Key Takeaways

- Republican tax bill updates.

- New on tariffs.

- Trump challenges tax exempt statuses.

- IRS budget cuts.

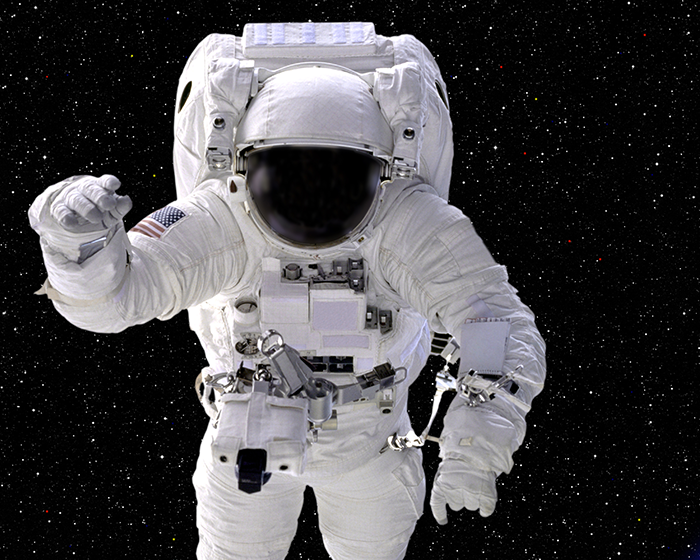

- National Astronaut Day!

Republicans Count on Trump Tax Plan to Boost Economy, but There’s a Catch - Richard Rubin, Wall Street Journal:

House Republicans are fitting versions of those policies into the bill they aim to unveil in the coming weeks. Those tax cuts will be smaller in aggregate, and economists say they are unlikely to spur much growth. (Tipped workers are about 2% to 3% of the workforce and some already don’t pay income taxes.) Still, the new Trump ideas are the pieces voters may notice most, along with a higher child tax credit and a bigger deduction for state and local taxes.

Republicans Wrestle With Trump’s Demands for Tax Cuts - Andrew Duehren, New York Times:

Republicans face key hang-ups on Trump agenda bill as House heads into crucial week - Emily Brooks and Mychael Schnell, The Hill:

The top point of discontent revolves around how to address the state and local tax (SALT) deduction cap, with Republicans in high-tax blue states pushing for a sizable increase and deficit hawks pumping the brakes. The conference is also in conflict over the green energy tax credits that were passed as part of sweeping Democratic legislation during the Biden administration, which conservatives pan but moderates say benefit their districts.

Tariffs

Proposed Tariffs Rates Have Been Lowered, But They Are Still Far Too High - Robert McClelland, Tax Policy Center:

Perhaps the administration will continue to walk back tariffs closer to their pre-April 2 levels. But 10 percent could become “the new normal,” with most imports subject to 10 percent or 25 percent tariffs and relatively few imports receiving permanent exemptions.

Trump Says He Will Put 100% Tariff on Movies Made Outside U.S. - Brooks Barnes, New York Times:

Mr. Trump said he had authorized Jamieson Greer, the United States Trade Representative, to begin the process of taxing “any and all Movies coming into our Country that are produced in Foreign Lands.” Mr. Trump added, “This is a concerted effort by other Nations and, therefore, a National Security threat.”

Tax-Exempt Organizations

Trump's social media post targeting Harvard's tax-exempt status could create problems for the IRS - Dareh Gregorian, NBC:

In a Truth Social post Friday, Trump said, “We are going to be taking away Harvard’s Tax Exempt Status. It’s what they deserve!”

Trump Officials Explore Ways of Challenging Tax-Exempt Status of Nonprofits - Brian Schwartz, Joel Schectman, and Richard Rubin:

The meetings started taking place shortly after the Trump administration appointed a new top interim lawyer at the agency, Andrew De Mello, whom Trump had nominated for a different post in his first term. De Mello privately discussed the nonprofit rules with agency officials, including those at the tax-exempt division, according to people familiar with the matter.

IRS Funding

Trump Proposes Slashing IRS Funding to Lowest Level Since 2002 - Doug Sword and Benjamin Valdez, Tax Notes ($):

The proposed cut would build on a difficult few months for the agency, which is the target of an ongoing reduction in force and has seen thousands of staff accept the Trump administration’s deferred resignation offer. The agency has also been embroiled in several lawsuits over access to taxpayer data by the Department of Government Efficiency and the Department of Homeland Security.

White House Budget Seeks $2.5B Cut From IRS Funding - Asha Glover and Stephen K. Cooper, Law 360 Tax Authority ($):

The White House didn't offer specifics on which tax credits it would like eliminated. A senior OMB official, who requested anonymity, told reporters Friday that details will come in the full budget later in the year.

Tax Trouble

Muncie area tax preparer sentenced to 18 months in federal prison for filing nearly 400 false tax returns - IRS (defendant name omitted):

To increase the amount of refunds her clients would receive, Moles falsely stated that her clients qualified for the American Opportunity Tax Credit (“AOTC”). The AOTC is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. Taxpayers can get a maximum annual credit of $2,500 per eligible student. To be eligible to claim the AOTC, a taxpayer (or a dependent) must have received a Form 1098-T, Tuition Statement, from an eligible educational institution.

What day is it?

It's National Astronaut Day!

Make a habit of sustained success.