Key Takeaways

- Upcoming sales tax holidays.

- Disaster relief for multiple states.

- Vaping taxes by State.

- Arizona law to benefit small business owners.

- Arkansas tax cuts.

- Hawaii Federal conformity and PTET reduction.

- Likely Kansas significant tax breaks to come.

- Controversial Use Tax Bonds for Kansas professional sports teams.

- Oregon added to IRS Direct File.

- Rhode Island changes for Financial Institutions.

- Tax Policy Corner

- Tax History Corner

Thanks for visiting Eide Bailly State Tax News & Views. Consider Eide Bailly's fine state tax services team for your state tax planning and compliance needs.

We continue our bi-weekly summer schedule for State Tax News & Views. Our next state post will appear July 12.

Sales Tax Holidays

Many states offer tax free "holidays" on the purchases of qualifying items, most commonly occurring in the summer before school is back in session. For a comprehensive list of upcoming dates and what items apply by state, click here.

Disaster Relief

It has been a year of extreme weather in much of the country. As such, the IRS has recently offered tax relief for many of those affected:

- Kentucky; for those affected by severe storms, straight-line winds, tornadoes, landslides and mudslides that began on April 2, 2024.

- West Virginia; for those affected by severe storms, straight-line winds, tornadoes, flooding, landslides, and mudslides that began on April 2, 2024.

- Arkansas; for those affected by severe storms, straight-line winds, tornadoes, and flooding that occurred on May 24, 2024.

- Oklahoma; for those affected by severe storms, straight-line winds, tornadoes, and flooding that began on May 19, 2024.

- Florida; for those affected by severe storms, straight-line winds, and tornadoes that began on May 10, 2024.

- New Mexico; for those affected by the South Fork Fire, Salt Fire, and Flooding that began on June 17, 2024.

- Mississippi; for those affected by severe storms, straight-line winds, tornadoes and flooding that began on April 8, 2024.

- Iowa; for those affected by severe storms, flooding, straight-line winds, and tornadoes that began on June 16, 2024.

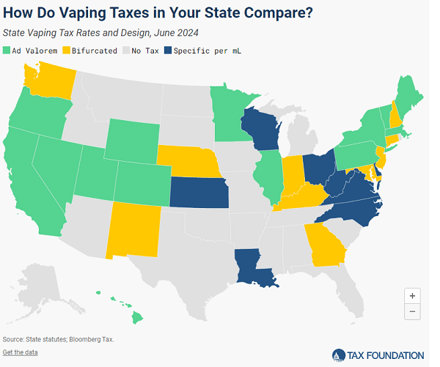

Vaping Taxes by State, 2024 - Adam Hoffer and Jacob Macumber-Rosin, Tax Foundation:

As of June 2024, 32 states and the District of Columbia levy an excise tax on vaping products. Some states tax based on manufacturer, wholesale, or retail price (ad valorem), while other states tax based on product volume or number of cartridges (ad quantum). And some apply a bifurcated system with different rates for open and closed systems.

State-By-State Roundup

Arizona

Arizona Bill Implements Tax Exemptions for Young Small Business Owners - Tax Analysts, Tax Notes($). "Arizona S.B. 1370, signed into law June 21, amends current tax legislation for businesses operated by individuals younger than 19 to prohibit municipalities from requiring such individuals to obtain business licenses or permits; the bill also exempts young business owners from transaction privilege taxes if their gross income does not exceed $10,000 annually."

Arkansas

Ark. Cuts Income Tax Rates, Expands Homestead Credit - Jaqueline McCool, Law 360 Tax Authority($):

California

California Lawmakers OK Budget That Temporarily Curtails Business Tax Breaks - Paul Jones, Tax Notes($):

However, the $211 billion package — passed by lawmakers June 13 — doesn’t necessarily represent the final budget, which legislative leaders were still negotiating with Gov. Gavin Newsom (D) as of press time. When a deal is reached, subsequent legislation will be passed modifying the budget to reflect the final agreement.

Hawaii

Kelly confirmed in a June 18 statement to Tax Notes that she would sign the bill. She said that although the tax relief package "is not perfect and emphasizes income tax reductions instead of property tax relief," it provides "significant relief" while allowing the state to continue funding schools and infrastructure.

Cigarettes, Other Tobacco Products, and Electronic Smoking Devices - July 1, 2024, Tax Rate Changes - Comptroller of Maryland:

Oregon

IRS adds another state to Direct File, as House Republics seek to defund it - Jory Heckman, Federal News Network:

The Treasury Department announced Tuesday that Oregon will opt into Direct File next year, and expects other states will also do so ahead of the next filing season.

Oregon joins 12 other states who offer Direct File; Arizona, California, Florida, Massachusetts, New Hampshire, New York, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming.

Pennsylvania

Pa. House Panels OKs Sale of Net Losses, R&D Tax Credits - Zak Kostro, Law 360 Tax Authority($). "Pennsylvania would create a program to allow emerging biotechnology and technology businesses to sell their net operating losses and unused research and development tax credits to other companies under a bill advanced by the state House of Representatives' Finance Committee."

Rhode Island

Rhode Island Creates Apportionment Election for Financial Institutions - Tax Analysts, Tax Notes($). "Rhode Island H.7927, signed into law June 24, creates an election for banking institutions to allocate and apportion their net income according to the receipts factor for taxation purposes beginning January 1, 2025, and authorizes a combined reporting study for banking institutions that are a part of a unitary business."

Vermont

Vermont Legislature Overrides Veto of Property, Software Tax Bill - Paul Jones, Tax Notes($):

The override came early on June 17, following Scott’s decision to veto H. 887 on June 6. In a statement issued via email June 17, Vermont’s Senate President Pro Tempore Phil Baruth (D) said the bill was the only realistic proposal to meet education funding needs, and that by approving it, lawmakers had prevented an even larger property tax increase.

Tax Policy Corner

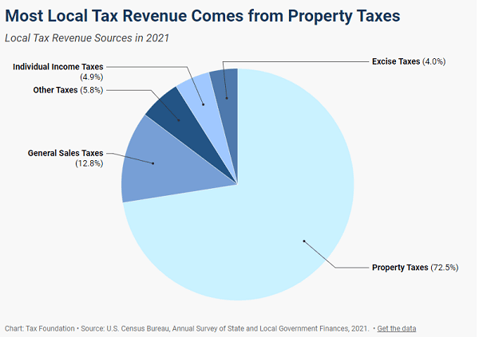

Local Income vs. Sales Taxes: Which Is the Better Source of Local Revenue? - Andrey Yushkov, Tax Foundation:

...

Evaluating local tax structure is not simply an exercise of labeling taxes good or bad. Crucially, it involves an analysis of design characteristics—especially when jurisdictional boundaries are easy to cross. Diversifying the local revenue structure may not be a bad idea, particularly considering the popular dissatisfaction with, and some objective concerns about, property taxes (particularly when they are improperly designed).

Short-Term Rental Laws And The Litigation They've Sparked - Isaac Monterose, Law 360 Tax Authority($):

Here's a roundup of the local efforts to enact restrictions or taxes on short-term rentals and the ongoing cases litigating them.

Tax History Corner

In consideration of Independence Day approaching next week...

No Taxation Without Representation

The phrase, most likely, had its origins in 1750's Ireland but its American roots are often credited to Boston politician James Otis whose 1764 speeches included the phrase, "taxation without representation is tyranny.”

Make a habit of sustained success.