Key Takeaways

- "Separate Reporting" states ramp up transfer pricing audits.

- Long-term questions linger for state revenues.

- Old tax laws vs. new tech.

- California world-wide filers may have refund opportunity.

- Legislative news.

- First 1040 deadline anniversary.

Welcome to this edition of our roundup of State and Local Tax News. Remember Eide Bailly for your State and Local Tax and Business Incentive Needs.

Conoco Suit Highlights Conflict in State Transfer Pricing Audits - Michael Bologna, Bloomberg ($):

Louisiana’s court battle against oil and gas giant ConocoPhillips Co. over an alleged pattern of profit shifting to mitigate tax liabilities has illuminated the opaque world of state transfer pricing disputes and raised concerns about a more aggressive audit environment. … Most of the audit activity is concentrated in “separate-reporting” states, primarily across the Southeast. The 17 separate-reporting states allow tax returns for each business entity in an affiliated group, opening opportunities for income shifting. In contrast, mandatory unitary combined-reporting states treat parent corporations and their subsidiaries as a single entity for state income tax purposes.

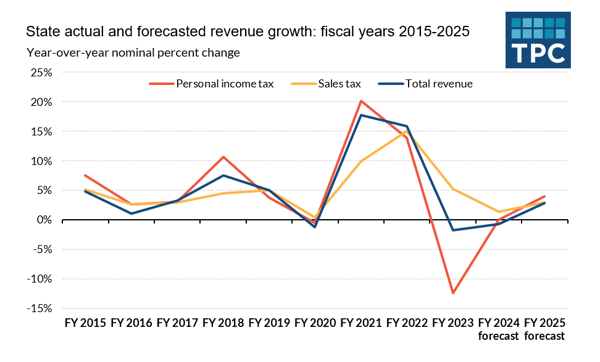

State Forecasts: Revenues Have Stabilized but Long-Term Questions Remain - Lucy Dadayan, TaxVox:

State revenue collections surged in fiscal years 2021 and 2022, primarily driven by temporary factors related to the pandemic and recovery. But state revenues weakened substantially in fiscal year 2023. This downturn was partly due to several states implementing tax rate cuts or issuing rebates to taxpayers. These policies led to an estimated $16 billion revenue reduction in fiscal year 2023.

State tax legislation is projected to lower state revenues by an additional $13.3 billion in fiscal year 2024, with $5.4 billion of these cuts being non-recurring or one-time policies. Taken together, these are the largest estimated reductions on record resulting from legislative adjustments. Depending on how the tax cuts were structured, some states will face a bumpier fiscal path ahead.

Also: “Notably, North Dakota stands alone in forecasting a significant revenue contraction, which is partly due to legislative changes, including significant income tax cuts.”

The Future Is Faster Than the Law: Aging Statutes and Advancing Technology - Christopher Jardine, Tax Notes ($):

As technology rapidly advances, states are often several years behind in implementing statutes or guidance on taxing the evolving forms of business activities, leaving attorneys, judges, and taxpayers to apply rules written for the age of radio and television to the internet, smartphones, and streaming services.

...

Cloud computing services, or software as a service (SaaS), is another relatively recent development with varying treatment by states. About a third of states tax SaaS, and some rules for taxing it depend on whether it is sold for business or personal use.

Very few states have addressed SaaS through their legislatures, however, instead issuing letter rulings or guidance that interpret existing laws in cases in which the law does not specifically cover SaaS.

State-By-State Roundup

Arizona

Arizona Sues IRS Over Taxation of 2023 Rebate - Paul Jones, Tax Notes ($). "The suit, filed in the U.S. District Court for the District of Arizona, follows the IRS's December 2023 decision that federal income tax will be applied to Arizona's Families Tax Rebate — a one-time refund allowing eligible taxpayers to claim $250 per dependent under age 17 and $100 per dependent over that age, capped at three dependents."

California

Calif. Offers Tax Extension Following San Diego Floods - Jaqueline McCool, Law360 Tax Authority ($). “In a notice issued Tuesday, the board said it would conform to the extension issued by the Internal Revenue Service, allowing San Diego residents to file and pay taxes by June 17 that were due from Jan. 21 until that date. The extension applies to individual returns and payments, quarterly payments, business entity returns, pass-through entity payments, and tax-exempt organization returns, the notice said.“

Microsoft’s California Win Signals More Large Refunds to Come - Laura Mahoney, Bloomberg ($):

Microsoft Corp.'s $94 million win before the California Office of Tax Appeals regarding the treatment of repatriated income opens the door for a broad range of multinational companies to seek similar income tax refunds, tax practitioners say.

...

“This is the most significant corporate income tax case before the OTA since its inception and it happens to be a taxpayer win,” said Shail P. Shah, attorney with Greenberg Traurig LLP.

Although Microsoft’s case involved repatriated earnings under the 2017 federal tax law, the ruling could benefit companies whether or not they repatriate, Shah said. All companies that file California income tax returns on a water’s edge basis — which means they exclude income from foreign affiliates when calculating how much income is taxable in California — could seek a refund.

Chris Martin, an Eide Bailly state tax specialist, comments "This is a monumental decision by California’s Office of Tax Appeals. It allowed Microsoft to include 100% of dividends in the sales factor while still taking advantage of the 75% dividends received deduction. At least two main questions remain: Will the OTA make the decision precedential? And will the FTB attempt to deny other refund claims as distortive to the apportionment factor? Taxpayers who file waters-edge returns in California should review their California returns for possible refund claims."

‘Star Wars’ Spinoff Film Wins $21 Million California Tax Credit - Laura Mahoney, Bloomberg. "Lucasfilm Ltd. will get $21.7 million in California tax credits for filming 'The Mandalorian & Grogu' in California, making the 'Star Wars' spinoff one of the largest productions to receive a credit from the program."

Colorado

Colo. House OKs Multistate Online Insurance Tax Filing - Sanjay Talwani, Law360 Tax Authority ($). “The House approved H.B. 1119 on Monday by a vote of 55-5. If enacted, it would require taxes on insurance premiums and surplus lines, as well as other charges and fees imposed by the insurance division, to be paid through a secured third-party application.”

Hawaii

Hawaii Lawmakers Advance Capital Gains Tax Increase - Paul Jones, Tax Notes ($):

Hawaii lawmakers are mulling another proposal to tax capital gains as regular income, with the House Finance Committee approving the proposal.

Under H.B. 1660, Hawaii-sourced capital gains would be treated as ordinary income rather than taxed separately at a lower maximum rate of 7.25 percent for individuals, which is well below the state's top marginal income tax rate of 11 percent.

llinois

Illinois Governor’s Tax Plan Angers Localities, Retailers - Michael Bologna, Bloomberg ($). "Gov. J.B. Pritzker’s plan to abandon Illinois’s 1% tax on groceries might be popular with consumers, but it has ignited a wave of finger-pointing with city and county officials, who called the plan 'an insult' to local governments. And retailers? They aren’t happy either."

Illinois Circuit Court Strikes Down Chicago Mansion Tax Initiative - Christopher Jardine, Tax Notes ($). “In a February 26 order in Building Owners and Managers Association v. Board of Election Commissioners for the City of Chicago, the Cook County Circuit Court ruled in favor of the Building Owners and Managers Association of Chicago (BOMA) and ordered the Chicago Board of Election Commissioners to not count any votes cast on a referendum question that asks voters whether to increase real estate transfer taxes on transactions above $1 million in the upcoming March 19 primary election.”

Minnesota

Minnesota Fixes Drafting Error on Standard Tax Deduction - Michael Bologna, Bloomberg ($). "Walz, a second-term Democrat, signed HF 2757, which builds an inflation adjustment into the standard deduction for tax year 2023. The bill boosts the deduction to $27,650 for married joint filers or surviving spouses, $20,800 for head of household filers, and $13,825 for all others. Revenue Commissioner Paul Marquart spotted the problem last summer and warned it would cost taxpayers an extra $350 million in taxes if lawmakers ignored the problem."

Mississippi

Miss. Gov. Again Pitches Plan To Kill Individual Income Tax - Michael Nunes, Law360 Tax Authority ($). "Republican Gov. Tate Reeves, in an address on Monday, said Mississippians must demand low taxes and lighter regulations in a bid to expand the state's economy. As part of his fiscal year 2025 budget recommendation published in January, the governor once again called for the elimination of the state's flat income tax."

Nebraska

Nebraska Business Group Supports Property Tax Relief, Economic Incentives - Emily Hollingsworth, Tax Notes ($). “Alex Reuss, the chamber’s executive vice president of legislation and policy, told Tax Notes in a February 26 statement that ‘the NE Chamber supports several bills aiming to cap local spending, while allowing for flexibility in areas experiencing rapid growth (LB1414), frontload property tax relief so Nebraskans see their property tax bill go down (part of LB1415), and implement levy decreases at the rate of valuation increases (LB1241).’”

New Jersey

Can Restoring the Nation’s Highest Business Tax Fix N.J. Transit? - Tracey Tully and Patrick McGeehan, New York Times. “On Tuesday, Mr. Murphy proposed reversing course and again implementing a corporate business tax of 11.5 percent — the nation’s highest rate — for the state’s most profitable companies. He presented the restoration of the tax as a permanent solution to the dire financial condition of New Jersey’s statewide transit system.”

Netflix, Hulu Add NJ Victory to List of Franchise-Fee Court Wins - Perry Cooper, Bloomberg. "This is the latest in a series of wins for the streaming services, which have faced similar class actions by localities across the country. More than a dozen courts have ruled in their favor, holding that state statutes don’t provide municipalities a right to sue or that franchise obligations don’t apply to streamers. Most recently, a California appeals court rejected a challenge led by the city of Lancaster."

North Dakota

ND General Revenue Collection Up $219M From Estimates - Michael Nunes, Law360 Tax Authority ($). “In the report, published Wednesday, the state collected $1.749 billion in revenue through the first seven months of the fiscal year, up from the $1.529 billion it had expected to collect. Revenue from sales and use tax, individual income and corporate income taxes are trending higher so far this fiscal year, according to published figures.“

Oklahoma

Oklahoma Legislature Passes Bill to End Sales Tax on Groceries - Emily Hollingsworth, Tax Notes ($):

Oklahoma lawmakers have approved ending the state's sales tax on food items, following the governor's pledge to sign any tax cut that comes to his desk.

H.B. 1955 was passed 42 to 2 by the Senate on February 22. The bill, which was introduced in 2023, cleared the House 88 to 7 on March 31, 2023.

South Carolina

SC Legislature OKs Standards For Transfer Pricing Matters - Maria Koklanaris, Law360 Tax Authority ($). “S. 298, which passed Wednesday when the House agreed to Senate amendments, could substantially limit when the state or a business can ask for combined reporting during audits of intercompany transactions.”

South Dakota

South Dakota Bars Using Central Bank Digital Currencies to Pay Taxes - Emily Hollingsworth, Tax Notes ($). “South Dakota isn’t the only state to express concerns about the potential for a federal CBDC. In May 2023 Florida enacted S.B. 7054, which revised the state’s definition of money to exclude CBDCs.”

Utah

Utah Personal Income Tax Rate Poised to Drop Again, to 4.55% - Michael Bologna, Bloomberg ($). "The Utah House voted 63-11 to support SB 69, which would drop the state’s flat 4.65% rate to 4.55%, retroactive to Jan. 1. A fiscal analysis pegged the cost of the reduction at $167 million annually beginning in fiscal year 2025. The measure won support in the Senate on Jan. 31 by a vote of 23-6."

Virginia.

Virginia Considers Expanding Its Sales Tax Base to B2B Digital Services - Andrey Yushkov, Tax Policy Blog. “What is the difference between good and bad tax policy? Sometimes that dividing line is buried deep in abstruse definitions and complex procedures. Other times, two words in a bill are enough to make a good policy go awry. This is the case in Virginia, where the Senate amended the Governor’s budget bill (S.B. 30 as introduced and as amended) such that, if adopted, it would include all business-to-business (B2B) digital services in the sales tax base.”

Washington

Wash. Concrete Co. Loses Challenge To Sales Tax Rule - Jaqueline McCool, Law360 Tax Authority ($). “In an opinion issued Tuesday, the appeals court affirmed a trial court ruling that denied [a] challenge to the Department of Revenue's Rule 211. The rule says that ‘providing tangible personal property with an operator’ is subject to the state's retail sales tax, and it was updated by the department to clarify that ‘rental of concrete pumping equipment with an operator’ was subject to the tax.”

Tax Policy Corner

Keys to Running a “Good” Revenue Department - David Brunori, Government Finance Research Center Blog. “In my opinion there are three factors that lead to success for tax agencies. First, sound tax administration is built on a legal structure that promotes fairness. The structure and substantive rules governing tax collection are largely in the purview of the legislature as the most important rules are created by statute. A tax structure that is unfair leads to a jaded citizenry and invites noncompliance. Moreover, a tax system that is complicated – and unfortunately most are – creates confusion, compliance burdens, and skepticism.”

Tax History Corner

The first Forms 1040 were due 110 years ago today.

Make a habit of sustained success.