Key Takeaways

- IRS scraps audit goal for taxpayers with $10 million income.

- California budget deal suspends NOLs, makes some credits refundable.

- Supreme Court takes case on clawing tax payments back to bankruptcy estate.

- Did the Supreme Court leave open the door to a wealth tax?

- “This is a campaign that is just unserious when it comes to fiscal policy.”

- Burke, Chicago alderman from 1969 to 2023, sentenced for tax-related corruption.

- National Catfish Day.

IRS Scrapped Audit Goal for Taxpayers Earning Over $10 Million - Benjamin Valdez, Tax Notes ($):

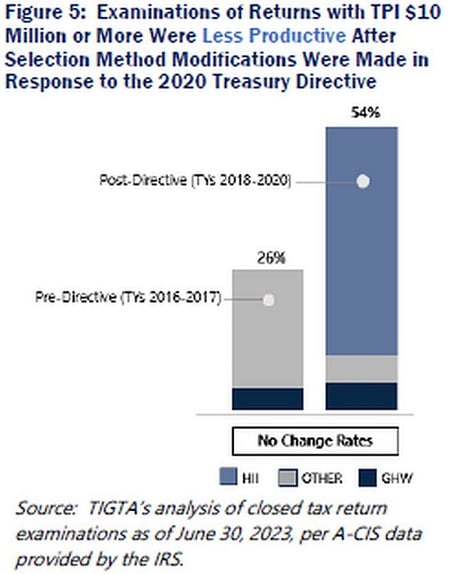

The IRS stopped complying with a 2020 Treasury directive requiring audits of at least 8 percent of all individuals with income of at least $10 million in order to place more focus on a 2022 directive to expand audits on taxpayers earning over $400,000, the Treasury Inspector General for Tax Administration said in a report released June 24.

The TIGTA report said that the IRS was doing more fruitless "no change" exams when it was meeting the 8% audit rate goal:

Why the focus on high-income returns? From the TIGTA report:

California Budget Deal Suspends Loss Deductions

California Governor, Legislature Reach Budget Deal - Paul Jones, Tax Notes ($):

The agreement includes a three-year suspension of both the use of carryforward NOLs for businesses with over $1 million in annual income and a limit of $5 million on the amount of business tax credits a taxpayer can use in a year. The three-year period would start in the current tax year and continue through 2026, as proposed by Democratic legislative leaders. Newsom had proposed that the three-year period begin in 2025 and continue through 2027.

Refundable Business Tax Credits Part of California Budget Deal - Laura Mahoney, Bloomberg ($):

...

Offering refundable credits through one of the bills in the new package (S.B. 175) softens the impact of another budget bill already on the governor’s desk (S.B. 167) to suspend deductions for net operating losses, or NOLs, for businesses with more than $1 million in income and cap annual business tax credit usage at $5 million in 2024, 2025, and 2026. The business tax limitations would raise more than $7 billion a year—one of the largest items on the list of options lawmakers are using to close a $27 billion deficit for the upcoming fiscal year.

Supreme Court Will Hear IRS Contest of Bankruptcy Clawback - Chandra Wallace, Tax Notes ($):

In a June 24 order in United States v. Miller, the Supreme Court granted review in the IRS’s challenge to a Tenth Circuit decision finding that section 106(a) of the Bankruptcy Code waives the federal government’s sovereign immunity and allows a bankruptcy trustee to get that money back from the IRS.

Related: IRS Collection Issues

So there's a chance?

Democrats’ Wealth Tax Dreams Look Dim After Supreme Court Ruling - Samantha Handler, Bloomberg ($). "While the majority’s decision didn’t directly address the issue of whether taxing unrealized gains, such as a wealth tax, would be unconstitutional, some justices indicated they wouldn’t be inclined to uphold those types of taxes if the question came before the court. That might spell trouble for Democrats, who are pushing those kinds of proposals to pay for other tax breaks."

Democrats’ Billionaire Taxes Still Have a (Slight) Chance - Richard Rubin, Wall Street Journal. "One limited idea that could be cast as an anti-abuse policy could attack what is known as the buy-borrow-die strategy where wealthy people borrow against appreciated assets and take advantage of the rule that doesn’t apply income taxes to unrealized gains held at death. Treating that borrowing for some people as realization might have a better chance of surviving a court challenge than a general tax on unrealized gains, said David Schizer, a Columbia University law professor. "

Democrats’ Dream of a Wealth Tax Is Alive. For Now. Jim Tankersley, New York Times:

It did not, and liberal groups celebrated the victory.

Meanwhile in D.C.

Business fumes as Democrats blast GOP for blocking corporate tax credits - Alexander Bolton, The Hill:

...

The U.S. Chamber of Commerce has urged the Senate to approve the package, which the House passed at the end of January, and warned that if research and development expensing were not restored retroactively, it would “result in irreversible harm to U.S. innovation and competitiveness.”

The national debt is ballooning. The next president probably won’t stop it. - Jacob Bogage, Washington Post:

The article discusses a report by the Center for a Responsible Federal Budget.. The CRFB president, Maya MacGuineas, finds no cheer in the current presidential campaign:

The legislative battles will take place against a troubling fiscal backdrop. Last week, the CBO projected annual budget deficits of nearly $2 trillion for the foreseeable future. That mismatch between spending and revenue will drive borrowing ever higher, with the debt growing to more than $50 trillion by 2034 — or more than 122 percent of the nation’s overall economy — the CBO said.

Corporations face reversal of fortune as 2025 tax debate heats up - Brian Faler, Politico. "But with lawmakers facing intense pressure to extend trillions in tax cuts next year that mostly benefit individual Americans, both Republicans and Democrats see corporations as a potential piggy bank to cover the huge hit to the budget."

Blogs and Bits

Tax issues newlyweds need to consider - Kay Bell, Don't Mess With Taxes. "Now that you’re an official, legal duo, you no longer can file your tax returns as single taxpayers. This is the case as long as your vows were exchanged anytime in the tax year, including the very last day. If you are legally married on Dec. 31, the IRS considers you married for the full tax year."

One of my memorable tax conversations was with a 1040 client who mentioned his wife on a phone call:

Me: "Congratulations! When did you get married"

Him: "Two Years Ago"

Me: "..."

Prioritizing Travel and a New Business Over Paying Tax Debt Dooms Tax Discharge - Parker Tax Pro Library. "The court held that because the debtor had the funds to pay the back taxes but instead spent her money on a bracelet business and travel expenses, she was guilty of willfully attempted to evade taxes and thus was not eligible for a discharge of her tax liability in bankruptcy."

Final regs. issued on conservation easement deduction disallowance - Martha Waggoner, The Tax Adviser. "Under the disallowance rule in Sec. 170(h)(7), added by Section 605(a) of the SECURE 2.0 Act, a qualified conservation contribution is disallowed if the amount is more than 2.5 times the sum of each partner's or shareholder's relevant basis (as defined in Sec. 170(h)(7)(B)) in the partnership or S corporation."

Ken Griffin’s Data Leak Suit Against IRS Ends in Settlement - Sabrina Willmer and David Voreacros, Bloomberg. "The US Internal Revenue Service agreed to settle a lawsuit brought by hedge fund manager Ken Griffin that accused the agency of failing to protect his confidential financial information from a contractor who stole his tax data and leaked it to ProPublica."

Tax Policy Corner

No Free lunch lasts forever - Allison Schrager, Known Unknowns. "Presidential candidate Trump has an idea to make tipped income tax-free. This is a terrible idea. Making certain kinds of compensation tax-advantaged (even when well-intentioned) just creates all sorts of distortions. That’s true even if you think it is a type of compensation we should (arguably) have more of, like retirement savings or health insurance premiums."

A Cato Plan to Cut Tax Rates to Near 100‐Year Low - Adam Michel, Liberty Taxed. "In the current fiscal environment, with spending projected to increase faster than the economy, extending the tax cuts without offsetting spending or tax changes is fiscally unsustainable. Congress cannot keep tax revenue flat while increasing spending year after year."

Tax Crime Watch, Chicago

Former Chicago alderman Ed Burke sentenced to 2 years in prison for corruption - Todd Feurer, Marybel Gonzalez, Chris Tye, Sabrina Franza, and Carol Thompson, CBS News, Chicago (my emphasis). "He was convicted of schemes to shake down the developers of the Old Post Office in downtown Chicago in exchange for help with tax incentives, the owners of a Burger King franchise restaurant in his ward in exchange for help with permits, and a developer who wanted help getting a pole sign approved for a new Binny's Beverage Depot store. He was also accused of threatening to hold up a fee increase for the Field Museum after learning the museum had not considered his goddaughter for an internship."

There's always a tax angle. Mr. Burke was a powerful Chicago politician when I graduated from high school in 1978. He had a long run.

Chicago consultant sentenced to a year in federal prison for tax offenses - IRS:

Annazette Collins of Chicago willfully filed a false individual tax return for the calendar years 2014 and 2015, and willfully failed to file an individual income tax return for the calendar year 2016. Collins also willfully failed to file a corporate income tax return for the calendar year 2016 on behalf of her consulting and lobbying business, Chicago-based Kourtnie Nicole Corp. Prior to operating her consulting business, Collins served in the Illinois General Assembly as a Representative and Senator.

You can do a lot of things in Chicago, but you still should file your tax returns.

What Day Is It?

It's National Catfish Day! A good old catfish fry is hard to beat.

Make a habit of sustained success.