Key Takeaways

- “It's a Money Loser."

- Surviving residency audits.

- $4B state cannabis tax revenue

- VMT taxes: a state map

- California taxpayer apportionment loss.

- Tax legislation advances in CO, GA, HI, MN, NE.

- MN bill would make some corporate returns public.

- Another KS tax cut veto looms.

- Iowa's prom credit.

‘It’s a Money Loser’: Tax Breaks for Data Centers Are Under Fire - Saijel Kishan, Bloomberg Businessweek:

At issue is that these nerve centers of the digital age typically employ just a few dozen workers. To run one, all that’s needed is a skeleton crew that includes technicians, security personnel and building-control specialists, whereas a factory of similar size would have hundreds if not thousands of workers.

Surviving a Residency Audit - Russ Fox, Taxable Talk:

Cannabis Brought States Record $4 Billion Tax Revenue in 2023 - Angélica Serrano-Román, Bloomberg ($):

...

California leads in cannabis sales tax revenue, bringing in more than $1 billion in 2023, followed by Illinois and Washington, which reported $552 million and $532 million, respectively. Washington, which has a 37% cannabis excise tax—one of the highest in the nation—was among the first states to launch retail sales in 2014, alongside Colorado.

$4 billion is nothing to sneeze at, but it also shows that weed taxes aren't a plant-based cure-all for state budget problems. $4 billion is less than 4/10 of 1% of budgeted state spending for fiscal year 2024. The $1 billion for California cannabis tax revenue for 2023 is a small piece of a $286 billion 2023 state budget.

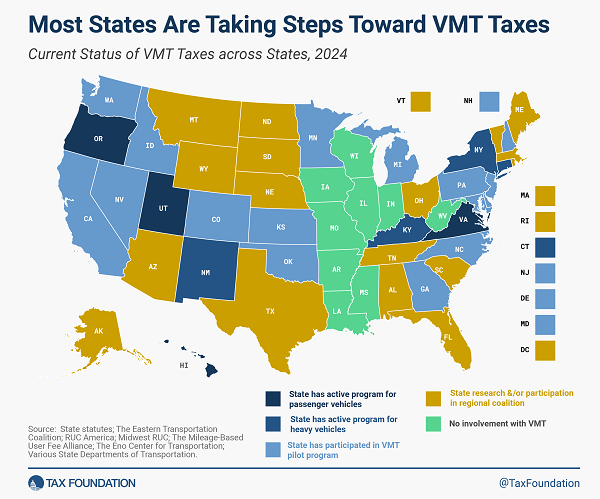

Vehicle Miles Traveled Taxes Rollout across States - Jacob Macumber-Rosin and Adam Hoffer, Tax Policy Blog. "Vehicle miles traveled (VMT) taxes are the road funding tool of the future. For decades, the gas tax proved to be a reliable user fee that funded road construction and maintenance, and consumers paid for their road usage via gasoline taxes when they filled up at the pump. Unfortunately, gas tax revenues have decoupled from road expenses and have been unable to support road funding in recent years. As such, states nationwide are exploring ways to supplement or replace gas tax revenues."

State-By-State Roundup

Alabama

Child care, housing tax credits win final approval from the Alabama Legislature - Jemma Stephenson, Alabama Reflector. "The Alabama Senate Tuesday approved two bills creating tax credits aimed at improving access to affordable housing and child care in the state, despite concerns from the Senate education budget chair."

California

Asset Sale Was Properly Excluded From Company's California Sales Factor - Cameron Browne, Tax Notes ($). "A parent company can't include the $53 million sale of its Alaska subsidiaries' car dealerships in its California apportionment formula because the sale was substantial and occasional, the California Office of Tax Appeals (OTA) ruled."

Calif. Credit For Tax Paid Doesn't Apply To Couple, OTA Says - Jaqueline McCool, Law360 Tax Authority ($). "The Kellys argued that they had erred in paying the tax to Virginia instead of California and could no longer claim a credit in Virginia due to the statute of limitations, so California should allow the credit to ensure the capital gain sale was not taxed twice."

Digital Ad Tax Bill Clears First Hurdle in California Senate - Laura Mahoney and Michael Bologna, Bloomberg ($):

...

If enacted, the measure would be effective from 2024 through 2029. The tax would be levied on gross receipts from “data extraction transactions” that derive from digital advertising sales. Companies with gross receipts less than $2.5 billion a year would be exempt, effectively leaving just the three tech titans affected.

Colorado

Combined Reporting Change, Quantum R&D Incentives Head to Colorado Governor - Emily Hollingsworth, Tax Notes ($):

The bill would require all affiliate members of a C corporation to be included in a combined return for corporate income tax purposes. Under the current rule — called the "3 of 6 rule" — only affiliates that meet three or more specific requirements must be included in combined returns.

Colo. Lawmakers Approve Film Tax Credit Extension - Sanjay Talwani, Law360 Tax Authority ($). "The Senate passed H.B. 1358 by 25-8, sending it on to Democratic Gov. Jared Polis. If enacted, the bill would extend Colorado's film production tax credit, currently scheduled to end this year, through 2031."

Gov. Polis and Colorado Lawmakers Strike Property Tax Deal - Michael Bologna, Bloomberg ($). "Gov. Jared Polis, a second-term Democrat, held a briefing with legislative leaders Monday to unveil SB24-233, which aims to provide tax relief as Coloradans cope with a surge in real estate valuations. The bill was scheduled to start Senate committee votes later Monday ahead of the General Assembly’s scheduled May 8 adjournment."

Florida Sales Tax, Insurance Premium Tax Breaks Signed Into Law - Matthew Pertz, Tax Notes ($):

-two disaster preparedness holidays for items like tarps, flashlights, and generators purchased June 1 through June 14, and August 24 through September 6;

-the "Freedom Month" holiday for pool toys, fishing supplies, and admission to museums and theme parks purchased in July;

-a back-to-school holiday for school supplies and clothes purchased July 29 through August 11; and

-the "Tool Time“ holiday for power tools and related items purchased September 1 through September 7.

Georgia

Georgia Governor Signs Budget, Vetoes Two Tax Bills - Matthew Pertz, Tax Notes ($). "Georgia Gov. Brian Kemp (R) has signed the state budget and issued vetoes on bills that would have doubled the homestead deduction and eliminated a sales tax break for data centers."

Hawaii.

Hawaii Legislature Passes Major Income Tax Cut Bill - Paul Jones, Tax Notes ($). "For tax year 2024 the bill would increase the standard deduction from $4,400 for joint filers and $2,200 for individual filers to $8,800 and $4,400, respectively. In 2026 the deduction would further increase to $16,000 and $8,000, respectively, and in 2028 to $18,000 and $9,000. In 2030 the standard deduction would be $20,000 and $10,000, respectively; and $24,000 and $12,000, respectively, in 2031."

Link: H.B. 2404.

Kansas

Gov. Laura Kelly affirms plan to veto bipartisan $2.3 billion, five-year tax reform bill - Tim Carpenter, Kansas Reflector. "Gov. Laura Kelly said there was “absolutely no way” to avoid vetoing the $2.3 billion tax reduction bill approved with bipartisan majorities in the Kansas Legislature, arguing the cumulative year-to-year result of a half-billion-dollar drop in revenue would crack the state’s financial foundation."

The Kansas legislature has failed to override two previous tax cut vetoes this session.

Louisiana

La. House OKs Constitutional Convention For Tax Overhaul - Paul Williams, Law360 Tax Authority ($). "The Republican-controlled House approved H.B. 800 by a 75-27 vote Tuesday, sending the legislation to the state Senate. The bill would initiate the constitutional convention no earlier than May 30, after which committees would debate potential changes that they would seek until Aug. 1. The convention would then firm up the proposed changes by Aug. 15, and voters would decide whether to approve the new document."

Minnesota

Minnesota House Passes Omnibus Bill With Corporate Tax Changes - Emily Hollingsworth, Tax Notes ($):

H.F. 5247 was amended and narrowly approved in the House in a 68 to 60 vote on May 3 and was sent to the Senate. The franchise tax disclosure provision was retained, as was a provision requiring a study on corporate tax base erosion, despite criticisms of both proposals by the Council On State Taxation and the Minnesota Center for Fiscal Excellence. Motions to eliminate the contentious provisions failed ahead of the vote.

The disclosure provision would require the DOR to publicly disclose state corporate franchise tax returns, along with tax forms related to the calculation of the tax, filed by taxpayers with annual gross sales or receipts totaling $250 million or more.

Competing Minnesota Tax Bills Head to Conference Committee - Michael Bologna, Bloomberg ($). "The House also favors a framework, opposed by business groups, for possible enactment of new corporate tax filing protocols. One provision would require the Revenue Department to disclose corporate franchise tax return data for businesses with more than $250 million in total domestic sales in a taxable year. Such disclosures would be required within two or three years after returns are filed, on a website maintained by the department."

Nebraska

Nebraska Exempts Conference Attendees From Income Tax - Jamie Rathjen, Bloomberg ($):

- Presence in Nebraska for up to seven days in a year.

-Earning up to $5,000 for the days worked in Nebraska.

New Jersey

NJ Firms Stand to Lose Tax Breaks Unless Workers Come to Office - Danielle Muoio Dunn, Bloomberg ($). "Since the Covid-19 pandemic, the state Legislature has repeatedly relaxed in-office requirements for companies participating in decade-old tax incentive programs. But the most recent waiver expired at the end of March, meaning businesses must now comply with a mandate that workers spend at least 60% of their time on site or risk losing their tax credits."

Missouri

Mo. Lawmakers Approve Opt-Outs To Pass-Through Entity Tax - Paul Williams, Law360 Tax Authority ($). "The state House of Representatives unanimously approved H.B. 1912, giving final legislative approval to the bill one day after the state Senate passed an amended version of the legislation with a 31-0 vote. The bill would add mechanisms for members of pass-through entities, such as S corporations and partnerships, to elect not to be taxed at the entity level."

Ohio

Cleveland Refunds Remote Worker's Taxes After City's Appeal Dismissed - Christopher Jardine, Tax Notes ($). "In an April 26 order in Morsy v. Gentile (formerly Morsy v. Dumas), the Ohio Court of Appeals, Eighth District, granted Cleveland Interim Finance Director James Gentile’s motion to dismiss the underlying appeal of the Cuyahoga County Court of Common Pleas’ decision in favor of Manal Morsy. The lower court enjoined Cleveland from collecting municipal income tax withholding or payments from income earned outside the city by Morsy, finding that although the statute authorizing the taxes was facially constitutional, it was unconstitutional as applied to Morsy."

Oregon

TurboTax ‘Quickly Working’ to Fix Oregon Refund-Shorting Glitch - Michael Bologna, Bloomberg. "Wyden objected to a 'software error' that caused Oregon taxpayers to claim the standard deduction on their state returns when itemizing would have generated a higher refund."

Pennsylvania

Pennsylvania House to Take Up Senate Income Tax Reduction Bill - Emily Hollingsworth, Tax Notes ($). "The bill would decrease the state’s flat personal income tax rate from 3.07 percent to 2.8 percent for tax years beginning on or after January 1, 2025. The reduction would save taxpayers billions of dollars and 'represent the largest tax cut for working families in our Commonwealth’s history,' according to a May 7 news release by Senate Republicans."

Washington

Washington DOR Finds Franchisee Income Not Exempt From B&O Tax - Andrea Muse, Tax Notes ($) "A multinational retail store operator’s income from franchisees is not income from the lease of real estate and is subject to Washington’s business and occupation (B&O) tax, the state Department of Revenue ruled."

Link: Determination No. 18-0105

Tax Policy Corner

States Acting Badly: Seven Bad (but Not Quite Deadly) Sins - Clark Calhoun, Amy Nogid, and Jashua Labat, Alston & Bird via Tax Notes ($):

Many of us are aware of the saga of the Wynnes in Maryland that started in 2008. They successfully challenged the denial of a tax credit in determining their local personal income tax; the U.S. Supreme Court determined that the failure to provide a credit for taxes paid to another state in determining county tax due violated the dormant commerce clause. In response, and to limit the state’s refund exposure, the Legislature retroactively limited the interest rates payable for refunds arising from the Wynne decision to 3 percent rather than the standard statutory rate for refunds of 13 percent. The courts have upheld the validity of the retroactive adjustment to the refund interest rate.

Say It Ain't So - David Brunori, Law360 Tax Authority ($):

...

Alas, North Carolina Gov. Roy Cooper wants to stop the phaseout of the corporate income tax, as well as scheduled reductions in the personal income tax.

State Tax Oddities, Prom Department

Iowa allows an individual tax credit of 25% of the first $2,000 spent on certain school supplies and expenses. Per Iowa tax return instructions, qualifying expenses include "Rental or purchase of 'non-street' costumes for a play or special clothing for a concert not suitable for everyday wear; rental of prom dresses and tuxedos.

Best wishes for a memorable evening to all who are going to the prom, but especially to anyone renting a prom dress this year.

Make a habit of sustained success.