Key Takeaways

- Court says IRS can block state laws converting SALT deduction to charitable deduction.

- Property taxes jump.

- State wealth taxes.

- How to tax digital bundles.

- Idaho cuts income tax rates.

- MN enacts 2023 NOL fix.

- When presidents were tax-free.

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs.

Federal Court Finds SALT Workaround Regs Reasonable - Andrea Muse, Tax Notes ($):

A federal district court has rejected a multistate challenge to the IRS’s regulations on charitable contribution workarounds to the federal cap on the state and local tax deduction.

When the 2017 tax act limited itemized deductions for state and local taxes to $10,000, a few states floated an idea where taxpayers could "contribute" amounts to a state and then get dollar-for-dollar state tax credit - in other words, changing the deduction for state and local taxes to a charitable deduction.

[Judge] Gardephe granted the federal government’s motion for summary judgment, however, after concluding that nothing in IRC section 170, which allows a deduction of any charitable contribution made within the tax year, suggests “that Congress intended charitable contributions made to state or local government sponsored funds — in exchange for tax credits — would be exempt from the standard rule that the amount of a federal charitable contribution is reduced by the amount of the benefit received.”

States’ Challenges to Federal SALT Deduction Cap Thrown Out - John Woolley, Bloomberg ($):

The decision is a major blow to any state attempts for residents donate to charity and earn equivalent credits on their state and local taxes, while also deducting the donation from their federal income tax. Under the upheld Treasury rule, those federal deductions are limited by the amount of credits they generate for state and local taxes—negating much of the tax benefit.

A different method used by states to counteract the SALT deduction cap—allowing pass-through businesses, instead of their individual owners, to pay income tax and owners to get a state credit for their share of the amount paid—is likely unaffected by the ruling.

More than likely.

US Homeowners See Biggest Property Tax Rise in Five Years - Alex Tanzi, Bloomberg. "Data collected by ATTOM, a real estate data firm, which tracked property taxes for 89.4 million single-family homes, shows that governments collected more than $363 billion in 2023. That’s an increase of 6.9% and almost double the 3.6% gain a year earlier."

Advocates Push Wealth Taxes Despite Mixed Results - Benjamin Valdez, Tax Notes ($):

Maryland, Rhode Island, and Vermont. Some proposals have been shot down but others are still in play or advancing. Massachusetts has a millionaire's tax and New Mexico recently approved legislation reducing taxes on lower earners and restricting the capital gains tax deduction, proof that taxing the wealthy can be done.

But many states have been focused on cutting taxes in light of record revenue surpluses, which are partly due to inflation and one-time federal pandemic relief funds. Personal and corporate income tax rates have been cut in 26 states over the last three years, which could cost those states a cumulative $111 billion over the next five years, according to the Center on Budget and Policy Priorities.

States Solicit Industry Input on Taxing Bundled Digital Products - Michael Bologna, Bloomberg ($):

A Multistate Tax Commission work group will convene stakeholder meetings to examine the ways technology, communications, and e-commerce companies bundle digital products and services, attorneys with the intergovernmental tax agency said.

...

Taxing digital bundles is inherently difficult for state tax administrators because of the diverse commercial models, which can include packages of both tangible and intangible property, online services, software, hardware, subscriptions, memberships, and other items.

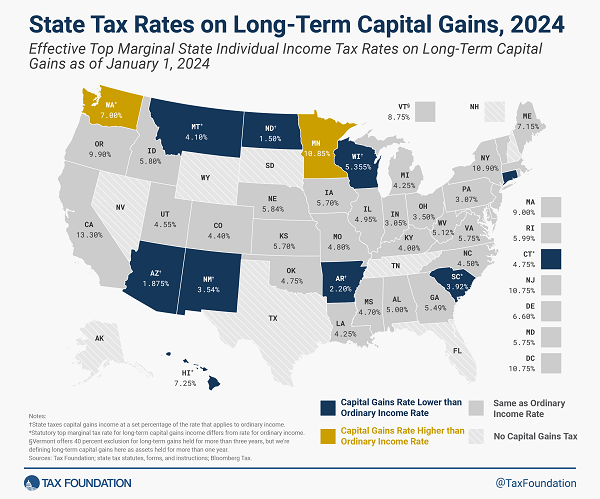

State Tax Rates on Long-Term Capital Gains, 2024 - Katherine Loughead, Tax Foundation. "Thirty-one states and the District of Columbia overtax capital gains income simply by subjecting capital gains to the same rate schedule that applies to ordinary income. Further, two states—Minnesota and Washington—expose some capital gains to higher rates than apply to ordinary income. Specifically, Minnesota taxes most capital gains at ordinary rates but levies an additional 1 percentage point tax on net investment income exceeding $1 million. Washington imposes a 7 percent tax on capital gains income exceeding $250,000, but the state does not tax ordinary income."

State-by-State Roundup

Arizona

Arizona Unlikely to Win Early Bid to Bar IRS From Taxing Rebates - Perry Cooper, Bloomberg ($):

The state argues the IRS is treating Arizona’s rebates differently than it treated similar rebate programs in 21 other states and wants an injunction to stop the IRS. Judge G. Murray Snow of the US District Court for the District of Arizona questioned why that poses a redressable injury to the state and not just to individual residents who may incur federal income tax liability.

“I think the state is going to struggle to establish standing here, and that is a real issue,” Snow said.

California

Calif. Can Tax Gain From Contact Lens Biz Sale, OTA Says - Maria Koklanaris, Law360 Tax Authority ($):

Colorado

Colorado Launches Tax Incentives for Geothermal Projects, E-Bikes - Emily Hollingsworth, Tax Notes ($):

The first application cycle for the Geothermal Electricity Tax Credit Offering will run from April 1 to June 30, according to a release from Democratic Gov. Jared Polis's office. The program, which is administered by the Colorado Energy Office, consists of two income tax credits: an investment tax credit and a production tax credit. Both will sunset at the end of 2032.

...

Polis's office also announced that the state's e-bike tax credit program launched April 1. Under the program, Colorado residents purchasing an e-bike from a participating retailer will receive a $450 discount on the bicycle, and the retailer will be eligible to claim a $500 income tax credit. The purchaser must pay tax on the price of the bicycle before the discount, according to the Department of Revenue's webpage on the credit. To claim the credit, the retailer must register through the DOR's online portal.

Georgia

Georgia Lawmakers Split Their Verdict on Film Tax Credit Changes - Angélica Serrano-Román, Bloomberg ($):

A group of legislators, predominantly Republicans, introduced two bills to change the credit. HB 1180 aimed to place an annual cap on the value of transferable tax credits, and HB 1181 was designed to restrict taxpayers’ ability to carry unused tax credits, including film incentives, forward to future years.

The Senate passed HB 1181 with a vote of 45-2 on March 11, following unanimous support from the House on Feb. 27. But it decided not to act on HB 1180, which would have limited annual film tax credit transfers to 2.5% of the state budget, which amounts to around $900 million, based on current spending figures.

Hawaii

Hawaii Senate Taxwriters Advance Tax Relief Bill - Paul Jones, Tax Notes ($). "H.B. 2404 was modified and approved by the Senate Ways and Means Committee April 1. A copy of the amended bill was not uploaded as of press time, but according to the description of the amendments by the committee chair and a document summarizing the changes, the amended version would expand the personal income thresholds for the state’s tax brackets, increase the standard deduction, and index them for inflation. The committee's changes also dropped several provisions that were in the House-approved version. If passed by the Senate, the bill would likely go to a conference committee to reconcile the differences."

Idaho

Idaho Cuts Income Tax Rate, Increases School Facilities Funding - Emily Hollingsworth, Tax Notes ($). "Gov. Brad Little (R), who backed the bill, signed H. 521 into law on March 29. The bill reduces the state's flat individual and corporate income tax rate from 5.8 percent to 5.695 percent, retroactive to January 1. It will also bolster funding for school facilities by more than $150 million annually to limit the amount of property taxes school districts would need for funding school facility construction. H. 521 passed the Senate on a 23–11 vote March 21 after it cleared the House 61 to 6 on February 23."

Iowa

Iowa Senate approves constitutional amendment requiring flat income tax rate - Stephen Gruber-Miller, Des Moines Register. "If the proposed amendment passes the House this year, lawmakers would have to pass the measure again in 2025 or 2026. It would then be placed on a statewide general election ballot and would require majority approval to be added to the constitution."

Iowa House passes tax credit to spur rural growth, job creation. Will businesses come? - Gazette-Lee Des Moines Bureau. "House File 2674 creates a new rural development tax credit designed to encourage investment in new or expanding businesses in Iowa's 88 smallest counties. It allows up to $27 million in tax credits for investors and makes $45 million in growth capital available, such as loans or equity investments, for rural small businesses across Iowa to expand their operations and create quality jobs."

Kansas

Kansas Tax-Cutting Bill Advances, Then Stumbles in House - Michael Bologna, Bloomberg ($):

Kansas was poised to enact broad tax relief legislation until it ran into bipartisan opposition late Thursday, sending the measure back to negotiations. The bill would give $2.3 billion back to taxpayers over five years through a cut in the top marginal rate, a bump in the standard deduction, and full elimination of the sales tax on groceries.

Significantly, the proposed law, HB 2036, had the blessings of Gov. Laura Kelly (D), who vetoed two previous tax-cutting plans backed by the Republican-controlled Legislature. After months of disagreements, Kelly and legislative leaders landed on a compromise package Wednesday that was quickly folded into a conference committee report.

Maryland

Citing Bridge Collapse, Maryland to Waive Late Payment Penalties, Interest - Matthew Pertz, Tax Notes ($). "Comptroller Brooke Lierman (D) announced that the state will automatically waive interest and penalties for late payments of the employer withholding tax, sales and use tax, tobacco tax, motor fuel tax, admissions and amusement tax, tire fee, bay restoration fee, and transportation network fee, as long as the payments are made by May 31."

Minnesota

Minnesota Corrects Drafting Error, Making NOL Reduction Effective in 2024 - Melissa Menter, Eide Bailly. "The Minnesota House and Senate have passed H.F. 3769 and Governor Tim Walz is expected to sign the bill into law next week. The bill corrects a drafting error from the 2023 legislative session that mistakenly made a reduction in the allowable NOL deduction effective for taxable years beginning after December 31, 2022. Under the bill, the reduction in allowable NOL deduction from 80% to 70% will now be effective for taxable years beginning after December 31, 2023."

Missouri

Voters Reject Stadium Tax for Royals and Chiefs, Leaving Future in KC in Question - Associated Press via US News & World Report. "Royals owner John Sherman and Chiefs president Mark Donovan acknowledged long before the final tally that the initiative would fail. More than 58% of voters ultimately rejected the plan, which would have replaced an existing three-eighths of a cent sales tax that has been paying for the upkeep of Truman Sports Complex — the home for more than 50 years to Kauffman and Arrowhead Stadiums — with a similar tax that would have been in place for the next 40 years."

Missouri House Votes to Phase Out Corporate Income Tax - Matthew Pertz, Tax Notes ($). "The bill faces a less enthusiastic Senate next. Last year, a similar bill, which would have immediately reduced the corporate income tax rate to 2 percent and created triggers to eliminate the tax entirely, was passed by the House by a wider margin (111 to 48) but died in the Senate Appropriations Committee."

Oklahoma

Oklahoma High Court Sides Against Governor on Tribal Compact Bills - Emily Hollingsworth, Tax Notes ($). "In Stitt v. Treat, the Oklahoma Supreme Court held April 2 that lawmakers had constitutional authority to enact two special session bills letting agreements on tobacco excise tax and motor vehicle registrations and licenses remain in effect until the end of 2024 if accepted by tribal nations. The court also determined that the bills do not undermine the governor’s ability to negotiate tax compacts with the tribes."

Tennessee

Tenn. House Panel Advances $800M In Corp. Tax Rebates - Sanjay Talwani, Law360 Tax Authority ($). "On a voice vote, the House Finance, Ways and Means Committee passed H.B. 1893 as amended, which would change how the state's corporate franchise tax is determined, reducing future tax payments by about $400 million annually. The bill would also allow some companies to claim rebates of one year of past taxes, at a cost of about $800 million, according to a fiscal note."

Vermont

Vermont House Approves Income Tax Increase for High Earners - Benjamin Valdez, Tax Notes ($):

H. 829 was passed by the House on a 97–42 vote April 2. The bill, as amended by the House Ways and Means Committee, would add a new top personal income tax rate of 11.75 percent for single filers earning more than $410,650 or joint filers earning more than $500,000, beginning in tax year 2025. Vermont’s personal income tax rates range from 3.35 percent to 8.75 percent — the current top rate.

...

The bill, now headed to the Senate for consideration, follows the recent approval of two measures in the House that would raise corporate income taxes. Those bills would use the revenue to raise funding for healthcare and the judicial system.

House lawmakers are setting up a potential standoff with Gov. Phil Scott (R), who said he opposes all three bills. In a largely partisan vote, Democrats praised H. 829 as an equitable solution to the state’s housing crisis, while Republicans criticized the tax increase.

Tax History Corner

Tax History: A Tax for Thee but Not for Me: Woodrow Wilson’s Tax-Free Salary - Joseph Thorndike, Tax Notes Tax History Project:

Woodrow Wilson liked income taxes. But he was happy to avoid paying them, at least on his presidential salary.

Wilson’s tax forms — recently added to the Tax History Project’s archive of presidential returns — studiously avoided any mention of his official compensation, at least for several years of his presidency. The omission is hardly surprising, since Congress had expressly excluded presidential salaries when crafting the Revenue Act of 1913.

While this seems like a bad look for a politician, a version of this seems to have persisted:

Eventually, presidents started paying income taxes on their salaries again. It’s not clear exactly when. Warren Harding and Calvin Coolidge seem to have paid, but they also seem to have received refunds for those payments. In any case, the evidence is thin either way, since the returns of all presidents serving in the 1920s are still private.

All we can say for sure is that Franklin Roosevelt paid income taxes throughout his presidency. We know this because FDR’s returns are public. But we also know, thanks to those same records, that Roosevelt tried repeatedly to shield himself from tax hikes he had personally championed. Beginning in 1934, FDR insisted that his salary could not be diminished by new tax rates. He even applied for refunds based on this familiar argument. (Prior analysis: Tax Notes Federal, June 28, 2021, p. 2055.) The public records of FDR’s taxpaying, however, don’t make clear the success of his efforts.

Nowadays, not only do presidents have to file taxes, but they get audited every year. That's fine, but the tax law would be a lot simpler if the president - and representatives, senators, and cabinet members - had to do their returns in a live webcast - preferably with MST3K avatars for online spectator commentary.

Make a habit of sustained success.