Key Takeaways

- “We have spent $2.63 for every $1 we have collected in remote sales tax.”

- Multistate Tax Commission ponders tax on business inputs, trucking apportionment.

- Throwback rules.

- Making SALT cap workarounds easier in AL, CA, OK.

- Colorado revisits combined reporting rules.

- Iowa flat tax bill signed.

- Kansas: another tax bill veto, another tax bill sent for veto.

- Maine tax increase joins veto parade

- MN courts consider PL 86-272 scope.

- Will trial "move" Trump to New York?

- Tea tax cut and its unintended consequences.

Welcome to this edition of State Tax News & Views. Remember Eide Bailly for your State & Local Tax Needs.

The High Cost of Wayfair Compliance for Small Sellers - Amy Hamilton, Tax Notes ($):

“We have spent $2.63 for every $1 we have collected in remote sales tax,” said Bradley Scott, director of finance for Halstead Bead Inc., an Arizona-based online retailer of jewelry-making supplies. The remote seller is currently registered to collect, report, and remit sales and use taxes to 15 states — though since the South Dakota v. Wayfair Inc. decision the company has, at some point, collected remote sales tax for 34 states.

The Wayfair decision allows states to require collection of sales taxes by out-of-state sellers with no physical presence in a state if the sales into the state exceed minimum thresholds. When these thresholds are set so that the cost of compliance exceeds the tax raised, they just may be too low.

Related: A Sales Tax Reform Game Changer: How Wayfair Changed the Sales Tax Reform Landscape.

Navigating The Looming Commercial Property Tax Shortfall - Richard Auxier and Thomas Brosy, TaxVox. "Cities, counties, and other local governments have traditionally relied on property taxes as a substantial and stable revenue stream. But with remote work taking hold after the pandemic, studies suggest that the value of office buildings could fall by half in many cities. The question facing policymakers is not if this will affect local budgets but how bad will it get."

Multistate Tax Project Aims to Exempt Digital Business Inputs - Michael Bologna, Bloomberg ($):

...

In addition to exemptions for business inputs and the development of simple and transparent models, Strong said the project embraces: taxation of all retail sales by default; clear and specific definitions of digital products when possible, and clear exemptions; avoiding treatment of digital products as tangible personal property; avoiding distinguishing products based on the manner they are transferred; distinguishing products based on how they are produced and what is produced; sourcing digital products based on where the products are used, or destination sourcing; and exempting products based on who they are sold to.

Businesses Object to Alternative Tax-Sourcing Model for Trucking - Michael Bologna, Bloomberg:

Launching a project that embraces two very different sourcing approaches “runs contrary” to the commission’s mission of tax uniformity across the states, said Nikki Dobay, a state and local tax attorney in the Portland office of Greenberg Traurig LLP.

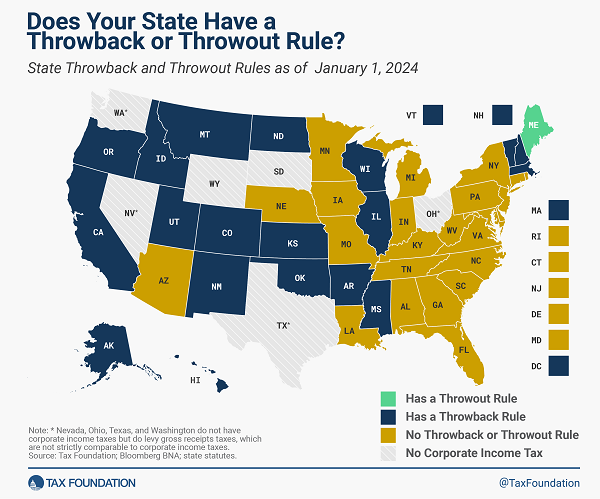

Throwback and Throwout Rules by State, 2024 - Joseph Johns, Tax Foundation. "Under throwback rules, sales of tangible property that are not taxable in the destination state are “thrown back” into the state where the sale originated, even though that is not where the income was earned. This means that if a company located in State A sells into State B, where the company lacks economic nexus, State A can require the company to 'throw back' this income into its sales factor."

State-By-State Roundup

Alabama

Alabama Governor Approves Changes to Passthrough Entity Election - Matthew Pertz, Tax Notes ($). "H.B. 187, signed into law on April 26, gives passthroughs more time to elect to be taxed at the entity level. Under previous law, passthroughs were required to make the election before March 15 of any year. For tax years beginning on or after January 1, the bill allows electing passthroughs to do so on or before their income tax deadline, including any extensions. Starting in 2025, both election and revocation of electing passthrough status will be made on a taxpayer’s timely return."

Arizona

IRS Rejects Arizona's Effort To Exempt State Tax Rebates - Jared Serre, Law360 Tax Authority ($). "Issued in 2023 following a state budget surplus, the rebates provided up to $750 to certain taxpayers who were eligible for the state's dependent tax credit and had a state tax liability at any time from 2019 to 2021."

California

California Senate OKs Change to SALT Cap Workaround Rules - Paul Jones, Tax Notes:

S.B. 1501 was passed by the Senate on April 25 as part of its consent calendar. Introduced by Senate Revenue and Taxation Committee Chair Steve Glazer (D), the bill would create an alternative to the requirement that passthrough entities using the SALT cap workaround prepay a portion of the elective entity-level tax by June 15 of the relevant tax year. For taxpayers who don’t or can’t pay by that date, the measure would create a penalty that taxpayers could opt to pay later instead.

California Digital Ad Tax Bill Stalls Under Business Opposition - Laura Mahoney, Bloomberg ($):

The measure would impose the tax on gross revenue from digital advertising services in the state on companies with at least $100 million in global annual revenue, starting Jan. 1, 2025. It would generate $670 million in the 2024-25 fiscal year and $1.39 billion the following year, according to the California Department of Tax and Fee Administration.

Colorado

Colo. House OKs MTC Method For Corp. Tax Reporting - Sanjay Talwani, Law360 Tax Authority ($):

Josh Pens, director of tax policy at the Colorado Department of Revenue, told the MTC on Tuesday that the bill would repeal Colorado's "unique" six-part test used to determine the makeup of a combined group.

Colo. House OKs Agricultural Stewardship Tax Credits - Sanjay Talwani, Law360 Tax Authority ($). "The credits could be worth up to $150 per acre and up to $300,000 per farm or ranch annually, depending on the number of approved stewardship practices employed. As amended, the bill would cap the statewide credits at $3 million annually, with a waiting list for requests of up to $2 million. As introduced, the bill would have capped the statewide credits at $10 million annually."

Link: H.B. 1249

Iowa

Gov. Kim Reynolds signs a new Iowa income tax cut into law. What that means for you - Stephen Gruber-Miller, Des Moines Register. "Iowa's top income tax rate this year is 5.7%. Under the new law, all Iowans will pay a 3.8% income tax rate next year."

Iowa’s Accelerated Flat Income Tax Becomes Law - Emily Hollingsworth, Tax Notes ($). "S.F. 2442 increases from $500,000 to $1 million the business investment threshold for purposes of the targeted jobs withholding credit, and it allows for the deduction of expenses allocable to investments in an investment subsidiary for franchise tax purposes. Financial institutions subject to the franchise tax can qualify for the deduction if they elect to include the income and expenses of an investment subsidiary on their returns."

As of this writing, a bill restoring restoration of the exclusions for capital gain income on the sale of breeding livestock. retroactive to 2023, awaits signature (HF 2649). Other tax legislation cleared the Iowa House, but died without coming to a vote in the Iowa Senate. The failed legislation includes an extension of the retired farmer lease income exclusion to pass-through income (HF 2666), a bill extending the Iowa retirement exclusion to non-qualified deferred compensation (HF 2638), and a proposal to revive the Iowa Film Tax Credit (HF 2662).

Indiana

Indiana to Provide Amazon, Google Up to 50 Years of Data Center Tax Breaks - Emily Hollingsworth, Tax Notes ($). "The incentives deal is based on the IEDC’s data center sales tax exemption program. The program exempts purchases of qualifying data center equipment and energy from the state’s 7 percent sales and use tax for a 25-year period for data center investments of less than $750 million. The exemption can last up to 50 years for data center investments exceeding $750 million. Local governments can also provide personal property tax exemptions for data center owners that invest at least $25 million in real or personal property into the facility."

Kansas

Kansas Senate fails to override governor’s veto of tax cut package - Sherman Smith and Rachel Mipro, Kansas Reflector:

The 26-14 override attempt on House Bill 2036 failed by one vote because two-thirds of the chamber’s 40 members are needed to override a veto.

Kansas Legislature adopts $2.3 billion, 5-year tax cut despite bipartisan forecast of veto - Tim Carpenter and Sherman Smith, Kansas Reflector:

...

“This bill is not going to become law,” said Sen. Tim Shallenburger, a Baxter Springs Republican who voted for the latest incarnation of tax reform. “It’s time we go down to the second floor and try to figure out what in the world the governor will accept. If we can’t accept it, we go home and do nothing. If we can, we ought to do it.”

Maine

Maine Governor Vetoes Income Tax Increase for High Earners - Matthew Pertz, Tax Notes ($). "The bill would have created three additional tax brackets on top of the current tax structure, while amending the income thresholds for the existing brackets, beginning January 1, 2025."

The top rate would have risen to 8.45%, up from the current 7.15%.

Minnesota

Minnesota Justices Weigh Scope of Uline Tax-Free Sales Activity - Richard Tzul, Bloomberg ($):

...

Uline asked the high court to reverse the state tax court’s finding that the company’s opposition research conducted in Minnesota isn’t sufficiently ancillary to soliciting orders, making it ineligible for PL 86-272 immunity. The company is trying to get an exemption from income or franchise taxes for 2014 and 2015.

Will the Minnesota Legislature Force the DOR to Follow Tax Court Opinions? - Kyle Brehm, Fredrickson & Byron P.A. via Tax Notes ($). "For decades a rather insidious problem has been developing with the Minnesota Department of Revenue’s selective respect for the Minnesota Tax Court’s interpretation of Minnesota tax laws. That said, with a change in the commissioner of revenue, a proposal for an equitable rule by some Minnesota Supreme Court justices, and recently proposed legislation, help for taxpayers may finally be on the way."

New York

New York City Corporate Tax Regs Won’t Mirror Recent State Tax Regs - Emily Hollingsworth, Tax Notes ($). "A recent summary of the proposed regs released by the New York City Department of Finance noted that although they would "substantially parallel the State's corporate tax reform regulations," some would be markedly different, including those on the allocation of income from partnerships and passive investment customers."

New York Taxman Should Hope Trump’s Criminal Trial Runs Long - David Pope, DLA Piper via Bloomberg:

Trump isn’t domiciled in New York, but he owns a residential unit in Trump Tower and feasibly could be in the state for more than 183 days due to his legal problems.

Oklahoma

Okla. Will Allow Making Pass-Through Election With Filing - Jaqueline McCool, Law360 Tax Authority ($):

H.B. 3559, which Republican Gov. Kevin Stitt signed Monday, will make it easier for an entity to elect to be taxed as a pass-through entity. Before the change, entities were required to make the election during the tax year or two months 15 days after.

Tax Policy Corner

We Should Welcome This Fight - David Brunori, Law360 Tax Authority ($):

The MTC's guidance, adopted by New York, essentially says that if you use the internet to conduct business, you will no longer be protected by P.L. 86-272. As I have said 100 times, though, virtually every company has a website and some presence on the internet. The New York regulation effectively repeals P.L. 86-272.

Tax History Corner

Trouble brewing. The history of tax law is full of unintended consequences. Now that we are in May, it's a good time to revisit a tax cut that did not quite have the intended results. From History.com:

British Prime Minister, Frederick, Lord North, who initiated the legislation, thought it impossible that the colonists would protest cheap tea; he was wrong. Many colonists viewed the act as yet another example of taxation tyranny, precisely because it left an earlier duty on tea entering the colonies in place while removing the duty on tea entering England.

Eventually that led to the Boston Tea Party, and other events.

Make a habit of sustained success.