Key Takeaways

- IRS looks to expand AI use for audit selection.

- 1,800 new hires for IRS large business division.

- What to do when you receive a collection notice.

- IRS doesn't automatically apply automatic penalty relief.

- Taxes missing from debate.

- Tax Foundation analyses of candidate tax plans.

- Joint Committee of Taxation report on federal tax progressivity.

- 9/11.

IRS Exploring More Internal Artificial Intelligence Initiatives - Benjamin Valdez, Tax Notes ($):

...

The IRS has been using machine learning for decades, according to Pandya, but it’s still exploring the many possible uses of generative AI. It’s also using AI to assist in audit selection for complex partnerships, although humans are still involved along the way.

As part of its venture into the realm of generative AI, the agency has also expressed interest in purchasing an off-the-shelf AI tool for tax and legal research, and it seeks to award a contract for AI program staff support by the fourth quarter of 2025.

IRS Beefs Up Large Business Division With 1,800 New Hires - Erin Schilling, Bloomberg ($):

...

Experienced agents are training new hires in short spurts to avoid slowing down ongoing audits, Paz said. That may mean they leave a case for a few weeks to lead training classes, rather than doing training full time.

You Received a Collection Notice – Now What? - Erin Collins, NTA Blog:

...

First-Time Abate (FTA) may also be an option to consider when you can show filing compliance, payment compliance, and a clean penalty history. You must show you did not have to file a return or if required to file, had no penalties assessed against you in the prior three years (or any penalty was removed for an acceptable reason other than FTA, for example, due to reasonable cause); have timely filed all required returns (or filed a valid extension); and have paid or have a valid payment plan to pay all taxes due for years other than the year for which the relief is requested. FTA applies only to certain penalties (failure to file, failure to pay, failure to deposit). Supporting documentation is not required if you meet FTA criteria. However, you must request penalty relief, in writing or by phone, to be considered for FTA.

It's outrageous that you have to ask for automatic penalty relief. It's a tax on the frightened and the ill-informed.

Related: Eide Bailly Dispute Resolution and Collections Services.

IRS Working on Tweaks to Alternative Dispute Resolution Programs - Nathan Richman, Tax Notes ($):

The new ADR program management office, part of the IRS Independent Office of Appeals, will continue the cross-functional analysis following a Government Accountability Office report that spawned it and should generate incremental changes to some ADR programs, Elizabeth Askey, acting chief of Appeals, said September 10 at an event hosted by the Tax Executives Institute.

Taxes on the Campaign Trail (But Not Much on the Debate)

Missing in the Debate: Any Talk on Taxes - Richard Rubin, Wall Street Journal:

Kamala Harris took a brief shot at the cuts benefitting high-income people and corporations. Trump talked briefly about the strong economy during his administration. Whoever wins will have to reckon with a complex multi-trillion-dollar negotiation that affects nearly every American.

Harris, Trump Clash Over Characterization of Tariffs as a Tax - Alexander Rifaat, Tax Notes ($):

“My opponent has a plan I call the ‘Trump sales tax,’ which would be a 20 percent tax on everyday goods you rely on to get through the month,” Harris said, citing research estimating that the proposal would cost American households nearly $4,000 a year.

...

Trump countered that Harris was being dishonest. “I have no sales tax. That’s an incorrect statement; she knows that,” he said. “We’re doing tariffs on other countries.”

Donald Trump Tax Plan Ideas: Details & Analysis - Erica York, Tax Foundation. "Our estimates illustrate that Trump’s proposed tariffs threaten to offset the economic benefits of his proposed tax policy changes, while falling short of offsetting the tax revenue losses. Trump’s combination of policies could therefore shrink economic output and grow the national debt."

Kamala Harris Tax Plan Ideas: Details and Analysis - William McBride, Erica York, Garrett Watson, and Alex Muresianu, Tax Foundation. "We find the tax policies would raise top tax rates on corporate and individual income to among the highest in the developed world, slowing economic growth and reducing competitiveness. The tax credits and other carveouts would complicate the tax code, run more spending through the IRS, and, together with various price controls, fail to improve affordability challenges in housing and other sectors."

Why I Have Always Hated—And Now Hate Even More—the Presidential Election Season - Eugene Steuerle, The Government We Deserve:

The candidates refuse to address this issue. They can’t. If they were that honest with us, they would lose. Often, they switch the subject to schemes centered on blame and envy: attack immigrants, tax imported purchases under the false pretense that it’s a way to tax foreigners, or go after the rich (who should pay more but can’t by themselves solve our fiscal woes.) “Don’t worry,” the candidates tell us, “nothing will ever be required from ninety-eight percent of you.” You’re entitled to everything you have and more.”

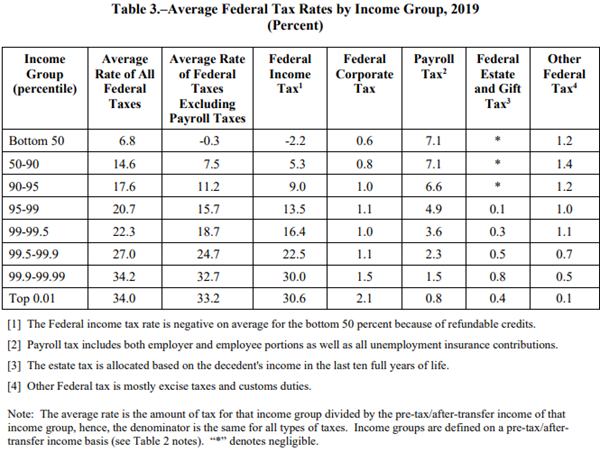

Effective federal tax rates at high incomes: higher than you might think.

JCT Summarizes Current Law on High-Income Taxation - Tax Notes ($). "The report covers current law individual income taxation, rules concerning nonwage income, estate and trust income taxation, business taxation, tax treatment of gains and losses from property disposition, mark-to-market taxation, domestic business income taxation, and all-in tax rates on individual income."

As products of the non-partisan JCT, reports like this can be dry reading, but they reward the effort. For example (my emphasis, footnotes omitted):

Blogs and Bits

Honoring 9/11 heroes by volunteering on Patriot Day - Kay Bell, Don't Mess With Taxes. "If you can't volunteer today since 911 Day 2024 is on a weekday and you're working, your gift of time at your favorite nonprofit will be welcome whenever you can get there."

NEVER FORGET! - Robert D. Flach, The Wandering Tax Pro. "On September 11, 2001, my client, and fellow Dickinson High School Class of 1971 graduate (although we did not discover this until many, many years later when he happened to notice an award I had received from my high school graduating class that was hanging on the wall of the Newark Avenue office and said that he graduated from DHS in 1971 too), Maurice 'Moe' Barry was one of the members of the Port Authority Police Emergency Response Team, among the 'first responders' to the initial attack, who were killed when the tower collapsed."

September 16 Deadline for Extended Pass-Through Filings - Chris Korban, Tax School Blog. "Pass-through entities such as S corporations and partnerships with a calendar-year-end face an upcoming extended tax filing deadline on September 16, 2024. Although the six-month extension may seem generous, many filers find themselves pressed for time as the due date approaches. To avoid penalties and delays, be sure to file your return on time, whether submitting electronically or by certified mail."

IRS Modifies Automatic Consent Procedures for Research Expenses Paid in 2022 or 2023 - Parker Tax Pro Library. "Code Sec. 174(a)(2) requires taxpayers to charge SRE expenditures to capital account and allows amortization deductions of such capitalized expenditures ratably over a 5-year period in the case of SRE expenditures attributable to domestic research, or a 15-year period in the case of SRE expenditures attributable to foreign research, beginning with the midpoint of the tax year in which such expenditures are paid or incurred."

Taxpayers have options for appealing disallowed ERC claims - National Association of Tax Professionals. "Unfortunately, as explained below, the process for appealing a disallowed ERC claims is more complicated than it is for most disallowed refund claims."

Tax Crime Watch: St. Louis

Missouri man sentenced to 3 years in federal prison for fraud and tax offenses - IRS (Defendant names omitted, emphasis added):

According to court documents and statements made in court, between approximately March 2021 and April 2022, Defendant conspired...to obtain online bank account credentials from potential victims, and then transfer money from victims’ bank accounts to cryptocurrency accounts controlled by Defendants. As part of the scheme [a co-defendant] provided Defendant with personal identifying information of victims, and Defendant used that information to open email accounts and accounts at a cryptocurrency exchange. Defendants attempted to recruit bank “insiders” to participate in their scheme, but were disrupted by an undercover law enforcement investigation and failed to transfer any funds from compromised accounts.

In a second scheme, Defendant filed wholly fictitious tax returns for “Shireberk International,” which had no actual business operations, for the 2018 through 2021 tax years. The returns resulted in a refund of $3,449,935.

Judge Nagala ordered [Defendant] to pay restitution of $111,738.52. The remaining funds were recovered by law enforcement.

It is amazing that a "wholly fictitious" business could get the IRS to issue a $3.4 million check. That sort of thing would be cost someone their job in the private sector. While the press release doesn't say so, it's safe to assume that no IRS personnel careers were harmed.

What day is it?

It's September 11. That's enough for one day.

Make a habit of sustained success.