Key Takeaways

- Second quarter payments are due June 17.

- Entity tax credits and taxable refunds.

- Strange bedfellows blocking tax bill.

- Supreme Court mulls Philadelphia double-tax case.

- Newlywed tax tips.

- Summer job tax tips.

- Iowa storm deadline relief.

- Many martinis.

June 17 estimated tax payment deadline fast approaching - IRS:

Taxpayers making estimated tax payments should consider this deadline to avoid falling behind on their taxes and facing possible underpayment penalties. And the IRS reminds taxpayers that third quarter payments are due Sept. 16, and the final estimated tax payment for tax year 2024 will be due on Jan. 15, 2025.

While you can still use the old-school 1040-ES quarterly payment vouchers, there are more reliable electronic means:

The Electronic Federal Tax Payment System (EFTPS) can also be used to make an estimated payment. Payment by check or money order made payable to the “United States Treasury” is accepted. For instructions and help figuring out their estimated tax, taxpayers should refer to Form 1040-ES, Estimated Tax for Individuals.

The hidden side of SALT cap workarounds

Pushing the Passthrough Entity Tax Envelope - Michael Schler, Tax Notes ($):

But it is not clear that taxpayers are reporting such cash refunds as income.

Pass-through entity taxes were enacted to bypass the $10,000 cap on itemized deductions for state and local taxes that took effect in 2018. Typically a partnership or entity pays a tax, and the entity owner gets a state tax credit to apply to personal state tax liability.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround

Strange bedfellows

House Progressives Like Mike (Sort of) for Blocking Tax Bill - Doug Sword, Tax Notes ($):

...

Progressives argue that the child tax credit got the short end in a deal negotiated between House Ways and Means Committee Chair Jason Smith, R-Mo., and Finance Committee Chair Ron Wyden, D-Ore.

The bill’s three main business provisions — rolling back research and development amortization, renewing 100 percent bonus deduction, and returning net interest expensing to a less narrow formula — would cost the treasury $125 billion in 2024, according to the Joint Committee on Taxation (JCX-3-24). That compares with the $8.2 billion first-year cost of expanding the refundability of the child tax credit.

Supreme Court mulls double-tax case

Justices Want Feds’ Input on Philadelphia Double-Taxed Wage Case - Perry Cooper, Bloomberg ($):

Amicus briefs filed in support of Zilka warned the state court’s decision could insulate local taxes from constitutional scrutiny and make it more expensive to work across state lines.

Philly Tax Case Could Give Answers On Reach Of Localities - Maria Koklanaris, Law360 Tax Authority ($). "The panelists, speaking at the Federation of Tax Administrators' annual meeting in Long Beach, California, noted that the court gave a hint Monday that it is strongly weighing whether to grant review to the resident, Diane Zilka. The justices invited Solicitor General Elizabeth Prelogar to file a brief outlining the U.S.' views on Zilka's certiorari petition that is seeking review of a Pennsylvania Supreme Court ruling that upheld the city's denial of the tax credit. Pennsylvania's top court held that the city's policy of crediting Zilka's local taxes paid to Wilmington, Delaware, where she commuted to work, but not her Delaware state taxes, passed constitutional muster."

Newlywed tips, tax-free tips

Newlyweds tax checklist - IRS. "Report any name changes to the Social Security Administration. The name on a person's tax return must match what’s on file at the SSA. If it doesn't, it could delay any tax refund. To update information, taxpayers should file Form SS-5, Application for a Social Security Card. It’s available on SSA.gov, by phone at 800-772-1213 or at a local SSA office."

Trump Floats Tax-Free Tips for Workers. That Could Mean More Tipping for Customers. - Richard Rubin and Vivian Salama, Wall Street Journal. "The proposal would create a two-tiered labor market where tipped workers would gain a significant advantage over other low-wage employees because they could potentially avoid Social Security taxes, Medicare taxes and federal income taxes"

Blogs and bits

A mini tax primer for students with summer jobs - Kay Bell, Don't Mess With Taxes. "As for the young workers facing income tax withholding, the amount taken out of your checks each pay period is based on the information you provide your employer’s payroll office. Specifically, your workplace uses your Form W-4, Employee's Withholding Allowance Certificate, to calculate how much federal income tax to withhold from your pay."

Supreme Court: Estate's Value Includes Insurance Proceeds Used to Redeem Shares - Parker Tax Pro Library. "The Supreme Court affirmed a decision of the Eighth Circuit and held that a closely held corporation's contractual obligation to redeem shares did not reduce the corporation's value for purposes of the federal estate tax."

Tax Credits For Higher Education - Tax School Blog. "Two credits are available to reduce the cost of higher education for taxpayers, their spouses. and their dependents: the American Opportunity Credit (AOC) and the lifetime learning credit."

Iowans Impacted by Recent Storms Are Eligible for Limited Tax Relief - Kristine Tidgren, Ag Docket:

The announcement stems from disaster declaration, DR-4784, issued by the Federal Emergency Management Agency on May 24, 2024. It applies to individuals and households that reside in or have a business in Adair, Montgomery, Polk, and Story Counties in Iowa.

National taxpayer advocate: TikTok a difficult adversary for IRS - Martha Waggoner, The Tax Adviser:

"We are prohibited from going into TikTok as a federal agency, so how do you counter a social media site that you can't go into?" she asked. "We're not supposed to even see what's in there."

Lax enforcement and nine martinis

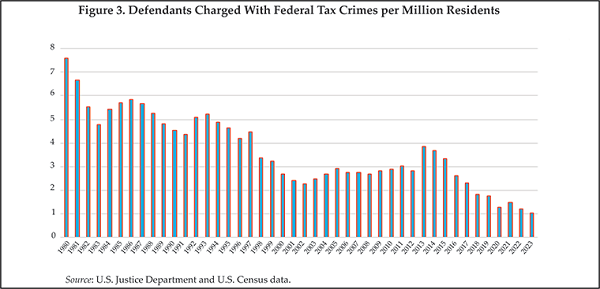

Federal Criminal Tax Enforcement Falls to Record Low - Rod Rosenstein, Tax Notes ($): "Federal criminal tax enforcement is moribund, despite boastful rhetoric in IRS Criminal Investigation division annual reports and threatening remarks in Justice Department press releases."

The nine-martini lunch? A taxpayer did a terrible job of documenting deductions in a Tax Court opinion issued yesterday, but managed to show that the the old-school liquid lunch might still have some life to it.

Kat Lucero of Law360 Tax Authority ($) explains the tax issue:

...

The trio's "shoebox method" is unacceptable because the taxpayers attached numerous cash register paper receipts to the tax return, but they did not make any effort on the return or in their court briefs — and only a slight effort in oral testimony — to link the receipts to a deductible trade or business expense, Judge Halpern said.

Poor documentation isn't that unusual, unfortunately. The lunches documented, though? From the opinion (emphasis added):

I attended one three-martini lunch in the early days of my career. A semi-retired partner liked to take new staffers to lunch, where he would eat a bowl of chili washed down with vodka martinis, and presumably run it through his expense report as a mentoring lunch. But I think he stopped at three.

What Day is it?

It's National Corn on the Cob Day. Of course, the good sweet corn isn't available until July, so you are allowed to take a rain check.

Make a habit of sustained success.