Key Takeaways

- Current state and local tax rates.

- Disaster relief for multiple states.

- CA gun and ammunition excise tax.

- Missouri PTET options.

- Missouri Infrastructure tax benefits.

- New Hampshire property tax exemption.

- New Jersey transit fee.

- Pennsylvania NOL deduction increases.

- Texas updates sales tax sourcing rule.

- West Virginia tax cuts.

- Boston Celtics for Sale; Tax Implications

- Tax Policy Corner

- Tax History Corner

Thanks for visiting Eide Bailly State Tax News & Views. Consider Eide Bailly's fine state tax services team for your state tax planning and compliance needs.

We continue our bi-weekly summer schedule for State Tax News & Views. Our next state post will appear August 2nd.

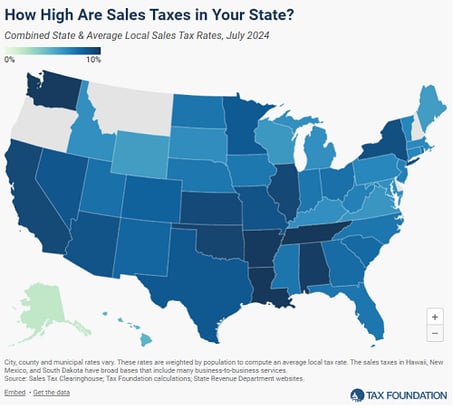

State and Local Sales Tax Rates, Midyear 2024 - Jared Walczak, Tax Foundation. "The five states with the highest average combined state and local sales tax rates are Louisiana (9.565 percent), Tennessee (9.556 percent), Arkansas (9.47 percent), Washington (9.45 percent), and Alabama (9.29 percent). The five states with the lowest average combined rates are Alaska (1.82 percent), Hawaii (4.50 percent), Wyoming (5.44 percent), Maine (5.50 percent), and Wisconsin (5.70 percent)."

The July 15 deadline applies to taxpayers affected by disaster declarations in three states. These include:

- The Wrangell Cooperative Association of Alaska Tribal Nation.

- Eight counties in Maine: Cumberland, Hancock, Knox, Lincoln, Sagadahoc, Waldo, Washington and York.

- Four counties in Rhode Island: Kent, Newport, Providence and Washington.

New disaster relief announced:

West Virginia; for those affected by severe storms, flooding, landslides, and mudslides that began on April 11, 2024.

Arkansas; extended deadlines for those in Baxter, Benton, Boone, Carroll, Fulton, Grant, Greene, Madison, Marion, Nevada, Randolph, Sevier, and Sharp counties.

State-By-State Roundup

California

California’s Gun and Ammunition Excise Tax Takes Effect - Tyrah Burris, Tax Notes($):

The tax, which began July 1, was enacted under 2023’s A.B. 28. The bill established the California Violence Intervention and Prevention Grant program, which will use revenue from the tax to fund education, research, and investigation programs to prevent gun violence in schools.

Missouri

Mo. Allows Opt-Outs To Pass-Through Entity Tax - Jaqueline McCool, Tax Law 360($). "H.B. 1912, which was signed by Republican Gov. Mike Parson, will add mechanisms for members of pass-through entities, such as S corporations and partnerships, to elect not to be taxed at the entity level."

Missouri Bill Creates Utility Infrastructure Tax Benefits - Tax Analysts, Tax Notes($). "Missouri S.B. 872, signed into law July 9, creates an income tax deduction equal to 100 percent of state and local grant money received for the purpose of expanding broadband internet access across the state. The bill also creates a state and local sales tax exemption for chemicals, machinery, equipment, and materials used to generate or transmit electricity."

Missouri Enacts New Income Tax Payment Option for PTE Members - Kennedy Wahrmund, Tax Notes($):

Entity members that opt out can claim the state's business income deduction, which allows taxpayers to subtract up to 20 percent of qualified business income from their proportionate share of income.

New Hampshire

New Hampshire Bill Amends Charity Property Tax Exemption - Tax Analysts, Tax Notes($). "New Hampshire H.B. 1055, signed into law July 12 as Chapter 183, amends the property tax exemption for charitable organizations by allowing organizations to file their exemption application after the June 1 deadline if the local tax rate has not been approved for the given year."

New Jersey

New Jersey Corporate Transit Fee Extension Becomes Law - Emily Hollingsworth, Tax Notes($):

Murphy signed the fiscal 2025 budget on June 28. A. 4704, the vehicle for the transit fee, imposes a 2.5 percent surtax on corporations with taxable net income of at least $10 million, raising their overall corporate tax rate from 9 percent to 11.5 percent.

Pennsylvania

Pennsylvania Property Tax And Rent Rebate Coming In July - Andrew Leahey, Forbes. "Governor Josh Shapiro has announced that Pennsylvania will begin distributing $266 million in property tax and rent rebates, beginning July 1. The expansion of the existing rebate program represents a major targeted tax cut for seniors, aiming to provide significant relief to thousands of residents."

Pa. Eliminates Tax on At-Home Charging For EVs - Jacqueline McCool, Law360 Tax Authority($):

S.B. 656, which Shapiro, a Democrat, signed Wednesday, will impose an annual electric vehicle road user fee on owners and registrants of electric vehicles and plug-in hybrid electric vehicles with gross weights up to 14,000 pounds, according to a fiscal note.

Pennsylvania Governor Signs Bill Doubling Deduction for Some NOLs - Tyrah Burris, Tax Notes($). "S.B. 654 was signed into law on July 11. It doubles the NOL deduction from 40 percent to 80 percent for losses incurred in tax year 2025 or after and allows a state-level deduction for medical cannabis business expenses. The bill also allows landowners to claim a personal income tax deduction for oil and gas well depletion."

Texas

Texas Adopts Latest Change to Controversial Sales Tax Sourcing Rule - Paul Jones, Tax Notes($):

Vermont

Vermont's Child Care Contribution Tax Takes Effect - Tyrah Burris, Tax Notes($):

The tax was enacted in 2023 under H. 217, and the revenue will be used to fund the Child Care Financial Assistance Program and investments in Vermont’s child care system.

West Virginia

Gov. Justice announces another historic personal income tax cut for West Virginia - Office of the Governor. "State revenue collections exceeded estimates by $826.6 million for Fiscal Year 2024, enabling a 3% or 4% personal income tax cut, as set by the trigger system in House Bill 2526, which the Governor signed in 2023."

Tax Policy Corner

The SALT Cap: Looking Beyond 2025 - Ted Peterson, Tax Notes($):

Increasing the SALT cap to $20,000 is a pragmatic approach that would have minimal impact on tax revenue while easing return filing challenges for middle-income Americans. This adjustment would offer relief to more taxpayers without exclusively benefiting the wealthiest earners.

Boston Celtics for Sale: Are Massachusetts Taxes a Factor? - Emily Hollingsworth, Tax Notes($):

Some tax and sports analysts argue that Massachusetts’s recently adopted 4 percent surtax on individual incomes exceeding $1 million, and its existing estate tax, are placing a greater tax burden on the successful franchise. However, others argue that the state’s tax landscape is far down the list of concerns for owners who may be considering federal estate taxes and the NBA’s so-called luxury tax.

Tax History Corner

...

Those who paid the beard tax, had to wear a special “beard token” – a copper or silver badge with the Russian eagle on one side and a picture of the lower face with a beard on the other. It was inscribed with two phrases: “the beard tax has been taken” and “the beard is a superfluous burden”.

Make a habit of sustained success.