Key Takeaways

- Market-based sourcing isn't always simple.

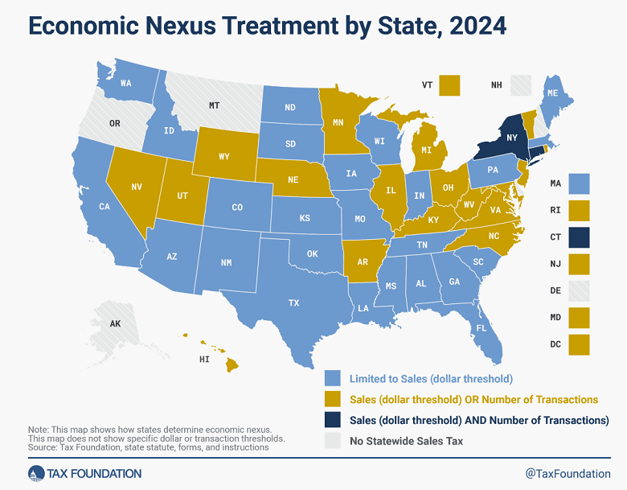

- Forget the 200-transaction rule?

- Economic nexus.

- Retroactive Tax bills advance in Iowa, Pennsylvania.

- Utah enacts income tax cut.

- Wisconsin nixes sales taxes on bullion.

- The Irish Hearth Tax.

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs.

Practitioners Discuss Challenges for Market-Based Sourcing States - Cameron Browne, Tax Notes ($):

More states are adopting market-based sourcing for apportionment, and while it might seem easier to use than the cost-of-performance method, it has also created new questions that need answers, according to practitioners.

Speaking on a March 12 panel at the American Bar Association/Institute for Professionals in Taxation advanced tax seminars in New Orleans, Heather Weiner, senior director of tax and risk management at American Eagle Outfitters Inc., noted that 21 states have adopted market-based sourcing in the last 10 years. There is no sign that the states will reverse that trend, she added.

"Market-based sourcing" is when state tax agencies attribute sales of services based on where the benefit of the service occurs, rather than where the service is performed. The article discusses complications than can arise:

Speakers on the panel said that while determining who the customer is may be simple for a lot of transactions, sales of services can get more complicated. Jennifer W. Karpchuk, the co-chair of the state and local tax practice at Chamberlain Hrdlicka, noted that there can be multiple beneficiaries of a taxpayer’s service and it is important to determine who receives the primary benefit of the taxpayer.

Transactional Threshold for Economic Nexus Falling Out of Favor - Christopher Jardine, Tax Notes ($):

Following the Supreme Court’s 2018 decision in South Dakota v. Wayfair Inc. — in which the Court upheld South Dakota’s law providing that remote sellers are subject to sales tax if they have sales exceeding $100,000, or have 200 or more separate transactions, in the state — numerous states moved to pass similar laws.

The article quotes Jamie Yesnowitz of Grant Thornton:

“I think that [a transactional threshold is] kind of a wonky rule, because it kind of affects different taxpayers differently. If you have someone that sells really cheap widgets, you can get 200 transactions very quickly, and for very little revenue, they now have to collect in that jurisdiction. And that leads to the worst of both worlds. The taxpayer has [costs of collecting] and the state doesn’t get very much money from those taxpayers."

Economic Nexus Treatment by State, 2024 - Manish Bhatt, Tax Foundation. "Prior to the Supreme Court’s 2018 decision in South Dakota v. Wayfair, only sellers with a physical presence in a state could be required to collect and remit state sales taxes. (States sometimes got creative through ideas like “click-through nexus” or “cookie nexus” in an effort to circumvent the restriction.) The Wayfair court, however, recognized the changing nature of the economy and the rise of e-commerce and overturned decades of precedent, allowing states to begin taxing non-resident businesses selling into the state."

State-By-State Roundup

Arizona

Ariz. Rebates Trigger Federal Tax, IRS Tells Court - Sanjay Talwani, Law360($):

Arizona's one-time 2023 payments to taxpayers are subject to federal taxation because they do not qualify for exclusions for general welfare or disaster relief payments, the Internal Revenue Service told a federal court.

The reduced rate, which goes into effect May 1, applies retroactively to the start of the 2024 tax year.

Arizona Judges Hit Car-Parts Seller Hard on Tax Nexus Arguments - Perry Cooper, Bloomberg Tax($). "Online auto parts retailer RockAuto LLC faced a tough crowd at oral arguments before an Arizona appeals court Wednesday in its suit over whether sales into the state drew transaction privilege taxes."

Colorado

Colorado DOR Adopts Regulation on Individual Income Tax Federal Deductions Addback - Michael Murphree, Bloomberg Tax($). "The Colorado Department of Revenue (DOR) adopted a regulation on an individual income tax addback for certain federal deductions. The purpose of the rule is to provide guidance to certain individual income taxpayers who are required to add back a portion of the itemized or standard deductions from their federal income tax return to determine their Colorado taxable income."

Georgia

Georgia Tax Deductions for Fetuses Lowered Tax Base $100 Million - Michael Bologna, Bloomberg ($). "The state Department of Revenue reports 36,486 unborn children with a detectable heartbeat were claimed on 2022 tax returns. Georgia offers a $3,000 dependency deduction, resulting in a $109.4 million reduction to its taxable base, the department said. Georgia operated a graduated personal income tax in 2022 with rates ranging from 1% to 5.75%, resulting in a tax expenditure of under $6 million to the state."

Illinois

Chicago Voters Nix Tiered Rates On Real Estate Transfer Tax - Maria Koklanaris, Law360 Tax Authority ($). "Chicago voters rejected a contentious referendum Tuesday night that would have authorized the city to impose tiered real estate transfer tax rates including an increase for properties sold at $1 million and higher."

Indiana

Indiana Removes Transaction Threshold for Remote Sellers - Emily Hollingsworth:

A new law in Indiana retroactively eliminates the transaction threshold from the state's remote seller nexus law.

...

Under prior law, Indiana required remote sellers to collect and remit the state's 7 percent sales tax if they exceeded 200 separate sales transactions in the current or previous calendar year or if their gross revenue from in-state sales exceeds $100,000 in a calendar year. The latter threshold was not eliminated under S.B. 228.

Link: S.B. 228

Iowa

Iowa Bill Would Require Flat Income Tax and Bar Graduated Rates - Emily Hollingsworth, Tax Notes($). "A recently introduced Iowa bill would mandate a flat individual income tax and bar the state from adopting graduated rates."

Iowa advances farm tax breaks. The Iowa General Assembly has advanced three tax bills that may affect 2023 tax filings for farm taxpayers.

HF 2649 would enact a capital gain exemption for the sale of breeding livestock for taxpayers whose gross income is over 50% from farming. It is similar to a deduction that was repealed with the tax reform package that took effect last year. The bill cleared the Iowa House on a 94-0 vote.

HF 2666 would expand the exclusion for retired farmer lease income to cover income from pass-through entities. The current exclusion only covers farm tenancies for land directly owned by a farmer. It was advanced out of the Iowa House Ways and Means committee this week.

HF 2660, advanced this week by the Iowa House Ways and Means committee this week, would clarify the application of reseach credit to "agriscience research." Iowa does not allow a research credit for agricultural production activities, and some aggressive taxpayers have claimed that their farming is permitted "agriscience." This would be effective retroctively to 2017.

Taxpayers who might be affected by these bills might want to hold off on filing 2023 returns until their status is resolved.

Kansas

Kansas Lawmakers Again Push Flat Tax Proposal - Emily Hollingsworth, Tax Notes($). "Kansas lawmakers are again advancing a flat income tax proposal, despite Gov. Laura Kelly (D) repeatedly calling a flat tax a nonstarter."

Minnesota

Minn. House OKs Retroactive NOL Deduction Fix - By Sanjay Talwani, Law360($). "Minnesota would retroactively delay the effective date of a cut to its allowable income tax deduction for net operating losses under legislation passed by the state House of Representative to correct an error in previous legislation."

Nebraska Consumption Tax Proposal Is 'Bad Policy,' Tax Foundation Says -Emily Hollingsworth, Tax Notes($). A Nebraska proposal to eliminate the state's income, sales, and corporate taxes in favor of a broad consumption tax would hurt the state's competitiveness and could result in “an unprecedented fiscal crisis,” according to the Tax Foundation.

New Jersey

AT&T Entity Challenges $78.5M R&D Tax Credit Denial In NJ - Paul Williams, Law360($). "New Jersey's tax agency improperly denied an AT&T entity's attempt to carry forward nearly $78.5 million in research and development tax credits from closed tax years to an open tax year, the company argued in the state Tax Court."

New York

NY High Court Revives Suit Against NYC Property Taxes - Law360 Staff, Law360($). "A lawsuit challenging the fairness of New York City's property tax system lives on, with New York's highest court finding a group's complaint sufficiently pleads causes of action against the city for violations of New York's Real Property Tax Law and the federal Fair Housing Act."

Pennsylvania

Pennsylvania Taxwriters Advance SALT Cap Workaround Bill - Benjamin Valdez, Tax Notes ($).

"Members of the committee on March 20 voted 9 to 2 to advance S.B. 659, a bill that would allow passthrough entities to pay tax at the entity level at the flat personal income tax rate of 3.07 percent and for owners to claim a refundable credit for the taxes. The measure would allow passthrough owners to effectively avoid the $10,000 cap on individuals' SALT deduction established under the federal Tax Cuts and Jobs Act."

The story says the bill would be effective retroactively to 2021.

South Carolina

Amazon Loses Rehearing Bid In $12.5M SC Sales Tax Dispute - Maria Koklanaris, Law360($). "Amazon does not merit a rehearing of a South Carolina appeals court panel ruling that the online retail giant owes the state $12.5 million in sales tax for marketplace sales made before the landmark Wayfair decision, the panel said Monday."

These two cases, RockAuto LLC and Amazon, are just two recent court cases that address physical presence vs. economic nexus. Chances are good that we will continue to see Wayfair related issues come through the state courts over the next few year.

Utah

Utah Approves Income Tax Rate Cut - Jared Serre- Law360($):

Utah's flat income tax rate will drop from 4.65% to 4.55% under a bill signed into law.

S.B. 69, which was signed Thursday by Republican Gov. Spencer Cox, impacts the state's individual income tax rate, as well as corporate income and franchise tax rates.

Wisconsin

Wis. Exempts Bullion With Precious Metals From Sales Tax - Michael Nunes, Law360 Tax Authority ($). "A.B. 29, which Democratic Gov. Tony Evers signed Thursday, exempts metal bullion that contains at least 35% gold, silver, copper or other precious metals from the state's 5% sales tax"

Wisconsin Cheese Maker Stuck Paying Taxes on Its Machinery - Bernie Pazanowski, Bloomberg Tax($). "Some equipment used by a Wisconsin cheese manufacturer isn’t exempt from taxation under an provision for “machinery, tools, and patterns, not including such items used in manufacturing,” the Wisconsin Court of Appeals said Wednesday."

Tax Policy Corner

Don't Do It, Vermont - David Brunori, Law360 Tax Authority ($):

Vermont is considering mandatory worldwide combined reporting. Yes, the Supreme Court said it was legal back in 1983. But since then, no state has enacted worldwide except for some weirdness in Alaska.

If you get a chance, read the Council on State Taxation's letter to the Vermont Legislature laying out the argument against worldwide combined reporting. It is available on the COST website. The letter presents a brief history of the issue. It also explains the compliance burdens placed on companies. And don't forget the international issues created by worldwide combined reporting. When California did this in the early 1980s, it nearly sparked a trade war ― with our allies.

Tax History Corner

This week was St. Patrick's Day, so this is a fitting time to consider the Irish Hearth Tax. Per Wikipedia: Unlike in England, which abolished the Hearth Tax in 1689, it continued in the Kingdom of Ireland till the early 19th century although it underwent major reform at end of the 18th century. It was levied half yearly by the Sheriff of each county on the basis of lists of the names of householders compiled by local Justices of the Peace. The list of the households required to pay the Hearth Tax became known as the Hearth Money Rolls, which were arranged by county, barony, parish, and townland. The tax was sometimes collected over an area known as a 'walk', which was based on both the town and a large rural area outside the town. It may not have been popular in 17th Century Ireland, but surviving tax records are a boon to their descendants doing ancestry research.

Make a habit of sustained success.