Key Takeaways

- "Liberation Day" tariffs: 20% on everything?

- Housing, Auto sectors face impact.

- Reaction in the markets, Congress.

- Will IRS staff cuts spur abusive tax shelters?

- IRS "ghosting" Congressional Oversight chair.

- TCJA scoring fight continues.

- National Peanut Butter and Jelly Day.

Trump is set to announce ‘reciprocal’ tariffs in a risky move that could reshape the economy - Josh Boak, Associated Press:

The new tariffs, coming on what Trump has called “Liberation Day,” are a bid to boost U.S. manufacturing and punish other countries for what he has said are years of unfair trade practices. But by most economists’ assessments, the risky move threatens to plunge the economy into a downturn and mangle decades-old alliances.

Trump preps major tariff hike as business, Wall Street brace for impact - David Lynch, Washington Post:

...

In recent days, Trump has spoken favorably of the simpler approach that would impose an identical tariff of roughly 20 percent on goods from almost all nations.

What Happens, Who Pays

Where Trump’s tariffs will really hit home - Katy O'Donnell, Politico. "Tariffs on imported goods will slam the housing sector – which represents about 16 percent of GDP – just as it’s starting to show signs of life after years of stymied sales due to soaring home prices and high mortgage rates. But the market’s comeback is fragile, and the typically busy spring selling season has been a disappointment so far. The last thing it needs is a price hike on the materials used in new home construction and remodeling."

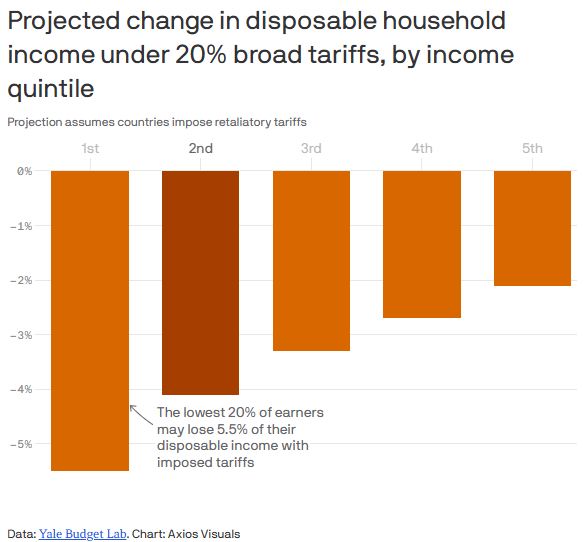

Trump tariffs would hit lower-income Americans hardest - Emily Peck, Axios. "The lowest income households could see their disposable income fall by as much as 5.5%, in a scenario of 20% across-the-board tariffs where other countries retaliate with levies of their own, per an analysis from the Yale Budget Lab."

US Automakers Make Mad Dash to Push Trump to Temper Tariffs - Keith Naughton and David Welch, Bloomberg via MSN. "Detroit’s automakers have conceded that they’re willing to pay tariffs on completed cars and large components like engines and transmissions, the people familiar with the matter said. But representatives for the companies have told the administration that levies on parts would drive up costs by billions of dollars, leading to layoffs and profit warnings that would run counter to Trump’s goal of building up the industry, one of the people said."

US car dealers fret as Donald Trump’s tariffs set to take effect - Claire Bushey, Financial Times.

...

The additional cost will vary based on model and manufacturer. Michigan consultancy Anderson Economic Group has estimated the tariffs will add between $4,000 and $10,000 to the cost of most vehicles, and about $12,000 to the cost of an electric vehicle.

Tariff Politics

Trump faces tariff rebellion - Morgan Chalfant, Eleanor Mueller, and Burgess Everett, Semafor.

GOP senators line up with Democrats to oppose Trump’s Canada tariffs - Lisa Kashinsky, Jordain Carney, and Meredith Lee Hill, Politico. "Sen. Susan Collins (R-Maine) said Monday that she plans to back the resolution led by Sen. Tim Kaine (D-Va.) that would terminate the national emergency Trump declared last month, citing fentanyl trafficking and illegal immigration. Trump has used that declaration to justify 25 percent across-the-board tariffs on America’s northern neighbor and leading trade partner — duties that Trump has threatened to start levying later this week."

Tariff Gambit Bets Americans Will Swallow Higher Prices - Alan Rappeport, New York Times:

But it is not an easy sell. The onslaught of tariffs has roiled markets and dampened consumer confidence. Auto tariffs that go into effect on Thursday will add a 25 percent tax on imports of cars and car parts, likely upending pricing in the sector. Mr. Trump has already imposed tariffs of 20 percent on Chinese goods and more are expected later this week, when the president announces his “reciprocal” tariffs on major trading partners, including those in Asia and Europe.

IRS and Tax Season

IRS Layoffs Could Spark Use of Abusive Tax Shelters, Tax Pro Says- Kristen Parillo, Tax Notes ($):

...

“We've seen this in cycles over the years, right? Where there's a perception that the IRS isn't working, it leads to greater activity — and in partnerships particularly, because this has always been the vehicle for abusive tax transactions and tax shelters,” Brackney continued. “And so, if we can all hang in there, for those of us who practice in controversy, undoubtedly there'll be another cycle of abusive tax shelters that use partnerships, and we'll be able to talk about how the [centralized partnership audit] rules apply to those in a few years.”

IRS Oversight Chair Says Agency Is Ghosting Him - Doug Sword, Tax Notes ($):

...

“I’ve had no one to talk to for a while,” Schweikert told reporters April 1. He previously said he had two IRS officials at his disposal for answering questions.

Options for free filing and tax help - IRS. "Eligible taxpayers in 25 states can file their federal taxes online securely, easily and for free directly with the IRS using Direct File. The web-based service offers guided help in English and Spanish to prepare and file a federal tax return from a smartphone, tablet or computer. Taxpayers can even import certain data from their IRS account. Check out this fact sheet to learn who can use Direct File."

Congress and the 2017 Tax Law

Republicans Eye $25,000 SALT Cap as Trump’s Tax Cuts Take Shape - Nancy Cook, Bloomberg News:

...

The plan, which is still in the process of being drafted and is not final, also includes a renewal of President Donald Trump’s 2017 tax reductions for individuals and closely held businesses as well as some of his campaign tax pledges, the people said, requesting anonymity to discuss private matters.

Senate GOP Argues Budget Chair Has Final Say on Scoring Tax Bill - Cady Stanton and Katie Lobosco, Tax Notes ($).

...

Using that tactic would mean that, on paper, extending the expiring TCJA tax cuts would cost nothing because they are currently in place.

The 2017 Tax Bill only met scoring rules because many provisions had a 2026 expiration date.

House Advances A Flurry Of Tax-Related Bills Focused On Administration - Kelly Phillips Erb, Forbes. "The IRS may extend filing dates for tax returns when there is a federally-declared disaster area. However, without a tweak to the law, some taxpayers may find their refunds at risk due to the lookback period. To resolve that issue, the Disaster-Related Extension of Deadlines Act requires the IRS to treat the postponement of a federal tax return deadline due to a federally declared disaster (or certain other events) as an extension of the deadline for purposes of calculating the limit on a tax refund."

Blogs and Bits

5 tax moves to make this April - Kay Bell, Don't Mess With Taxes:

All you have to do is (1) file your Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, and (2) send in any tax you owe by Tax Day.

Ranch Springs, LLC v. Commissioner: A Case Study in the Valuation of Conservation Easements and the Pitfalls of Aggressive Tax Planning - Ed Zollars, Current Federal Tax Developmenmts. "The Ranch Springs decision serves as a stark warning against the use of speculative valuation methodologies, particularly the income approach based on hypothetical business ventures, when valuing undeveloped land for conservation easement donations."

Bozo Tax Tip #8: Publicize Your Tax Crimes on Social Media! - Russ Fox, Taxable Talk. "A helpful hint to the Bozo tax community: Law enforcement does read social media."

IRS Small Business Outreach

Par funding CEO sentenced to 15 and a half years in prison for RICO conspiracy, securities fraud, tax crimes, and related offenses - IRS (Defendant names romoved, emphasis added):

...

Par Funding’s principal means of generating income was to “advance” money to businesses (known as merchant cash advance or “MCA” customers) that were in need of short-term financing at high rates of return.

The enterprise would use threats of violence to collect money from customers whose payments were overdue. Accounts Receivable Specialist admitted that, in threatening one particular Par Funding customer, he told the customer that he must repay the company immediately because Accounts Receivable Specialist was not to be messed with and had previously torched people’s cars and kicked people’s teeth in.

Why is the IRS picking on America's hard-working small business funders? And what's the tax angle, anyway?

For years, the defendant committed a variety of tax crimes related to his fraudulent proceeds, including conspiring to defraud the IRS and filing false tax returns, as well as employment tax fraud. The total federal tax loss stemming from Defendant’s crimes exceeds $8 million. He also caused $1.6 million in state tax loss to the Pennsylvania Department of Revenue by falsely reporting that he and his wife were residents of Florida from 2013 through 2019, when in fact they resided in Pennsylvania.

Maybe sometimes IRS enforcement is a good idea.

What Day is It?

It's National Peanut Butter and Jelly Day, honoring the official go-to meal of tax pros who get home too late for dinner.

Make a habit of sustained success.