Key Takeaways

- Wishing for a low-tax state?

- Facts & Figures 2024 available.

- Georgia tax court referendum

- Indiana updates Wayfair guidance.

- Kansas tax relief tussle continues.

- Kentucky bullion break vetoed

- Minnesota NOL fix.

- Nebraska digital tax advances.

- Film subsidies.

- April 15 in history.

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive needs.

Do You Wish You Lived in a Low-Tax State? Michael Kolomatsky, New York Times:

New York State’s tax burden was highest, over 12 percent. Hawaii, Vermont, Maine and California followed, each topping 10 percent. At the other end of the scale, Alaska has a tax burden less than half of New York’s, or slightly below 5 percent. New Hampshire, Wyoming and Florida followed, all roughly six percent.

Taxes aren't everything, but they are a thing.

Residents of this state pay $987,117 in lifetime taxes. Guess which one? - Daniel de Visé, USA Today. "New Jersey residents pay $987,117 in lifetime taxes, the analysis found, the highest tab in the nation. Washington, D.C., comes second, with a lifetime tax burden of $884,820. Connecticut and Massachusetts are third and fourth, at $855,307 and $816,700."

Facts & Figures 2024: How Does Your State Compare? - Tax Foundation. "How do taxes in your state compare regionally and nationally? Facts and Figures, a resource we’ve provided to U.S. taxpayers and legislators since 1941, serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more."

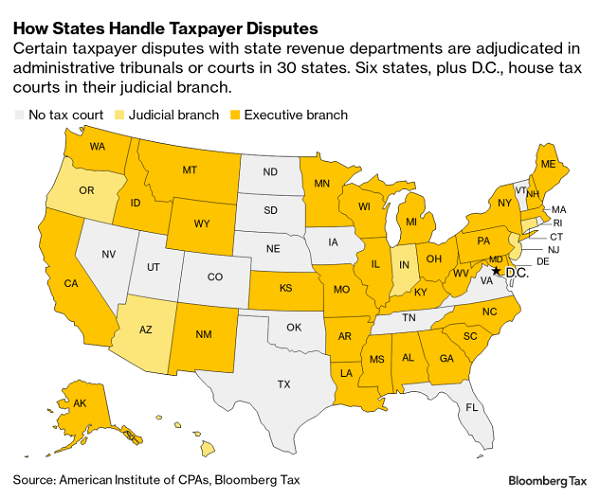

Georgia Voters to Weigh In on Setting Up Judicial Tax Court - Michael Bologna, Bloomberg ($). "If voters approve, Georgia would join a small number of states that have moved the authority to settle tax disputes from an administrative panel tethered to an executive-branch agency to the state judiciary."

Taxpayers disputing state department of revenue decisions often find that the same departments are most of the appeal process. If they end up in court, they often appear before state district courts that spend their days dealing with divorces, property disputes, and other normal judicial business, but rarely with tax issues. Lacking expertise, the judges often default to the state's position.

From the article:

If voters approve, Georgia would join a small number of states that have moved the authority to settle tax disputes from an administrative panel tethered to an executive-branch agency to the state judiciary.

John Gupta, head of Eide Bailly's state and local tax team, comments:

State-By-State Roundup

Arizona

Federal Court Won’t Bar IRS From Taxing Arizona Rebate - Andrea Muse, Tax Notes ($):

In an April 5 order in Arizona v. IRS, the U.S. District Court for the District of Arizona concluded it is unlikely that it has jurisdiction to hear Arizona’s challenge to an IRS determination that the rebate is subject to federal income tax, denying the state’s motion for a preliminary injunction.

California

California Bills Extend SALT Cap Workaround and Ease Payments - Laura Mahoney, Bloomberg ($):

The bills apply to California’s SALT cap workaround, which allows pass-through businesses like partnerships and S corporations to elect to pay a 9.3% state tax on their income. Members of those entities then claim a credit on their personal income taxes equal to their share of the firm’s tax payment.

The bills passed the state Senate Revenue and Taxation Committee with unanimous votes, and move next to the chamber’s Appropriations Committee.

Links: (S.B. 1192 and S.B. 1501.

We are likely to see more such extensions of SALT workarounds even if the $10,000 cap on state and local tax itemized deductions expires as scheduled after 2025. Many taxpayers prior to the enactment of the cap had no benefit from state tax itemized deductions because of alternative minimum tax, and the entity tax SALT workarounds also work around that.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround.

Indiana

Indiana Updates Sales Tax Guidance for Remote Sellers, Facilitators - Emily Hollingsworth, Tax Notes ($):

But merchants that are registered in Indiana and exceeded the 200-transaction threshold in 2023 must remain registered for 2024, even if they didn’t meet the $100,000 threshold, according to revisions to Information Bulletin No. 89. Merchants that also don't meet the monetary threshold in 2024 can close their Indiana sales tax accounts in 2025.

Related: A Sales Tax Reform Game Changer: How Wayfair Changed the Sales Tax Reform Landscape

Indiana Announces Incentives for $3.9 Billion Semiconductor Site - Emily Hollingsworth, Tax Notes ($). "The Indiana Economic Development Corp. (IEDC) offered several performance-based tax incentives and grants to attract the company to locate in the state, including up to $554.7 million in tax rebates through the state’s Innovation Development District program. The program, which captures incremental state and local tax revenue to support businesses and localities within the district, was created under 2022's S.B. 361."

Iowa

Iowa Lawmakers OK Lowering Captive Insurer Premium Taxes - Zak Kostro, Law 360 Tax Authority ($). "The bill would reduce the tax applied to a captive insurance company's reinsurance premiums written above $40 million annually, according to a fiscal note. The tax rate for assumed reinsurance premiums written between $40 million and $60 million would be lowered from 5% to 0.045%, the fiscal note said. Premiums written above $60 million would be taxed at a rate of 0.02%, the fiscal note said, instead of the 5% rate that applies under current law."

Link: H.F. 2636

Iowa Senate Advances Flat Tax Mandate - Emily Hollingsworth, Tax Notes ($). "The Senate passed S.J.R. 2004 on a 34–15 vote April 2. The measure, introduced by the Senate Ways and Means Committee as a study bill, proposes to amend the Iowa Constitution to require the state to keep the individual income tax at a single rate."

Kansas

Kansas Legislature Approves Tax Relief Plan - Emily Hollingsworth, Tax Notes ($):

The plan would reduce the state's income tax brackets from three to two for tax year 2024 and thereafter. The new rates would be at 5.15 percent and 5.55 percent for single and joint filers. The state's current income tax rates are at 3.1 percent, 5.25 percent, and 5.75 percent.

Kansas Lawmakers Send Governor New Income Tax-Cutting Bill - Danielle Muoio Dunn, Bloomberg ($):

The Republican-controlled Legislature passed the measure, HB2036, in the early morning hours Saturday after a different tax-cutting bill that Kelly had agreed to, and the Senate approved, was stopped in the House. A spokesperson for Kelly didn’t immediately return a request for comment.

Link: S Sub for HB2036

Kentucky

Ky. Gov. Rejects Tax Amnesty Program, Bullion Tax Break - Paul Williams, Law360 Tax Authority ($):

Kentucky courts have previously blocked unfunded programs from going forward, the governor said. With respect to the exemption for bullion, Beshear said he was vetoing that provision because sales tax applies to other collectible goods and "if you own gold, you can afford to pay sales tax." The Republican-controlled General Assembly could attempt to override the vetoes.

Maine

Maine lawmakers endorse higher tax brackets for wealthier residents - Randy Billins and Eric Russell, Portland Press Herald.

...

A single person making $1 million now pays $3,686 plus 7.15% on anything over $58,050, a total of $71,035. The new plan would require a payment of $35,258 plus 8.45% of the excess over $500,000, or $77,508. So the millionaire would pay $6,473 more.

Link: LD 1231

Minnesota

Minn. Retroactively Delays Cut To NOL Deduction - Sanjay Talwani, Law360 Tax Authority ($). "H.F. 3769, signed by Democratic Gov. Tim Walz, delays from tax year 2023 to 2024 a cut in the allowable NOL deduction from 80% to 70% of taxable income."

Nebraska

Neb. Lawmakers Advance Digital Ad Tax, Property Tax Relief - Michael Nunes, Law360 Tax Authority ($):

The unicameral Legislature amended L.B. 388 on Wednesday with a plan to broaden the sales tax base and impose a 7.5% tax on digital advertisers with more than $1 billion in revenue, by a vote of 28-14. The bill, which still requires a final reading, is part of a tax package advocated by Republican Gov. Jim Pillen to increase sales tax revenues as a means of funding a 40% cut in property tax revenue.

Gov. Pillen opts for slimmed-down property tax relief bill. Special session prospects rise. - Paul Hammel, Nebraska Examiner. "Pillen’s initial proposal to raise sales taxes was pilloried by both conservative and progressive groups. Conservatives condemned it as a “tax shift” that didn’t result in a tax decrease, while progressive groups said a sales tax increase was regressive and would more adversely impact low-income Nebraskans."

Digital taxes have been floated in a number of states, but litigation over Maryland's version, which was the first one passed, has given legislatures pause. The Nebraska version would only apply to companies with gross advertising revenue over $1 billion, which shows that it is aimed at big tech companies.

Tennessee

Tennessee House Approves Slimmer Franchise Tax Refund Bill - Angélica Serrano-Román, Bloomberg ($).

The House voted 68-20 for a plan, HB 1893, that would cost $713 million in refunds, plus $400 million annually going forward. That’s below the Senate’s version, SB 2103, which would send about $1.5 billion to corporate taxpayers, in addition to reducing state revenue in future years. The Senate approved its version March 21 by a vote of 25-6.

Tennessee Lawmakers Pass Dueling Measures to Cut Franchise Tax - Matthew Pertz, Tax Notes ($). "The House’s amendment would reduce the period for which a taxpayer could claim a refund from the past three years — as the Senate intended — to just one year. It would also require the state Department of Revenue to publish a list of all companies that receive refunds under the bill. A similar amendment was rejected in the Senate, and the Council On State Taxation argued in testimony that publishing that information would 'neither inform the public policy debate nor raise additional revenue.'"

Virginia

Youngkin agrees to scrap tax cuts in proposed overhaul of state budget - Gregory Schneider and Laura Vozzella, Washington Post:

Lawmakers also rejected the sales tax increase but agreed to extend the sales tax to digital goods — and went a step further by applying it to business downloads as well, not just consumer purchases. They used the revenue to fund salary increases for teachers and state employees, along with other priorities.

Washington

Washington Capital Gains Tax Rules Delete ‘Domicile’ Presumption - Laura Mahoney, Bloomberg ($). "The Department of Revenue removed a presumption that if a person is domiciled in Washington at any time during a tax year, the department would presume the person is a domiciliary at the time of the sale or exchange of property subject to the tax within that year, tax policy specialist Michael Hwang said during a public hearing on the draft regulation Tuesday. Several attorneys objected to the presumption during a public hearing on the draft in October, saying it had no basis in the tax statute."

Washington CPAs Weigh In on Latest Draft of Capital Gains Tax Reg - Paul Jones, Tax Notes ($). "Washington’s capital gains tax — enacted in 2021 to fund child care and early education — is a 7 percent tax on residents’ annual long-term capital gains in excess of $250,000, with various exemptions and deductions. It was challenged by opponents, including conservative groups and business owners, and upheld by the Washington Supreme Court in March 2023 (a U.S. Supreme Court challenge also failed). Because long-standing precedent bars progressive income taxation in the state, the tax is framed as an excise tax on the sale of long-term gains. The first year of the tax was 2022."

Tax Policy Corner

Why States Have Spent Billions Subsidizing Hollywood - Matt Stevens, New York Times.

...

Of course, skeptical economic white papers can be no match for the allure of exclusive parties and the promise of a cameo in a blockbuster movie. Hollywood insiders lobby politicians with campaign donations and perks, which is another reason states keep expanding these programs. In Michigan, a big-name producer wined and dined lawmakers just as the state’s film incentives were set to expire. If you squint at the right scene from “Batman v Superman: Dawn of Justice,” you’ll spot a former Senate majority leader.

Tax History Corner

Tax day looms. April 15 became the deadline for U.S. individual returns beginning with 1954 filings due in 1955.

In the intervening seventy-ish years, there have been a number of changes in the tax law and the economy, making April 15 an unattainable deadline for many filers. Fortunately, extensions are available. Unfortunately, extending doesn't occur automatically, as either a paper filing or an electronic filing of some sort is needed.

There is no easily available word count of the original Internal Revenue Code of 1954, but rest assured, it was a lot shorter than the current tax code.

The economy has changed as well. For example, it is estimated that there were only about a dozen computers in the US. IBM unveiled its Model 701 in 1954, selling 19 units at over $2 million each - about $23.4 million adjusted for inflation. The number of computers soared by 1960. to about 200. You can be sure that there are more than that many in backpacks and pockets in a typical middle school.

If April 15 gets you down, maybe a few happier events that occurred on April 15 in history might cheer you up (courtesy onthisday.com):

1621 Hugo Grotius arrives in France after escaping prison in a book chest.

1755 Samuel Johnson's "A Dictionary of the English Language" published in London

1910 William Howard Taft is first US President to throw out the 1st ball at a baseball game

1931 1st backwards walk across American begins

1947 Jackie Robinson becomes 1st African-American to play in US major league baseball (Dodgers)

1965 NFL changes penalty flag from white to bright gold

Just don't Google "April 15" and "Lincoln" or "Titanic."

Make a habit of sustained success.