Key Takeaways

- Hey, taxes are due today.

- How to file.

- How to extend.

- How to pay.

- IRS offers last-minute tips.

- Tax bill hopes fade on tax day.

- Donut tax deals.

- It's a matter of interpretation.

- National Laundry Day.

Deadline day. When Dwight Eisenhower was President of 48 states, when "Sh-Boom" by The Crew Cuts was on top of the pop charts, when 1 out of 3 U.S. homes still lacked indoor plumbing, and when average annual taxable income was around $2,300, April 15 became the deadline for filing individual tax returns. Apparently nothing has happened in the last 70 years that would make anybody require any more time to prepare their 1040s, so today is still the filing deadline.

It's not just 1040s:

- Gift tax returns are due today on paper Form 709, unless you extend with paper Form 8892.

- Calendar-year Trust and estate income tax returns are due today on Form 1041, unless extended with Form 8736.

- Calendar-year C corporation returns are due today on Form 1120, unless extended on Form 7004.

- Estimated taxes are due for individuals, trusts and calendar-year C corporations today.

Many states also have returns due today.

If for some reason you are unable to file today - and yes, there are all sorts of developments in the past 70 years that make it harder to meet an April 15 deadline - you can extend your 1040 easily, either by filing a paper Form 4868, or by extending electronically. No matter your income level, you can extend for free using IRS Free File. If you have to pay with your extension, an online extension payment also extends your return.

How should you file? If you can file electronically, that's how you should file, whether you are filing your return or are just extending. The IRS still struggles to process paper returns. Paper returns can delay your refund by months. And despite some silly things you may have read, e-filing is more secure than trusting your return to the vagaries of the postal service.

If you must file on paper, document your filing. Certified Mail, Return Receipt Requested, is the standard. Yes, it costs $4.40, but it can more than pay for itself if the IRS asserts a late filing penalty. If you really are a last-minute filer and you get to the post office after it closes, you can use an authorized private delivery service. Be sure you use the right delivery option; for example, UPS Next Day Air qualifies, but UPS Ground does not. Save your shipping documents.

How should you pay? Consider one of the IRS electronic payment options. You can pay individual estimated tax payments on the IRS direct pay website. This is recommended. Otherwise, you put yourself at the mercy of the postal service and the IRS mailroom.

What if you can't pay? It's still best to file or extend anyway. If you fail to file or extend on time and you have less than 90% of your balance due paid in, you pay a 5% for being one day late, plus 5% for each additional month, up to 25%. If you file or extend on time, that comes down to 1/2% per month. Interest applies to any underpayment as well.

Can I pay in installments? Most taxpayers who owe can qualify online for a payment plan. It doesn't make interest or all penalties go away, but it helps.

Happy filing!

For all of you day traders, today is also a deadline - for 2024 taxes. Today is the last day to make a Section 475(f) mark-to-market election for this year. Those making this election are required to recognize unrealized gains and losses at the end of each year.

The gains and losses for electing taxpayers are ordinary - easing the pain of the $3,000 annual limitation on capital loss use. As day traders typically only hold their investments briefly, the loss of advantageous long-term capital gain treatment may not hurt much.

But if you had big trading losses in 2023, it's too late. The 2023 mark-to-market election was due a year ago.

Filing season winddown

U.S. citizens and resident aliens who live and work outside of the United States and Puerto Rico get an automatic two-month extension, until June 15, to file their tax returns. However, tax payments are still due April 15 or interest will accrue on the unpaid tax.

Members of the military on duty outside the United States and Puerto Rico also receive an automatic two-month extension to file. Those serving in combat zones have up to 180 days after they leave the combat zone to file returns and pay any taxes due. Details are available in Publication 3, Armed Forces' Tax Guide.

When the U.S. president makes a disaster area declaration, the IRS can postpone certain tax deadlines for taxpayers in affected areas. Taxpayers in qualified disaster areas do not need to submit an extension electronically or on paper. Information on the most recent tax relief for disaster situations can be found on the Extension of time to file your tax return page.

Phone Wait Times, Service Rebound With Extra Cash, IRS Says - Erin Slowey, Bloomberg:

...

Phone wait times on the IRS main helpline also dropped to an average three minutes, down from last year’s four minutes and a significant cut from the nearly 30 minutes taxpayers waited during the 2022 filing season. The IRS also answered more than 1 million more calls compared to the same period in 2023.

Filing Season Sees Uptick in Refund Amounts and Website Use - Benjamin Valdez, Tax Notes ($):

Also this:

...

Kristan said that uncertainty over the House-passed tax bill has added stress for business taxpayers, as has the inability to deduct research costs.

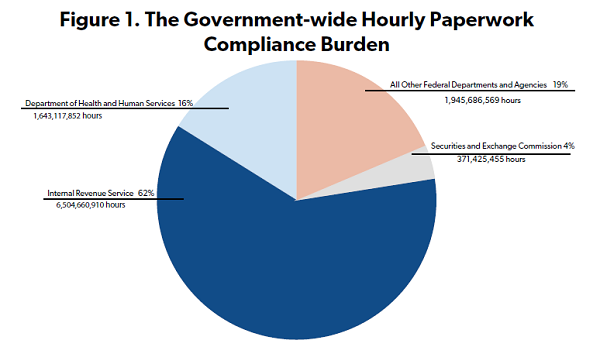

Tax Complexity: How Long and How Much Do Income Taxes Cost? - Demian Brady, National Taxpayers Union Foundation. "NTUF’s estimate of tax complexity uses analysis of data and supporting documentation that the IRS files with the Office of Information and Regulatory Affairs (OIRA) pursuant to statutory requirements to track paperwork burdens. Complying with the tax code in 2023 consumed a staggering 6.505 billion hours, including tasks such as recordkeeping, learning about the law, filling out the required forms and schedules, and submitting information to the IRS."

Tax news from D.C.

Tax Day Comes While the Tax Bill Fades Away - Samantha Handler, Bloomberg:

Senate Finance Chair Ron Wyden (D-Ore.) emphasized over the last few months that he wanted the Senate to vote on the $78 billion tax package he negotiated with House Ways and Means Chair Jason Smith (R-Mo.) before the filing season was over. While the package of business and family tax breaks easily passed the House, it’s been blocked in the Senate by Republicans who have a variety of issues with the bill.

Our Jay Heflin reports:

Legislative outlook: With each passing day, the odds decrease for the tax bill passing the Senate and becoming law.

New Appropriations Chair Expects Renewed Run at IRS Funds - Doug Sword, Tax Notes ($):

Rep. Tom Cole, R-Okla., who was tapped April 10 to lead the powerful panel, said he didn’t want to prejudge what appropriators would want but noted he supported efforts during the last budget cycle to claw back $67 billion in IRS funding and to eliminate federal funding to the OECD.

Blogs and bites

Score Delicious Deals And Freebies On Tax Day 2024 - Kelly Phillips Erb, Forbes.

For example:

Can't finish your taxes? File for an extension instead - Kay Bell, Don't Mess With Taxes. "Pay what you can: A lot of people put off filing because they know they owe. But as noted (repeatedly), delaying isn't going to help here. Not to belabor the point (again), but you must pay your expected tax liability when you file Form 4868."

Bozo Tax Tip #1: Use a Bozo Tax Professional! - Russ Fox, Taxable Talk. "Don’t be a bozo. If you use a tax professional, use an ethical preparer. You may pay more and get a lesser refund, but you will rest a lot easier."

Tax Day 2024 – Let’s Celebrate with Some History! - Chris Korban, Tax School Blog. "Tax Day for the federal income tax in the United States first fell on March 1, 1913. Just five years later in 1918, the deadline was changed to March 15. It wasn’t until 1955 when April 15 became Tax Day, and it remains as such to this day barring conflicts with weekends, holidays, or, as we observed in 2020 and 2021, extenuating circumstances. "

The Real Tax Gap - Eric Boehm, Reason. "The sense that the wealthy aren't paying as much these days might stem from the fact that the top marginal tax rates have steadily fallen in recent decades. The top federal income tax bracket charged 70 percent in 1980, but today demands 37 percent from those lucky enough to qualify for it. Despite that, the tax code has grown significantly more progressive during the same period. The top 1 percent of earners paid less than 20 percent of all income taxes in 1980, and well more than double that amount now."

Tax in the courtrooms

Government Insolvency Not Needed for Tax Debt Ruling, Court Says - Mary Katherine Browne, Tax Notes ($):

“By the district court’s lights, no court ever would order relief under section 7402, because the national government’s solvency does not depend on tax payments from any one person or business, even the largest. Yet judges should not interpret statutes in a way that makes them ineffectual,” the court said.

From the Seventh Circuit opinion (taxpayer names and citations omitted):

The United States filed this suit seeking both a money judgment and an injunction compelling the Taxpayers to deposit withholding taxes into a bank using an approved payroll service. The proposed injunction also would require the Taxpayers to pay their taxes ahead of private creditors, permit the IRS to inspect their books. and records, and notify the IRS if they start another business

The district court surprisingly ruled that while the taxpayers needed to pay the back taxes, he wouldn't order an injunction to force them to remit future withholdings. The appellate court wasn't having it: "The district court's contrary decision on these factors is an abuse of discretion."

...

Mizuhara allegedly also telephoned the bank and falsely identified himself as Ohtani to trick bank employees into authorizing wire transfers from Ohtani’s bank account to associates of the illegal gambling operation.

From January 2024 to March 2024, he also allegedly used this same account to purchase via eBay and Whatnot approximately 1,000 baseball cards – at a cost of approximately $325,000 – and had them mailed to Mizuhara under an alias, “Jay Min,” and mailed to the clubhouse for Ohtani’s current MLB team

No tax charges have yet been filed, though theft income is taxable. As the gambling losses are deductible only to the extent of gambling winnings, the interpreter likely faces a good-sized tax bill.

It seems that tax cheats and embezzlers like sports memorabilia, There are probably worse uses for IRS agent time than hanging around memorabilia shows.

What day is it?

If filing taxes today isn't enough fun for you, it's also National Laundry Day!

Make a habit of sustained success.