Key Takeaways

- GOP eyes continued SALT deduction cap

- States slow in adopting to federal partnership exam rules.

- Revenues slowing.

- Zapper transparency.

- California faces worldwide tax limits.

- Legislation moving in GA, HA, IL, IN, NM, VT, WA.

- Wisconsin tax cut veto.

- NJ S corporations may need to amend.

- Accounting records going way back.

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs. The SALT roundup is taking next week off and will return March 22.

Permanent SALT Cap Among Republican-Favored Tax Revenue Raisers - Jack Fitzpatrick, Bloomberg ($).

A permanent $10,000 limit on state and local tax deductions would be a high priority for Republicans in a bipartisan commission on the debt, a key GOP lawmaker said Thursday, acknowledging members would need to raise revenue to reach a deal with Democrats.

The piece cites House Budget Committee Chair Jodey Arrington:

Congress capped the state and local tax deduction — dubbed the SALT cap — at $10,000 in the 2017 Republican-backed tax law (Public Law 115-97). The limit is among the provisions of the law expiring at the end of 2025. Making it permanent would reduce the deficit by $1.2 trillion between 2026 and 2033, according to the Tax Foundation, a figure Arrington cited.

No mention is made on the future treatment of pass-through entity taxes enacted to work around the SALT deduction cap if the cap is made permanent, but that is likely to be an issue.

Related: IRS Blesses Entity-level Tax Deduction used as SALT Cap

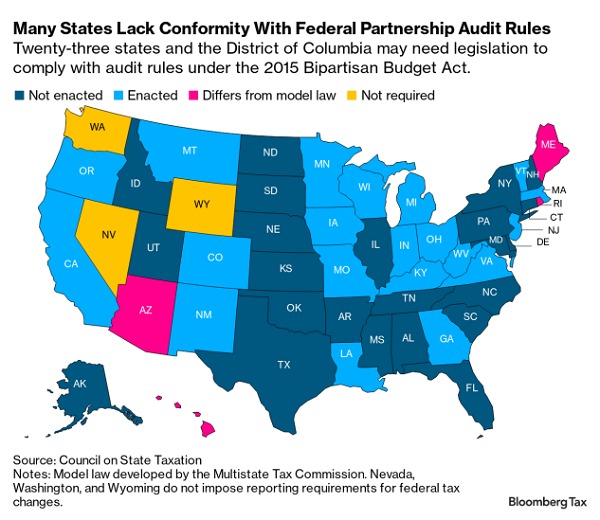

States Lag in Adopting Federal Partnership Tax Audit System - Angélica Serrano-Román and Michael Bologna, Bloomberg ($):

The IRS’s partnership audit regime, established in the Bipartisan Budget Act of 2015 and in effect since 2018, introduced a centralized process aimed at streamlining audits of large, complex partnerships, including private equity firms and hedge funds. Under this system, the agency can assess and collect taxes at the partnership level rather than at the individual partner level, unless the partnership elects to have partners compute and pay the tax.

But 23 states and the District of Columbia haven’t enacted the laws necessary to collect their share of tax adjustments resulting from federal audits. The lag has led to potential revenue losses for states and confusion for taxpayers, including large multistate businesses often required to file hundreds—sometimes thousands—of amended returns at the state and local levels when federal adjustments occur, practitioners said.

Falling US State Tax Collections Threaten More Budget Pain - Melina Calkia, Bloomberg ($). "Thirty-seven states saw tax collections sink in the six months through December, compared to the same period a year earlier, according to inflation-adjusted data from the Urban Institute . Total state tax revenue dropped in December by 4.5% year-over-year, the data show."

Tax ‘Zappers’ Warrant Transparency by State Revenue Departments - Andrew Leahey, Bloomberg:

The battle against sales tax evasion has taken a sophisticated turn in the past few decades with the advent of sales tax “zappers”—electronic sales suppression software that manipulates sales records to evade remitting collected sales tax. Most recently, Wisconsin in December joined more than 30 other states in criminalizing the use of these tools.

...

State revenue departments should provide lists of POS systems they have found to contain, or have available, corresponding zappers or electronic sales suppression tools—just as the IRS maintains its listed transactions lists. Publishing such lists wouldn’t necessitate an end to audits or investigations of businesses that choose to use them.

Instead, it would represent a shift toward an environment where businesses are put on notice and given an opportunity to avoid entanglement with problematic systems from the outset. It would further encourage POS system providers and developers to maintain high standards of compliance and stay ahead of zapper development.

State-By-State Roundup

California

Calif. OTA Ruling May Limit Foreign Income State Can Reach - Maria Koklanaris, Law360 Tax Authority ($). "In its ruling, obtained Monday by Law360, the OTA concluded that Microsoft can include 100% of dividends received from foreign affiliates in the denominator of its California sales factor even though only 25% of its foreign dividends were included in income subject to apportionment. As a result, all of Microsoft's qualifying dividends, totaling about $109 billion, were included in its sales factor denominator, and the income apportionable to California was greatly reduced, triggering a $94 million refund."

Georgia

Georgia House OKs Bills to Match Corporate and Income Tax Rates, Create Tax Court - Matthew Pertz, Tax Notes ($). "H.B. 1023, sponsored by Rep. Bruce Williamson (R), would tie the corporate income tax rate to the individual income tax rate permanently. Both rates are currently 5.49 percent, but a bill endorsed by Gov. Brian Kemp (R) and passed by the House would lower the individual income tax rate to 5.39 percent for 2024, and there are further scheduled cuts from Kemp’s 2022 flat tax bill that could bring the rate down to 3.99 percent by 2028. H.B. 1023 passed 138 to 28 on February 29."

Georgia House Votes to Tighten Rules for Film Tax Incentives - Angélica Serrano-Román, Bloomberg ($). "Amid scrutiny from lawmakers and critics of the incentive program, the state House passed HB 1180 on Thursday by a vote of 131-34. The measure places a cap on the value of tax credits that can be transferred each year, limiting annual transfers to 2.5% of the state budget, which amounts to around $900 million based on current spending figures."

Hawaii

Hawaii House OKs $25 Tourism Tax To Fight Climate Change - Jaqueline McCool, Law360 Tax Authority ($). "H.B. 2406, which the state House of Representatives passed by a 47-2 vote Tuesday, would mandate that revenue from the tax on transient accommodations would go into a fund to combat the effects of climate change. The tax would not apply to emergency accommodations, according to the bill."

Hawaii Senate OKs Cannabis Legalization Bill - Sam Reisman, Law360 Tax Authority ($). The bill would establish a new Cannabis Regulatory Authority to oversee legalization and tax cannabis sales at 14%, and would go into effect Jan. 1, 2026. The proposal would allow individuals to possess up to an ounce of cannabis flower and up to 5 grams of products.

Link: S.B. 3335

Hawaii Senate OKs Federal Tax Conformity - Jaqueline McCool, Law360 Tax Authority ($). "S.B. 3173, which was unanimously passed in the Senate on Tuesday, would update the state's tax laws relating to income, estate and generation-skipping transfer taxes to conform to the 2023 federal code. The bill goes next to the state House of Representatives."

Illinois

Illinois Appeals Court: 'Mansion Tax' Measure Should Be on Ballot - Christopher Jardine, Tax Notes ($). "In Building Owners and Managers Association v. Board of Election Commissioners for the City of Chicago, the Appellate Court of Illinois, First District, vacated the Circuit Court of Cook County's order directing the Chicago Board of Election Commissioners to disregard votes cast on a referendum that asks whether the transfer tax rate should be increased for properties that sell for more than $1 million and decreased for properties that sell for less than $1 million."

Indiana

Indiana Legislature OKs Removing Transaction Threshold for Remote Sellers - Emily Hollingsworth, Tax Notes ($). "The bill would eliminate the requirement that remote sellers collect and remit sales taxes to Indiana if they exceed 200 separate sales transactions into the state for the present or previous calendar year. The change would be retroactive to January 1. Under the bill, remote sellers will still be required to collect and remit the tax if their annual gross revenues from Indiana sales exceed $100,000."

Link: S.B. 228

New Jersey

NJ Says Tax Form Error May Require Filers To Amend Returns - Paul Williams, Law360 Tax Authority ($). "The version of Schedule K in form CBT-100S that was originally released contained an error in Part III, and taxpayers "should review their returns to ensure that they've properly reported their corporation business tax," the division said in a notice posted online Friday. Taxpayers will be required to file an amended return if they reported an incorrect amount, the division said."

New Jersey Governor Proposes Surtax on Big Businesses to Fund Transit - Matthew Pertz, Tax Notes ($). "The proposed tax — called a corporate transit fee in Murphy's fiscal 2025 budget — would be levied at 2.5 percent on companies with over $10 million in revenue. Essentially a reboot of the corporate business tax surcharge that expired at the end of 2023, the fee would affect fewer businesses than the original surtax, which was imposed on any business with more than $1 million in income."

New Mexico

New Mexico Enacts Tax Relief, Flat Corporate Rate - Paul Jones, Tax Notes ($):

New Mexico Gov. Michelle Lujan Grisham (D) has approved an omnibus tax package that includes rate cuts for lower levels of income, changes to the capital gains deduction and to the taxation of subpart F income, and clean energy industry incentives.

The fate of H.B. 252, signed into law March 6, contrasts with the governor’s veto of many parts of last year’s omnibus tax bill, which contained many similar provisions. At that time, Lujan Grisham cited concerns about the 2023 bill's roughly $1 billion ongoing cost, but H.B. 252 is much less pricey. The latest fiscal estimate projects that it will cost the general fund $186.7 million in fiscal 2025, which would grow to $266.5 million in fiscal 2028. The cost for localities would range from $10.5 million to $9.6 million for those years.

Tennessee

Small Businesses No Longer Have to File Business Tax - Tennessee Department of Revenue. "The Tennessee Works Tax Act eliminated the annual business tax filing obligation for businesses with annual gross sales under $100,000 within a county and/or city. This change applies to tax periods ending on or after December 31, 2023. To help raise awareness of this change, the Department of Revenue recently sent letters with instructions to business owners who may be affected asking them to confirm locations that are no longer subject to business tax."

Vermont

Vermont Lawmakers Consider Harmful Taxes on the Wealthy - Manish Bhatt, Tax Policy Blog. "Through H.827, Vermonters with a net worth of $10 million or more would be taxed on unrealized capital gains. Specifically, the bill would apply individual income tax treatment to 50 percent of the unrealized gain or loss of a taxpayer’s assets. The tax would be capped at 10 percent of the worth of the taxpayer’s assets exceeding $10 million. Vermont would not seek to tax the same unrealized gains or losses twice; if an unrealized gain for a particular investment were taxed and then that gain was lost and regained, the restored return on investment would not be re-taxed."

Washington

Washington Lawmakers Approve Income Tax Ban - Paul Jones, Tax Notes ($):

Washington state lawmakers have approved an initiative barring state and local income taxes, avoiding a November ballot fight over the question.

Initiative 2111 was passed by the Senate on a 38–11 vote and by the House on a 76–21 vote on March 4, just days before the session's end. The measure — which was qualified via signature-gathering in January by Let’s Go Washington, a conservative group backed by Republican millionaire Brian Heywood — establishes that neither the state nor any locality may impose a tax on personal income. Washington has no income tax, and a 1933 precedent limits any income tax to a uniform levy of not more than 1 percent.

Wisconsin

Wis. Gov. Vetoes GOP Income Tax Cut Proposal, Again - Michael Nunes, Law360 Tax Authority ($). "On Friday, Gov. Tony Evers vetoed A.B. 1020, which would have expanded the second-lowest income tax bracket, subject to a 4.4% tax rate, to include income between $14,320 and $112,500 after adjustment for inflation. Currently, that bracket covers income between $14,320 and $28,640, with income over $28,640 subject to tax of 5.3%. In a veto message, the governor said that he vetoed the legislation because it would reduce funding for social programs."

Tax Policy Corner

As Congress Debates a More Generous Child Tax Credit, 11 States Already Deliver a Fully Refundable CTC - Richard Auxier and Nikhita Airi, TaxVox. "As explained in a new brief on state child tax credits, 11 states currently provide a “fully refundable” CTC. That is, there is no income phase in, so a family with an eligible child but little or no income still gets the state credit. And if the refundable state credit exceeds the household’s state income tax liability, the household receives the excess amount as a refund payment from the state."

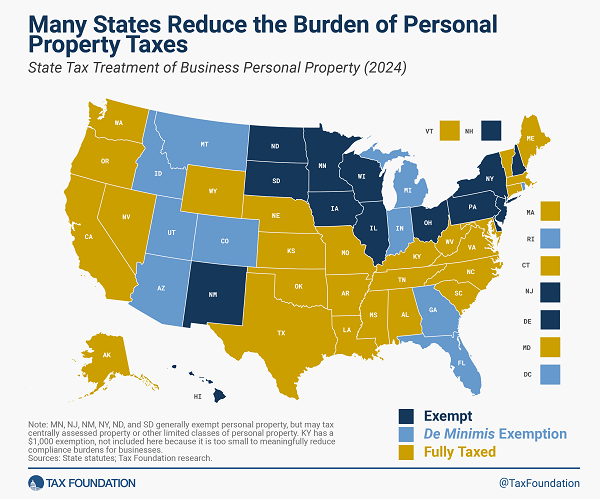

Tangible Personal Property De Minimis Exemptions by State, 2024 - Jared Walczak, Tax Foundation. "In most states, businesses not only pay taxes on their real property (land and structures), but also on their machinery, equipment, fixtures, and supplies, which are classified as tangible personal property (TPP). For many small businesses, the amount owed is negligible, but the compliance costs can be considerable. By allowing a de minimis exemption for businesses with only modest amounts of property, states can eliminate these compliance costs for a trivial loss of revenue. Fourteen states broadly exempt tangible personal property from taxation, while another 10 impose taxes on TPP but offer de minimis exemptions to avoid unduly burdening businesses with only a small amount of potentially taxable property."

Tax History Corner

Archaeology reports that the oldest surviving fragment of a book is about taxes. Of course. From the article (my emphasis):

The papyrus fragment, which was unearthed along with hundreds of other pieces of papyrus at the site of El Hibeh in 1902, began as a bound document dating to 260 B.C. that recorded taxation rates for beer and oil scrawled in Greek letters using black ink. The sheet was then removed from its binding and sent as a letter before being transformed once again when its painted with images, including one depicting a son of the falcon-headed god Horus, and reused as wrapping for a mummy during the Ptolemaic period (304–30 B.C.).

...

The presence of holes for the tackets to pass through, a handful of which still have remnants of thread, and the symmetrical ink transfer across the precise fold at the center, confirmed that the bifolio had once been bound within an ancient manuscript. “An accountant must have detached the bifolio from the book, folded and sealed the letter, and then passed it on to a creditor or a debtor,” says Zammit Lupi.

Accountancy is a very old profession.

Make a habit of sustained success.