Key Takeaways

- Pass-through entity taxes and SALT deduction cap revenue.

- State officials pan IRS Direct File.

- Legislative developments.

- Can states afford tax cuts?

- The year 75% of federal income taxes were forgiven.

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs.

SALT Workarounds Present Revenue Headache for 2025 Tax Talks - Samantha Handler, Bloomberg ($):

...

Both progressive and conservative tax groups back outlawing the workarounds, though no federal legislation has been introduced yet to do so. Closing the workarounds will likely be part of 2025 negotiations, as much of the 2017 law expires at the end of that year, including the SALT cap.

The workarounds invite “a lot of complexity into the law for no good reason, other than to skim off whatever it is of the revenue that would otherwise go to the government from the imposition of the SALT cap,” said Kirk J. Stark, a tax law professor at UCLA.

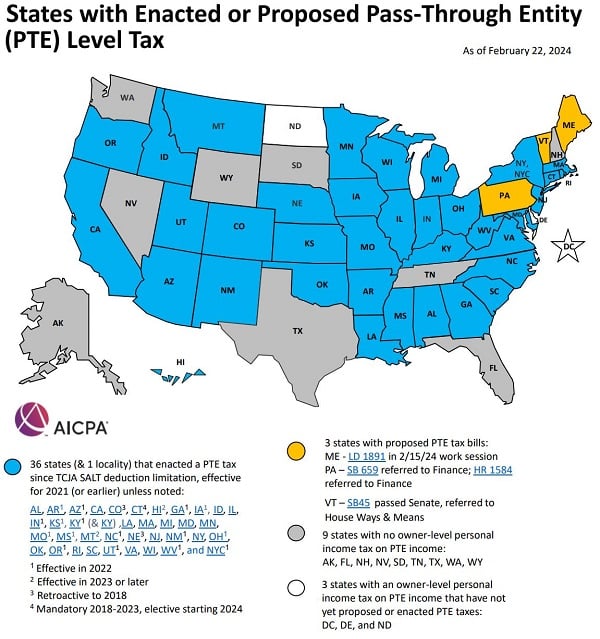

The IRS opened the door to entity-level taxes to work around the $10,000 cap on itemized deductions for state and local taxes when it issued Notice 2020-75 in November 2020. Pass-through entity taxes have been enacted in 36 states. Each state's version is a little different, with varying rules for payment, electing the regime, whether the state provides an owner income exclusion or tax credit, and whether tax credits are refundable.

While Notice 2020-75 allows entities to deduct these optional taxes, questions remain over the timing of the deductions and the taxation and nature of any resulting refunds.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap Workaround.

State Officials Urge IRS to Nix Direct File Program - Emily Hollingsworth, Tax Notes ($):

The IRS recently made its pilot program available in 12 states, allowing eligible taxpayers to electronically file federal tax returns directly on the IRS’s website for free. The Inflation Reduction Act of 2022 directed funding to the IRS to study the feasibility of a direct-filing program.

In the letter, the 21 state officials call for the IRS’s direct-file option to be terminated at the end of the pilot program, arguing that “Direct File will create challenges for taxpayers and state treasurers and the costs of Direct File far outweigh any potential benefits it may confer to taxpayers.”

State-By-State Roundup

California

Wealthy Californians Can Use Existing Strategies to Reduce Taxes - Marguerite Weese, Bloomberg:

...

Rather than focusing on uncertainty, high-net-worth individuals looking to reduce their tax burdens in California may want to consider their existing options: moving themselves or assets out of state, using irrevocable trusts, or exploring charitable tax reduction strategies.

Florida

Disney Succumbs to Ron DeSantis in Fight Over Florida Tax District - Robbie Whelan and Joseph De Avila, Wall Street Journal. "The confrontation crescendoed last year, when the Republican-controlled Florida legislature passed a law to strip Disney of its authority over the Reedy Creek Improvement District, a uniquely designed tax entity set up in the late 1960s that had given Disney extensive control over the governance of Walt Disney World’s land and infrastructure for more than 50 years."

Idaho

Idaho to Cut Income Tax Rate, Boost School Facilities Funding - Emily Hollingsworth, Tax Notes ($). "H. 521, which is backed by Gov. Brad Little (R), would lower the state's flat individual and corporate income tax rate from 5.8 percent to 5.695 percent, retroactive to January 1. It would also bolster funding for school facilities by more than $150 million annually to limit the amount of property taxes school districts would need to fund facilities. The Senate passed the bill on a 23–11 vote March 21 after the House approved it 61 to 6 on February 23."

Kansas

Kan. House Passes Tax Rate Cuts, Early End To Food Tax - Jaqueline McCool, Law360 Tax Authority ($). "The House substitute for S.B. 300 unanimously passed the lower chamber and now heads to the Senate for consideration. The bill would restructure the state's income tax rates for single and joint filers, reduce the state's bank tax to 1.63% and end the sales tax on food this summer rather than phasing it out under an existing plan. The first $100,000 in value of a residential property would also be exempt from tax under the bill."

Maryland

Maryland’s Worldwide Combined Reporting: To Be or Not to Be? - Andreay Yushkov, Tax Foundation. "Much of state revenue officials’ optimism regarding worldwide combined reporting comes from a report by the Institute on Taxation and Economic Policy (ITEP). The report, which made inaccurate assumptions about apportionment rules and global profit shifting, estimated corporate income tax gains from adopting worldwide combined reporting in Minnesota would be $418 million, about a third of total state corporate franchise tax collections. The Tax Foundation, COST, and other organizations have exposed the report’s faulty assumptions."

Missouri

Mo. House OKs Banning St. Louis Tax On Remote Workers - Paul Williams, Law360 Tax Authority ($). "St. Louis is one of two cities in Missouri that imposes an earnings tax on employee wages, with Kansas City being the other, but it is the only one that has taken the position that it can tax remote workers. Six remote workers sued St. Louis over the practice, and in 2023,Judge Jason Sengheiser of the 22nd Judicial Circuit Court ordered the city to issue them refunds, holding that the city illegally made an administrative change to its prior policy of providing tax refunds to workers for days worked outside the city."

Missouri House Sends Corporate Tax Phase-Out Bill to Senate - Angélica Serrano-Román, Bloomberg ($). "The House voted 100-50 to pass HB 2274, aiming to reduce the corporate income tax from the current 4% to 3%, effective Jan. 1, and to lower it annually by one percentage point until it would end by 2028. The rate had been 6.25% before it was cut to 4% in 2018."

Nebraska

Nebraska Lawmakers Advance R&E Deductions, Income Tax Safe Harbor - Emily Hollingsworth, Tax Notes ($):

The bill would also decouple the state from IRC sections 168(e)(6) and 168(k) to allow for an immediate and total deduction for expenses related to qualified improvement property or qualified property, respectively, starting in tax year 2025.

As amended by the Revenue Committee, the bill also incorporates provisions from five other tax bills, according to a March 22 legislative update.

Link: L.B. 1023

New Jersey

New Jersey Legislature Passes Bill to Increase Petroleum Tax Cap, Tax EVs - Matthew Pertz, Law360 Tax Authority ($). "If enacted, the bill would also institute a $250 fee on the registration or renewal of an EV. The fee would increase by $10 every year until it reaches $290 in 2028."

Link : A. 4011

New York

New York’s Convenience-of-Employer Test Stands on Wobbly Ground - Arthur Rosen, Michael Hilkin, and Jonathan Hague, Bloomberg:

However, the “convenience of the employer” test, or convenience test, provides a radical qualifier by adding that “any allowance claimed for days worked outside New York State must be based upon the performance of services which of necessity, as distinguished from convenience, obligate the employee to out-of-state duties in the service of his employer.”

Tennessee

Tenn. House Panel OKs Corp. Tax Change, $800M In Rebates - Sanjay Talwani, Law360 Tax Authority ($):

If enacted, the measure would eliminate a component of the tax tied to property value, saving corporations $400 million per year, while allowing rebates of some past payments, at a cost of about $814 million in the amended bill, according to a fiscal note.

West Virginia

West Virginia bill phasing out tax on Social Security benefits signed into law - Bob Aalron, WCHSTV.com. "Retroactive to Jan. 1 of this year, it applies to taxes filed in 2025. After that 35% cut, the 2026 filing will drop 65% on Social Security income and then disappear in total when 2026 taxes are filed in 2027."

Wisconsin

Wisconsin Governor Approves Tax Reciprocity Study, Bullion Exemption - Paul Jones, Tax Notes ($):

S.B. 374, signed by Gov. Tony Evers (D) March 21, directs the Department of Revenue to pursue a study with the Minnesota DOR regarding how recreating a reciprocal income tax agreement would affect both states. The study’s focus would include the number of cross-border workers and the potential amount of tax revenues that would be forgone by each state if they create a new reciprocal income tax agreement. The study is intended to facilitate negotiation of a new agreement.

Vermont

Vermont House Approves Corporate Tax Increase - Benjamin Valdez, Tax Notes ($):

...

Both bills are non-starters for Gov. Phil Scott (R), who on March 27 devoted his weekly press conference to urging against the proposed changes.

Link: H.721

Tax Policy Corner

Can States Afford Their Recent Tax Cuts? - Jared Walczak, Tax Policy Blog:

Think about what this means. The tax-cutting states grew revenue faster with lower rates.

We shouldn’t take this too far, naively asserting that tax cuts paid for themselves. But we should also acknowledge that states that have prioritized tax competitiveness have done better than their status quo peers.

Tax History Corner

Tax History: Compromising on the Current Tax Payment Act of 1943 - Joseph Thorndike, Tax Notes Tax History Project. The Tax Notes historian discusses a problem that hadn't occurred to me - the problem of moving to income tax withholding when it hadn't been required before:

The move to current collection created a transition problem: Absent any relief provisions, taxpayers would be expected to double up on tax payments.

The solution is one I don't think we'll see the likes of again:

I can't imagine the planning in the transition year, especially without modern computers.

Make a habit of sustained success.