Key Takeaways

- Will Vance support of child credit revive tax bill?

- Vermont gets February 3 Debby Deadline.

- IRS says it's finding hires.

- Crypto reporting update.

- Harris "blindsided" allies with support for tip exemption.

- About these "88,000 armed agents."

- A one-side "close personal relationship" leads to tax trauma.

- World Calligraphy Day.

Programming Note: I will be hosting a free Eide Bailly webinar next Tuesday, August 20, on Tax Planning Tips: Key Business & Individual Considerations. Register here.

Tax Bill Could Get Second Life After Latest Vance Comments - Doug Sword, Tax Notes:

...

“It’s like a zombie bill,” Howard Gleckman of the Urban-Brookings Tax Policy Center said. “It won’t die, but it’s not quite alive, either.”

Gleckman agrees that it would be a long shot for a second cloture vote to occur in September and that some Senate Democrats might push for one while contrasting Vance’s expansive view of the credit with the Senate GOP’s narrower one.

IRS News: Storm Deadlines, Hiring Success, Crypto Forms

Hurricane Debby relief expanded to all of Vermont; various deadlines postponed to Feb. 3, 2025 - IRS:

Affected taxpayers in Vermont now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments. Vermont is the fifth state to qualify for IRS relief, along with Florida, Georgia, North Carolina and South Carolina, announced last week.

IRS Reports Success in Hiring Tax Professionals - Benjamin Valdez, Tax Notes ($):

The summer hiring spree is part of the agency’s push to expand its ranks using its infusion of funding from the Inflation Reduction Act. The IRS had 82,990 total employees in fiscal 2023.

“We need more mid-career, we need more early-career, and we need more late-career tax professionals,” Lemons said.

Crypto Tax Reporting Gets an Upgrade With Revised 1099-DA Form - Vivian Fang, Indiana University via Bloomberg:

...

The IRS has delayed reporting requirements for these platforms, but this doesn’t imply an exemption. The agency has clarified that it needs more time to craft guidance suited to the decentralized nature of DeFi platforms—not that it plans to exclude them from tax reporting.

Campaign Corner: Tip Crazy

Harris blindsided Democrats with ‘no tax on tips’ plan - Alexander Bolton, The Hill:

...

But key Democratic lawmakers and progressive activists have raised serious concerns about the substance of the proposal to shield tipped income from taxation, worrying that it would leave out many lower- and middle-income workers who are just as deserving of tax relief but don’t work for tips.

Why Harris, some Democrats and a Nevada union endorsed Trump’s no taxes on tips policy - Megan Messerly, Politico. "In Nevada, the tip policy may be critical to Harris, who is polling better than President Joe Biden had in recent battleground surveys, but who has yet to return to the levels of support Democrats drew from Latinos in 2020."

Why Trump and Harris’s ‘no tax on tips’ plans may not help tipped workers - Jacob Bogage, Julie Zauzmer Weil, and Lauren Kaori Gurley, Washington Post:

...

The Yale analysis found that at least 37 percent of tipped workers already don’t pay any federal income tax because they don’t earn enough each year, so they wouldn’t be helped by being exempted from some income taxes.

And the policy might actually end up hurting those workers, some economists said: Some tipped workers might no longer qualify for the earned income tax credit, which helps low-income families tremendously, or get credit toward eventual Social Security benefits from tips.

Some Tips About Tips and Taxes - Jim Maule, MauledAgain. "So who would benefit from excluding tip income from gross income? Most likely, the small percentage of tipped workers who collect large amounts of tips. Those workers, estimated to constitute about 5 to 10 percent of tipped workers, gather their tips at luxury hotels and restaurants."

Trump Again Makes False Claim About IRS Agents - Alexander Rifaat, Tax Notes:

...

As of fiscal 2023, the IRS had 82,990 total employees, including approximately 2,100 armed agents in the agency’s Criminal Investigation division.

Walz Backed Tax Hikes Funding Plans For Children, Families - Maria Koklanaris, Law360 Tax Authority ($). "That all changed at the beginning of 2023, when Democrats flipped the state Senate, giving them a trifecta for the first time in more than a decade. With that backing, Walz signed an omnibus package and other pieces of legislation that were chock-full of his party's wishes. They include a paid family leave plan funded by a payroll tax, a child tax credit, reduced taxes on Social Security income, a 1% tax on investment income over $1 million, a surtax on capital gains income that appears to be the only one in the nation, and conformity to the federal tax on global intangible low-taxed income."

Trump, Harris Duel for Voters With Budget-Busting Tax Proposals - Gregory Korte, Bloomberg:

None of the proposals being floated give any consideration to how the tax cuts will shift the tax burden — from older taxpayers to younger ones, from parents to people without dependent children, and from tipped workers to salaried ones.

Blogs and Bits

IRS updates guide to help tax pros create a written information security plan - Kay Bell, Don't Mess With Taxes. "If’s officially known as IRS Publication 5708, Creating a Written Information Security Plan for your Tax & Accounting Practice. The document walks tax pros through development and implementation of the titular Written Information Security Plan, or WISP."

Unpacking the Section 45Z Clean Fuel Production Credit - Kristine Tidgren, Ag Docket. "Farmers considering their options under the CSA pilot program or similar future programs developed for I.R.C. § 45Z should consider the restrictions. The rules of the current CSA pilot program specifically prohibit the farmer from participating in carbon credit or offset programs for the same acres. There does not appear to be a restriction on participation in EQIP or CSP programs. Additionally, the farmers are binding themselves to continue to practice no-till and cover crops on the same acreage so that the soil carbon continues to be sequestered and stored, except for a periodic tillage occurring no more than once every five or ten years."

Innocent Spouse Relief Granted to Taxpayer Who Was Not Involved in Husband's Business - Parker Tax Pro Library. "The Tax Court held that a taxpayer was entitled to innocent spouse relief under Code Sec. 6015(f) from deficiencies and penalties resulting from disallowed deductions relating to a condominium that her husband purchased and rented out to his wholly owned S corporation. The court found that there was no evidence linking her to the business's decision making and that she rarely used the condominium and thus did not derive a significant benefit from it."

How Tax Reform Can Bolster Americans’ Shrinking Saving - Claire Rock, Tax Policy Blog. "Universal savings accounts (USAs), however, would be similar to your traditional or Roth IRA but would be relatively free of rules and limitations. Any individual could contribute up to the maximum amount each year to save for anything, from an unexpected expense to a down payment on a starter home."

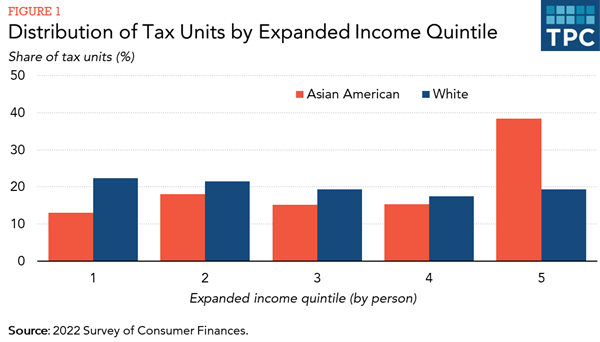

We Know More, But Not Enough, About The Tax Treatment of Asian American Families - William Gale and Julie Gnany, TaxVox. "Asian American taxpayers have a bimodal distribution; that is, they largely fall into two main areas of this distribution, and their incomes vary more widely compared to white taxpayers. While a large proportion of Asian Americans are in the top 20 percent of the distribution, a sizable share is in the lowest 20 to 40 percent of the distribution, revealing diversity within the Asian American community. This finding challenges the “model minority” stereotype that all Asian American families are financially well-off."

Close Personal Relationship Corner

Illinois financial advisor sentenced to 2 years for investment fraud and filing a false tax return - IRS (Defendant name omitted, emphasis added):

Defendant, who worked as an unregistered investment advisor and fund manager, had a close personal relationship with Victim-1, who was a resident of Madison, Wisconsin. Beginning in January of 2009, Victim-1 made regular and periodic investments into Defendant’s investment fund with the understanding that Defendant was conservatively investing the money. Beginning in 2018, Defendant began misrepresenting the performance of the fund to Victim-1...

When the fund lost a significant amount of its value in February 2020 due to a series of risky trades, Defendant again lied to Victim-1 about the fund’s performance and induced Victim-1 to invest an additional $150,000. On March 18, 2020, Defendant emailed Victim-1 a purported copy of a Charles Schwab account statement for the fund. Defendant had altered the statement to show that the total value of the fund on Dec. 31, 2019, was $1,017,191, however, the actual value of the fund was $58.

It's not clear what the nature of the "close personal relationship" was, but it may not have been entirely honest and open.

What Day is it?

It's World Calligraphy Day, for those of you who aren't legibility-challenged.

Make a habit of sustained success.