Key Takeaways

- Senate impasse threatens research cost relief

- Avoiding return mistakes

- IRS Commissioner wants to help businesses that "play by the rules."

- Utah Governor signs 2024 tax rate cut.

- IRS issues April AFRs.

- ERC deadline looms.

- Where governments get their revenue, and why the U.S. is different.

- Taxpayer sues over trust, revealing his tax fraud.

- National Poultry Day.

Business Tax Breaks Face ‘Now or Never’ Moment in Senate - Richard Rubin, Wall Street Journal:

U.S. businesses, big and small, have united behind a bipartisan bill to revive expired tax breaks for research and equipment spending, help that many see as critical to competing with foreign rivals or even surviving.

The problem: They can’t get Senate Republicans—usually their allies—to budge.

While GOP Senators favor restoring the business tax breaks, they don't support them enough to accept parts of the child tax credit included in the bill to win needed support from Democrats. The business provisions are:

- Restoration of full deductibility for domestic research costs (rather than amortization over 60 months);

- increased limits for business interest deductions; and

- restoration of 100% bonus depreciation, which began to phase down in 2023.

Related: The Impact of Changes to Section 174.

The tax bill calendar - Bernie Becker, Politico ($):

After this week, the Senate is scheduled to leave town for a two-week recess, then to return on April 8 — exactly one week before the tax filing deadline.

Now, supporters of the tax bill have noted that April 15 won’t serve as a functional deadline for getting the tax bill done, because the IRS would still be able to deliver any extra CTC benefits to taxpayers even after the filing season is over.

But it’s still not totally clear when the political will for getting a bipartisan tax bill done during a presidential election year might evaporate, though it almost certainly will at some point. So with the tax filing deadline looming, the business community and other backers of the legislation will be looking for signs from Schumer — and soon — about if he might bring the Wyden-Smith plan to the floor and see if Democrats can pick off enough Republicans to reach the magic 60-vote threshold.

Filing season news

Answer the digital assets question. Everyone who files Forms 1040, 1040-SR, 1040-NR, 1041, 1065, 1120 and 1120S must check one box answering either "Yes" or "No" to the digital asset question. The question must be answered by all taxpayers, not just by those who engaged in a transaction involving digital assets in 2023. Taxpayers must report all income related to digital asset transactions.

See IRS.gov Digital Assets for details on when to check “yes” and how to report the income.

Report all taxable income Keep in mind that most income is subject to taxation. Keep in mind that most income is subject to taxation. Failing to accurately report income may result in accrued interest and penalties. This includes various sources of income such as interest earnings, unemployment benefits and income derived from the service industry, gig economy and digital assets. For further details, consult Publication 525, Taxable and Nontaxable Income.

Make sure banking routing and account numbers are correct. Taxpayers have the option to request direct deposit of a federal refund into one, two or even three accounts. Provide correct banking information: If expecting a refund, ensure the routing and account numbers provided for direct deposit are accurate to avoid delays or misdirected refunds.

Werfel to Big Business: IRS Is Not Your Enemy - Alexander Rifaat, Tax Notes ($):

IRS Commissioner Daniel Werfel sought to allay corporate fears over the agency’s drive to increase audits on large businesses by claiming the heightened scrutiny will create a fair playing field for those who are compliant.

Speaking at a Tax Executives Institute conference March 18, Werfel tried to draw a distinction between President Biden’s push for higher corporate tax rates and the IRS’s plan to step up enforcement efforts to go after large corporations.

“We are completely agnostic on how much you pay — we just want it to be accurate. People will say ‘the IRS is just trying to grab more money.’ No, we want an accurate return,” Werfel said, adding that businesses should support the move because it rewards those that “play by the rules.”

Werfel is playing the long game - Laura Weiss, Punchbowl News:

Werfel was adamant that the remaining $60 billion is a good investment, and that he’s using it to propel the IRS forward. In his speech, Werfel presented a vision of a modernized, more digital IRS that can better provide taxpayer assistance, scrutinize high-income taxpayers more likely to be dodging taxes and implement tax laws fairly.

For one, Werfel said the agency will use funding to make sure taxpayers can do everything they need to tax-wise digitally, if they choose.

Werfel Calls Online Biz Account Authentication A Challenge - David van den Berg, Law360 Tax Authority ($). "Businesses can have many employees and verifying whether a worker is a valid user of a company's online tax account can be complex, Werfel said during a Tax Executives Institute conference in Washington, D.C. When authenticating access to company accounts, the agency either could "open the aperture very wide" or keep it narrow, but it wouldn't work to allow only a company's chief executive to access an account, he said."

In other tax news...

Utah Governor Approves Latest Income Tax Rate Cut - Paul Jones, Tax Notes ($). "S.B. 69, signed by Gov. Spencer Cox (R) March 14, reduces the state’s income tax rate from 4.65 percent to 4.55 percent for residents and corporations, retroactive to the start of the 2024 tax year. The cut is estimated to cost the state approximately $201.4 million in fiscal 2025 and $167.7 million in fiscal 2026."

IRS Issues Applicable Federal Rates (AFR) for April 2024 - Bailey Finney, Eide Bailly. "The Section 382 long-term tax-exempt rate used to compute the loss carryforward limits for corporation ownership changes during April 2024 is 3.37%"

The Test Your Side Hustle Must Pass to Be a Tax Deduction - Ashlea Ebeling, Wall Street Journal. "One common mistake is using the tax break to justify spending money. You typically can’t deduct the mileage to drive to a local coffee shop to write, or the cost of meals in your home area."

Biden’s Climate Law Has Created a Growing Market for Green Tax Credits - Jim Tankersley, New York Times. "The climate law that President Biden signed in 2022 has created a large and growing market for companies to buy and sell clean-energy tax credits, new Treasury Department data suggests, creating opportunities for start-ups to raise money for projects like wind farms and solar panel installations."

Blogs and bits

7 warning signs you filed an incorrect ERC claim - Kay Bell, Don't Mess With Taxes. "1. Too many quarters being claimed. Some ERC promoters urged employers to claim the tax credit for all quarters that it was available. Qualifying for all quarters is uncommon."

Countdown to ERC Compliance: Voluntary Disclosure Program Deadline March 22 - Tax School Blog. "The special program runs through March 22, 2024, and lets taxpayers repay just 80% of the claim received."

Taxpayers Hit with Civil Fraud Penalties for Sham Trust Arrangement - Parker Tax Pro Library. "The Tax Court held that the trusts a married couple formed as part of a tiered trust arrangement, in which all of their business and personal assets were placed, were sham entities with no economic substance and therefore, the income of the trusts was attributable to the taxpayers."

Presenting Sales Tax on the Business Return - Thomas Gorczynski, Tom Talks Taxes. "If the tax is imposed on the consumer, the business is simply collecting the tax and remitting it to the state or locality on behalf of the consumer. The amounts collected are not gross receipts for the business nor an expense when remitted."

American Opportunity Tax Credit Issues - Annette Nellen, 21st Century Taxation. "This is the credit that for the past many years provides up to a $2,500 credit for each of the first four years of higher education at a college or university. It started in the early 1990s as the Hope Scholarship credit for a lower amount and only the first two years of college."

Tax Policy Corner

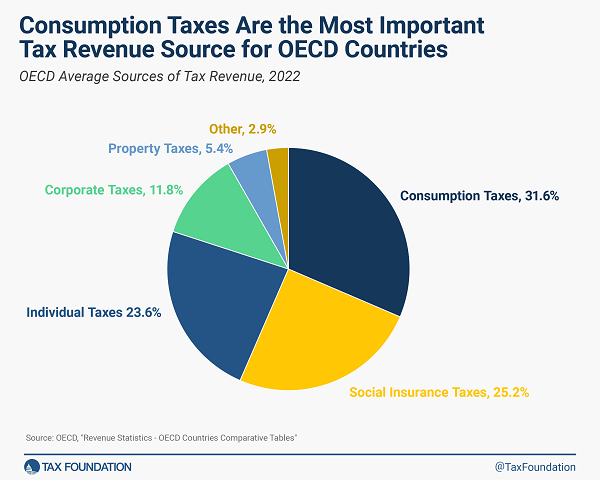

Sources of Government Revenue in the OECD, 2024 - Cecilia Perez Weigel and Daniel Bunn, Tax Foundation. "The United States is the only country in the OECD with no value-added tax (VAT). Instead, most U.S. state governments and many local governments apply a retail sales tax on the final sale of products and excise taxes on the production of goods such as cigarettes and alcohol. The lack of a VAT makes the U.S. a bit of an outlier as it raises just 15.7 percent of total government revenue from consumption taxes while the OECD average is nearly twice that amount at 31.6 percent."

President Biden’s $400,000 tax pledge has a ‘magic asterisk’ - Glenn Kessler, Washington Post. "To pay for many popular programs and to claim $3 trillion in deficit reduction, the budget is silent on how Biden would keep his promise not to raise taxes on people making less than $400,000 in a revenue-neutral way. That may be smart politics but it’s incomplete budgeting, especially because the cost of keeping that pledge is nearly $2 trillion over 10 years. If the president is reelected, he will struggle to meet that promise without giving up on other priorities."

What Does Biden Plan for the Tax Code? - Adam Michel, Liberty Taxed. "While the budget is elusive about how the tax code will change for middle‐ and lower‐income Americans, it is quite detailed in its proposals to increase taxes on their employers and higher‐income Americans."

Four Proposals to Radically Simplify the Income Tax - William Gale, Tax Notes:

The third option, “back to the future,” incorporates the simplifications in the first approach and raises the standard deduction substantially (to $100,000 for couples and $50,000 for singles from current levels of $27,700 and $13,850), thus removing the obligation to file an income tax form for the vast majority of households. The proposal, based on the proposal by Michael J. Graetz and analysis by Jim Nunns et al., is called “back to the future” because when the income tax was first created in 1913, it applied only to a small slice of the population. To offset the lost revenue from raising the standard deduction, the proposal would set the tax rate on income above $100,000 for couples or $50,000 for singles to a minimum of 25 percent and create a 10 percent VAT. To help offset the burdens of the VAT on low- and moderate-income households, the refundable personal credit would rise to $2,800.

Free version of the proposals here.

Tax in the courtroom

Nevada man sentenced to 27 months in prison and ordered to pay over 1.1 million dollars in restitution for tax fraud - IRS (Defendant identification omitted, emphasis added).

According to the evidence at trial and other publicly available court records, from 1997 to 2013, Defendant received about $16 million in trust income as lifetime beneficiary of two testamentary trusts established after the death of his first wife.... These trusts were shareholders in Alvarado Realty Company (“ARCO”).

At first, Defendant properly reported his trust income on tax returns prepared by a certified public accountant. Then ARCO restructured into a C corporation with subchapter S status. This meant corporate income, losses, deductions, and credits now passed to shareholders for tax purposes. Since the taxes Defendant owed to the government were no longer withheld by ARCO or the trusts, Defendant did not pay them. Instead, Defendant conspired with... an attorney specializing in tax law and the preparation of federal income tax returns, to submit knowingly false tax returns from 2007 through 2011 showing little or no trust income. As a result, Defendant owes the IRS $1,188,645.00.

How did the IRS find out?

Defendant came to the attention of the IRS in 2013 when he filed a lawsuit against his former brothers-in-law. Defendant claimed that the in-laws mismanaged trusts to Defendant’s financial disadvantage. During the litigation, District Judge Alan M. Malott heard evidence that prompted him to refer Defendant’s case to the IRS for further investigation. The state case was resolved in favor of the in-laws.

The Moral? First, don't commit tax fraud. If you do, maybe think twice before filing lawsuits.

What day is it?

Dinnertime. It's National Poultry Day!

Make a habit of sustained success.