Key Takeaways

- "What they actually need to do is process the claims as soon as possible."

- IRS IT needs compared to those of "a mid-sized bank."

- Trump says he has a tariff plan, but doesn't reveal it.

- Economists warn of tariff damage.

- How trade war could unfold.

- Senate looks to "move quick" on tax proposal.

- A tax rate increase?

- An appraisal misses by 7,694%.

- Cent Day.

Employee Retention Credit Guidance Raises New Questions - Caitlin Mullaney, Tax Notes ($):

Contradictions between the FAQ and previous notice guidance were also noted by Elanjian, who advised practitioners and businesses to be careful about relying on nonauthoritative guidance.

“It seems like the IRS has published these FAQs as a metaphorical punting of the decision on when to account for the income tax effects to taxpayers and tax preparers,” Elanjian said.

Tonya Rule, leader of the Eide Bailly ERC practice, comments:

What they actually need to do is process the claims as soon as possible. While taxpayers can follow the non-authoritative guidance, I would advise taxpayers and practitioners to print the new FAQ’s in case the IRS decides they were ill-advised and takes them off of their website.

Related: IRS provides new flexibility in reporting ERC income adjustments

The Modernization Program That Would Not Die - Marie Sapirie, Tax Notes ($):

No kidding.

Nothing could go wrong if we drive right through Chesterton's Fence.

While I won't minimize the IT challenges of a "midsize bank" (A bank with an IT staff of 100 is pretty big in my book), at least a bank has a relatively limited set of transactions compared to the IRS, and a much smaller customer base. The IRS has to deal with a dozen different Form 1120-series returns alone, a tax law that changes every year, random policy provisions larded into the tax code by Congress, and, well - see the next item.

IRS Places Dozens of Information Technology Employees on Leave - Benjamin Valdez, Tax Notes ($). "The employees, placed on immediate paid leave on March 28, managed several IT operations at the IRS that 'are critical for the filing season,' including data centers, user and network services, and cybersecurity, according to the source, who is a former IRS IT executive."

'Liberation Day' Eve

Trump Says He Settled on ‘Liberation Day’ Tariff Plan but Doesn’t Reveal It - Gavin Bade, Brian Schwartz, and Vipal Monga, Wall Street Journal:

Trump’s team has pitched him on several ideas of how to tariff other countries, including a 20% global tariff on virtually all imports. Throughout Monday, some of his aides were under the impression that he hadn’t committed to a particular path, according to people familiar with the matter. The people stressed that conversations remain fluid, and Trump’s comments that he had decided on an approach caught some White House advisers off guard.

Trump aides draft tariff plans as some experts warn of economic damage - Jeff Stein and David Lynch, Washington Post:

If implemented, the plan is likely to send shock waves through the stock market and global economy. Assuming that permanent tariffs took effect in the current quarter and triggered robust retaliation by U.S. trading partners, the economy would almost immediately tumble into a recession that would last for more than a year, sending the jobless rate above 7 percent, according to Mark Zandi, chief economist for Moody’s, who described the results as a worst-case scenario.

White House advisers cautioned that several options are on the table and no final decision has been made.

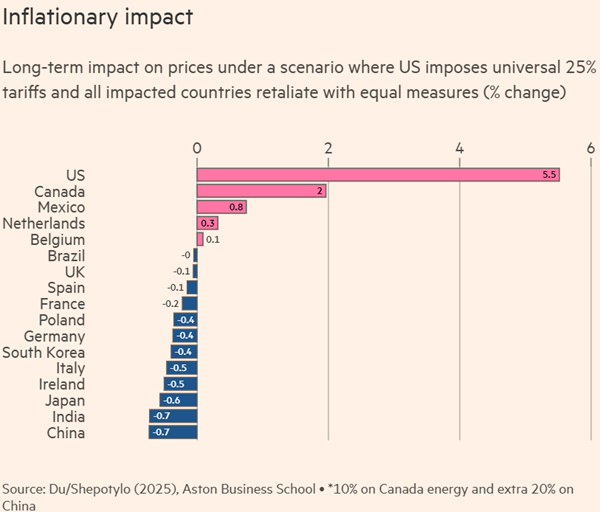

How a $1.4tn Trump trade war could unfold - Peter Foster and Alan Smith, Financial Times:

Econometric analysis of a worst-case scenario, where US trade partners hit back against Washington, shows a Trump-inspired tariff war would cause widespread trade disruption, rising prices and falling living standards.

GOP senators vs. Trump on tariffs - Lisa Kashinski and Mia McCarthy, Politico:

Still, the resolution has no teeth — it is ultimately a political statement. Any show of opposition in the Senate is likely to die in the House, where Speaker Mike Johnson has already moved to block the ability of tariff critics to force a floor vote on ending the types of national emergencies Trump is leaning on to levy his tariffs.

Congress and Taxes

House Advances Bills on Disaster Extensions and Lost Checks - Tyrah Burris, Tax Notes ($):

...

The House advanced the Internal Revenue Service Math and Taxpayer Help Act (H.R. 998), introduced by Ways and Means Committee member Randy Feenstra, R-Iowa., by a voice vote. The bill would require the IRS to explain math errors to taxpayers and convey the deadline for any errors to be abated. The legislation would also require a description of the math or clerical error in plain language alongside any adjustments that need to be made to the return and require the agency to send a notice to the taxpayer’s last known address.

Ben Peeler, leader of the Eide Bailly tax controversy practice, welcomes these changes:

Additionally, we hope that the extension of the mailbox rule will clear up so many of the disputes, especially when there are errors in the software on either the IRS or processing company side.

Big Beautiful Bill Update

Trying to move quick on tax cuts - Bernie Becker, Politico:

The Senate passing a budget this week would be another big step toward Republicans passing a measure with tax cuts, more funding for border security and other priorities, even if the two chambers also would be holding off on working through some fundamental issues like how much spending would be cut in the broader fiscal package.

If the Senate plans to bring a budget resolution to the floor as soon as Wednesday, that also means Republicans expect the chamber’s parliamentarian, Elizabeth MacDonough, to answer one of the key outstanding questions in budget reconciliation — whether she’d allow the GOP to use what’s known as the current policy baseline.

The GOP reconciliation plan is getting House blowback - Laura Weiss, Andrew Desiderio, and Jake Sherman, Punchbowl News:

“For me, it’s dead on arrival,” Rep. Ralph Norman (R-S.C.) said. Norman added he has a problem with going above a $4 trillion debt-limit increase. GOP leaders are considering a $5 trillion debt-limit hike.

Scoop: Trump might let taxes rise for the rich to cover breaks on tips - Marc Caputo and Neil Irwin, Axios. "Some White House officials believe letting income taxes on the very highest earners rise would buy breathing room on other priorities, and help blunt Democrats' attacks as they seek to extend President Trump's 2017 tax cuts."

Blogs and Bits

Mississippi's income tax on the way out, in the 2030s - Kay Bell, Don't Mess With Taxes. "After some specific phasing down of the tax rates, which is 4.7 percent on 2024 tax year returns now being filed, the final cuts to and end of the state tax rate will be determined by growth triggers starting in 2031."

Interim Final Rule Exempts Domestic Companies from Beneficial Ownership Reporting - Parker Tax Pro Library. "Under this interim final rule, entities previously defined as 'domestic reporting companies' are exempted from the reporting requirements and do not have to report BOI to FinCEN, or update or correct BOI previously reported to FinCEN."

Bozo Tax Tip #9: Only Income Earned Outside the United States Is Taxable - Russ Fox, Taxable Talk. "Section 861 states that certain items are always considered as income from within the United States. It does not say that income earned in the US is exempt from tax. But tax protesters claim that’s the case; courts, though, basically state, ‘You must be kidding.’ This argument has never been used successfully."

Appeals Court Sets Back Truck Assembler Excise Tax Argument

IRS Gets Win as Court Overturns $400 Million Tax Break on Trucks - Tristan Navara, Bloomberg ($):

But Fitzgerald didn’t overcome an exception to the safe harbor, which doesn’t permit the deduction for trucks that never triggered the excise tax when they were new, the court said. The company didn’t meet its burden to show its trucks did, as “at least some of those vehicles were first sold in tax-exempt transactions,” Readler said.

Link: No. 24-5078

Adventures in Appraisal

Tax Court Nixes $26M Easement Deduction Over Quarry Value - Kat Lucero, Law360 Tax Authority ($):

Ranch Springs exceeded the actual easement value by $25.5 million, or 7,694%, when the partnership claimed the deduction on its 2017 tax return a year after it purchased the 110-acre open space for $715,000, which was a comparable price to nearby similar property during the 2014-2020 period, according to the opinion.

From Judge Lauber's opinion:

This argument is wholly unconvincing.

He adds this in a footnote (my emphasis:

This was a case in which the conservation easement was granted to generate charitable deductions, and partnership interests were sold to investors as a pure tax play. If the only economics for an investment are based on implausible valuation tricks, that investment just might not go well.

What day is it?

It is, of course, April Fools Day. It's also National One Cent Day, so some respect for that bag of pennies in your closet, please.

Make a habit of sustained success.