Key Takeaways

- Inspector general: IRS exempt organization unit productivity slips.

- "Slimmed down" property tax cut emerges from Nebraska special session.

- Is there a "secret" ESOP S corporation listed transaction?

- Harris adopts Biden tax agenda; eyes tip exemption "guardrails."

- Schumer pledges to kill SALT deduction cap.

- Trump "noncommittal" on electric vehicle credits.

- Forgotten beneficiary designation remembers long-ago girlfriend.

- Jail time sticks to Iowa refrigerator magnate.

TIGTA Finds Dip in Tax-Exempt Unit’s Productivity - Benjamin Valdez, Tax Notes ($):

Additionally, 57 percent fewer cases were closed in fiscal 2023 compared with fiscal 2020.

Compliance checks are reviews of an exempt organization’s compliance with federal tax return filings and aren’t formal examinations. The reviews help encourage voluntary compliance and “allow the IRS to reach more taxpayers at a lower cost than traditional audits,” TIGTA said in the report, dated August 16.

Nebraska tax special session ends

Nebraska Governor Signs Slimmed-Down Property Tax Cut Measure - Michael Bologna, Bloomberg ($):

By one estimate, the much slimmer LB 34 will reduce local property levies by 3% compared with the 40% cut the first-term Republican governor originally sought. Pillen’s plan would have required a significant expansion of the sales tax base to pay for the 40% tax reduction.

Governor Pillen had threatened to veto the package.

Legislature passes slimmed-down property tax relief package, ends Nebraska’s special session - Zach Wendling, Nebraska Examiner. "LB 34 was passed without any new sales taxes on goods or services — a draft plan targeted up to 120 exemptions earlier this summer — or increased “sin” taxes, as Pillen and lawmakers had originally pitched."

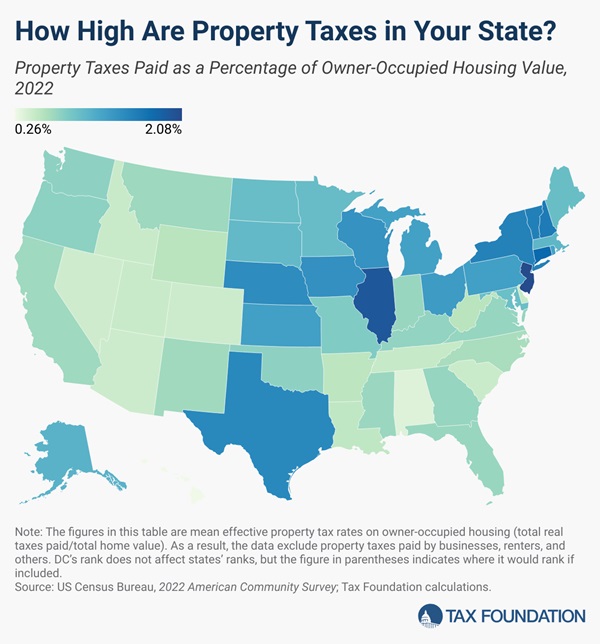

Property Taxes by State and County, 2024 - Andrey Yushkov, Tax Foundation. "Because the dollar value of property tax bills often fluctuates with housing prices, it can be difficult to use this measure to make comparisons between states. Further complicating matters, rates don’t mean the same thing from state to state, or even county to county, because the millage is often imposed only on a percentage of actual property value, as is discussed below. However, one way to compare is to look at effective tax rates on owner-occupied housing—the average amount of residential property taxes actually paid, expressed as a percentage of home value."

IRS News: Tax data security tips; "Secret" ESOP rule

IRS, Security Summit highlight “Security Six” and key steps for tax pros to protect themselves - IRS. "Multi-factor authentication adds an extra layer of protection beyond a password. The returning user enters credentials like a username and password. Then, there’s another step, such as entering a security code, token or a biometric like a fingerprint. Under new rules from the Federal Trade Commission, all tax professionals are required to use multi-factor authentication."

Lawsuit Alleges ‘Secret’ Listed Transaction Rule for Some ESOPs - Kristen Parillo, Tax Notes ($):

...

To guide them through ERISA tax issues, WCEC hired Lex J. Byers, a consultant and founder of IFL Capital Group who marketed a program called the Byers Proprietary ESOP System, which the complaint says used documents preapproved by the IRS as compliant with ERISA.

Be careful with S corporation ESOPs. They can be great, but they can be catastrophic in the wrong circumstances or if not implemented correctly.

Taxes on the Campaign Trail

Democratic Platform Under Harris Sticks to Biden’s Tax Agenda - Alexander Rifaat, Tax Notes ($, my emphasis):

...

The platform also confirms Harris’s pledge to raise the corporate tax rate to 28 percent but appears to allude to Democratic assumptions that Biden would be the nominee.

“President Biden will raise that tax back to 28 percent,” the document says about the corporate tax rate.

Big, if true.

Harris’s economic plan: grocery prices, housing credits and tax rises - James Politi, Lauren Fedor, and Colby Smith, Financial Times ($). "Harris’s economic ideas include increasing the corporate tax rate to 28 per cent from 21 per cent, a federal ban on price-gouging in the food sector, a big effort to boost housing supply and more tax breaks for families with children and first-time homebuyers."

Kamala Harris eyes guardrails on plan to eliminate taxes on tips - Jacob Bogage and Jeff Stein, Washington Post. "Harris’s advisers have discussed only exempting taxes on tips for service and hospitality workers who earn $75,000 per year or less, according to three people familiar with the campaign’s thinking, who spoke on the condition of anonymity to discuss private conversations. While the plan would exempt tips from federal income tax, tipped earnings would still be subject to payroll taxes, the people said, because those taxes fund Social Security and Medicare. Harris’s plan would also cap the amount of income workers could claim came from tips."

Schumer pledges to end cap on SALT deductions after 2025 - Alexander Bolton, The Hill. "Former President Trump and his Republican allies in Congress inserted a provision in the 2017 tax reform bill to cap state and local tax deductions at $10,000. That provision hit residents of expensive blue states such as New York, New Jersey and California with higher state and local taxes especially hard, but it raised a lot of revenue to offset the cost of Trump’s other proposals, such as cutting the corporate tax rate from 28 percent to 21 percent.

Trump vows to ax power plant rule, noncommittal on EV tax credit - Rachel Frazin, The Hill:

“I’m a big fan of electric cars, but I’m a fan of gasoline-propelled cars, and also hybrids and whatever else happens to come along,” he added.

Blogs and Bits

IRS touts enhanced tax options for businesses with online accounts - Kay Bell, Don't Mess With Taxes. "The IRS notes that a limited liability company (LLC) that reports business income on Form 1040 Schedule C cannot yet use a business tax account."

IRS Announces Second Employee Retention Credit Voluntary Disclosure Program - Parker Tax Pro Library. "The second ERC Voluntary Disclosure Program, which expires on November 22, 2024, is limited to ERC claims filed for tax periods in 2021 and allows participants to retain 15 percent of the claimed ERC amount. Announcement 2024-30."

IRS To ‘Recapture’ Over 30,000 ERC Claims. Can It Do That? - Guinevere Moore, Forbes. "As I explained, IRS announcement included a carrot and a stick. The carrot: a promise of closure for businesses and business owners who claimed the credit and are now lying awake at night worried about whether they are included in the 460 ERC cases the IRS is criminally investigating, together with a promise that the business can keep some portion of the credit. The stick: over 30,000 'recapture' letters are hitting the post office this fall, altering taxpayers that the IRS will reverse so-called 'improperly paid' ERC claims. This article focuses on the stick and how taxpayers who get these letters can deal with them."

Employers now have interim guidance on student loans and retirement plans - Martha Waggoner, The Tax Advisor. "The IRS provided interim guidance to employers that provide matching retirement plan contributions based on student loan payments, a new benefit courtesy of a 2022 law."

Have We Learned Anything New About Who Pays the Corporate Tax? - Adam Michel, Liberty Taxed. "Economists will continue to debate the magnitude and distribution of investment, wage, and economic growth effects from tax cuts, but it is clear that tax cuts cause improvements in all three economic measures. The opposite is also true: tax increases will depress wage growth, investment, and the broader economy."

IRS CAP Real-Time Biz Audit Program Now Open to Private Companies - Ronald Marini, The Tax Times. "Launched in 2005, CAP employs real-time issue resolution through transparent and cooperative interaction between taxpayers and the IRS to improve federal tax compliance by resolving issues prior to the filing of a tax return."

Ex-girlfriend windfall corner

Failing to Update Beneficiary Tax Forms Can Lead to Legal Battles - Stephen Ferszt, Olshan Frome Wolosky via Bloomberg:

Rolison died 26 years later, in 2015. Despite routine notifications from P&G about updating his beneficiary designations, Rolison left his original designation unchanged. His ex-girlfriend received over $750,000 from the P&G plan.

Maybe he just still carried a torch all those years?

Judge sticks Iowa refrigerator magnate with prison time

Businessman sentenced to 18 months in federal prison for false income tax return (IRS, taxpayer name omitted, emphasis added):

According to public court documents, Defendant is the majority shareholder of a company... which rents dorm minifridges to colleges and college students across the United States. Beginning in 2015 and continuing until 2021, Defendant diverted over $3.8 million from the corporation to himself and failed to report this income to the Internal Revenue Service. Defendant concealed these payments from the corporation’s accountant and tax preparer by providing falsified check ledgers that falsely identified checks from the corporation to Defendant as seemingly legitimate business expenses.

If you have to lie about it to your accountant and tax preparer, you shouldn't be doing it.

Link: Plea agreement.

What Day is it?

It's National Spumoni Day, for those who celebrate.

Make a habit of sustained success.