Key Takeaways

- Trump tariffs head to Supreme Court.

- Toymaker goes up against the White House.

- Trump: "If we lose, our Country could be reduced to almost Third World status."

- Shutdown drags on.

- Wealth Taxes, Head Taxes Fail in Illinois, France.

- A hidden hazard of foreign trusts.

- National Sandwich Day.

It's Tariff Week at the Supreme Court

Trump Admin Tells SCOTUS ‘Regulate Importation’ Includes Tariffs - Cameron Browne, Tax Notes ($):

Toymaker Readies Supreme Court Fight Over Trump’s Tariffs - Greg Stohr, Bloomberg via MSN:

Woldenberg, who runs two educational-toy businesses near Chicago, says the BubblePlush Yoga Ball Buddies, designed to help kids control their emotions, has been hit especially hard by Trump’s fluctuating global tariffs.

The BubblePlush, which also comes as a penguin or puppy, was slated to be made in China. But when Trump jacked up tariff rates to 145% on imports from that country in April, Woldenberg’s team scrambled to shift production to India, only to see Trump reduce the China duties and slap higher ones on India imports. The company rushed to have the goods arrive before the 50% India tariff took effect, but the shipment arrived six hours too late.

“We paid a $50,000 penalty for that,” Woldenberg said from a toy-festooned conference room in Vernon Hills, Illinois.

Trump reverses course on attending Supreme Court arguments this week - Josh Gerstein and Alex Gangitano, Politico:

...

“It will be, in my opinion, one of the most important and consequential Decisions ever made by the United States Supreme Court,” Trump wrote. “If we lose, our Country could be reduced to almost Third World status — Pray to God that that doesn’t happen!”

The Supreme Court justices to watch during the tariffs oral argument - Washington Post:

Trade Tracker #2: IEEPA tariffs will cost households $1,300 annually - Erica York, Supernormal Returns. "In short, the IEEPA tariffs amount to one of the largest tax increases in US history—implemented without congressional approval."

Shutdown Drags on

Shutdown pain grows, polls shift with Election Day one year out - Jake Sherman, Andrew Desiderio and John Bresnahan, Punchbowl News:

Those bipartisan talks continued over the weekend, and there’s some optimism about getting to a resolution.

However, Trump and the GOP leaders are showing no signs of caving on extending the expiring Obamacare premium subsidies. Schumer and Jeffries continue to demand an extension as part of any deal to reopen the government. So the standoff grinds on. Open enrollment began on Saturday.

States Say Federal Funding Pause Will Have Tax Ramifications - Kennedy Wahrmund, Tax Notes ($): "In an October 29 letter to President Trump, Michigan Gov. Gretchen Whitmer (D) and 20 other Democratic governors urged the U.S. Department of Agriculture and the White House to avert SNAP disruptions. According to the letter, the program not only "supports approximately 388,000 jobs nationwide and more than $20 billion in direct wages" but also generates more than $4.5 billion in federal and state tax revenue."

SNAP Food Aid At Risk In Shutdown Has A Nearly Century Long History - Kelly Phillips Erb, Forbes. "The basic formula used to determine your monthly SNAP benefit amount is the maximum benefit for household size, less 30% of your net monthly income. That 30% is based on the assumption that households can spend about 30% of their own income on food. SNAP fills in the gap between that contribution and the USDA’s estimate of what a healthy diet costs."

PCORI fees updated

IRS Posts Adjusted Applicable Amount for Determining PCORI Fees - Tax Notes ($). "The IRS has provided (Notice 2025-61, 2025-45 IRB 693) the adjusted applicable dollar amount for determining section 4375 and 4376 fees, which help fund the Patient-Centered Outcomes Research Institute, for policy years and plan years ending on or after October 1, 2025, and before October 1, 2026."

Link: Notice 2025-61. The applicable dollar amount is $3.47.

Wealth Taxes, Head Taxes Fail

Illinois Lawmakers Pass Transit Funding Plan Without New Taxes - Emily Hollingsworth, Tax Notes ($):

...

The Legislature-approved plan, which would take effect on June 1, 2026, would direct motor fuel tax revenue to regional transit funds and allow some counties to increase — via ordinance — local sales taxes that fund regional transit.

French lawmakers reject wealth tax proposal in budget debate - AFP:

But lawmakers in the National Assembly rejected the measure on Friday evening, 228 voting against and 172 in favour.

Is Brandon Johnson's head tax already dead? - Austin Berg, The Last Ward:

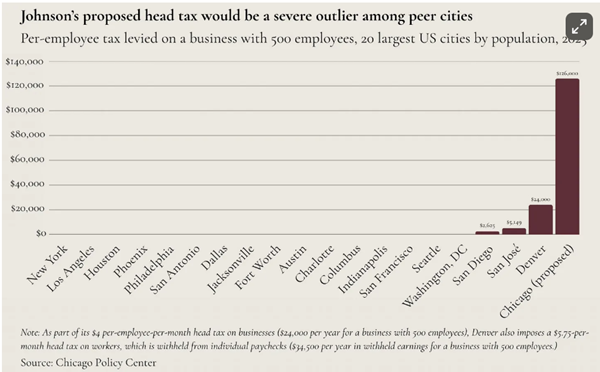

Further, no other big city charges anything close to what Johnson is proposing. Only four of the 20 largest cities in the country charge any kind of tax based on the number of employees a business hires.

Blogs and Bits

5 tax moves to make this November - Kay Bell on Substack. "Explore expiring home energy credits. The OBBBA also ends tax breaks for several home-related energy projects. This includes elimination on Dec. 31 of relatively easy upgrades that improved a residence’s energy efficiency. Tax-favored improvements here are such things as installing Energy Star rated windows; doors; insulation; and heating, ventilation, and air conditioning equipment."

Author Calls For Elimination Of Estate Tax And More Tax On The Wealthy - Peter Reilly, Forbes. "Madoff recommends three steps to improve things. The first is to repeal the estate and gift tax, which are broken and unfixable. Next is to repeal the income tax exclusion for inheritance and gifts and tax unrealized gains at death. She also calls for meaningful payout requirements on donor advised funds."

Tax Court Warns Counsel in Advance of Trial in Syndicated Conservation Easement Case - Jack Townsend, Federal Tax Procedure. "I think Tax Court judges are getting less tolerant, rightfully so, considering the massive waste of time for trials to claim grossly inflated valuations for conservation easements."

Five Ways The IRS Can Get Even More Time To Audit You - Robert Wood, Forbes. "The IRS statute of limitations never starts to run if you do not file a tax return."

An Overview of the IRS MATH Act - Thomas Gorczynski, Tom Talks Taxes. "§6213(b)(1) allows the IRS to assess additional tax due to “mathematical or clerical error appearing on the return” without issuing a notice of deficiency, which gives the taxpayer the right to contest the assessment in the U.S. Tax Court."

Related: Eide Bailly IRS Dispute Resolution and Collections Services.

Tax Obscura - Foreign Trusts and Vacation Homes

Foreign Trusts have an air of intrigue about them. I have had clients - sophisticated ones - wonder why I don't just offer to set up a web of trusts located in exotic tax havens to make all of their tax problems go away.

Consider the case of somebody who sets up a trust in, say, Monaco, to own a vacation home in St. Thomas. The taxpayer who sets up the trust uses the vacation home several weeks a year, rent-free - why would you pay yourself rent?

Maybe because that rent-free use triggers a tax reporting requirement with severe penalties for non-compliance. That rent-free use is considered a distribution from the foreign trust, requiring a Form 3520 filing. Failure to file Form 3520 is subject to a penalty of $10,000 or 35% of the unreported distribution, if greater.

It's not just vacation homes. Boats, cars, airplanes - any trust asset is subject to these rules.

Foreign trusts can sometimes meet specific planning needs, but they don't magically make taxes go away, and they can carry serious compliance costs. Be careful.

Related: Eide Bailly Foreign Trust and Estate Tax Compliance and Planning Services.

What day is it?

It's National Sandwich Day! It's fun when what you do every day, like eating a sandwich, suddenly observes a holiday.

Make a habit of sustained success.