and Erich Schwartzel, Wall Street Journal:

Entertainment-industry executives expressed confusion over how a levy could be applied to intellectual property with no specific monetary value. They said they feared retaliatory tariffs could damage their business overseas, where big-budget movies often earn most of their box-office receipts. Shares in Disney, Netflix and other media companies and movie-theater chains fell Monday.

IRS Workforce

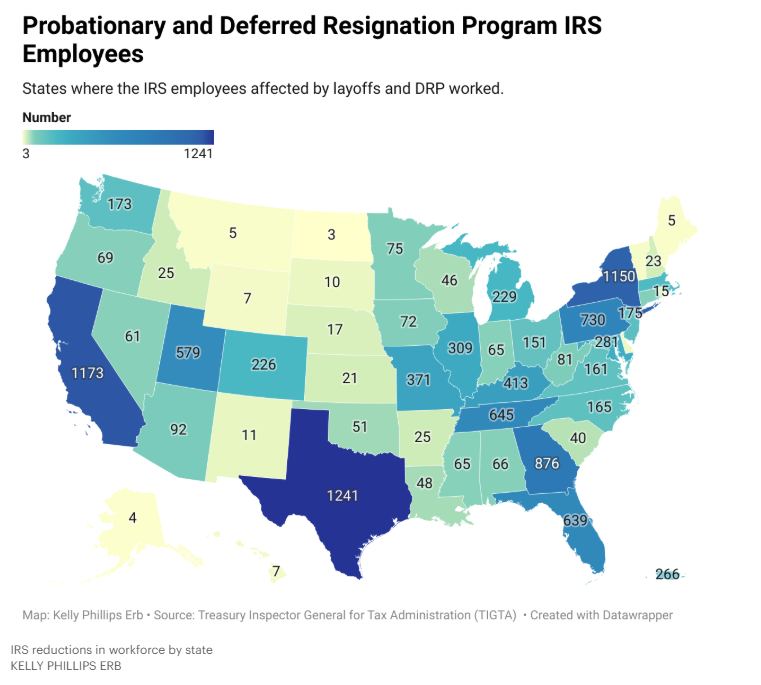

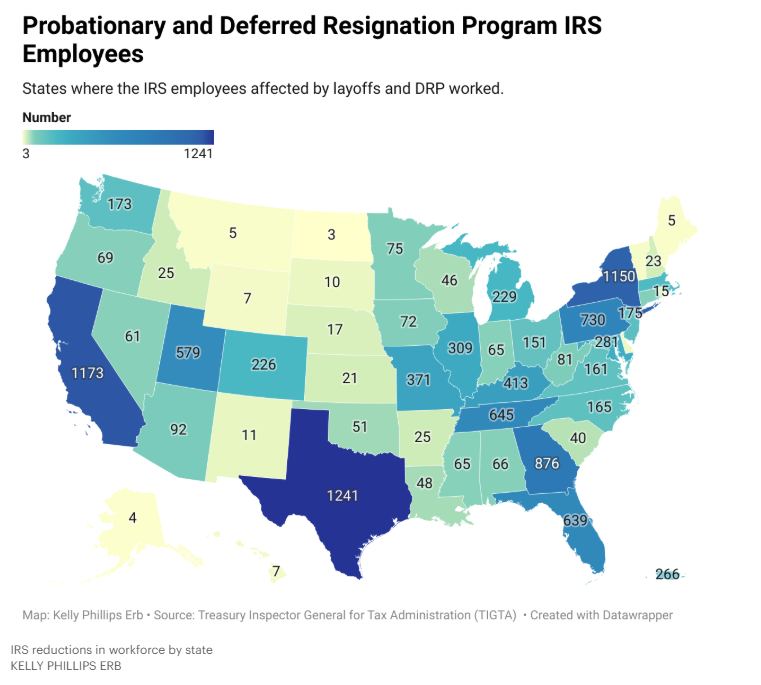

The IRS lost over 30 percent of its revenue agents from the terminations of probationary employees and the first round of the deferred resignation program, according to an agency watchdog.

As of March, 3,623 revenue agents — or 31 percent of all revenue agents — were either fired or resigned under the first deferred resignation program, the Treasury Inspector General for Tax Administration estimated in a report released May 5. Revenue agents are responsible for auditing the returns of individual and business taxpayers.

Under Trump, IRS Has Shed More Than 11% Of Its Workforce. More Cuts Are On The Way - Kelly Phillips Erb, Forbes:

Every state, including the District of Columbia and Puerto Rico, had probationary employees who received termination notices or accepted the DRP.

Iowa, Colorado, Mississippi, and Idaho had the highest percentage of employee separations compared to the IRS workforce in those states. By the numbers, Texas, California, New York, Georgia, and Pennsylvania had the most separations.

In the Courts

Navigating the Perilous Waters of Fraud: Lessons from Quinones v. United States - Ed Zollars, Current Federal Tax Developments:

This case underscores the potent effect of 28 U.S.C. § 2514 before the Court of Federal Claims. Any claim against the United States found to be tainted by fraud, even an attempted fraud in its proof or establishment, is subject to complete forfeiture. The burden of proof for fraud on the government is clear and convincing evidence, often demonstrated by comparing submitted documents to known facts. As CPAs, understanding the severity of this statute is vital, especially if any clients are pursuing claims against the U.S. in this venue. The Quinones case serves as a clear example that fantastical or unsupportable valuations and figures, when presented with knowledge of their falsity and intent to deceive, will lead to the claim’s forfeiture. It highlights the need for rigorous adherence to actual figures and supportable positions grounded in the Internal Revenue Code and Treasury Regulations.

What day is it?

It's National Beverage Day!