Key Takeaways

- TCJA debated

- Individual income tax review

- The IRA defended

- Tax Filing & Tax Preparer Issues

- The IRS uses AI

- The Supreme Court's nontax case

- The legendary lumberjack

TCJA Debated

Biden, Trump Spar Over Fate Of 2017 Tax Cuts In 1st Debate - Stephen K. Cooper, Law360($):

In a 90-minute debate televised on CNN, the two presidential candidates offered widely differing views of the impact of the Tax Cuts and Jobs Act, and offered opposing ideas for what to do when the tax law begins to expire in 2025.

Individual Income Tax Review

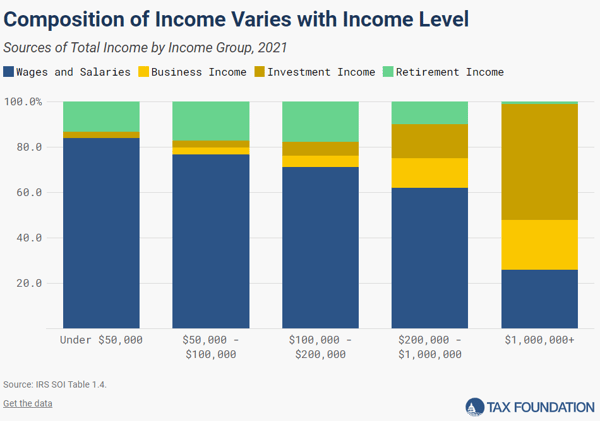

Sources of Personal Income, Tax Year 2021 - Erica York and Claire Rock, Tax Foundation:

Each household with taxable income must file a return to the Internal Revenue Service (IRS). On the IRS individual income tax form (Form 1040), taxpayers list and add all sources of taxable income to reach total income. From there, taxpayers figure their deductions and credits to determine tax liability and tax owed or refunded.

The IRA Defended

Tracking Implementation Of IRA Programs As Election Nears - Austin Harrison, Michael Hawthorne and David Schnittger, Law360($). "With November elections drawing near, the Biden administration is racing to cement its domestic policy achievements — notably, key provisions of the Inflation Reduction Act, a multibillion-dollar federal clean energy, climate and domestic manufacturing legislation signed into law on Aug. 16, 2022."

Tax Filing & Tax Preparer Issues

IRS To Offer Combined Filing For Energy Investment Credits - Kat Lucero, Law360($). "The Internal Revenue Service will let clean energy project owners that are claiming investment tax credits for more than 200 facilities file the claims with a single form, an agency official said Thursday."

IRS Criminal Chief Says COVID Fraud Work To Hold Steady - Asha Glover, Law360($):

The numbers vary by office, but investigators spend an average of 11% to 12% of their time working on cases involving fraud from COVID-19 policies, said Guy Ficco, chief of Internal Revenue Service Criminal Investigation, at New York University School of Professional Studies' tax controversy forum, held in New York and online.

TIGTA Flags Possible Return Accuracy Issues in Direct File Pilot - Benjamin Valdez, Tax Notes($):

One example, identified in February, includes an issue with the pilot that allowed biological dependents to be older than the parents listed on the tax return, the Treasury Inspector General for Tax Administration said in a report released June 27. Another concerned a requirement for taxpayers who changed their filing status to widowed to answer questions about their spouse.

Tax preparer regulation among ETAAC’s 12 recommendations - Kay Bell, Don't Mess With Taxes. "The Internal Revenue Service’s long-standing goal of regulating noncredentialed tax preparers got some support from the Electronic Tax Administration Advisory Committee’s (ETAAC) 2024 annual report. Such oversight is one of a dozen recommendations in the latest ETAAC document, released June 26."

The IRS Uses AI

Humans Are Still Involved in AI Audit Selection, IRS Confirms - Benjamin Valdez, Tax Notes($):

The agency’s use of AI and machine learning to select large partnerships for examination involves multiple rounds of testing by data scientists and constant oversight by tax experts, Holly Paz, commissioner of the IRS Large Business and International Division, said at a June 27 conference hosted by the New York University School of Professional Studies.

Supreme Court

Supreme Court Case Could Limit Tax Reg Challenges - Kristen A. Parillo, Tax Notes($):

...

Corner Post Inc., a North Dakota truck stop and convenience store that opened its doors in March 2018, appealed a 2022 decision by the Eighth Circuit that time-barred its APA challenge of a 2011 Federal Reserve regulation capping interchange fees at a level far above the fee cap set out in proposed regulations. The company asserted a facial challenge, meaning that in taking the action, the agency didn’t consider all comments, provide a reasoned explanation, or give proper notice of a proposed regulation.

What Day is It?

Celebrate Paul Bunyan today, the legendary lumberjack.

Make a habit of sustained success.