Key Takeaways

- IRS moves Employee Retention Credit moratorium date, will process claims from 9/14 to 1/31/24.

- IRS defends disallowance letters.

- 50,000 valid claims will be paid out starting in September.

- Where are people claiming clean energy credits?

- The county that seized a $130,000 home for an $8.41 tax deficiency.

- Iowa Ayahuasca church fights for tax exemption.

- National Book Lovers Day.

First, from the IRS press release: IRS moves forward with Employee Retention Credit claims: Agency accelerates work on complex credit as more payments move into processing; vigilance, monitoring continues on potentially improper claims:

The IRS is continuing to work denials of improper ERC claims, intensifying audits and pursuing civil and criminal investigations of potential fraud and abuse. The findings of the IRS review, announced in June, confirmed concerns raised by tax professionals and others that there was an extremely high rate of improper ERC claims in the current inventory of ERC claims.

In recent weeks, the IRS has sent out 28,000 disallowance letters to businesses whose claims showed a high risk of being incorrect. The IRS estimates that these disallowances will prevent up to $5 billion in improper payments. Thousands of audits are underway, and 460 criminal cases have been initiated. The IRS has also identified 50,000 valid ERC claims and is quickly moving them into the pipeline for payment processing in coming weeks. These payments are part of a low-risk group of claims.

The release acknowledged that some of the claims may have been disallowed in error:

The "relatively isolated" nature of the errors isn't universally accepted. Earlier this week Eide Bailly's ERC team leader told Tax Notes that every disallowance letter he had seen was wrong. Other tax pros seem to be seeing similar issues.

Some Employee Retention Credit Processing to Resume - Benjamin Valdez, Tax Notes ($):

“The lack of consideration given to disregarded entities alone could amount to more than 2,800 erroneous disallowance letters,” Elanjian said in an email. “Currently, the IRS has no way of knowing how many of the disallowance letters are valid (or not) unless the denial was due to a clerical error,” he added.

Christopher N. Moran of Venable LLP echoed that sentiment. “The denial letters I have seen indicate that the screening process has serious, obvious flaws that undermine the commissioner’s claim of a 90 percent accuracy rate,” Moran said.

ERC disallowance letters go to 28K businesses, moratorium adjusted - Martha Waggoner, The Tax Advisor. Regarding the new January 31 moratorium date:

The new moratorium cutoff "preserves that date, should the legislation go through," Werfel said, and "would not overcomplicate matters if we were to issue payments post-Jan. 31 at this time."

IRS Reopens Processing Some Covid-Era Claims, Pays Out More Cash - Erin Slowey, Bloomberg ($):

Many taxpayers with eligible claims have waited for months to get what they are owed. The agency—which is seeing 17,000 claims on average per week, according to Werfel—also plans to issue payments for 50,000 ERC claims that are considered low-risk starting in September.

IRS Targeting Up To $5B In Employee Retention Credit Claims - David van den Berg, Law360 Tax Authority ($):

...

Under current law, employers have until April 15, 2025, to file amended employment tax returns claiming the credit for the 2021 tax year.

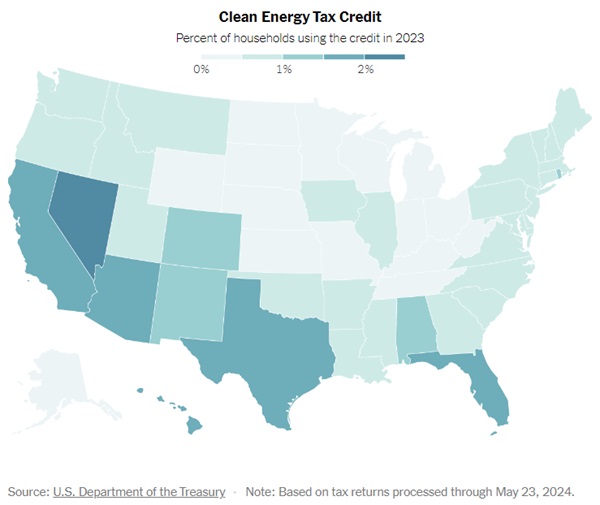

Who's taking credit?

Where (and How) Americans Are Taking Advantage of Clean Energy Tax Credits - Nadja Popovich, New York Times:

The bulk of the money, more than $6 billion, helped households install rooftop solar panels, small wind turbines and other renewable energy systems. These credits were most popular in sunny states, including much of the Southwest and Florida, the data shows.

New York Times Map

Related: Maximize Energy Efficiency Tax Credits and Deductions.

Losing your home for $8.41

Michigan Supreme Court Rules In Favor Of Homeowners In Years-Old Foreclosure Fight - Kelly Phillips Erb, Forbes ($):

In response, Oakland County seized his property and put it up for sale. The home netted just $24,500 at auction (in 2019, when the matter went to court, the property was estimated to be worth nearly $130,000). The county kept the overage from the auction: $24,215 in profits, or 8,496% of the actual tax, penalties, and interest due (the debt had grown to $285 with penalties, interest, and fees).

The taxpayer finally prevailed after years of litigation and help from a public interest law firm. Not all greed is in the private sector.

Losses and the Pillar 2 minimum tax

Companies Lose Tax Deduction in Broad Proposed IRS Regulations - Lauren Vella, Bloomberg ($):

...

The proposed regulations dictate how existing US rules meant to limit multinational companies’ ability to “double dip”—taking a loss in both a foreign country and the United States—would interact with the 15% global minimum tax.

The minimum tax, also known as Pillar Two of the OECD-led global tax deal, came into effect in about three dozen countries this year. It seeks to impose a 15% minimum tax on multinational companies in every country where they operate.

Related: Eide Bailly International Business Structuring Services.

Campaign Corner

Trump Criticizes Harris’s Support for IRA - Alexander Rifaat, Tax Notes:

In a press conference August 8, Trump alluded to the tax credits for electric vehicles included in the IRA, saying the policy is “ridiculous” and would prove unworkable.

Walz’s fiscal record veered from moderate to progressive champion - Caitlin Reilly, Roll Call. "The governor’s budget package also included a $3 billion tax law that lowered taxes for poor families and increased taxes on wealthy individuals and businesses. The left-leaning Institute on Taxation and Economic Tax Policy rated Minnesota the state with the “least regressive” tax system in the nation, thanks in part to the law."

Trump Makes Murky Claim of Quadrupled Taxes if TCJA Expires - Cady Stanton, Tax Notes ($). "Former President Trump claimed that allowing provisions of the Tax Cuts and Jobs Act to expire would lead to a “four times tax increase,” casting blame for the possible sunset on Democrats."

Five Unanswered Questions About Kamala Harris’s Tax Agenda - Nikhita Airi, TaxVox. "Prior to 2016, successive presidents of both major political parties encouraged international trade. That changed in 2018 when the Trump administration raised tariffs on China in an effort to reduce the US trade deficit. The Biden administration did not lower those tariffs, and in 2024, further raised tariffs on a large number of goods including steel, aluminum, semiconductors, and electric vehicle and battery technologies, alleging unfair trade practices. Harris could retain the 2017 tariffs and 2024 tariffs or raise tariffs on other goods and countries, both as foreign policy and to support domestic jobs and manufacturers."

Blogs and Bits

IRS employees & contractors owe $46 million in taxes - Kay Bell, Don't Mess With Taxes. "Of the 85,359 IRS employees on the agency’s rolls as of May 6, 2023, TIGTA found that more than 99 percent, or 85,344 staff, had fulfilled their tax filing obligations. As far as payments, the tax watchdog said 96 percent, or 82,036 employees, met or were paying their tax-due obligations."

Surprisingly, Taxes Are Present Even At Your Local Farmers’ Market - Robert Wood, Forbes. "'Do you need an invoice for your taxes?' the farmer asked. The buyer grabbed her produce and handed over the cash in a practiced movement, shaking her head no. But the interaction would be different with a local chef buying a cartful of food for a local restaurant. Invoices and even checks often feature prominently at the market, and the farmers may need to cater to such big buyers and what they need."

Return Preparer Oversight Is a Powerful Weapon Against Tax Scams - Erin Collins, NTA Blog. "In my 2024 Purple Book, I made a legislative recommendation to authorize the IRS to establish minimum competency standards for federal tax return preparers. Federal law does not currently impose competency or licensing requirements on paid tax return preparers."

Talk to me when there is a minimum competency standard imposed on legislators and tax administrators.

Tax in the courts.

Ayahuasca Church Continues Fight for Tax-Favored Status - Caitlin Mullaney, Tax Notes ($):

“Outside this Circuit, the law is clear: an entity denied 501(c)(3) status has Article III standing to sue the IRS to reverse that denial," Iowaska Church wrote in an August 5 petition for an en banc rehearing of the circuit court’s decision in Iowaska Church of Healing v. United States. "Yet the panel held that ICH lacks Article III standing to challenge its 501(c)(3) denial in the context of a [Religious Freedom Restoration Act] claim."

The church attorney defended the legitimacy of the church's religious services:

Defendant received nearly $500,000 of $2 million sought from IRS - IRS (Defendant name omitted, emphasis added):

According to court documents and statements made in court, between 2018 and 2020, surgical technologist Defendant, of Sunrise, created a trust and sought fraudulent refunds from the IRS. Defendant filed four false tax returns on behalf of the trust she created to seek nearly $2 million in tax refunds. Defendant continued filing such returns even after the IRS notified her that her claims were frivolous and had no basis in law. In total, the IRS issued nearly $500,000 to the trust in response to Defendant’s false claims. According to the indictment, Defendant allegedly used a portion of those tax refunds to purchase a car for a family member, get plastic surgery and renovate her home.

Don't do that. Still, it is frightening how easily this person got the IRS to send her $500,000. Cases like this should make lawmakers think twice before using the IRS as the Swiss Army Knife of public policy. When this pig flies, I suppose.

What Day is it?

Did you say something? I was reading. Oh, it's National Book Lovers Day!

Make a habit of sustained success.