Key Takeaways

- Shutdown continues.

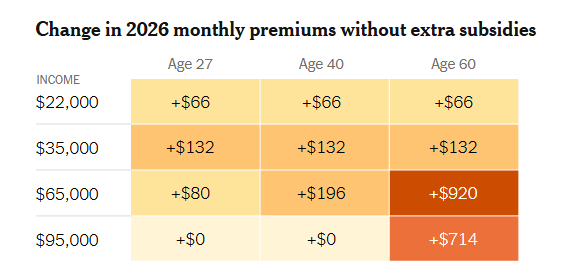

- ACA fight continues as open enrollment begins.

- IRS and ICE data sharing.

- Senate resolution to end tariffs.

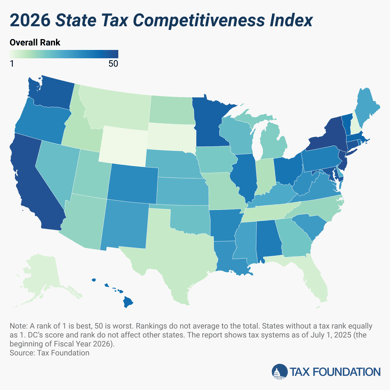

- Tax Foundation releases 2026 State Tax Competitiveness Index.

- Tax Court: Part of settlement interest income, not capital gain.

- Happy Halloween!

Shutdown Continues as Open Enrollment Begins

Obamacare subsidies meet their moment - Laura Weiss, Punchbowl News:

Here’s How Much Obamacare Prices Are Rising Across the Country - Margot Sanger-Katz and Alicia Parlapiano, New York Times:

Open Enrollment Set to Begin Without ACA Tax Credit Extension - Katie Lobosco, Tax Notes ($):

While there’s still time to extend the subsidy before it expires at the end of the year, Democrats wanted to address the issue before the open enrollment period so Americans would have certainty about the cost of the plan they select for coverage next year.

Senators left Washington for the weekend October 30 and aren’t scheduled to return until November 3, effectively pushing the government shutdown into its 34th day.

Behind the Scenes of IRS - ICE Data Sharing

ICE made expansive request for taxpayer data amid IRS pushback - Danny Nguyen, Politico:

How the IRS and ICE Tussled During Trump’s Deportation Push - Richard Rubin, Wall Street Journal:

Federal courts are reviewing the IRS actions to determine whether the agency complied with taxpayer privacy laws and other requirements. Partially redacted documents released in one case in U.S. District Court in the District of Columbia show the tension within the government as the Trump administration tried to break down the typical barriers between agencies and legal restrictions on data sharing.

Senate Takes Symbolic Anti-Tariff Stand

Senate Advances Resolution to End Trump’s Reciprocal Tariffs - Jonathan Curry, Tax Notes ($):

...

Observers have said that the votes are almost entirely symbolic: The resolutions would have to be adopted by the House and signed by Trump, who could veto it. Overriding his veto would require a two-thirds vote in both chambers. The process is further complicated by a set of procedures for challenging presidential emergency declarations, adopted by the House in March, that effectively precludes a vote in the other chamber from taking place until next year.

State Tax Competitiveness

2026 State Tax Competitiveness Index - Janelle Fritts, Jared Walczak, Abir Mandal, Katherine Loughead, Tax Foundation:

This does not mean, however, that a state cannot rank well while still levying all the major taxes. Idaho and Indiana, for example, levy all the major tax types, as do all the other states that rank 11th to 16th: North Dakota, North Carolina, Missouri, Arizona, Utah, and Michigan.

Blogs & Bits

International workers get some U.S. tax help from inflation adjustments in 2026 - Kay Bell, Don't Mess with Taxes via Substack:

For the 2026 tax year, the FEIE is $132,900. That’s an increase from this year’s earnings exclusion of $130,000.

A Refined Approach to Math Error Notices: Analysis of the Internal Revenue Service Math and Taxpayer Help Act - Ed Zollars, Current Federal Tax Developments:

The pilot program’s purpose is to test the delivery method for these notices. It requires sending a statistically significant portion of mathematical or clerical error notices under Section 6213(b) by certified or registered mail with e-signature confirmation of receipt.

The Best States for Retirement - Arnesa Howell, New York Times. "With its sunny beaches and friendly tax code, Florida is the best state to retire in, according to an annual study by WalletHub. But if you’re looking for a lower cost of living and you don’t mind experiencing all four seasons, you can find excellent alternatives in Western and Midwestern states."

Tax Trouble

3rd Circ. Affirms Tax On Interest In $191M Pharma Family Feud - Kat Lucero, Law 360 Tax Authority (defendant name omitted):

...

The panel also rejected the trust's claim that the merger violated the company's articles of incorporation by not being subject to a vote of the shareholders. The trust did not present evidence showing that the parent company created ahead of the merger did not vote as a shareholder in favor of the merger, the panel said.

The panel noted that the disagreement about the tax implications of the settlement payment were present at the time of the deal, with the trust arguing then that the sale of the shares had occurred with the execution of the settlement and not three years earlier, avoiding any portion of the settlement being characterized as interest.

Puerto Rico Treasury Officials Charged in Bribery Tax Scheme - William Hoke, Tax Notes ($):

...

The Justice Department said that an individual identified only as Person A was “engaged in the business of charging customers to unlawfully submit false tax information to the PRDT and unlawfully bribe and otherwise pay PRDT employees to create and submit materially false information to the PRDT for the elimination of taxes owed, evasion of taxes, and theft of funds by individual and corporations.”

What day is it?

Make a habit of sustained success.