Key Takeaways

- IRS apology, promises to improve security settle tax return leak lawsuit.

- Energy tax credits and economic substance

- House-passed tax bill "withers" in Senate

- Preparer legislation this year?

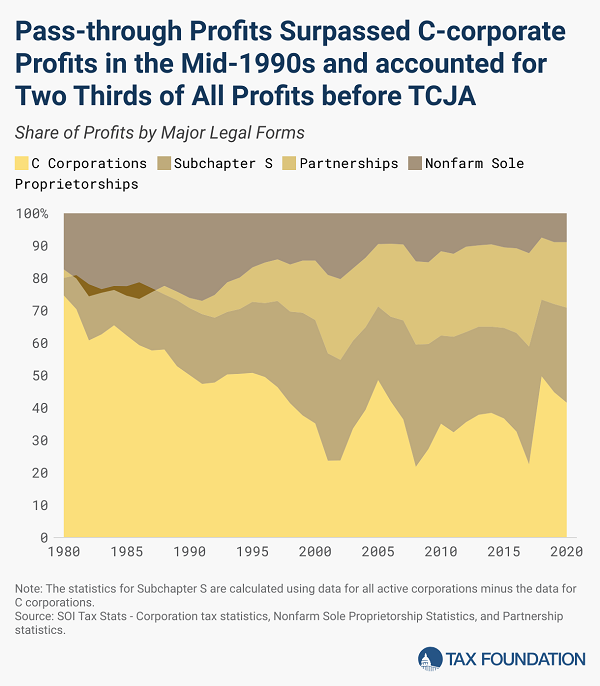

- TCJA didn't trigger C corporation stampede.

- ERC delay lawsuit.

- Trusted Tulsa personal assistant goes bad.

- Chocolate Pudding Day.

IRS Apologizes to Billionaire Ken Griffin for Leak of Tax Records - Richard Rubin, Wall Street Journal.

The apology followed Griffin’s withdrawal Monday of a lawsuit against the government. Griffin, along with Jeff Bezos and Elon Musk, was one of the wealthy taxpayers whose tax records were disclosed by IRS contractor Charles Littlejohn to the news organization ProPublica and revealed publicly in news articles starting in June 2021.

...

The complexion of Griffin’s civil case changed after Littlejohn was charged and pleaded guilty last year. Littlejohn, who was a contractor for Booz Allen Hamilton, sat for a deposition with Griffin’s lawyers before he went to prison.

ProPublica Data Leak Lawsuit Ends in Settlement - Mary Katherine Browne and Cady Stanton, Tax Notes ($):

...

In the wake of the dismissal, the IRS released a statement apologizing to Griffin and other affected taxpayers.

IRS Apologizes To Hedge Fund Founder Over Leaked Tax Data - Anna Scott Farrell, Law360 Tax Authority ($):

"I think that there's always going to be a bit more of a risk with a contractor than with an employee," Littlejohn said, according to the transcript. "You know, if you're an employee that's gone through the extensive process to get hired by a government institution, you have some allegiance to that institution; whereas, you know, whoever hired me, I mean, I don't — it's just a little different."

IRS Apologizes to Ken Griffin to Settle Tax Data Breach Case - Sabrina Willmer and David Voreacos, Bloomberg. "While it’s unusual for the IRS to apologize to an individual, this isn’t the first time the IRS has made a public apology. Last year the IRS acknowledged wrongdoing to millions of taxpayers who erroneously received notices and tax bills with incorrect information. The IRS also expressed regret in 2017 for giving extra scrutiny to non-profit groups with conservative sounding names."

Energy Credit Yellow Flag

Tax Pros Worry Credit Sales Could Raise Substance Issues - Kat Lucero, Law360 Tax Authority ($):

...

Developers that partner with tax equity investors to claim the investment tax credit under IRC Sections 48 and 48E with plans to sell the credit amount to a third party could be subject to some scrutiny under the economic substance doctrine. The credit rate is equal to 30% of the cost basis of an eligible clean energy development property, and developers are able to increase, or step up, the basis under these new forms of partnerships, also known as hybrid structures.

Legislative Front

Affordable Housing Backers’ Hopes Dim as Tax Package Withers - Samantha Handler, Bloomberg ($):

The bipartisan legislation expands the decades-old low-income housing tax credit with a 12.5% increase in the number of credits states can allocate. The measure aims to help states fund more affordable developments, and has been on top of the housing industry’s wish list since an increase in the credit from 2018 expired in 2021.

This is the same bill that would restore full deductions for domestic research costs and bonus depreciation, and would also increase the caps on deducting business interest.

Supreme Court sets up wealth tax battle for Congress - Tobias Burns, The Hill. "While the court left the possibility of an express wealth tax open, it also signaled a healthy amount of skepticism toward the idea, effectively putting pressure on lawmakers in both parties to come up with feasible legislation, if they decide to take up the issues."

Tax Scams May Fuel Interest in Preparer Legislation, Werfel Says - Erin Slowey, Bloomberg:

“I’m cautiously optimistic that this could be the year that we get the type of legislative authority that we need to move forward and strengthen the overall environment by which tax professionals operate,” Werfel said, citing the growing attention on tax scams as a driver for such legislation. He was speaking at the Latino Tax Fest in Las Vegas.

Given the difficulty in moving more pressing legislation this year, the caution part is warranted. Caution is also warranted by the likelihood that licensing will burden honest preparers while allowing scammers to proceed with a government seal of approval.

How the TCJA Affected Legal Business Forms - Huaqun Li, Tax Policy Blog:

Blogs and bits

Nov. 1 is new tax deadline for disaster-area taxpayers in 7 states - Kay Bell, Don't Mess With Taxes. "A month ago, an EF-4 tornado ripped through Greenfield, Iowa, devastating much of the community that’s the county seat of Adair County. Other Hawkeye State locales also sustained damages from the severe storms, tornadoes, and flooding that occurred on May 20. Those affected individuals and business owners in Adair, Adams, Cedar, Jasper, Montgomery, Polk, and Story counties now have until Nov. 1 to file various federal individual and business tax returns and make tax payments."

Taxpayer Relief After a Disaster - Ashley Akin, Tax School Blog. "To qualify for relief from a federally declared disaster, individuals and business entities must be considered affected taxpayers. Therefore, the first hurdle in determining who is affected is the presidential declaration of a federal disaster area. Affected taxpayers are not limited to those who live and conduct business in the area. They also include taxpayers whose records required for meeting a filing or payment deadline are in the disaster area, even if the taxpayers themselves are not located there. For example, affected taxpayers may qualify because they use a tax preparer in the disaster area who cannot file or pay on their behalf."

Certain East Palestine Derailment Relief Payments Are Excludable from Income - Parker Tax Pro Library. "The IRS announced that it has determined that the February 3, 2023, derailment of a freight train operated by a common carrier in East Palestine, Ohio, is a qualified disaster for purposes of Code Sec. 139. As a result of this determination, certain payments made by the common carrier to individuals affected by the derailment are excludable from gross income as qualified disaster relief payments under Code Sec. 139(a)."

Kenyan Police Open Fire as Tax Protesters Storm Parliament - Gabriele Steinhauser and Nicholas Bariyo, Wall Street Journal. "The protesters are demanding that the government of Kenyan President William Ruto withdraw a bill that would introduce major tax increases, arguing that the measures are hurting ordinary Kenyans already grappling with rising prices for everyday essentials."

Tax Policy Corner

Yes, The Rich Do Pay Their Fair Share! - Ali Motamedi, NTUF Blog. "According to the (Joint Committee on Taxation) report, the wealthiest 1 percent of income earners are projected to contribute 45 percent of all income taxes collected despite only being expected to generate 18.4 percent of the nation’s total income. By contrast, the JCT estimates that the bottom 90 percent of income earners will only contribute 19.6 percent of all income taxes collected despite generating 56.7 percent of the nation’s total income."

CBO’s Latest Budget Estimates May Make Extending The TCJA More Complicated - Howard Gleckman, TaxVox:

And that is without extending the 2017 Tax Cuts and Jobs Act (TCJA).

In the courts: ERC delays, false friends.

Fla. Construction Co. Says It's Owed $4M In Worker Credits - Anna Scott Farrell, Law360 Tax Authority ($):

In a complaint Monday, D.A.B. Constructors Inc. said that its bankruptcy trustee filed amended quarterly federal employment tax reports by September seeking the credits for 2021, but that the company has not yet been issued the refunds or received any explanation for the delay from the Internal Revenue Service.

I don't like to report on new lawsuits being filed, given how few succeed. I mention this one because we are likely to see more suits like this as the IRS continues to slow walk ERC claims because of apparently rampant fraud. For most taxpayers who are legitimately eligible for the credits, it's not clear how a lawsuit will speed up the refund, but it is certain to rack up legal fees.

Personal assistant sentenced after embezzling more than $2.1 million from long-time employer and friend - IRS. This is a case out of Tulsa (Defendant name omitted, emphasis added):

According to court documents, Defendant was a trusted assistant for over 38 years and worked directly for the business owner. Defendant had access to several bank accounts and was often included in family affairs. She took advantage of her deeply trusted position by repeatedly embezzling funds for nearly ten years. Defendant deposited funds into her personal accounts and paid personal credit card bills by forging the owner's deceased spouse's signature on hundreds of checks. Defendant admitted that her motives were based solely on greed. She further admitted to agents that until she was confronted by the owner and fired, she had no idea how much she had stolen.

Friendship is no substitute for effective financial controls.

Related: Eide Bailly Fraud Prevention & Detection Services.

What day is it?

Today is National Chocolate Pudding Day, and, fittingly, National Day of Joy.

Make a habit of sustained success.