Key Takeaways

- House tax bill - "lame-duck launching point?"

- The shape of Harris tax plans

- The candidates and the 2017 expiring tax cuts.

- Harris tax-the-rich plans "not enough."

- Corporate tax increases - are they the worst?

- Pillar Two international troubles.

- How many luxury golf carts is too many for a non-profit exec?

- National Pots de Creme day.

Tax Package Could Be Useful Lame-Duck Launching Point - Doug Sword and Cady Stanton, Tax Notes ($):

The balanced Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) — with $33.5 billion for an enhanced child tax credit and $32.8 billion for business tax breaks — took half of last year and part of January to be negotiated by House Ways and Means Committee Chair Jason Smith, R-Mo., and Senate Finance Committee Chair Ron Wyden, D-Ore. The Senate rejected a procedural move to advance the bill August 1.

With concerns about President Biden getting a win or even sending out child tax credit checks ahead of the election now in the rearview mirror, the door is open for an extenders bill during the lame-duck session, according to Joshua D. Odintz of Holland & Knight.

This is the bill that would restore current deductions for domestic research expenses, full bonus depreciation, and pre-2023 rules for business interest deductions.

Eide Bailly Congress-watcher Mel Schwarz has some thoughts:

1.It gets expensive things that both sides want off the table during a period when there is traditionally much less attention being paid to the effect on the deficit.

2. It makes some key provisions current policy, which may make them easier to enact going forward. This is particularly true if there is a movement to using a policy baseline for future legislation in addition to the statutory baseline.

3.If the tax bill does move during lame duck, it may only apply to 2024 and not look back to 2022 or 2023. This reduces its effect on the budget while still moving the provisions into a current policy baseline.

Even so, curb your enthusiasm:

Taxes on the Campaign Trail

Kamala Harris’s Tax Increases and Cuts Take Shape - Richard Rubin, Wall Street Journal:

...

For all of Harris’s disagreements with Trump, she has also promised to prevent any tax increases on households making under $400,000, extending most of the expiring Trump tax cuts. (For this purpose, Democrats ignore the effects of corporate tax increases on middle-income workers and shareholders.)

Such a policy effectively would lock her in to extending most of the 2017 tax law that she and every other Democrat in Congress voted against. During her 2020 presidential campaign, she had proposed repealing the Trump tax law.

Trump and Harris confront a trillion-dollar question over expiring tax cuts - Benjamin Guggenheim and Bernie Becker, Politico:

...

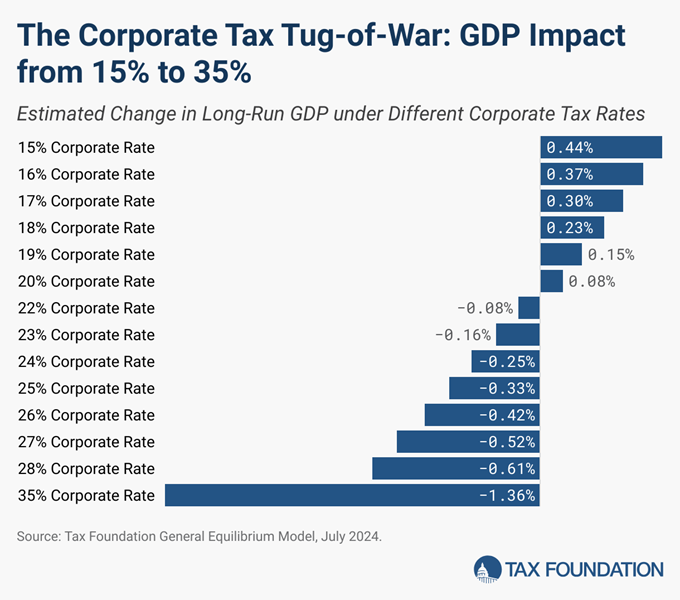

Even though the 2017 cut in the corporate tax rate, to 21 percent from 35 percent, isn’t set to expire, it is nonetheless a big part of the debate. Harris, like Biden, wants to raise the rate to 28 percent, while Trump has floated another cut, to perhaps as low as 15 percent.

Harris has an exotic plan to tax the rich. But it’s not enough. - Megan McArdle, Washington Post:

Though this limitation probably seems quite reasonable to six-figure couples in expensive metropolitan areas, earning $400,000 puts you in the top 3 percent of all households. Yes, that group earns a disproportionate share of national income: the top 5 percent of taxpayers take home 42 percent of total adjusted gross income. (Sorry, I was unable to find data that broke out the top 3 percent.) But they also pay two-thirds of all income taxes, with almost half coming from the top 1 percent.

...

The cascading strictures introduced by the pledge are perhaps why Democrats are being forced into desperation moves such as taxing unrealized capital gains.

The Corporate Tax Rate Tug-of-War - Erica York, Tax Policy Blog. "Studies have shown that the corporate income tax is the most harmful tax for economic growth, and recent analyses are now confirming the benefits of reducing the corporate income tax, finding that the TCJA’s corporate tax reforms significantly boosted domestic investment."

Harris’s Tax on Unrealized Gains is Only the Tip of a $5 Trillion Tax Iceberg - Adam Michel, Liberty Taxed. "Few other countries tax unrealized market gains in the way Harris proposes because it is administratively unworkable. One of the practical challenges is appropriately accounting for losses when the value of an asset declines. If paper gains are taxed, paper losses require a rebate for pre-paid taxes. In 2022, when Elon Musk’s net worth declined by a record-breaking $182 billion, the government would have owed him a $45 billion check—in effect, paying him back some of the taxes he paid in previous years on gains that were only fleeting. Writing the wealthiest Americans large checks when the economy falters would create significant budgetary issues, not to mention difficult political perceptions."

Trump And Harris Efforts To Fight Inflation Are Unlikely To Succeed - Howard Gleckman, TaxVox. "Trump and Harris face a challenge. Voters still see inflation as a major concern even though price pressures have been easing for months. As a result, both candidates want to appear to favor bold steps to fight inflation. But only two fiscal policy levers can moderate demand and broadly slow increases in the price level: Reducing federal spending or raising taxes. And neither candidate has offered plans to do either one."

Pillar Two Troubles

Can the OECD Make a Fool-Proof Pillar Two Safe Harbor? - Alex Parker, Things of Caesar:

...

The safe harbor for the under-taxed profits rule, the “Transitional UTPR Safe Harbor,” effectively prevents other countries from applying the UTPR on the domestic income of U.S. companies, regardless of the company’s effective tax rate. (Normally, the UTPR would apply anytime a multinational company has an entity, in their home jurisdiction or a subsidiary, with income that’s taxed at below 15%.) And the Transitional CbCR Safe Harbor aims to leverage the OECD’s prior country-by-country reporting system, to allow companies to use that information to show that they are outside of Pillar Two’s scope. These both apply through 2025.

Already, the safe harbors have proven to be, well, not entirely safe.

Pillar Two’s Unintended Consequences - Izabella Sara and Sean Bray, Tax Policy Blog. "The OECD’s Pillar Two aims to establish a global minimum tax rate of 15 percent to curb what European officials have referred to as a 'race to the bottom.' On the surface, imposing a worldwide flat tax rate might appear like a simple way to end tax competition below the 15 percent threshold and curb profit-shifting to low-tax jurisdictions, but in reality, Pillar Two will have complex effects on different jurisdictions’ models of governance. Ultimately, it may not eliminate competition for investment and income; it may just change the way countries compete for investment to less transparent, less efficient methods."

Related: Eide Bailly International Business Structuring Services.

Blogs and Bits

South Dakota & Puerto Rico taxpayers get disaster-related tax relief - Kay Bell, Don't Mess With Taxes. "FEMA designated 25 South Dakota counties as disaster areas. They are Aurora, Bennett, Bon Homme, Brule, Buffalo, Charles Mix, Clay, Davison, Douglas, Gregory, Hand, Hanson, Hutchinson, Jackson, Lake, Lincoln, McCook, Miner, Minnehaha, Moody, Sanborn, Tripp, Turner, Union, and Yankton."

Why Opening a Roth I.R.A. May Be a Good Move, No Matter Your Age - Martha White, New York Times. "Financial professionals say this is a good moment for people seeking to convert existing retirement accounts from pretax to Roth, because of historically low income tax rates that are set to readjust higher after 2025 unless Congress intervenes. In addition, Roth accounts can save heirs from getting hit with big tax bills from inherited I.R.A.s."

ERC Voluntary Disclosure Program Reopened with Updated Terms - Chris Korban, Tax School Blog. "For this second program, participants must promptly repay 85% of the funds they received from the credit (up 5% from the 80% required in the first program) to avoid being charged with penalties or interest. This second program only applies to repaying credits received for tax periods in 2021. Employers have until 11:59 pm local time on November 22, 2024, to participate in this second voluntary disclosure program."

Lawsuit Settlement Payment Was Ruled Taxable Despite PTSD, Here’s Why - Robert Wood, Forbes. "The tax law distinguishes between physical and emotional damages, but it’s a notoriously slippery slope. Damages for physical injuries or physical sickness can be excluded under Section 104 of the tax code, but emotional distress is generally taxable. Yet even emotional distress can be excludable if the emotional distress emanates from physical injuries or physical sickness. But exactly what is physical? There is awkward line-drawing, and tax disputes between plaintiffs and defendants, and later between plaintiffs and the IRS are common."

Non-profit? Maybe not for everyone.

Former executive of injured child benefit program charged with stealing over $4.8 million - IRS (Defendant name omitted, emphasis added):

Defendant also allegedly used the Birth-Injury Program debit card for personal gain. According to the criminal complaint, Defendant spent embezzled Birth-Injury Program money on various personal expenses.

For example:

-Defendant allegedly purchased numerous vehicles, including eight luxury golf carts for over $160,000 and a 2023 Chevrolet Suburban;

-Defendant allegedly spent over $100,000 on gambling, including at Rivers Casino in Portsmouth, Virginia, Colonial Downs Racetrack in New Kent, Virginia, and the Virginia Lottery;

-Defendant allegedly spent over $9,000 to hire private limousines, including to chauffer Defendant and his guests to Virginia-area vineyards;

-Defendant allegedly made numerous purchases of cryptocurrency, including Bitcoin and Dogecoin, and transferred funds to his brokerage accounts;

-Defendant allegedly paid over $30,000 for private jet travel to take his wife and friends to Nashville, Tennessee, for three days;

-Defendant allegedly paid over $60,000 to pay down his student loan debt, his mortgage, and other loans; and

-Defendant allegedly spent over $19,000 to purchase eight separate 2022 1-oz American Gold Eagle Bullion coins and a 100-oz silver bar.

If a non-profit executive is assembling a fleet of luxury golf carts and taking private jet trips, questions are in order.

What day is it?

It's National Pots De Creme Day!" "Overall, this dish is a loose custard that is made by mixing eggs, egg yolks, cream, and milk. A flavoring essence is also added. This is then baked in porcelain cups in a water bath at a low temperature."

Never heard of it, but I'll have some.

Make a habit of sustained success.